Answered step by step

Verified Expert Solution

Question

1 Approved Answer

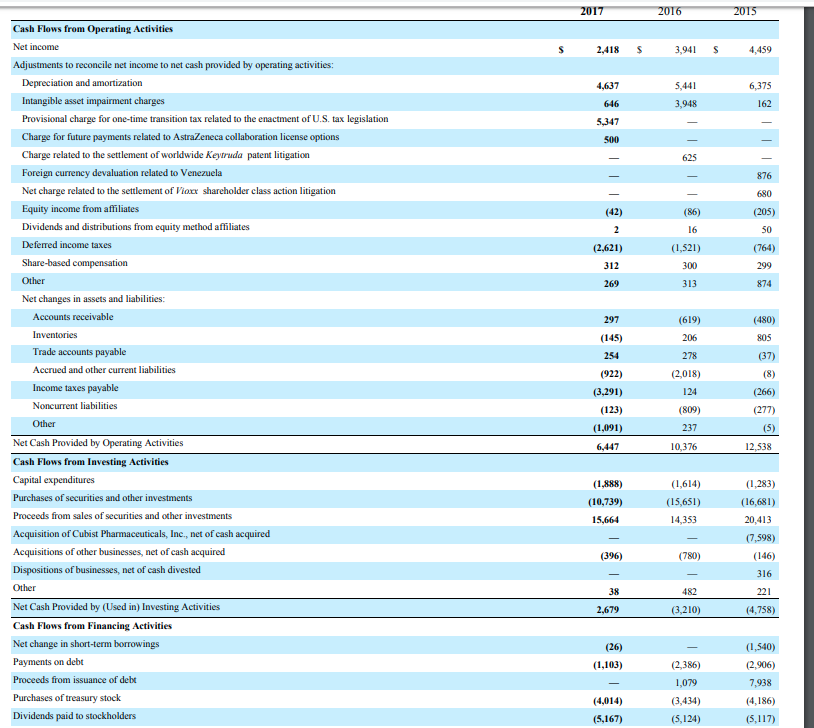

How do i calculate these ratios from the statement of cashflows? CAPEX= capital additions/depreciation expense Average life of fixed assets= fixed assets-at cost/depreciation expense Average

How do i calculate these ratios from the statement of cashflows?

CAPEX= capital additions/depreciation expense

Average life of fixed assets= fixed assets-at cost/depreciation expense

Average life of fixed assets=accumulated depreciation/depreciation expense

average remaining life= average life/average age

Cash Flows from Operating Activities Net income Adjustments to reconcile net income to net cash provided by operating activities: 2.418 S 3,941 4,459 Depreciation and amortization Intangible asset impairment charges Provisional charge for one-time transition tax related to the enactment of U.S. tax legislation Charge for future payments related to AstraZeneca collaboration license options Charge related to the settlement of worldwide Keytruda patent litigation Foreign currency devaluation related to Venezuela Net charge related to the settlement of Vioxx shareholder class action litigation Equity income from affiliates Dividends and distributions from equity method affiliates Deferred income taxes 5,441 646 3,948 162 (205) 50 (764) (42) (86) 16 (1,521) 300 313 (2,621) 312 Other 874 Net changes in assets and liabilities: Accounts receivable (619) (480) 805 (37) (145) Trade accounts payable Accrued and other current liabilities Income taxes payable 278 (922) (3,291) (123) (1,091) (2,018) (266) (809) Other 237 Net Cash Provided by Operating Activities Cash Flows from Investing Activities Capital expenditures Purchases of securities and other investments Proceeds from sales of securities and other investments Acquisition of Cubist Pharmaceuticals, Inc., net of cash acquired Acquisitions of other businesses, net of cash acquired Dispositions of businesses, net of cash divested 10,376 2,538 (1,888) (10,739) 15,664 (1,614) (15,651) 14,353 (1,283) (16,681) 20,413 (7,598) (146) 316 221 (4,758) (396) (780) 38 482 Net Cash Provided by (Used in) Investing Activities Cash Flows from Financing Activities Net change in short-term borrowings Payments on debt Proceeds from issuance of debt Purchases of treasury stock Dividends paid to stockholders 2,679 (3,210) (1,540) (2,906) 7,938 (4,186) (5,117) (26) (1,103) (2,386) 1,079 (3,434) (5,124) (4,014) (5,167)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started