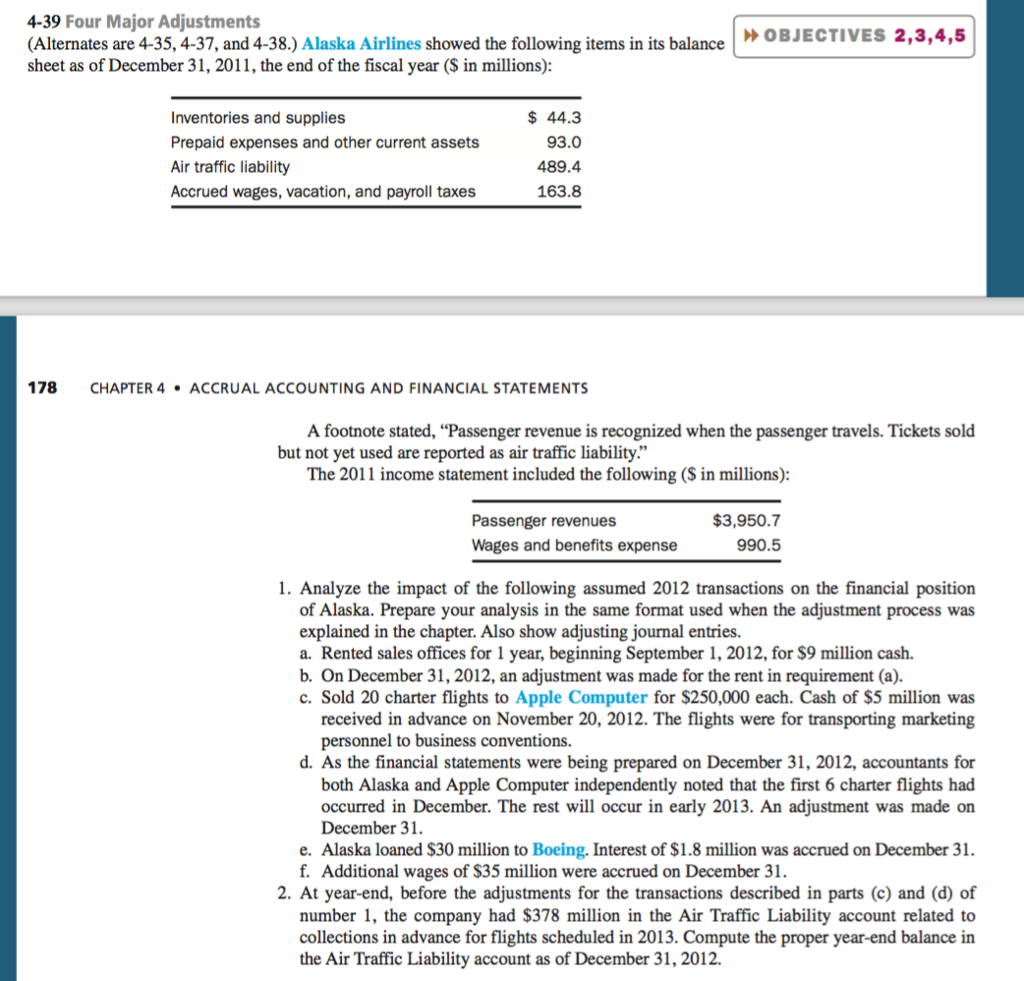

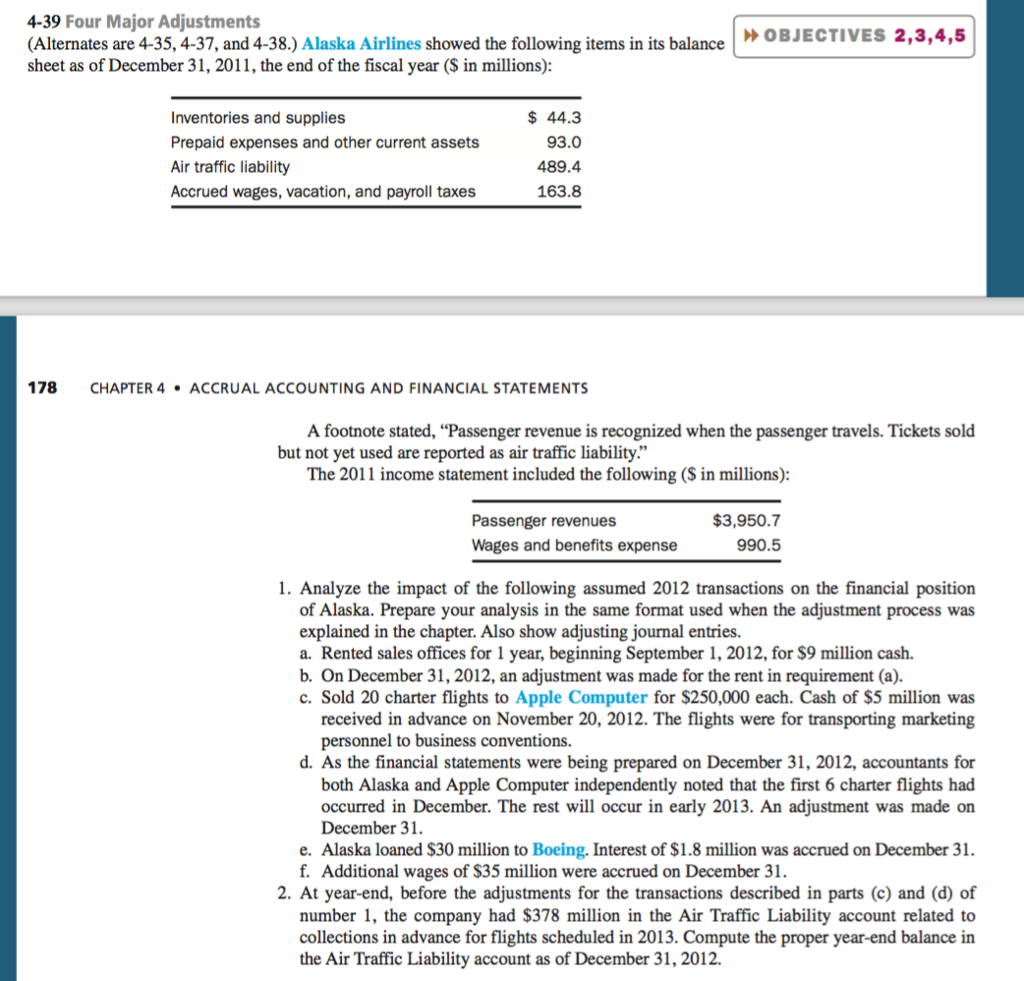

How do I do this problem, question 4-39 in the Financial Accounting Book? Alaska Airlines showed the following items in its balance sheet as of December 31, 2011, the end of the fiscal year ($ in millions): Inventories and supplies $ 44.3 Accrued wages, vacation, and payroll taxes 163.8 Prepaid expenses and other current assets 93.0 Air traffic liability 489.4 A footnote stated, Passenger revenue is recognized when the passenger travels. Tickets sold but not yet used are reported as air traffic liability. The 2011 income statement included the following ($ in millions): Passenger revenues $3,950.7 Wages and benefits expense 990.5 1. Analyze the impact of the following assumed 2012 transactions on the financial position of Alaska. Prepare your analysis in the same format used when the adjustment process was explained in the chapter. Also show adjusting journal entries. a. Rented sales offices for 1 year, beginning September 1, 2012, for $9 million cash. b. On December 31, 2012, an adjustment was made for the rent in requirement (a). c. Sold 20 charter flights to Apple Computer for $250,000 each. Cash of $5 million was received in advance on November 20, 2012. The flights were for transporting marketing personnel to business conventions. d. As the financial statements were being prepared on December 31, 2012, accountants for both Alaska and Apple Computer independently noted that the first 6 charter flights had occurred in December. The rest will occur in early 2013. An adjustment was made on December 31. e. Alaska loaned $30million to Boeing. Interest of $1.8million was accrued on December31. f. Additional wages of $35 million were accrued on December 31. 2. At year-end, before the adjustments for the transactions described in parts (c) and (d) of number 1, the company had $378 million in the Air Traffic Liability account related to collections in advance for flights scheduled in 2013. Compute the proper year-end balance in the Air Traffic Liability account as of December 31, 2012.

