How do i create a unadjusted trial balance with the following information that i have obtained?

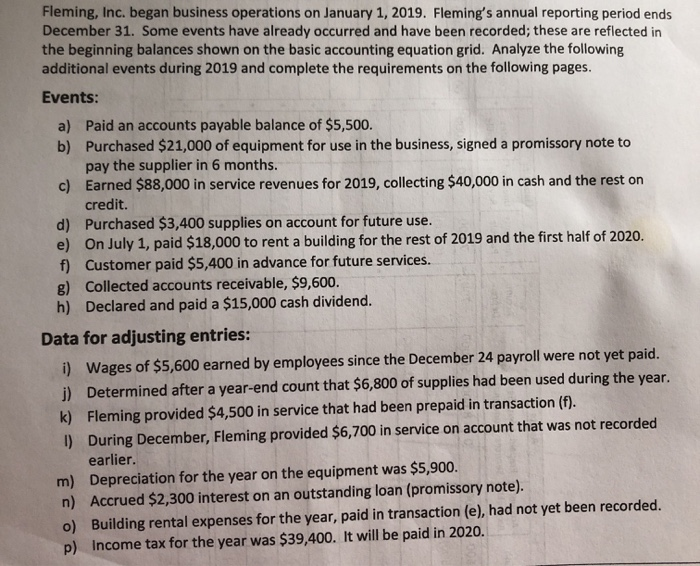

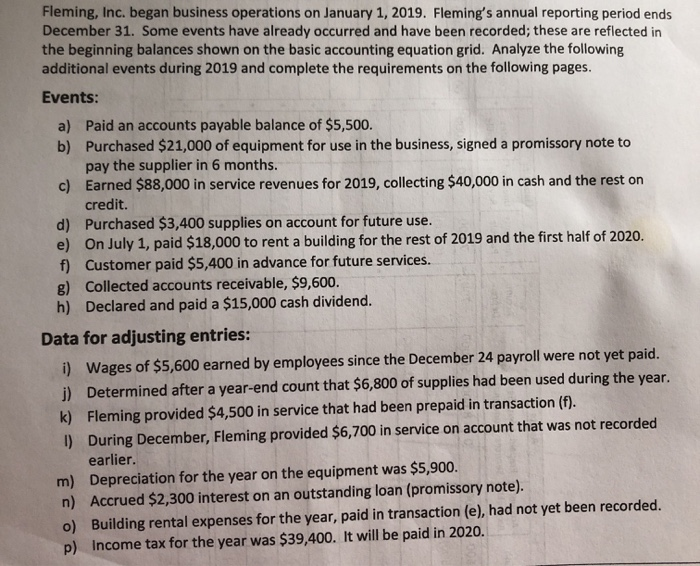

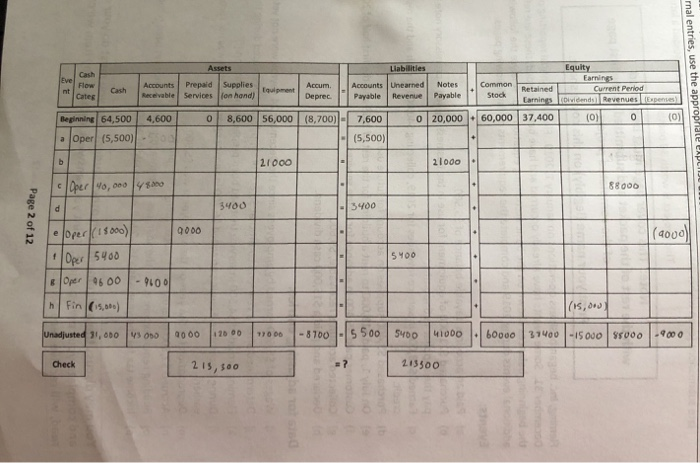

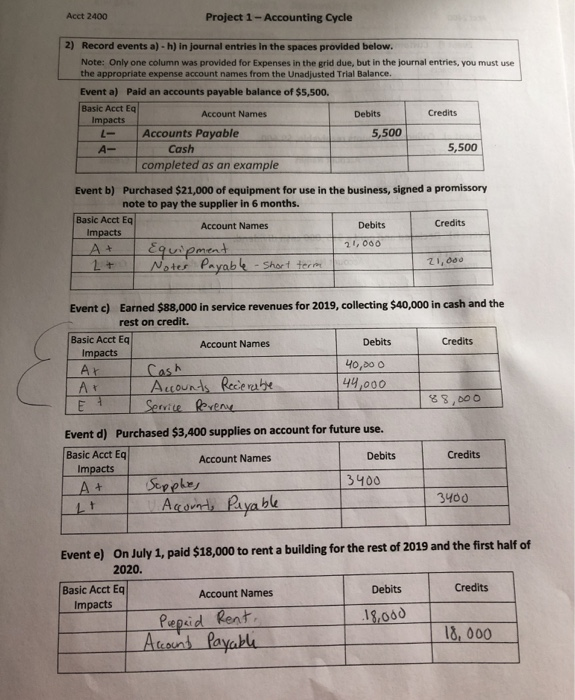

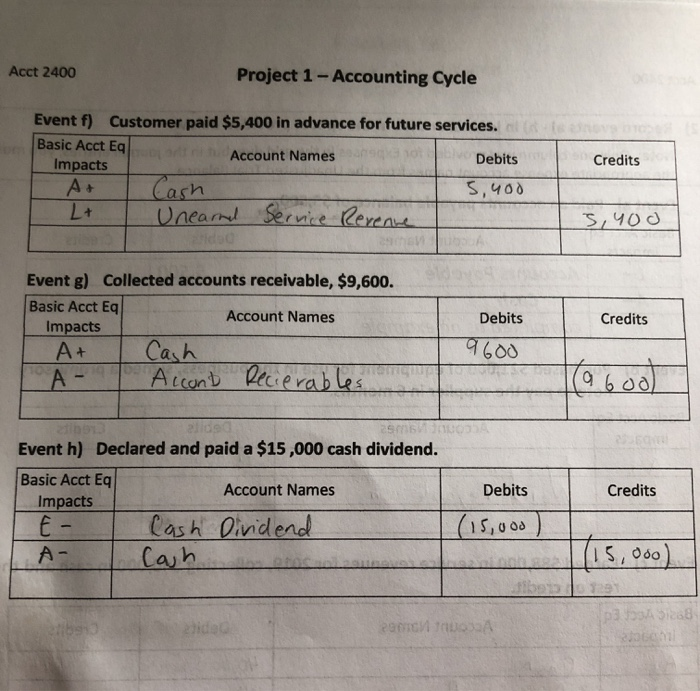

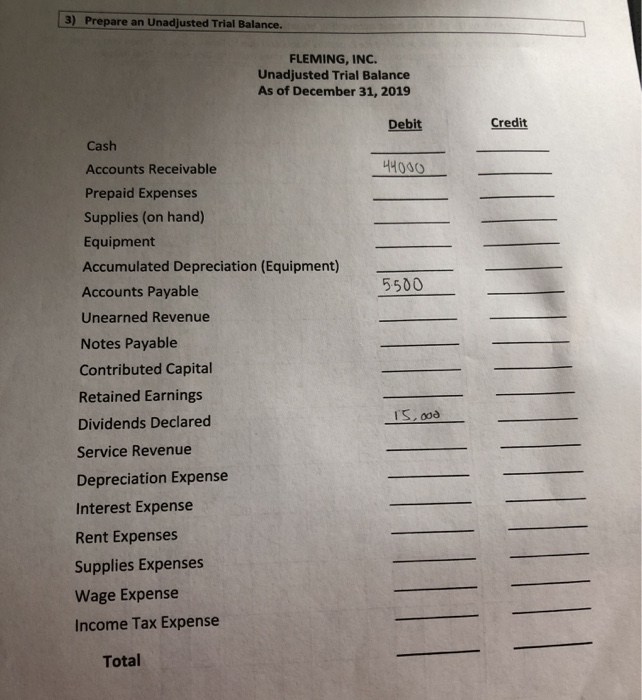

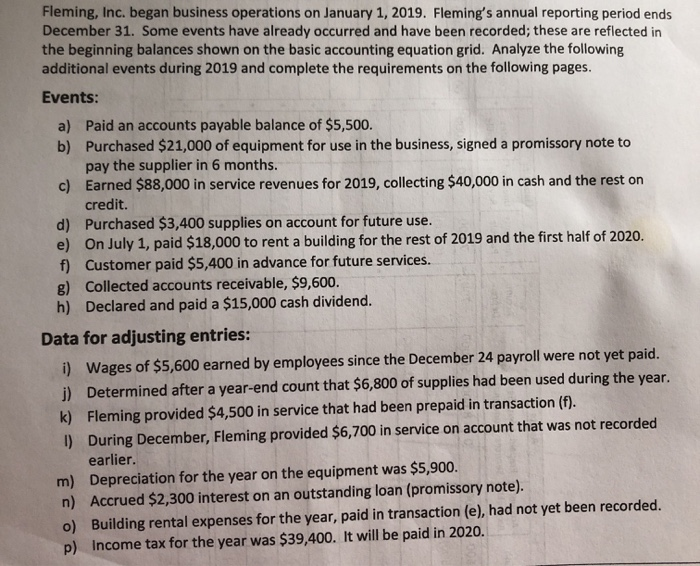

Fleming, Inc. began business operations on January 1, 2019. Fleming's annual reporting period ends December 31. Some events have already occurred and have been recorded; these are reflected in the beginning balances shown on the basic accounting equation grid. Analyze the following additional events during 2019 and complete the requirements on the following pages. Events: a) Paid an accounts payable balance of $5,500. b) Purchased $21,000 of equipment for use in the business, signed a promissory note to pay the supplier in 6 months. c) Earned $88,000 in service revenues for 2019, collecting $40,000 in cash and the rest on credit. d) Purchased $3,400 supplies on account for future use. e) On July 1, paid $18,000 to rent a building for the rest of 2019 and the first half of 2020. f) Customer paid $5,400 in advance for future services. g) Collected accounts receivable, $9,600. h) Declared and paid a $15,000 cash dividend. Data for adjusting entries: i) Wages of $5,600 earned by employees since the December 24 payroll were not yet paid. j) Determined after a year-end count that $6,800 of supplies had been used during the year. k) Fleming provided $4,500 in service that had been prepaid in transaction (f). 