How do I find the $2.71 value in the bottom section labeled Earnings Per share of common stock followed by the subsection Income before extraordinary item? Also how do I find the Extraordinary item after it

How do I find the $2.71 value in the bottom section labeled Earnings Per share of common stock followed by the subsection Income before extraordinary item? Also how do I find the Extraordinary item after it

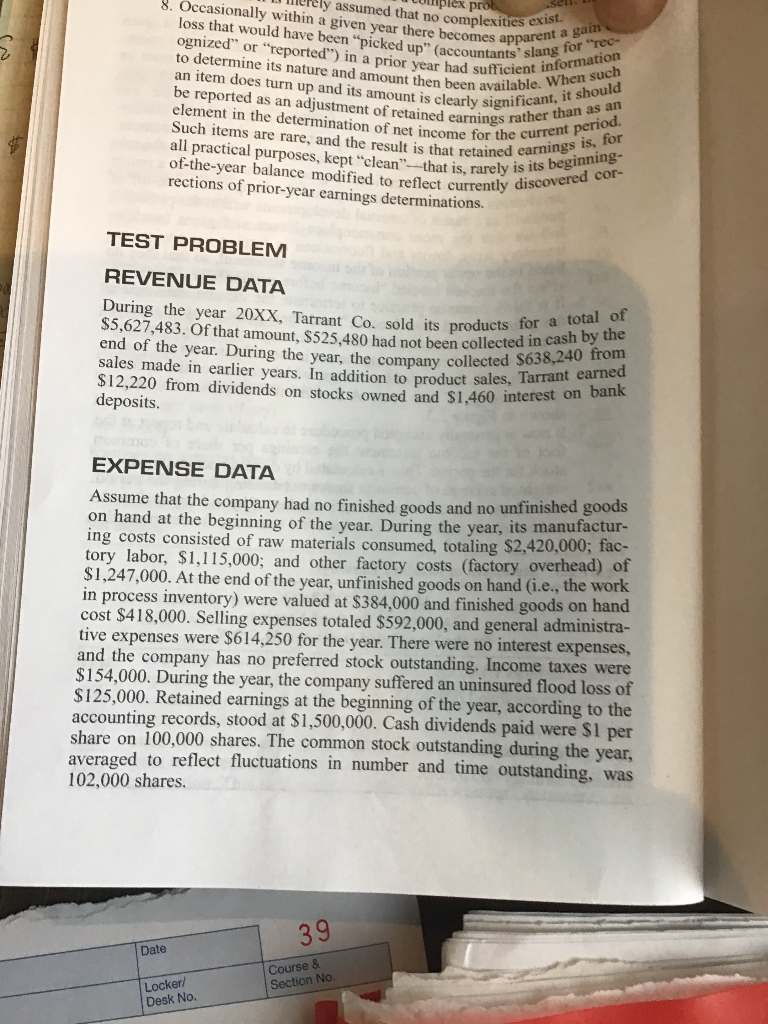

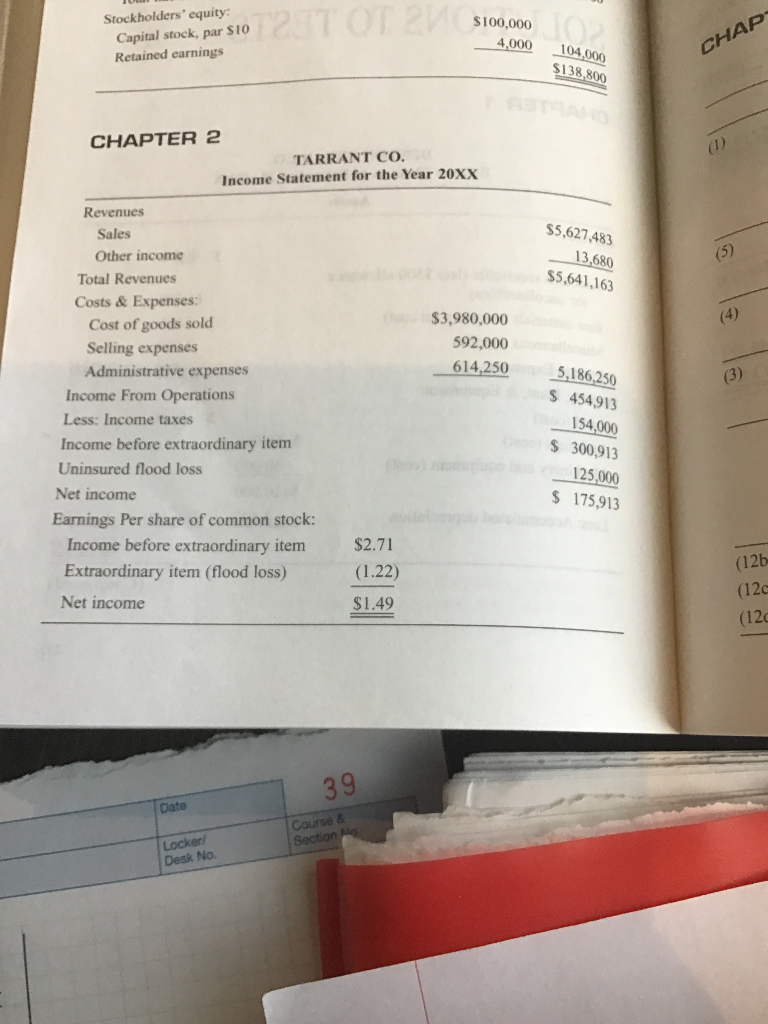

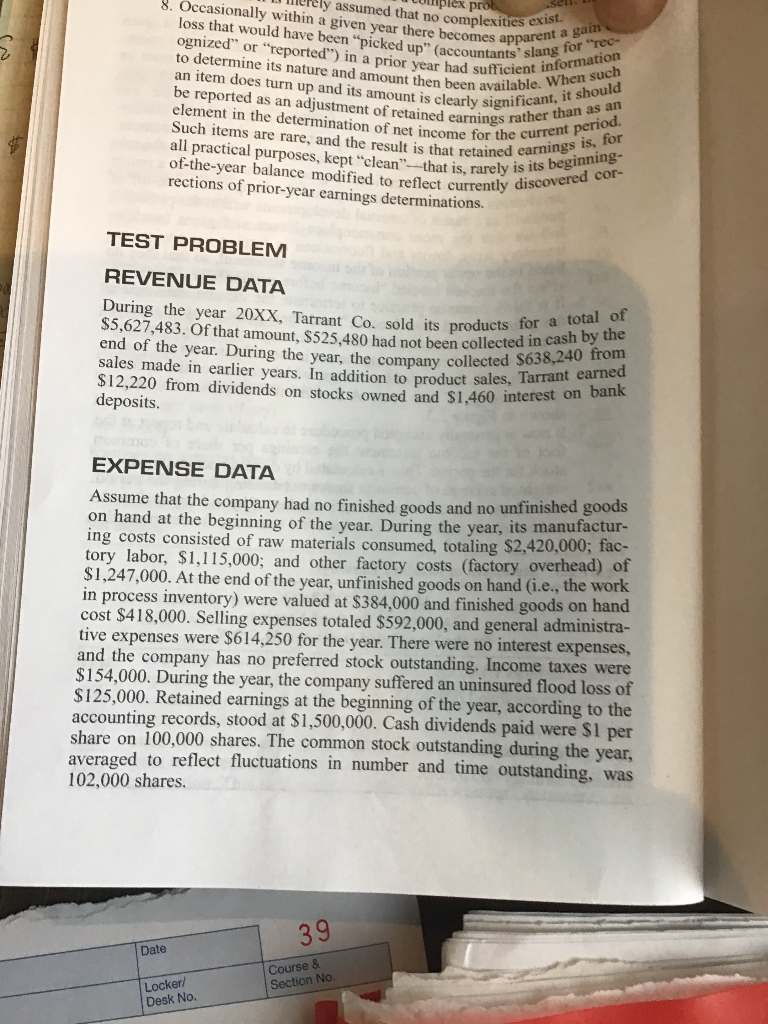

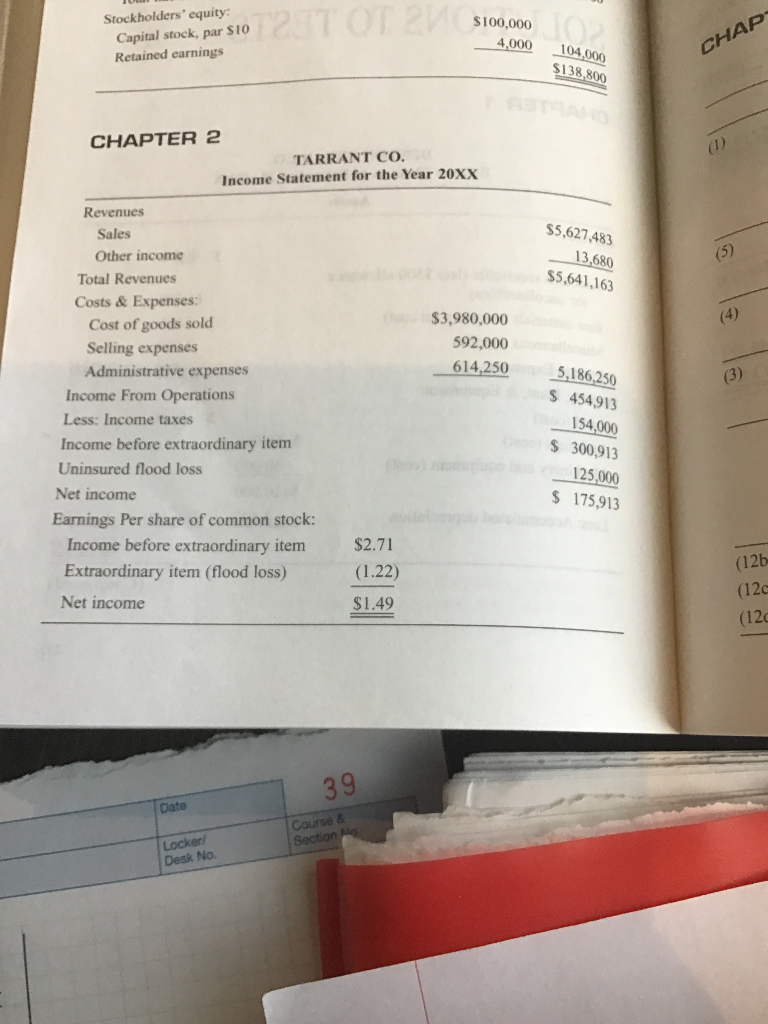

8. ccasionally within a given year there becomes apparent for rec lerely assumed that no complexities exis a ga iplex loss that would have been "picked up" (accountantsormati slang in to determine its nature and amount then been available. it shou an item does turn up and its amount is clearly significat than be reported as an adjustment of retained earningsape element in the determination of net income for the Such items are rare, and the result is that retainedearinning all practical purposes, kept "clean" that is, rarely is of-the-year balance modified to reflect currently rections of prior-year earnings determinations. prior year had sufficient n such nings i its begin dis TEST PROBLEM REVENUE DATA During the year 20XX, Tarrant Co. sold its products for a $5,627,483. Of that amount, $525,480 had not been collected in cals end of the year. During the year, the company collected S68, sales made in earlier years. In addition to product sales, Tarran $12,220 from dividends on stocks owned and $1,460 interest deposits 240 from