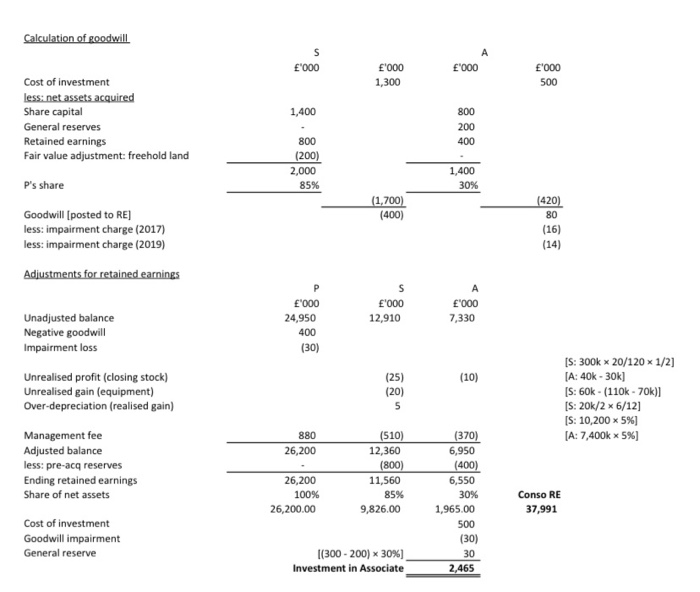

how do i get investment highlighted in purple in the 4th picture?

