Answered step by step

Verified Expert Solution

Question

1 Approved Answer

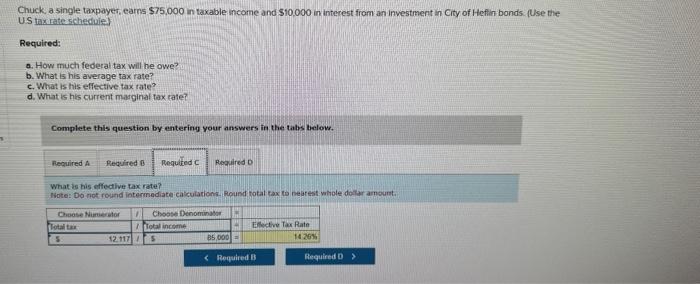

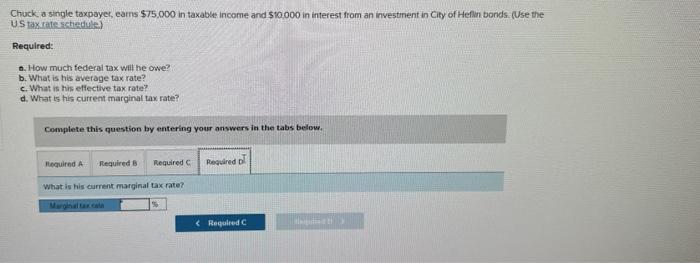

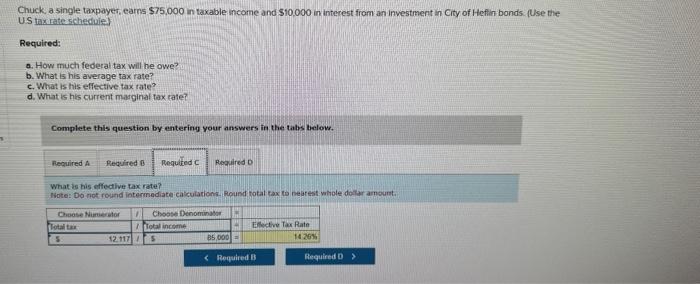

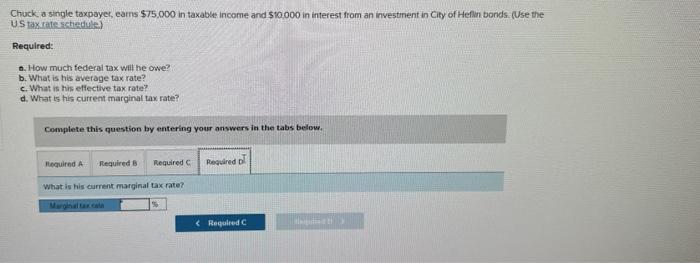

how do i do marginal tax rate? please explain in detail i have spent hours trying to figure it out. fhe last picture uploaded is

how do i do marginal tax rate? please explain in detail i have spent hours trying to figure it out. fhe last picture uploaded is where im having trouble. please break everything down so i can understand!

