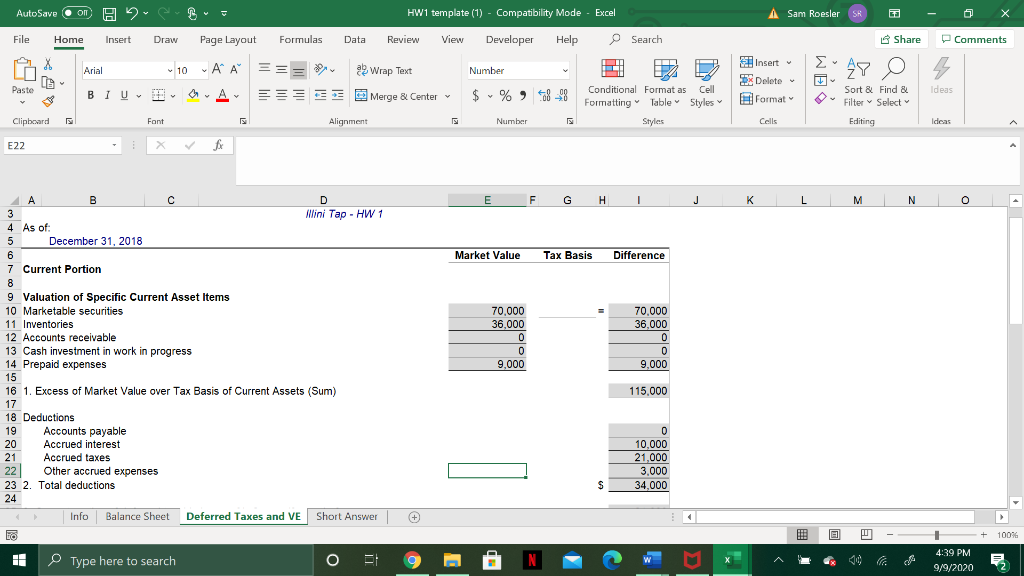

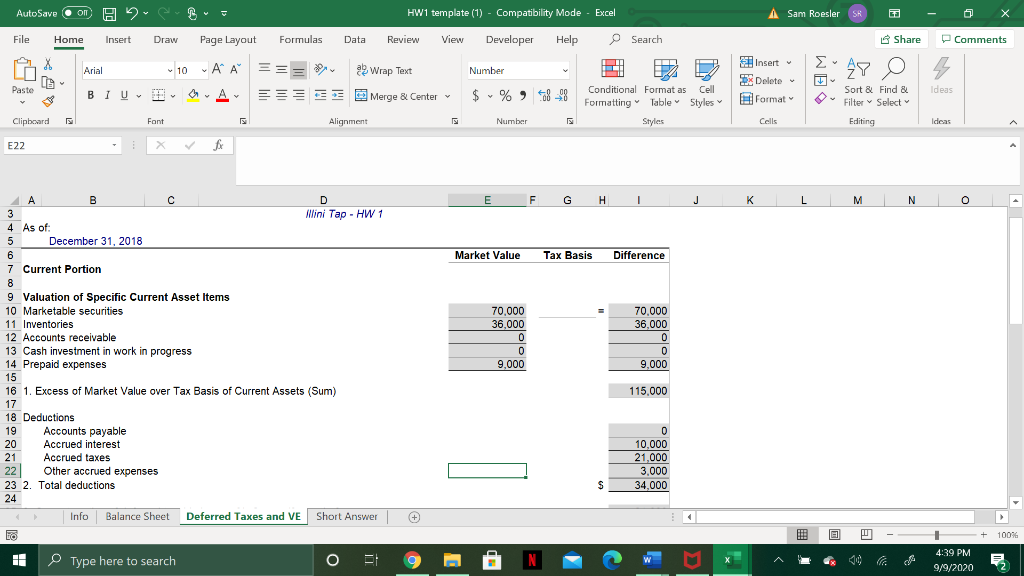

How do I find the Tax basis to calculate the deferred taxes?

AutoSave on H2 HW1 template (1) - Compatibility Mode Excel A Sam Roesler SK Ga File Home Insert Draw Page Layout Formulas Data Review View Developer Help Search Share Comments v X Arial 10 AA === Wrap Text Number ITA Insert 92 Delete Format 2ro Paste BIUD A Ideas Merge & Center $ % 8 - Conditional Format as Cell Formatting Table Styles Sort & Find & Filter Select Clipboard Font Alignment Number Styles Cells Editing Ideas A E22 f E F G H 1 J L M N 0 Market Value Tax Basis Difference B C D 3 Mlini Tap - HW 1 4 As of 5 December 31, 2018 6 7 Current Portion 8 9 Valuation of Specific Current Asset Items 10 Marketable securities 11 Inventories 12 Accounts receivable 13 Cash investment in work in progress 14 Prepaid expenses 15 16 1. Excess of Market Value over Tax Basis of Current Assets (Sum) 17 18 Deductions 19 Accounts payable 20 Accrued interest 21 Accrued taxes 22 Other accrued expenses 23 2. Total deductions 24 Info Balance Sheet Deferred Taxes and VE Short Answer FO 70,000 36.000 0 0 9,000 70,000 36,000 0 0 9,000 115,000 0 10,000 21,000 3,000 34,000 $ + LE 100% I Type here to search O a ita 4:39 PM 9/9/2020 AutoSave on H2 HW1 template (1) - Compatibility Mode Excel A Sam Roesler SK Ga File Home Insert Draw Page Layout Formulas Data Review View Developer Help Search Share Comments v X Arial 10 AA === Wrap Text Number ITA Insert 92 Delete Format 2ro Paste BIUD A Ideas Merge & Center $ % 8 - Conditional Format as Cell Formatting Table Styles Sort & Find & Filter Select Clipboard Font Alignment Number Styles Cells Editing Ideas A E22 f E F G H 1 J L M N 0 Market Value Tax Basis Difference B C D 3 Mlini Tap - HW 1 4 As of 5 December 31, 2018 6 7 Current Portion 8 9 Valuation of Specific Current Asset Items 10 Marketable securities 11 Inventories 12 Accounts receivable 13 Cash investment in work in progress 14 Prepaid expenses 15 16 1. Excess of Market Value over Tax Basis of Current Assets (Sum) 17 18 Deductions 19 Accounts payable 20 Accrued interest 21 Accrued taxes 22 Other accrued expenses 23 2. Total deductions 24 Info Balance Sheet Deferred Taxes and VE Short Answer FO 70,000 36.000 0 0 9,000 70,000 36,000 0 0 9,000 115,000 0 10,000 21,000 3,000 34,000 $ + LE 100% I Type here to search O a ita 4:39 PM 9/9/2020