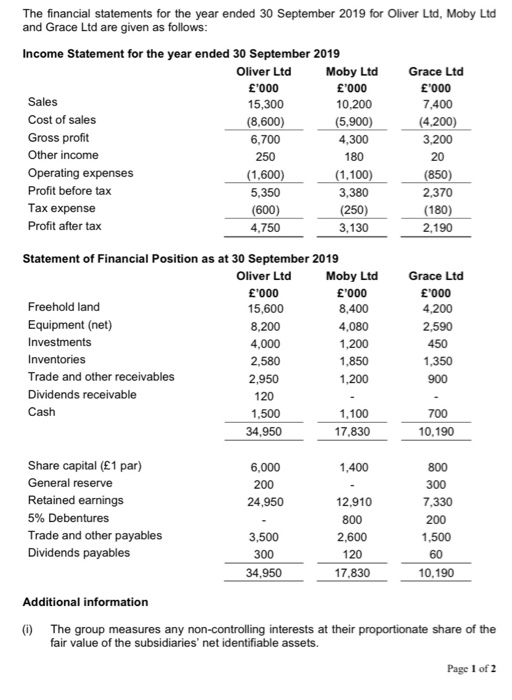

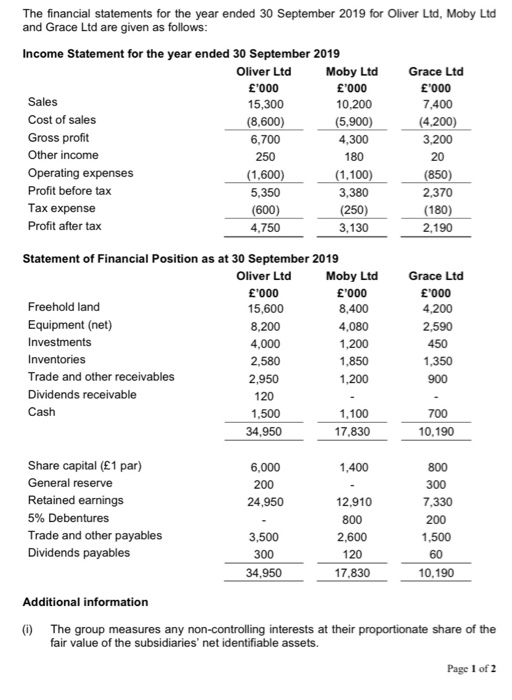

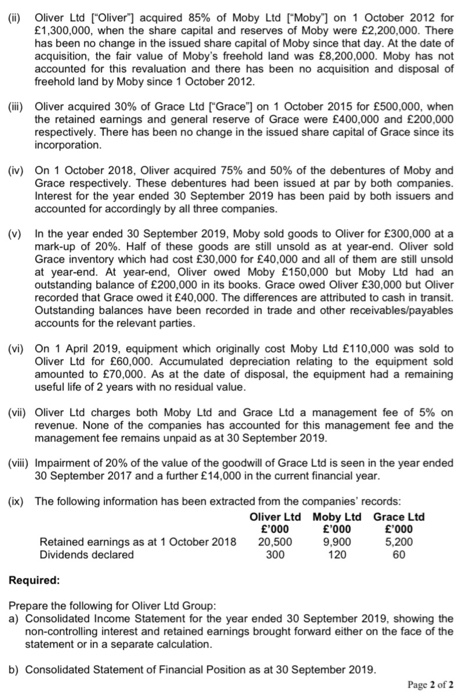

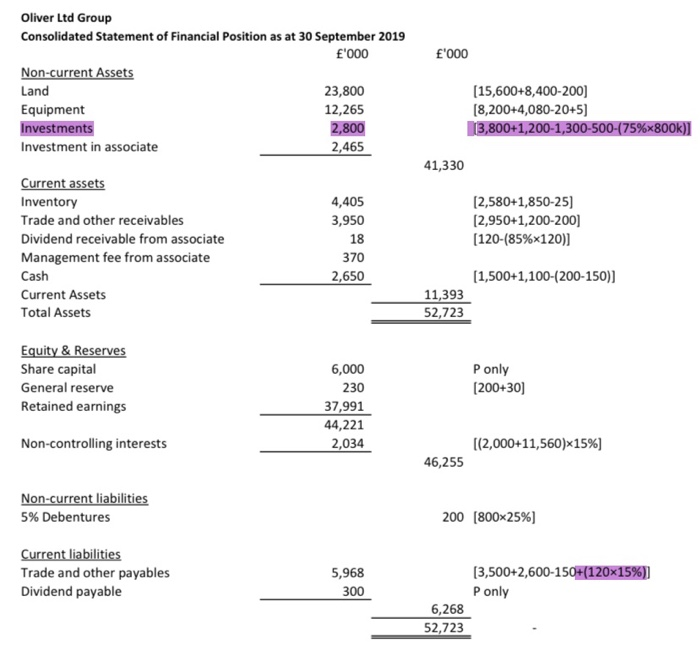

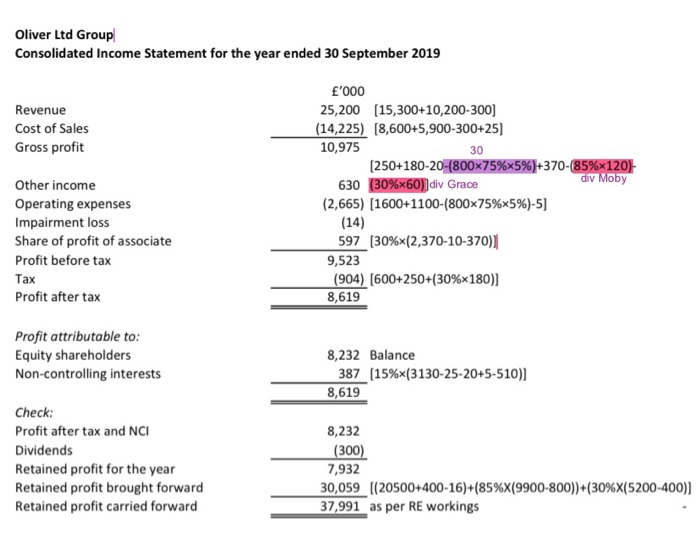

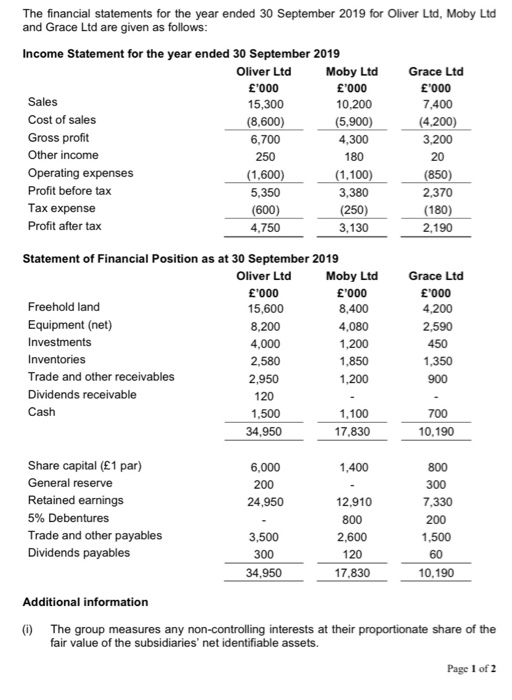

250 180 The financial statements for the year ended 30 September 2019 for Oliver Ltd, Moby Ltd and Grace Ltd are given as follows: Income Statement for the year ended 30 September 2019 Oliver Ltd Moby Ltd Grace Ltd '000 '000 '000 Sales 15,300 10,200 7,400 Cost of sales (8.600) (5,900) (4.200) Gross profit 6,700 4,300 3,200 Other income 20 Operating expenses (1,600) (1.100) (850) Profit before tax 5,350 3,380 2,370 Tax expense (600) (250) (180) Profit after tax 4,750 3,130 2,190 Statement of Financial Position as at 30 September 2019 Oliver Ltd Moby Ltd Grace Ltd '000 '000 '000 Freehold land 15,600 8,400 4,200 Equipment (net) 8,200 4,080 2,590 Investments 4,000 1,200 450 Inventories 2,580 1,850 1,350 Trade and other receivables 2,950 1,200 900 Dividends receivable 120 Cash 1,500 1,100 700 34,950 17,830 10,190 300 800 200 1,500 Share capital (1 par) 6,000 1,400 800 General reserve 200 Retained earnings 24,950 12,910 7,330 5% Debentures Trade and other payables 3,500 2,600 Dividends payables 300 120 60 34,950 17,830 Additional information 0 The group measures any non-controlling interests at their proportionate share of the fair lue of the subsidiaries identifiable assets. 10,190 Page 1 of 2 (6) Oliver Ltd ["Oliver") acquired 85% of Moby Ltd ["Moby") on 1 October 2012 for 1,300,000, when the share capital and reserves of Moby were 2,200,000. There has been no change in the issued share capital of Moby since that day. At the date of acquisition, the fair value of Moby's freehold land was 8,200,000. Moby has not accounted for this revaluation and there has been no acquisition and disposal of freehold land by Moby since 1 October 2012 () Oliver acquired 30% of Grace Ltd ["Grace") on 1 October 2015 for 500,000, when the retained earnings and general reserve of Grace were 400,000 and 200,000 respectively. There has been no change in the issued share capital of Grace since its incorporation (iv) On 1 October 2018, Oliver acquired 75% and 50% of the debentures of Moby and Grace respectively. These debentures had been issued at par by both companies. Interest for the year