Answered step by step

Verified Expert Solution

Question

1 Approved Answer

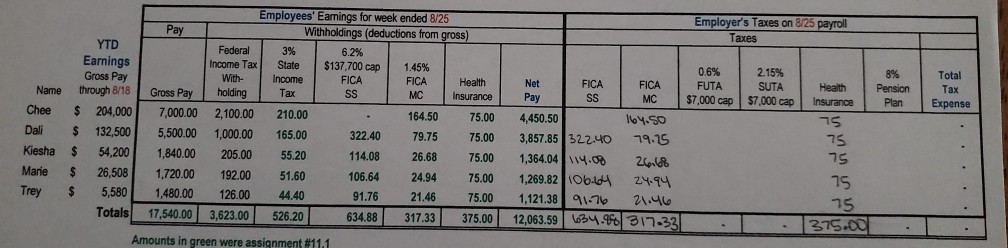

How do I fill out the rest of this table Employer's Taxes on 8/25 payroll Pay Taxes 0.6% Net FICA FICA FUTA $7,000 cap 2.15%

How do I fill out the rest of this table

Employer's Taxes on 8/25 payroll Pay Taxes 0.6% Net FICA FICA FUTA $7,000 cap 2.15% SUTA $7,000 cap 8% Pension Plan Total Tax Expense Health Insurance 75 Name Chee Dali Kiesha Marie Trey YTD Earnings Gross Pay through 8/18 $ 204,000 $ 132,500 $ 54,200 $ 26,508 $ 5,580 Totals Employees' Earnings for week ended 8/25 Withholdings (deductions from gross) Federal 3% 6.2% Income Tax State $137,700 cap 1.45% With- Income FICA FICA Health holding Tax SS MC Insurance 2,100.00 210.00 164.50 75.00 1,000.00 165.00 322.40 79.75 75.00 205.00 55.20 114.08 26.68 75.00 192.00 51.60 24.94 75.00 126.00 44.40 91.76 21.46 75.00 3,623.00 526.20 634.88 317.33 375.00 Gross Pay 7,000.00 5,500.00 1,840.00 1,720.00 1,480.00 17.540.00 4,450.50 164.50 3,857.85 322.40 79.15 1,364.04 114.0% 26.08 1,269.82 106.64 24.94 1,121.38 91-76 21.46 12,063.59634.6 31733 75 75 75 75 375.00 . Amounts in green were assinnment #111Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started