how do I construct a 1040, schedule 1 and schedule B?

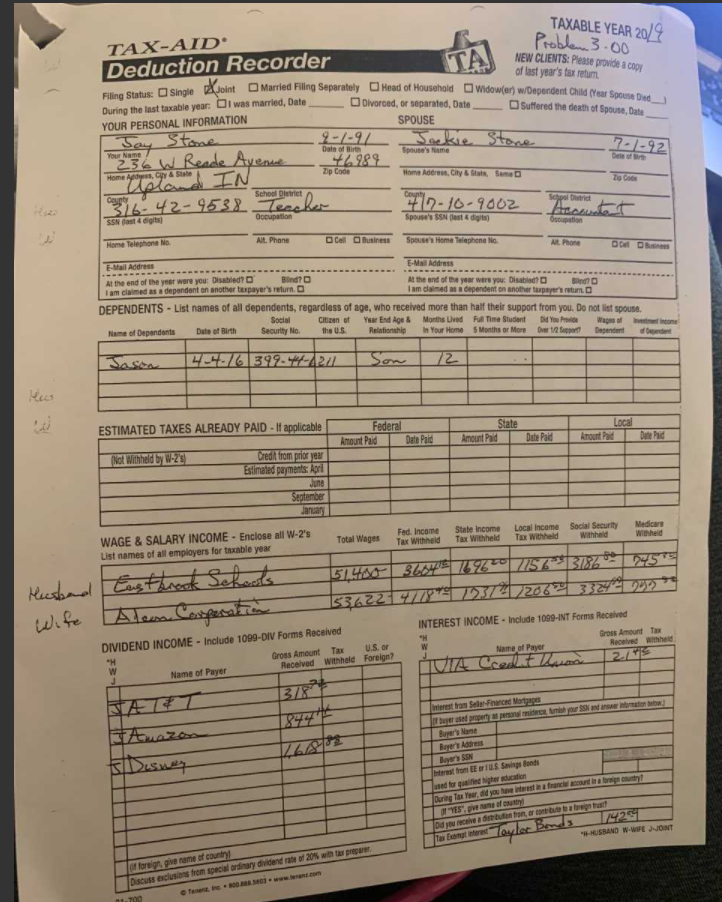

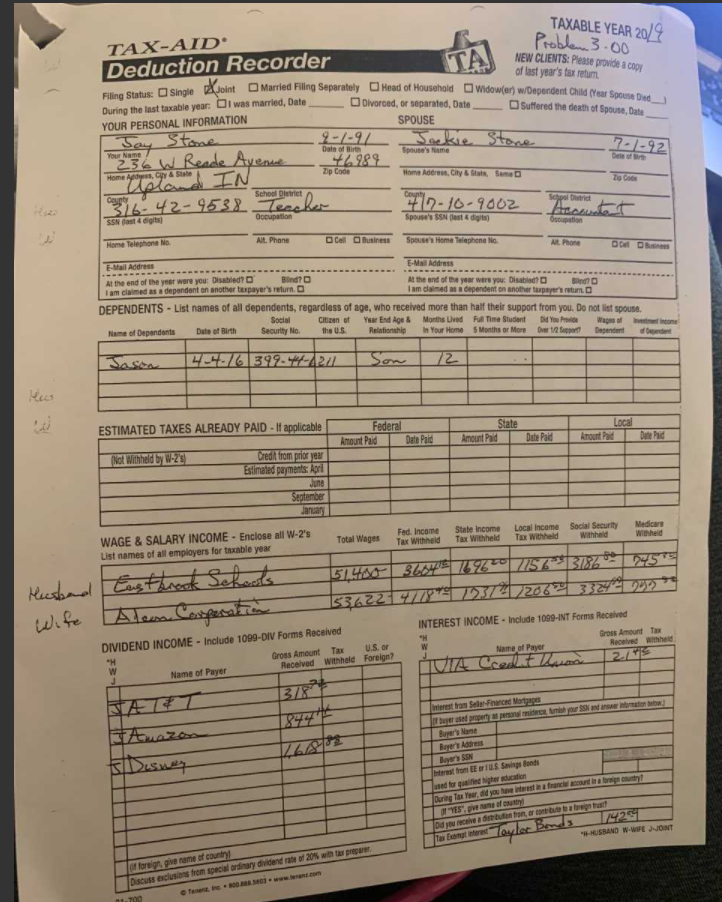

Filing Status: Single Joint Married Filing Separately Head of Household Widower) w/Dependent Child (Year Spouse Died) TAX-AID Deduction Recorder TAXABLE YEAR 2012 Problem 3.00 NEW CLIENTS: Please provide a copy of last year's tax return TA During the last taxable year: i was married, Date YOUR PERSONAL INFORMATION Divorced, or separated, Data Suffered the death of Spouse, Dute SPOUSE 9-1-91 Jackie Stone Dale of Birt Spouse's Name +2984 Zip Code Home Address, City & state, some 7-1-92 Your Name 236 W Reade Avenue Home Ady & State School District County Scholar 376.42-9538 Teacher 117-10-9002 Occupation Spouse's Nest 4 digital SSN last 4 git Option Home Telephone No. Alt. Phone Cell Business Spouse's Home Telephone No. Al Phone O Bus E-Mail Address E-Mail Address At the end of the year were you: Disabled Bind? At the end of the year wars you: Disabled BO I am claimed as a dependent on another tarpayer's return. I am calmed as dependent on another payer un DEPENDENTS - List names of all dependents, regardless of age, who received more than half their support from you. Do not list spouse. Social Citizen of Year End Age & Months Lived Full Time Student Did you Wages of Name of Dependent Date of Birth Security No the U.S. Relationship In Your Home Months or More Our Miral Jason LO399-4-211 Son 12 ESTIMATED TAXES ALREADY PAID - If applicable Federal Amount Paid Date Pald State Amount Paid Local Amount Paid Date Paid Dateid (Not Withheld by W-28 Credit from prior year Estimated payments: April June September January Fed. Income Tax Withheld State Income Tax Withheld Local Income Social Security Tax Withheld Withheld Total Wages Medicare Withheld WAGE & SALARY INCOME - Enclose all W-2's List names of all employers for taxable year Husband Eastbrook Schools Alen Corporation 51.490 366 67207757 3185 * 2054 153622 47784123727206033240039 INTEREST INCOME - Include 1009-INT Forms Received "H Gross Amount Tax w J Name of Payer Received withheld 2.is DIVIDEND INCOME - Include 1099-DIV Forms Received w Gross Amount Tax U.S. or Name of Payer Received withheld Foreign? LOA Ct l s Design berettan Selesed Ms There is more tradit Buyer'e Bayer Adres Boyer from EETUS Savings Bands and for her ducation During To Tour, did you have researcher a boy! "YES", peame of Did your rechercator, com a forma 1428 USBAND W- WENONT pas Bangt bort Taylor Bands foreign pire name of country Discuss exclusions