Answered step by step

Verified Expert Solution

Question

1 Approved Answer

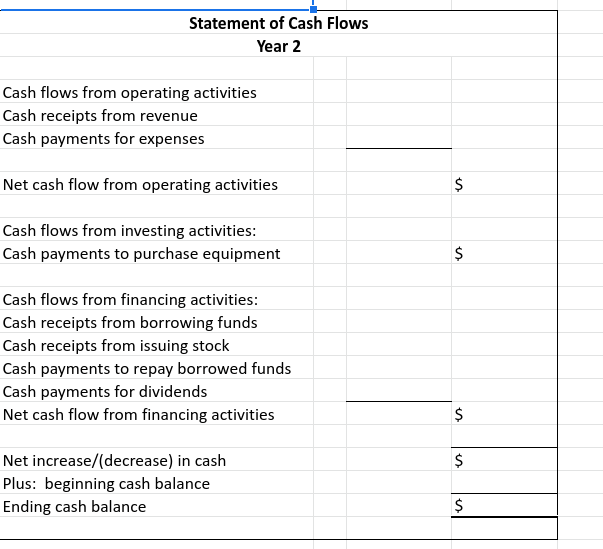

How do I fill out the statement of cash flow using this information? Statement of Cash Flows Year 2 Cash flows from operating activities Cash

How do I fill out the statement of cash flow using this information?