1) During December, Fleming provided $6,700 in service on account that was not recorded earlier. m) Depreciation for the year on the equipment was $5,900. n) Accrued $2,300 interest on an outstanding loan (promissory note). o) Building rental expenses for the year, paid in transaction (e), had not yet been recorded. p) Income tax for the year was $39,400. It will be paid in 2020. Equity mal entries, use the appropriate en Cash Accounts Receivable Prepaid Supplies Services lon hand) Tquipment Accum. Deprec. Accounts Payable Notes Payable Common Stock Retained Current Period Earnings (Dividends Revenues 4,600 0 8,600 56,000 0 20,000. 60,000 37,400 (0) Beginning 64,500 Oper (5,500) (8,700) - 7,600 (5,500) 21000 21 000 1. Oper 40,000/48000 88000 3400 3400 Page 2 of 12 9000 (4000 eloper (18000) 1. Oper/5400 13/Oper 9600-900 1. Fin (15,000) unadjusted 31,000 4 000 (15,00) 9000 12000 10001 - 8700 - 5500/5400 41000 60000 | 31400-15000 15000-9000 Check 215,300 215500 Acct 2400 Project 1 - Accounting Cycle 2) Record events a) - h) in journal entries in the spaces provided below. Note: Only one column was provided for Expenses in the grid due, but in the journal entries, you must use the appropriate expense account names from the Unadjusted Trial Balance. Event a) Pald an accounts payable balance of $5,500. Basic Acct Eq Account Names Impacts Debits Credits - Accounts Payable 5,500 A- Cash 5,500 completed as an example Basic Acct EQ Event b) Purchased $21,000 of equipment for use in the business, signed a promissory note to pay the supplier in 6 months. Impacts Account Names