nt earned on bank EXPENSE DATA oods Assume that the company had no finished goods and no unfinishedg on hand at the beginning of the year. During ing costs consisted of raw materials consumed, totaling $2,420 tory labor, $1,115,000; and other factory costs (factory overhead) S1,247,000. At the end of the year, unfinished goods on hand (Gi.e., the wo in process inventory) cost $418,000. Selling expenses totaled $592,000, and general administra- tive expenses were $614,250 for the year. There were no interest expenses, and the company has no preferred stock outstanding. Income taxes were the year, its manufactur- ,000; fac- were valued at $384,000 and finished goods on hand $154,000. During the year, the company suffered an uninsured flood loss of $125,000. Retained earnings at the beginning of the year, according to the accounting records, stood at $1,500,000. Cash dividends paid were $1 per share on 100,000 shares. The common stock outstanding during the year, averaged to reflect fluctuations in number and time outstanding, was 102,000 shares. Date Stockholders' equity $100,000 Capital stock, par S10 Retained earnings HA 4,000-104,000 S138,800 CHAPTER 2 TARRANT co. Income Statement for the Year 20xx Revenues Sales $5,627,483 Other income 3,680 $5,641,163 Total Revenues Costs&Expenses: S3,980,000 592,000 Cost of goods sold Selling expenses Administrative expenses Income From Operations Less: Income taxes Income before extraordinary item Uninsured flood loss 614,2505,186,250 S 454913 154,000 S 300,913 125,000 $175,913 Net income Earnings Per share of common stock: Income before extraordinary item