Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how do i do this? a. The first task is to determine an optimal risky portfolio that maximizes investor's Sharpe Ratio, which is one of

how do i do this?

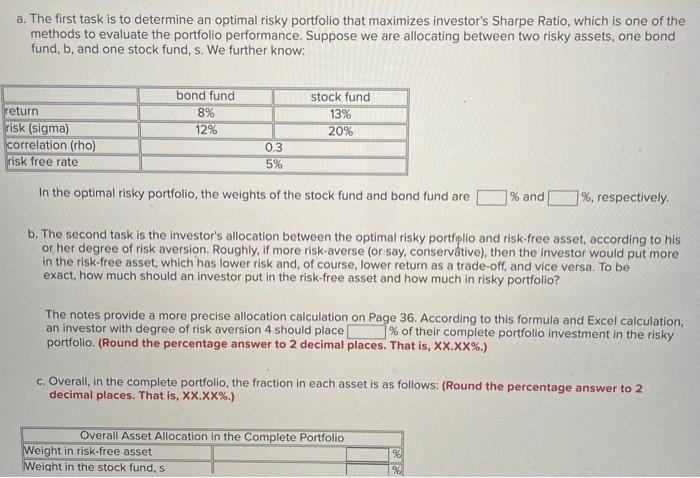

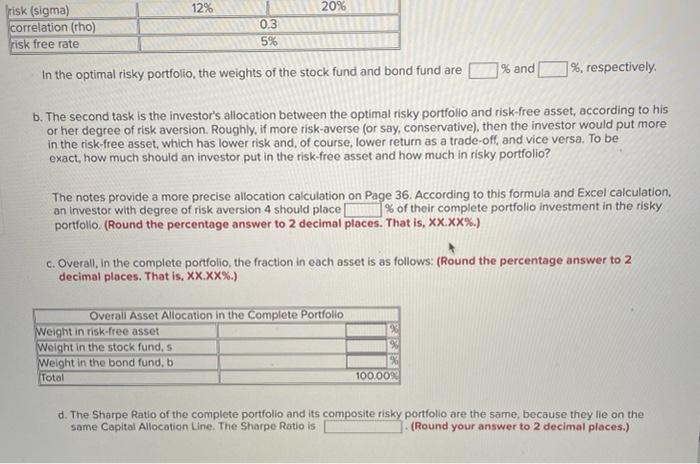

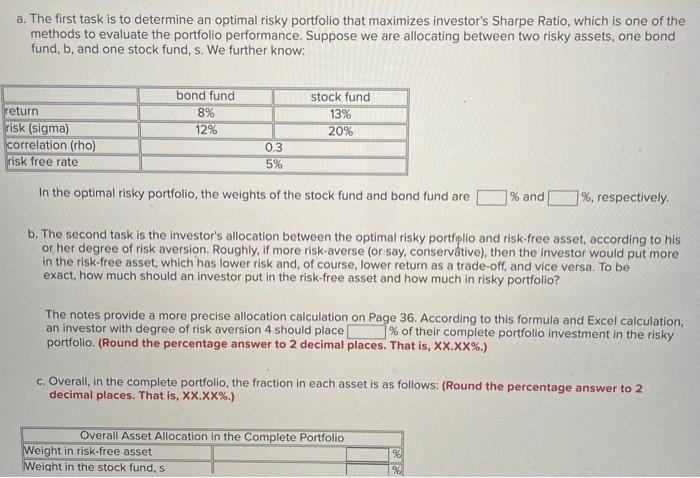

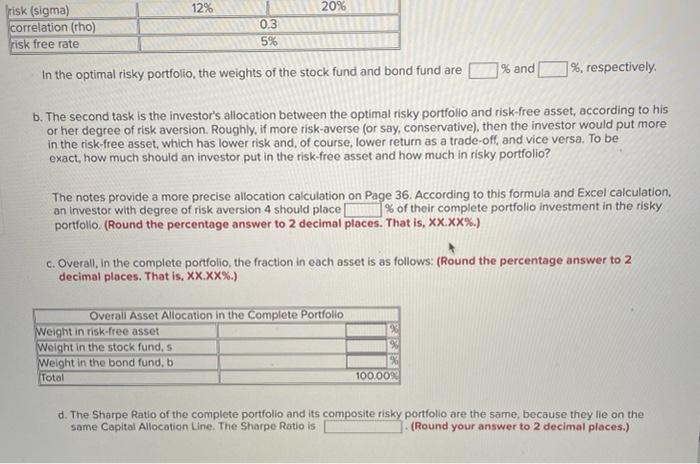

a. The first task is to determine an optimal risky portfolio that maximizes investor's Sharpe Ratio, which is one of the methods to evaluate the portfolio performance. Suppose we are allocating between two risky assets, one bond fund, b, and one stock fund, s. We further know: bond fund stock fund return 8% 13% 12% 20% risk (sigma) correlation (rho) 0.3 5% risk free rate In the optimal risky portfolio, the weights of the stock fund and bond fund are % and %, respectively. b. The second task is the investor's allocation between the optimal risky portfolio and risk-free asset, according to his or her degree of risk aversion. Roughly, if more risk-averse (or say, conservative), then the investor would put more in the risk-free asset, which has lower risk and, of course, lower return as a trade-off, and vice versa. To be exact, how much should an investor put in the risk-free asset and how much in risky portfolio? The notes provide a more precise allocation calculation on Page 36. According to this formula and Excel calculation, an investor with degree of risk aversion 4 should place % of their complete portfolio investment in the risky portfolio. (Round the percentage answer to 2 decimal places. That is, XX.XX%.) c. Overall, in the complete portfolio, the fraction in each asset is as follows: (Round the percentage answer to 2 decimal places. That is, XX.XX%.) Overall Asset Allocation in the Complete Portfolio Weight in risk-free asset Weight in the stock fund, s 12% 20% risk (sigma) correlation (rho) 0.3 risk free rate 5% In the optimal risky portfolio, the weights of the stock fund and bond fund are % and 1%, respectively. b. The second task is the investor's allocation between the optimal risky portfolio and risk-free asset, according to his or her degree of risk aversion. Roughly, if more risk-averse (or say, conservative), then the investor would put more in the risk-free asset, which has lower risk and, of course, lower return as a trade-off, and vice versa. To be exact, how much should an investor put in the risk-free asset and how much in risky portfolio? The notes provide a more precise allocation calculation on Page 36. According to this formula and Excel calculation, an investor with degree of risk aversion 4 should place % of their complete portfolio investment in the risky portfolio. (Round the percentage answer to 2 decimal places. That is, XX.XX%.) c. Overall, in the complete portfolio, the fraction in each asset is as follows: (Round the percentage answer to 2 decimal places. That is, XX.XX%.) Overall Asset Allocation in the Complete Portfolio Weight in risk-free asset Weight in the stock fund, s Weight in the bond fund, bi Total 100.00% d. The Sharpe Ratio of the complete portfolio and its composite risky portfolio are the same, because they lie on the same Capital Allocation Line. The Sharpe Ratio is (Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started