ended 30 September 2019 has been paid by both issuers and accounted for accordingly by all three companies. (1) In the year ended 30 September 2019, Moby sold goods to Oliver for 300,000 at a mark-up of 20%. Half of these goods are still unsold as at year-end. Oliver sold Grace inventory which had cost 30,000 for 40,000 and all of them are still unsold at year-end. At year-end, Oliver owed Moby 150,000 but Moby Ltd had an outstanding balance of 200,000 in its books. Grace owed Oliver 30,000 but Oliver recorded that Grace owed it 40,000. The differences are attributed to cash in transit. Outstanding balances have been recorded in trade and other receivables/payables accounts for the relevant parties. (vi) On 1 April 2019, equipment which originally cost Moby Ltd 110,000 was sold to Oliver Ltd for 60,000. Accumulated depreciation relating to the equipment sold amounted to 70,000. As at the date of disposal, the equipment had a remaining useful life of 2 years with no residual value. (vii) Oliver Ltd charges both Moby Ltd and Grace Ltd a management fee of 5% on revenue. None of the companies has accounted for this management fee and the management fee remains unpaid as at 30 September 2019. (vii) Impairment of 20% of the value of the goodwill of Grace Ltd is seen in the year ended 30 September 2017 and a further 14,000 in the current financial year. (ix) The following information has been extracted from the companies' records: Oliver Ltd Moby Ltd Grace Ltd '000 '000 '000 Retained earnings as at 1 October 2018 20,500 9,900 5,200 Dividends declared 300 120 60 Required: Prepare the following for Oliver Ltd Group: a) Consolidated Income Statement for the year ended 30 September 2019, showing the non-controlling interest and retained earnings brought forward either on the face of the statement or in a separate calculation. b) Consolidated Statement of Financial Position as at 30 September 2019. Page 2 of 2 Calculation of goodwill A '000 E'000 E'000 1,300 E'000 500 Cost of investment less: net assets acquired Share capital General reserves Retained earnings Fair value adjustment: freehold land 1,400 800 200 400 800 (200) 2,000 85% P's share 1,400 30% (1,700) (400) Goodwill [posted to RE] less: impairment charge (2017) less: impairment charge (2019) (420) 80 (16) (14) Adjustments for retained earnings S '000 12,910 '000 