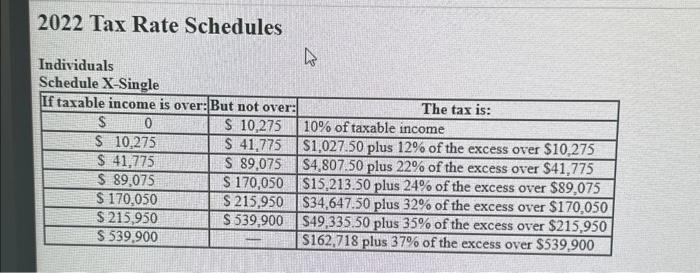

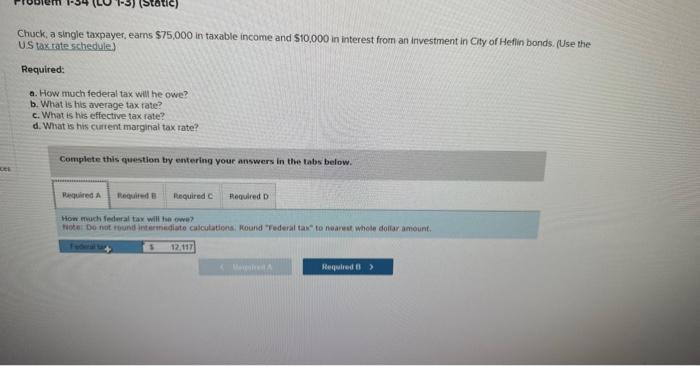

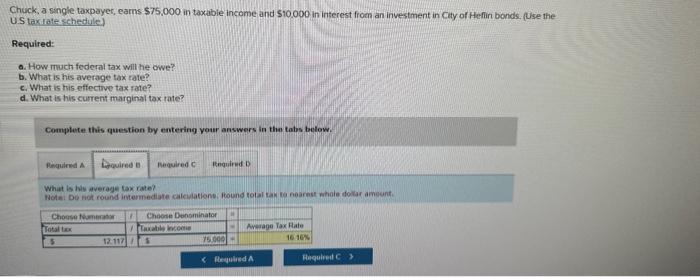

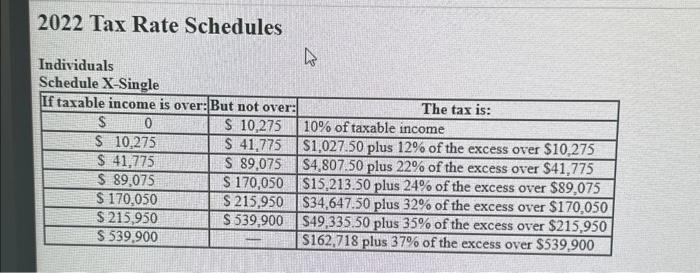

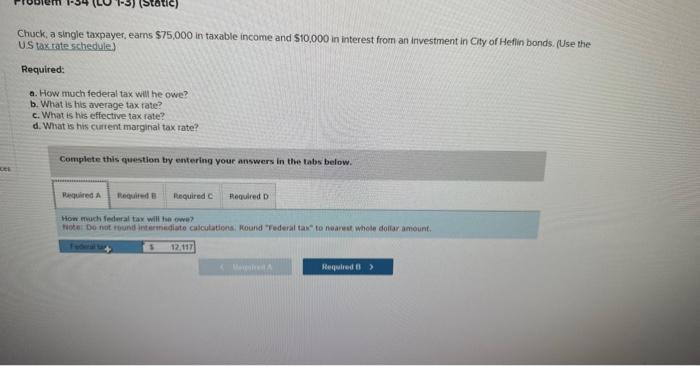

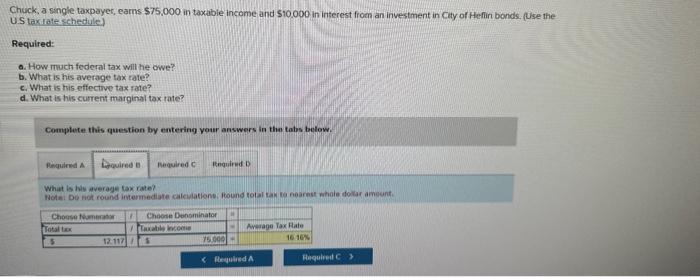

2022 Tax Rate Schedules Individuals Scharlula KaSinala Chuck, a single taxpayer, eams $75,000 in taxable income and $10,000 in interest from an investment in Cily of Heflin bonds. (Use the US tax tate schedule) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Complete this question try entering your answers in the labs below. Hoin fmuch lederal tax will be owe? Hoke: Do not round interinediate calcutatiena, lound "Federal taw" to naarest whole dollar anount. Chuck, a single taxpayer, earns $75,000 in taxable income and $10.000 in interest from an investment in city of Heflin bonds. (Use the US taxirate schedule) Required: a. How mach federal tax will he owe? b. What is his average tax rate? c. What is this effective tax rate? d. What is his current marginal tax rate? Complete this question by entering your answers in tha tabs below. What is hls average tax rate? Note: Do not round intermediate caleikations. Pound tolai gay ca nearnst whale dotar ameunt. Chuck, a single taxpayer, earns $75,000 in taxable income and $10,000 in interest from an investment in City of Heflin bonds. (Use the US tax inatescheduiel Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax cate? Complete this question by entering your answers in the tabs helow. What is his effective fax rote? Isote: bo not round intermediate calcularions, pound total tax to nearest whole doilar anount. Chuck, a single taxpayer, earns $15.000 in taxable income and $10.000 in interest from an investment in City of Hefin bonds. Use the UStaxirateschedile.) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Complete this question by entering your answers in the tabs below. What is his current marginal tax rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started