Answered step by step

Verified Expert Solution

Question

1 Approved Answer

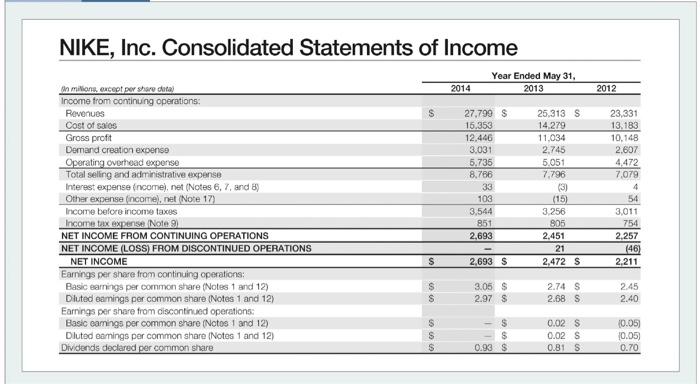

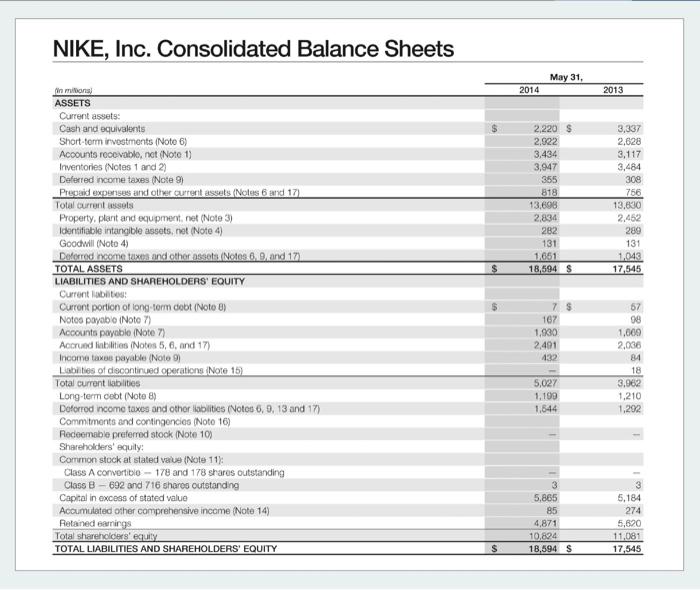

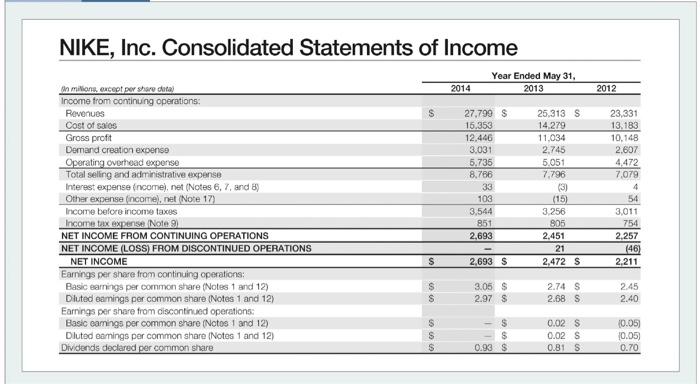

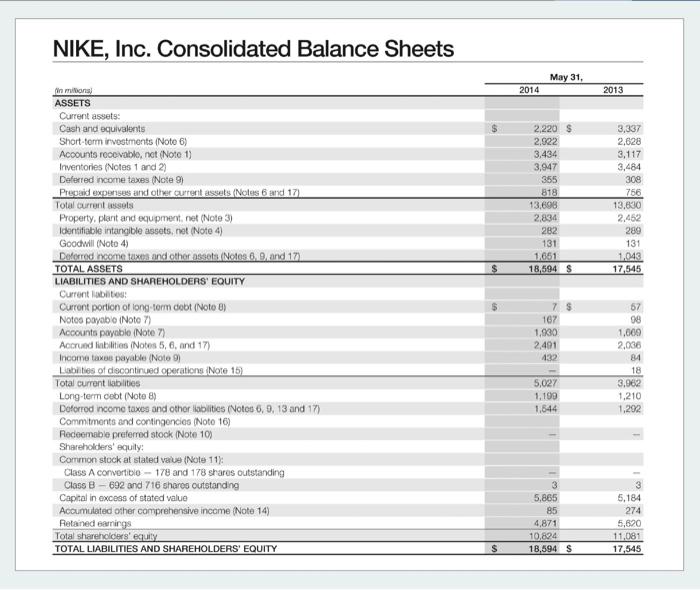

How do I compute ten financial ratios using this data from 2014, using Class B common stock and a price per share of $76.91? NIKE,

How do I compute ten financial ratios using this data from 2014, using Class B common stock and a price per share of $76.91?

NIKE, Inc. Consolidated Statements of Income Year Ended May 31, 2013 2014 2012 An milions, excepto share ita) Income from continuing operations: Revenues Cost of sales Gross profit Demand creation expense Operating overhead expense Total selling and administrative expense Interest expense income), net (Notes 6, 7, and 8) Other expense (income.net (Note 17) Income before income taxes Income tax expense Note: NET INCOME FROM CONTINUING OPERATIONS NET INCOME (LOSS) FROM DISCONTINUED OPERATIONS NET INCOME Earnings per share from continuing operations: Basic earnings per common share (Notes 1 and 12) Diluted earnings per common share Notes 1 and 12) Earnings per share from discontinued operations. Basic eamings per common share (Notos 1 and 12) Dluted earnings per common share Notes 1 and 12) Dividends declared per common share 27,799 $ 15.353 12,446 3,031 5.735 8.786 33 103 3,544 851 2,693 25,313 S 14.279 11.034 2.745 5051 7.796 (3) (15) 3.256 805 2,451 21 2,472 S 23,331 13.183 10.148 2.607 4,472 7,079 4 54 3.011 754 2.257 (46) 2.211 S 2,693 $ $ S 3.05 2.97 S 2.74 S 2.68 S 2.45 2.40 S S S 600 G 0.02 S 0.02S 0.81 S 10.05) 