24,950 400 (30) A '000 7,330 Unadjusted balance Negative goodwill Impairment loss (10) Unrealised profit (closing stock) Unrealised gain (equipment) Over-depreciation (realised gain) (25) (20) 5 [S: 300k * 20/120 x 1/2] [A: 40k - 30k) [S: 60k - (110k - 70k)] [S: 20k/26/12] [S: 10,200 x 5%) [A: 7,400k 5%) 880 26,200 Management fee Adjusted balance less: pre-acq reserves Ending retained earnings Share of net assets 26,200 100% 26,200.00 (510) 12,360 (800) 11,560 85% 9,826.00 (370) 6,950 (400) 6,550 30% 1,965.00 500 (30) 30 2,465 Conso RE 37,991 Cost of investment Goodwill impairment General reserve (300 - 200) * 30%) Investment in Associate '000 Oliver Ltd Group Consolidated Statement of Financial Position as at 30 September 2019 '000 Non-current Assets Land 23,800 Equipment 12,265 Investments 2,800 Investment in associate 2,465 (15,600+8,400-200) [8,200+4,080-20+5) 13,800+1,200-1,300-500-(75%x800k)] 41,330 Current assets Inventory Trade and other receivables Dividend receivable from associate Management fee from associate Cash Current Assets Total Assets 4,405 3,950 18 370 2,650 (2,580+1,850-25) (2,950+1,200-200) (120-(85%*120) (1,500+1,100-(200-150)] 11,393 52,723 Equity & Reserves Share capital General reserve Retained earnings Ponly [200+30) 6,000 230 37,991 44,221 2,034 Non-controlling interests [(2,000+11,560)x15%) 46,255 Non-current liabilities 5% Debentures 200 [800x25%) Current liabilities Trade and other payables Dividend payable 5,968 300 (3,500+2,600-150+(120x15%)] Ponly 6,268 52,723 Oliver Ltd Group Consolidated Income Statement for the year ended 30 September 2019 Revenue Cost of Sales Gross profit Other income Operating expenses Impairment loss Share of profit of associate Profit before tax Tax Profit after tax '000 25,200 (15,300+10,200-300) (14,225) (8,600+5,900-300+25] 10,975 30 (250+180-20-(800x75%x5%)+370-85%*120) 630 (30%x60)]div Grace div Moby (2,665) (1600+1100-(800x75%*5%)-5) (14) 597 [30%x(2,370-10-370) 9,523 (904) (600+250+(30%x180)] 8,619 Profit attributable to: Equity shareholders Non-controlling interests 8,232 Balance 387 (15%x (3130-25-20+5-510)] 8,619 Check: Profit after tax and NCI Dividends Retained profit for the year Retained profit brought forward Retained profit carried forward 8,232 (300) 7,932 30,059 (20500+400-16)+(85%X(9900-800))+(30%X(5200-400)] 37,991 as per RE workings