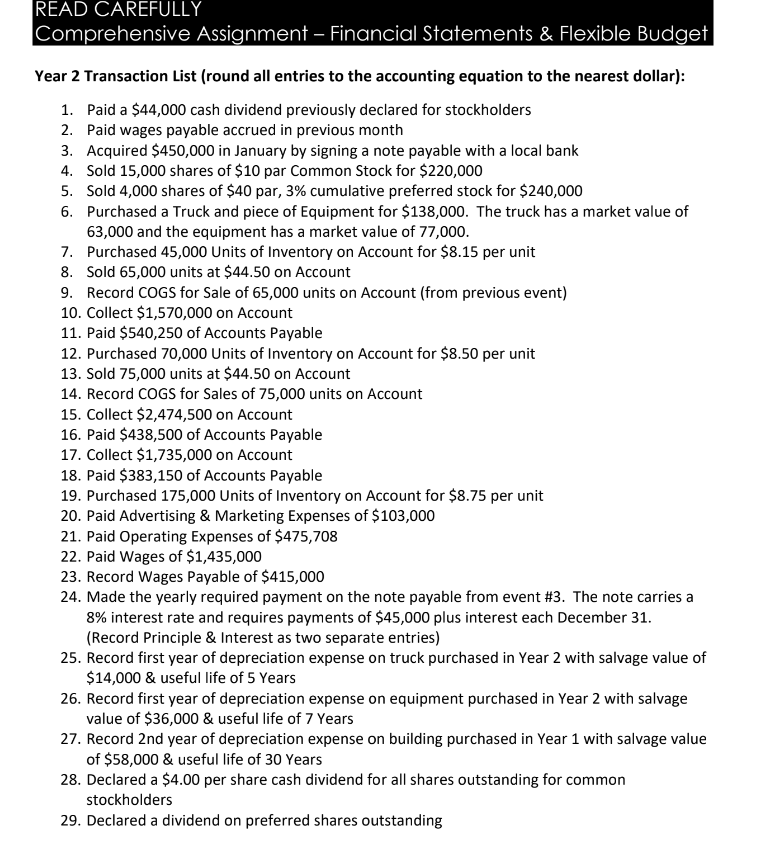

Statement of Cash Flows Year 2 Cash flows from operating activities Cash receipts from revenue Cash payments for expenses Net cash flow from operating activities $ Cash flows from investing activities: Cash payments to purchase equipment $ Cash flows from financing activities: Cash receipts from borrowing funds Cash receipts from issuing stock Cash payments to repay borrowed funds Cash payments for dividends Net cash flow from financing activities Net increase/(decrease) in cash Plus: beginning cash balance Ending cash balance $ Comprehensive Assignment - Financial Statements \& Flexible Budget Year 2 Transaction List (round all entries to the accounting equation to the nearest dollar): 1. Paid a $44,000 cash dividend previously declared for stockholders 2. Paid wages payable accrued in previous month 3. Acquired $450,000 in January by signing a note payable with a local bank 4. Sold 15,000 shares of $10 par Common Stock for $220,000 5. Sold 4,000 shares of $40 par, 3\% cumulative preferred stock for $240,000 6. Purchased a Truck and piece of Equipment for $138,000. The truck has a market value of 63,000 and the equipment has a market value of 77,000 . 7. Purchased 45,000 Units of Inventory on Account for $8.15 per unit 8. Sold 65,000 units at $44.50 on Account 9. Record COGS for Sale of 65,000 units on Account (from previous event) 10. Collect $1,570,000 on Account 11. Paid $540,250 of Accounts Payable 12. Purchased 70,000 Units of Inventory on Account for $8.50 per unit 13. Sold 75,000 units at $44.50 on Account 14. Record COGS for Sales of 75,000 units on Account 15. Collect $2,474,500 on Account 16. Paid $438,500 of Accounts Payable 17. Collect $1,735,000 on Account 18. Paid $383,150 of Accounts Payable 19. Purchased 175,000 Units of Inventory on Account for $8.75 per unit 20. Paid Advertising \& Marketing Expenses of $103,000 21. Paid Operating Expenses of $475,708 22. Paid Wages of $1,435,000 23. Record Wages Payable of $415,000 24. Made the yearly required payment on the note payable from event \#3. The note carries a 8% interest rate and requires payments of $45,000 plus interest each December 31. (Record Principle \& Interest as two separate entries) 25. Record first year of depreciation expense on truck purchased in Year 2 with salvage value of $14,000 \& useful life of 5 Years 26. Record first year of depreciation expense on equipment purchased in Year 2 with salvage value of $36,000 \& useful life of 7 Years 27. Record 2nd year of depreciation expense on building purchased in Year 1 with salvage value of $58,000 \& useful life of 30 Years 28. Declared a $4.00 per share cash dividend for all shares outstanding for common stockholders 29. Declared a dividend on preferred shares outstanding Statement of Cash Flows Year 2 Cash flows from operating activities Cash receipts from revenue Cash payments for expenses Net cash flow from operating activities $ Cash flows from investing activities: Cash payments to purchase equipment $ Cash flows from financing activities: Cash receipts from borrowing funds Cash receipts from issuing stock Cash payments to repay borrowed funds Cash payments for dividends Net cash flow from financing activities Net increase/(decrease) in cash Plus: beginning cash balance Ending cash balance $ Comprehensive Assignment - Financial Statements \& Flexible Budget Year 2 Transaction List (round all entries to the accounting equation to the nearest dollar): 1. Paid a $44,000 cash dividend previously declared for stockholders 2. Paid wages payable accrued in previous month 3. Acquired $450,000 in January by signing a note payable with a local bank 4. Sold 15,000 shares of $10 par Common Stock for $220,000 5. Sold 4,000 shares of $40 par, 3\% cumulative preferred stock for $240,000 6. Purchased a Truck and piece of Equipment for $138,000. The truck has a market value of 63,000 and the equipment has a market value of 77,000 . 7. Purchased 45,000 Units of Inventory on Account for $8.15 per unit 8. Sold 65,000 units at $44.50 on Account 9. Record COGS for Sale of 65,000 units on Account (from previous event) 10. Collect $1,570,000 on Account 11. Paid $540,250 of Accounts Payable 12. Purchased 70,000 Units of Inventory on Account for $8.50 per unit 13. Sold 75,000 units at $44.50 on Account 14. Record COGS for Sales of 75,000 units on Account 15. Collect $2,474,500 on Account 16. Paid $438,500 of Accounts Payable 17. Collect $1,735,000 on Account 18. Paid $383,150 of Accounts Payable 19. Purchased 175,000 Units of Inventory on Account for $8.75 per unit 20. Paid Advertising \& Marketing Expenses of $103,000 21. Paid Operating Expenses of $475,708 22. Paid Wages of $1,435,000 23. Record Wages Payable of $415,000 24. Made the yearly required payment on the note payable from event \#3. The note carries a 8% interest rate and requires payments of $45,000 plus interest each December 31. (Record Principle \& Interest as two separate entries) 25. Record first year of depreciation expense on truck purchased in Year 2 with salvage value of $14,000 \& useful life of 5 Years 26. Record first year of depreciation expense on equipment purchased in Year 2 with salvage value of $36,000 \& useful life of 7 Years 27. Record 2nd year of depreciation expense on building purchased in Year 1 with salvage value of $58,000 \& useful life of 30 Years 28. Declared a $4.00 per share cash dividend for all shares outstanding for common stockholders 29. Declared a dividend on preferred shares outstandingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started