Debits Credits Equipment 21,000 2 + Notes Payable - Short term 21,080 A Cash Event c) Earned $88,000 in service revenues for 2019, collecting $40,000 in cash and the rest on credit. Basic Acct Eq Account Names Debits Impacts Credits 40,000 Ar Accounts Recierable 44.000 Service Revene 88,000 Event d) Purchased $3,400 supplies on account for future use. Basic Acct Eq Account Names Debits Credits Impacts A+ Supplies 3400 It v Accounts Payable 3400 Event e) On July 1, paid $18,000 to rent a building for the rest of 2019 and the first half of 2020. Basic Acct Eq Account Names Debits Credits Impacts Pepaid Rent .18.000 Account Payable 18,000 Acct 2400 Project 1 - Accounting Cycle Event f) Customer paid $5,400 in advance for future services. Basic Acct Eq r Account Names Debits Impacts Cash 5,400 Unearna Service Revenue Credits At 3,400 Credits Event g) Collected accounts receivable, $9,600. Basic Acct Eq Impacts Account Names At Cash A Accont Recierables Debits 9600 19600 Debits Credits Event h) Declared and paid a $15,000 cash dividend. Basic Acct Eq Account Names Impacts f- Cash Dividend A- Cash ) 15,000 3 A 1268 PA 3) Prepare an Unadjusted Trial Balance. FLEMING, INC. Unadjusted Trial Balance As of December 31, 2019 Debit Credit 44000 5.500 Cash Accounts Receivable Prepaid Expenses Supplies (on hand) Equipment Accumulated Depreciation (Equipment) Accounts Payable Unearned Revenue Notes Payable Contributed Capital Retained Earnings Dividends Declared Service Revenue Depreciation Expense Interest Expense Rent Expenses Supplies Expenses Wage Expense Income Tax Expense 15,000 Total