How do I do the T accounts with Direct method

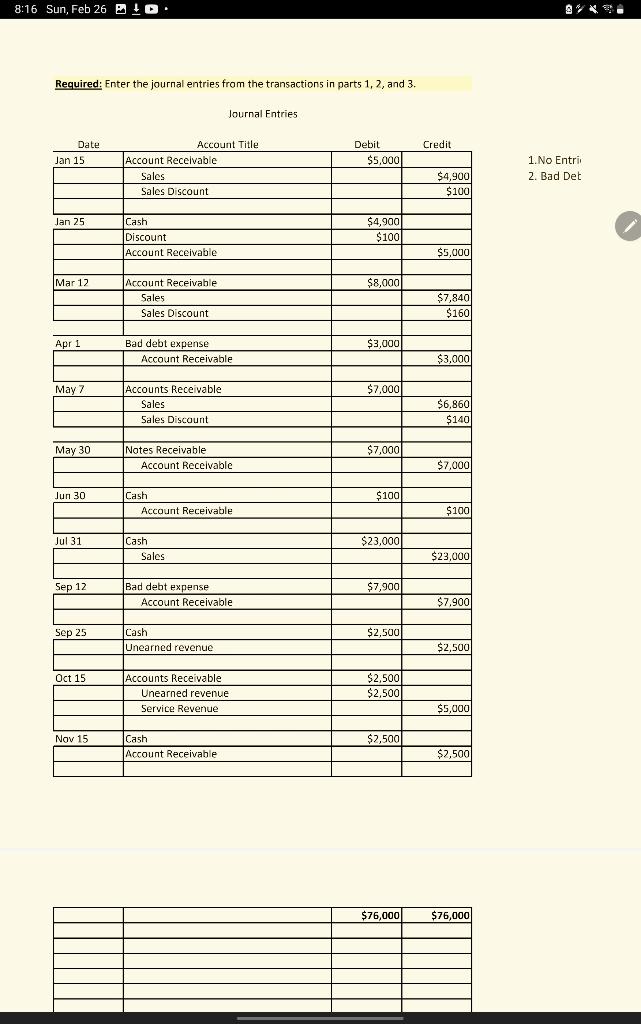

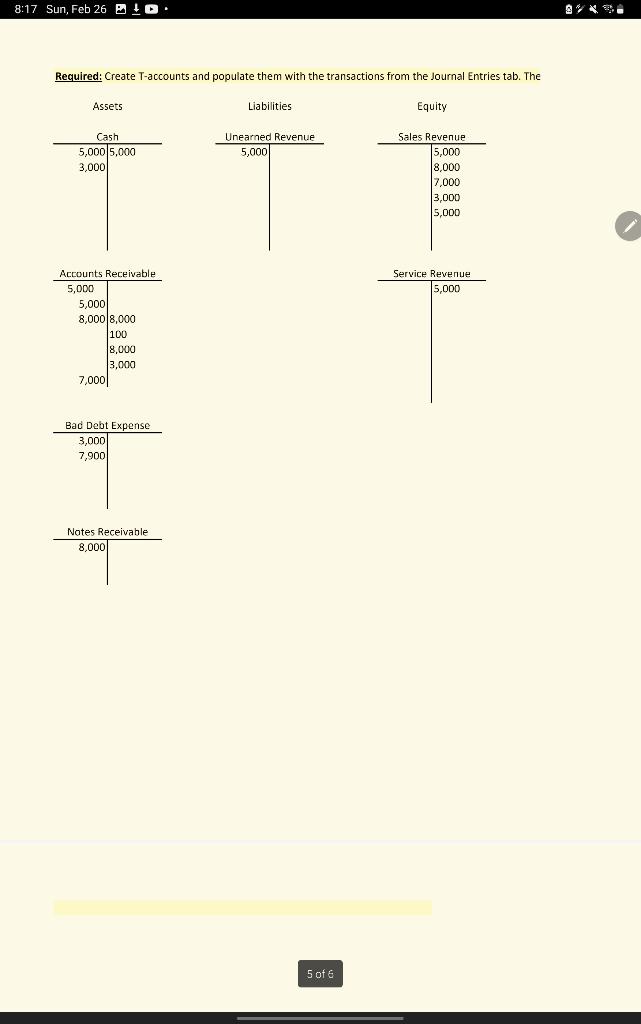

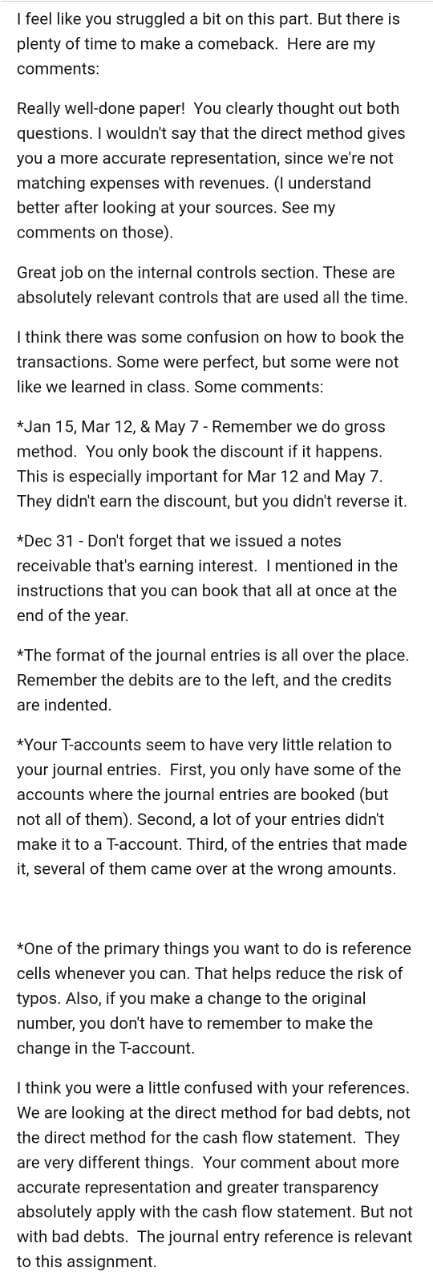

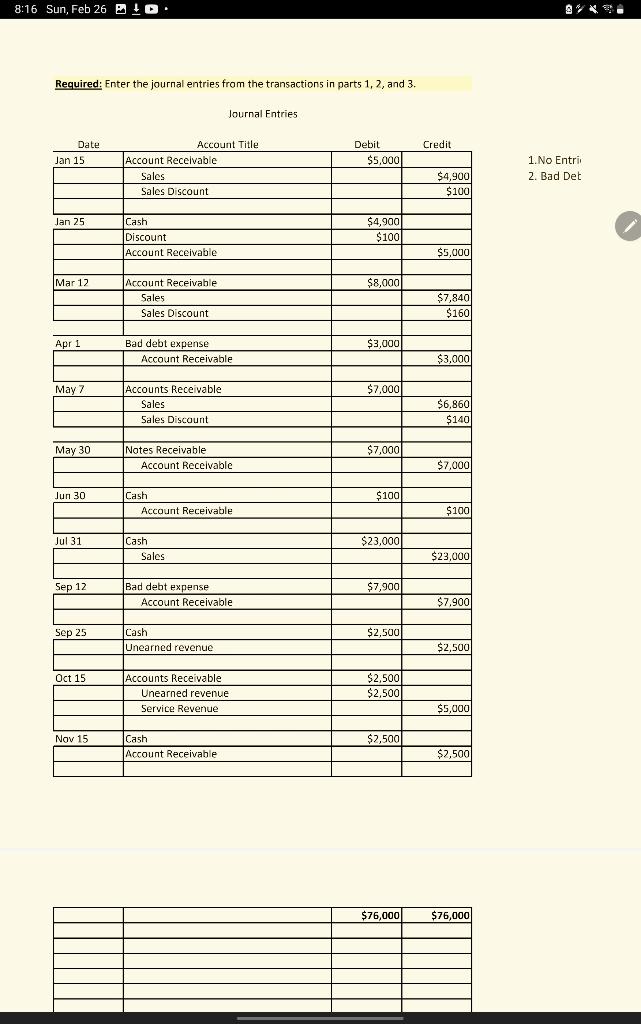

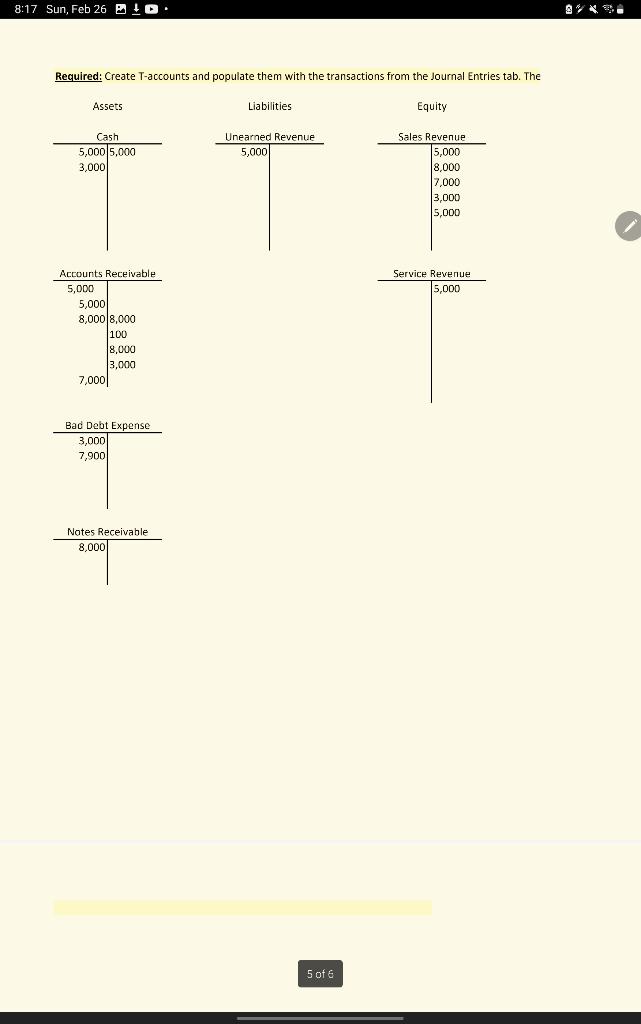

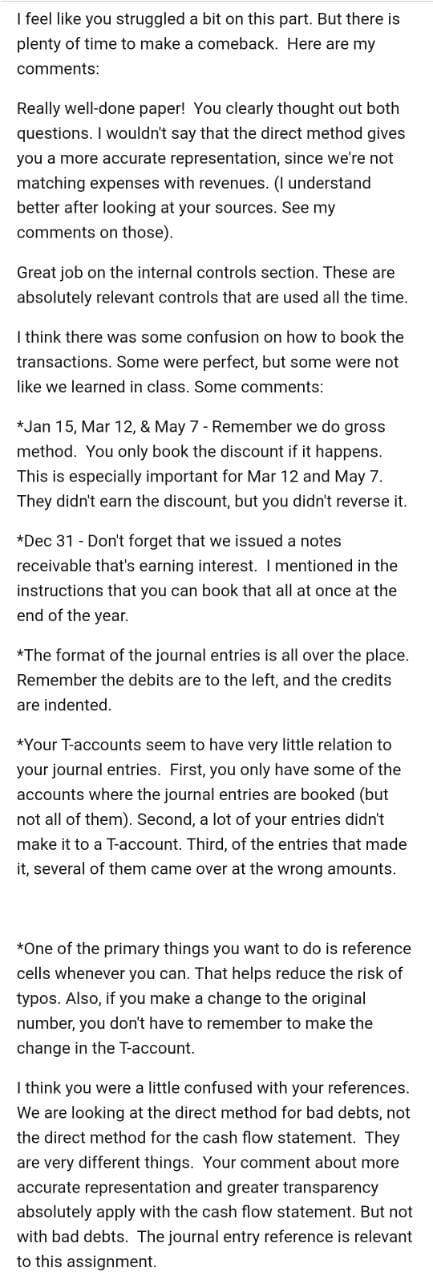

Required: Enter the journal entries from the transactions in parts 1, 2, and 3. Journal Entries Required: Create T-accounts and populate them with the transactions from the Journal Entries tab. The I feel like you struggled a bit on this part. But there is plenty of time to make a comeback. Here are my comments: Really well-done paper! You clearly thought out both questions. I wouldn't say that the direct method gives you a more accurate representation, since we're not matching expenses with revenues. (I understand better after looking at your sources. See my comments on those). Great job on the internal controls section. These are absolutely relevant controls that are used all the time. I think there was some confusion on how to book the transactions. Some were perfect, but some were not like we learned in class. Some comments: *Jan 15, Mar 12, \& May 7 -Remember we do gross method. You only book the discount if it happens. This is especially important for Mar 12 and May 7. They didn't earn the discount, but you didn't reverse it. *Dec 31 - Don't forget that we issued a notes receivable that's earning interest. I mentioned in the instructions that you can book that all at once at the end of the year. *The format of the journal entries is all over the place. Remember the debits are to the left, and the credits are indented. *Your T-accounts seem to have very little relation to your journal entries. First, you only have some of the accounts where the journal entries are booked (but not all of them). Second, a lot of your entries didn't make it to a T-account. Third, of the entries that made it, several of them came over at the wrong amounts. *One of the primary things you want to do is reference cells whenever you can. That helps reduce the risk of typos. Also, if you make a change to the original number, you don't have to remember to make the change in the T-account. I think you were a little confused with your references. We are looking at the direct method for bad debts, not the direct method for the cash flow statement. They are very different things. Your comment about more accurate representation and greater transparency absolutely apply with the cash flow statement. But not with bad debts. The journal entry reference is relevant to this assignment