Answered step by step

Verified Expert Solution

Question

1 Approved Answer

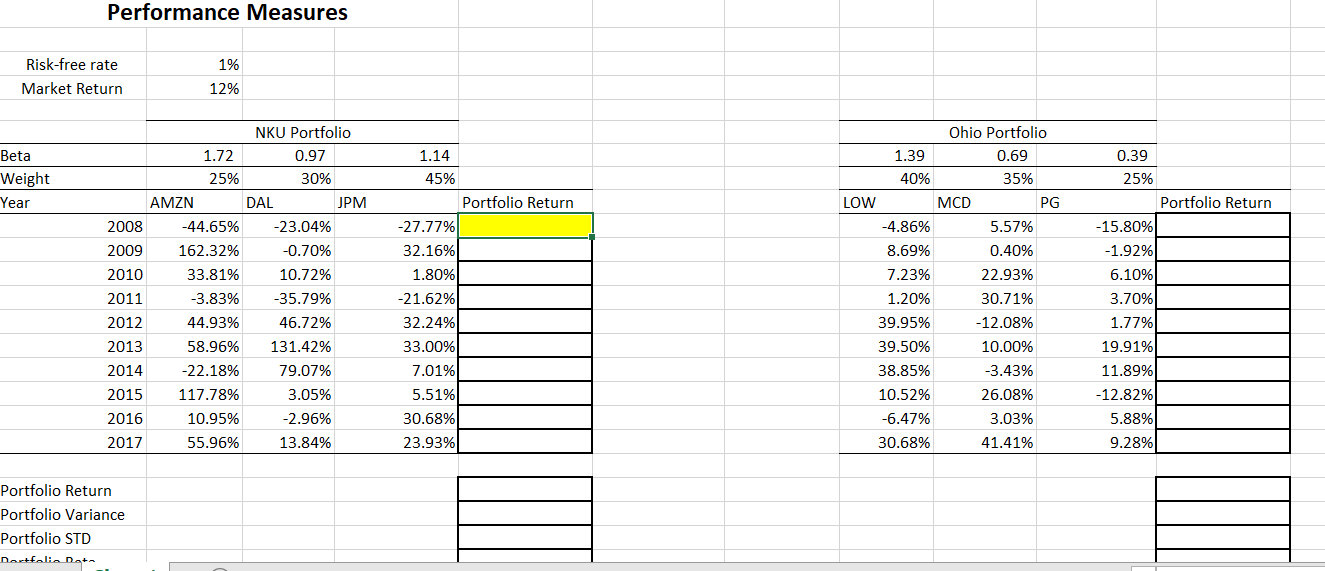

How do I find portfolio Return? Also, I need help with finding the portfolio variance, portfolio STD, and portfolio beta Performance Measures Risk-free rate Market

How do I find portfolio Return?

Also, I need help with finding the portfolio variance, portfolio STD, and portfolio beta

Performance Measures Risk-free rate Market Return 1% 12% 0.39 Beta Weight Year 1.14 45% 25% Portfolio Return Portfolio Return 1.72 25% AMZN 2008 -44.65% 2009 162.32% 2010 33.81% 2011 -3.83% 2012 44.93% 2013 58.96% 2014 -22.18% 2015 117.78% 2016 10.95% 2017 55.96% NKU Portfolio 0.97 30% DAL J PM -23.04% -0.70% 10.72% -35.79% 46.72% 131.42% 79.07% 3.05% -2.96% 13.84% -27.77% 32.16% 1.80% -21.62% 32.24% 33.00% 7.01% 5.51% 30.68% 23.93% Ohio Portfolio 1.39 0.69 40% 35% LOW MCD PG -4.86% 5.57% 8.69% 0.40% 7.23% 22.93% 1.20% 30.71% 39.95% -12.08% 39.50% 10.00% 38.85% -3.43% 10.52% 26.08% -6.47% 3.03% 30.68% 41.41% -15.80% -1.92% 6.10% 3.70% 1.77% 19.91% 11.89% -12.82% 5.88% 9.28% Portfolio Return Portfolio Variance Portfolio STD Dortfolio DataStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started