0.05) 0.70 0.93 S NIKE, Inc. Consolidated Balance Sheets May 31, 2014 2013 $ 2.220$ 2,922 3,434 3,947 355 818 13,698 2.834 282 131 1.651 18,594 $ 3,337 2,628 3,117 3,484 309 756 13,830 2,452 289 131 1.043 17,545 $ in milion ASSETS Current assets: Cash and equivalents Short-term investments (Note 6) Accounts recevable, not (Noto 1) Inventories (Notes 1 and 2) Deferred income taxes (Note 9 Prepaid expenses and other current assets (Noles 6 and 17) Total current assels Property, plant and equpment, net (Note 3) Identifiable intangible assets, not (Note 4) Goodwill (Note 4) Deferred ncome taxes and other assets. (Notes 6, 9 and 17) TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current habitos: Curront portion of long-term cbt (Noto B) Notes payable Noto 7) Accounts payablo Note 7 Accrued labilities (Notes 5, 6, and 17) Income taxus payable (Noto 9) Liabilities of discontinued operations Note 15) Total current abilities Long-term cebt (Note 8) Deforrod income taxes and other fables (Notes 6, 9. 13 and 17) Commitments and contingencies (Noto 16) Redeemable preferred stock (Note 10) Shareholders' equily: Corrmon stock at stated value Note 11): Class A convertible - 178 and 178 shares outstanding Class B - 692 and 716 shares outstanding Capital in excess of stated value Accumulated other comprehensive income (Note 14) Retained earnings Total shareholders equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 7 167 1.930 2,401 432 67 08 1.000 2,036 84 18 3.962 1.210 1,292 5,027 1,199 1,844 3 5,865 85 4,871 10,824 18,594 S 3 5,184 274 5,620 11,081 17,545 $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started