Extraordinary item (flood loss) Net income $2.71 (12b (120 (12 $1.49 3 9 Date Desk No. 8. ccasionally within a given year there becomes apparent for rec lerely assumed that no complexities exis a ga iplex loss that would have been "picked up" (accountantsormati slang in to determine its nature and amount then been available. it shou an item does turn up and its amount is clearly significat than be reported as an adjustment of retained earningsape element in the determination of net income for the Such items are rare, and the result is that retainedearinning all practical purposes, kept "clean" that is, rarely is of-the-year balance modified to reflect currently rections of prior-year earnings determinations. prior year had sufficient n such nings i its begin dis TEST PROBLEM REVENUE DATA During the year 20XX, Tarrant Co. sold its products for a $5,627,483. Of that amount, $525,480 had not been collected in cals end of the year. During the year, the company collected S68, sales made in earlier years. In addition to product sales, Tarran $12,220 from dividends on stocks owned and $1,460 interest deposits 240 from nt earned on bank EXPENSE DATA oods Assume that the company had no finished goods and no unfinishedg on hand at the beginning of the year. During ing costs consisted of raw materials consumed, totaling $2,420 tory labor, $1,115,000; and other factory costs (factory overhead) S1,247,000. At the end of the year, unfinished goods on hand (Gi.e., the wo in process inventory) cost $418,000. Selling expenses totaled $592,000, and general administra- tive expenses were $614,250 for the year. There