from special ordinary dividend rate of 20% win a prepare te www.com 700 Filing Status: Single Joint Married Filing Separately Head of Household Widower) w/Dependent Child (Year Spouse Died) TAX-AID Deduction Recorder TAXABLE YEAR 2012 Problem 3.00 NEW CLIENTS: Please provide a copy of last year's tax return TA During the last taxable year: i was married, Date YOUR PERSONAL INFORMATION Divorced, or separated, Data Suffered the death of Spouse, Dute SPOUSE 9-1-91 Jackie Stone Dale of Birt Spouse's Name +2984 Zip Code Home Address, City & state, some 7-1-92 Your Name 236 W Reade Avenue Home Ady & State School District County Scholar 376.42-9538 Teacher 117-10-9002 Occupation Spouse's Nest 4 digital SSN last 4 git Option Home Telephone No. Alt. Phone Cell Business Spouse's Home Telephone No. Al Phone O Bus E-Mail Address E-Mail Address At the end of the year were you: Disabled Bind? At the end of the year wars you: Disabled BO I am claimed as a dependent on another tarpayer's return. I am calmed as dependent on another payer un DEPENDENTS - List names of all dependents, regardless of age, who received more than half their support from you. Do not list spouse. Social Citizen of Year End Age & Months Lived Full Time Student Did you Wages of Name of Dependent Date of Birth Security No the U.S. Relationship In Your Home Months or More Our Miral Jason LO399-4-211 Son 12 ESTIMATED TAXES ALREADY PAID - If applicable Federal Amount Paid Date Pald State Amount Paid Local Amount Paid Date Paid Dateid (Not Withheld by W-28 Credit from prior year Estimated payments: April June September January Fed. Income Tax Withheld State Income Tax Withheld Local Income Social Security Tax Withheld Withheld Total Wages Medicare Withheld WAGE & SALARY INCOME - Enclose all W-2's List names of all employers for taxable year Husband Eastbrook Schools Alen Corporation 51.490 366 67207757 3185 * 2054 153622 47784123727206033240039 INTEREST INCOME - Include 1009-INT Forms Received "H Gross Amount Tax w J Name of Payer Received withheld 2.is DIVIDEND INCOME - Include 1099-DIV Forms Received w Gross Amount Tax U.S. or Name of Payer Received withheld Foreign? LOA Ct l s Design berettan Selesed Ms There is more tradit Buyer'e Bayer Adres Boyer from EETUS Savings Bands and for her ducation During To Tour, did you have researcher a boy! "YES", peame of Did your rechercator, com a forma 1428 USBAND W- WENONT pas Bangt bort Taylor Bands foreign pire name of country Discuss exclusions from special ordinary dividend rate of 20% win a prepare te www.com 700