How do I do this problem, question 4-39 in the Financial Accounting Book? Alaska Airlines showed the following items in its balance sheet as of December 31, 2011, the end of the fiscal year ($ in millions): Inventories and supplies $ 44.3 Accrued wages, vacation, and payroll taxes 163.8 Prepaid expenses and other current assets 93.0 Air traffic liability 489.4 A footnote stated, Passenger revenue is recognized when the passenger travels. Tickets sold but not yet used are reported as air traffic liability. The 2011 income statement included the following ($ in millions): Passenger revenues $3,950.7 Wages and benefits expense 990.5 1. Analyze the impact of the following assumed 2012 transactions on the financial position of Alaska. Prepare your analysis in the same format used when the adjustment process was explained in the chapter. Also show adjusting journal entries. a. Rented sales offices for 1 year, beginning September 1, 2012, for $9 million cash. b. On December 31, 2012, an adjustment was made for the rent in requirement (a). c. Sold 20 charter flights to Apple Computer for $250,000 each. Cash of $5 million was received in advance on November 20, 2012. The flights were for transporting marketing personnel to business conventions. d. As the financial statements were being prepared on December 31, 2012, accountants for both Alaska and Apple Computer independently noted that the first 6 charter flights had occurred in December. The rest will occur in early 2013. An adjustment was made on December 31. e. Alaska loaned $30million to Boeing. Interest of $1.8million was accrued on December31. f. Additional wages of $35 million were accrued on December 31. 2. At year-end, before the adjustments for the transactions described in parts (c) and (d) of number 1, the company had $378 million in the Air Traffic Liability account related to collections in advance for flights scheduled in 2013. Compute the proper year-end balance in the Air Traffic Liability account as of December 31, 2012.

4-39 Four Major Adjustments (Alternates are 4-35, 4-37, and 4-38.) Alaska Airlines showed the following items in its balance sheet as of December 31, 2011, the end of the fiscal year (S in millions) OBJECTIVES 2,3,4,5 Inventories and supplies Prepaid expenses and other current assets Air traffic liability Accrued wages, vacation, and payroll taxes $ 44.3 93.0 489.4 163.8 178 CHAPTER 4 . ACCRUAL ACCOUNTING AND FINANCIAL STATEMENTS A footnote stated, "Passenger revenue is recognized when the passenger travels. Tickets sold but not yet used are reported as air traffic liability." The 2011 income statement included the following (S in millions) Passenger revenues Wages and benefits expense $3,950.7 990.5 1. Analyze the impact of the following assumed 2012 transactions on the financial position of Alaska. Prepare your analysis in the same format used when the adjustment process was explained in the chapter. Also show adjusting journal entries. a. Rented sales offices for 1 year, beginning September 1, 2012, for $9 million cash. b. On December 31, 2012, an adjustment was made for the rent in requirement (a). c. Sold 20 charter flights to Apple Computer for $250,000 each. Cash of $5 million was received in advance on November 20, 2012. The flights were for transporting marketing personnel to business conventions. d. As the financial statements were being prepared on December 31, 2012, accountants for both Alaska and Apple Computer independently noted that the first 6 charter flights had occurred in December. The rest will occur in early 2013. An adjustment was made on December 31 e. Alaska loaned $30 million to Boeing. Interest of $1.8 million was accrued on December 31. f. Additional wages of $35 million were accrued on December 31 2. At year-end, before the adjustments for the transactions described in parts (c) and (d) of number 1, the company had $378 million in the Air Traffic Liability account related to balance in collections in advance for flights scheduled in 2013. Compute the proper year-end the Air Traffic Liability account as of December 31, 2012. 4-39 Four Major Adjustments (Alternates are 4-35, 4-37, and 4-38.) Alaska Airlines showed the following items in its balance sheet as of December 31, 2011, the end of the fiscal year (S in millions) OBJECTIVES 2,3,4,5 Inventories and supplies Prepaid expenses and other current assets Air traffic liability Accrued wages, vacation, and payroll taxes $ 44.3 93.0 489.4 163.8 178 CHAPTER 4 . ACCRUAL ACCOUNTING AND FINANCIAL STATEMENTS A footnote stated, "Passenger revenue is recognized when the passenger travels. Tickets sold but not yet used are reported as air traffic liability." The 2011 income statement included the following (S in millions) Passenger revenues Wages and benefits expense $3,950.7 990.5 1. Analyze the impact of the following assumed 2012 transactions on the financial position of Alaska. Prepare your analysis in the same format used when the adjustment process was explained in the chapter. Also show adjusting journal entries. a. Rented sales offices for 1 year, beginning September 