were no interest expenses, and the company has no preferred stock outstanding. Income taxes were the year, its manufactur- ,000; fac- were valued at $384,000 and finished goods on hand $154,000. During the year, the company suffered an uninsured flood loss of $125,000. Retained earnings at the beginning of the year, according to the accounting records, stood at $1,500,000. Cash dividends paid were $1 per share on 100,000 shares. The common stock outstanding during the year, averaged to reflect fluctuations in number and time outstanding, was 102,000 shares. Date Stockholders' equity $100,000 Capital stock, par S10 Retained earnings HA 4,000-104,000 S138,800 CHAPTER 2 TARRANT co. Income Statement for the Year 20xx Revenues Sales $5,627,483 Other income 3,680 $5,641,163 Total Revenues Costs&Expenses: S3,980,000 592,000 Cost of goods sold Selling expenses Administrative expenses Income From Operations Less: Income taxes Income before extraordinary item Uninsured flood loss 614,2505,186,250 S 454913 154,000 S 300,913 125,000 $175,913 Net income Earnings Per share of common stock: Income before extraordinary item Extraordinary item (flood loss) Net income $2.71 (12b (120 (12 $1.49 3 9 Date Desk No

How do I find the $2.71 value in the bottom section labeled Earnings Per share of common stock followed by the subsection Income before extraordinary item? Also how do I find the Extraordinary item after it

How do I find the $2.71 value in the bottom section labeled Earnings Per share of common stock followed by the subsection Income before extraordinary item? Also how do I find the Extraordinary item after it