1, 2012, for $9 million cash. b. On December 31, 2012, an adjustment was made for the rent in requirement (a). c. Sold 20 charter flights to Apple Computer for $250,000 each. Cash of $5 million was received in advance on November 20, 2012. The flights were for transporting marketing personnel to business conventions. d. As the financial statements were being prepared on December 31, 2012, accountants for both Alaska and Apple Computer independently noted that the first 6 charter flights had occurred in December. The rest will occur in early 2013. An adjustment was made on December 31 e. Alaska loaned $30 million to Boeing. Interest of $1.8 million was accrued on December 31. f. Additional wages of $35 million were accrued on December 31 2. At year-end, before the adjustments for the transactions described in parts (c) and (d) of number 1, the company had $378 million in the Air Traffic Liability account related to balance in collections in advance for flights scheduled in 2013. Compute the proper year-end the Air Traffic Liability account as of December 31, 2012

How do I do this problem, question 4-39 in the Financial Accounting Book? Alaska Airlines showed the following items in its balance sheet as of December 31, 2011, the end of the fiscal year ($ in millions): Inventories and supplies $ 44.3 Accrued wages, vacation, and payroll taxes 163.8 Prepaid expenses and other current assets 93.0 Air traffic liability 489.4 A footnote stated, Passenger revenue is recognized when the passenger travels. Tickets sold but not yet used are reported as air traffic liability. The 2011 income statement included the following ($ in millions): Passenger revenues $3,950.7 Wages and benefits expense 990.5 1. Analyze the impact of the following assumed 2012 transactions on the financial position of Alaska. Prepare your analysis in the same format used when the adjustment process was explained in the chapter. Also show adjusting journal entries. a. Rented sales offices for 1 year, beginning September 1, 2012, for $9 million cash. b. On December 31, 2012, an adjustment was made for the rent in requirement (a). c. Sold 20 charter flights to Apple Computer for $250,000 each. Cash of $5 million was received in advance on November 20, 2012. The flights were for transporting marketing personnel to business conventions. d. As the financial statements were being prepared on December 31, 2012, accountants for both Alaska and Apple Computer independently noted that the first 6 charter flights had occurred in December. The rest will occur in early 2013. An adjustment was made on December 31. e. Alaska loaned $30million to Boeing. Interest of $1.8million was accrued on December31. f. Additional wages of $35 million were accrued on December 31. 2. At year-end, before the adjustments for the transactions described in parts (c) and (d) of number 1, the company had $378 million in the Air Traffic Liability account related to collections in advance for flights scheduled in 2013. Compute the proper year-end balance in the Air Traffic Liability account as of December 31, 2012.

How do I do this problem, question 4-39 in the Financial Accounting Book? Alaska Airlines showed the following items in its balance sheet as of December 31, 2011, the end of the fiscal year ($ in millions): Inventories and supplies $ 44.3 Accrued wages, vacation, and payroll taxes 163.8 Prepaid expenses and other current assets 93.0 Air traffic liability 489.4 A footnote stated, Passenger revenue is recognized when the passenger travels. Tickets sold but not yet used are reported as air traffic liability. The 2011 income statement included the following ($ in millions): Passenger revenues $3,950.7 Wages and benefits expense 990.5 1. Analyze the impact of the following assumed 2012 transactions on the financial position of Alaska. Prepare your analysis in the same format used when the adjustment process was explained in the chapter. Also show adjusting journal entries. a. Rented sales offices for 1 year, beginning September 1, 2012, for $9 million cash. b. On December 31, 2012, an adjustment was made for the rent in requirement (a). c. Sold 20 charter flights to Apple Computer for $250,000 each. Cash of $5 million was received in advance on November 20, 2012. The flights were for transporting marketing personnel to business conventions. d. As the financial statements were being prepared on December 31, 2012, accountants for both Alaska and Apple Computer independently noted that the first 6 charter flights had occurred in December. The rest will occur in early 2013. An adjustment was made on December 31. e. Alaska loaned $30million to Boeing. Interest of $1.8million was accrued on December31. f. Additional wages of $35 million were accrued on December 31. 2. At year-end, before the adjustments for the transactions described in parts (c) and (d) of number 1, the company had $378 million in the Air Traffic Liability account related to collections in advance for flights scheduled in 2013. Compute the proper year-end balance in the Air Traffic Liability account as of December 31, 2012.