Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How do I get Requirement 1 and 2 Luke Johnson, the new controller of Collective Manufacturing Company (CMC) believes that the company should use the

How do I get Requirement 1 and 2

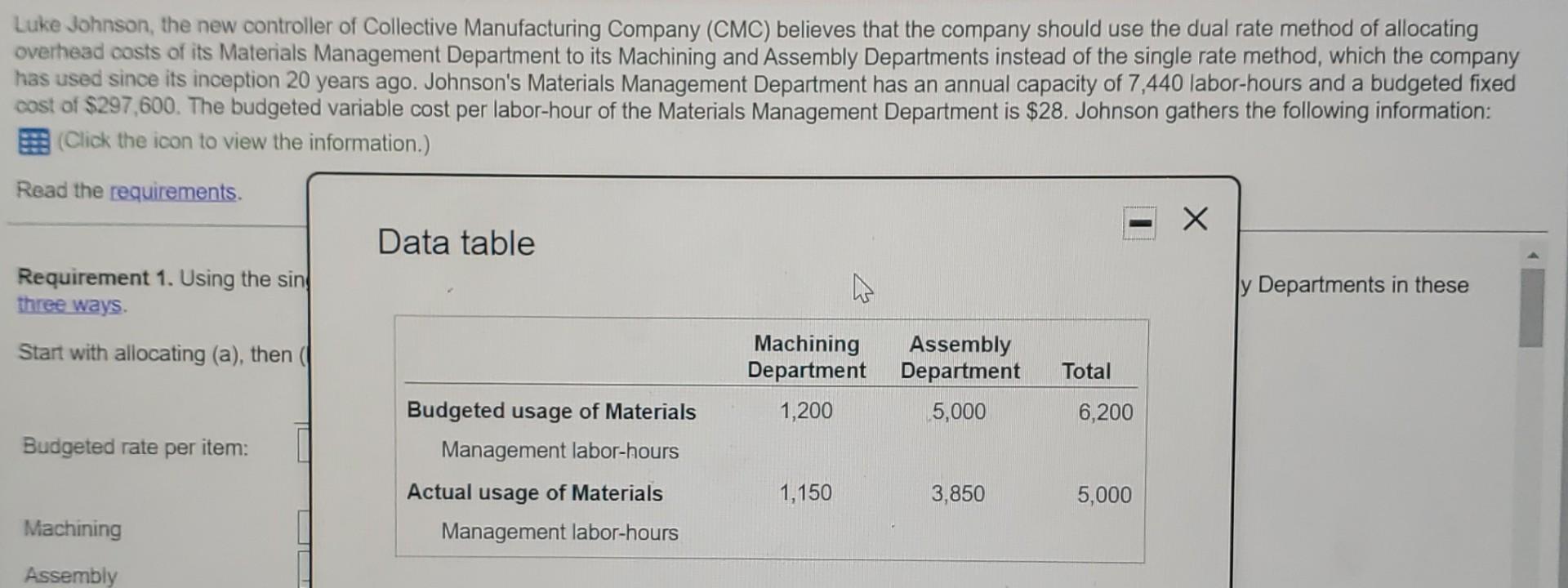

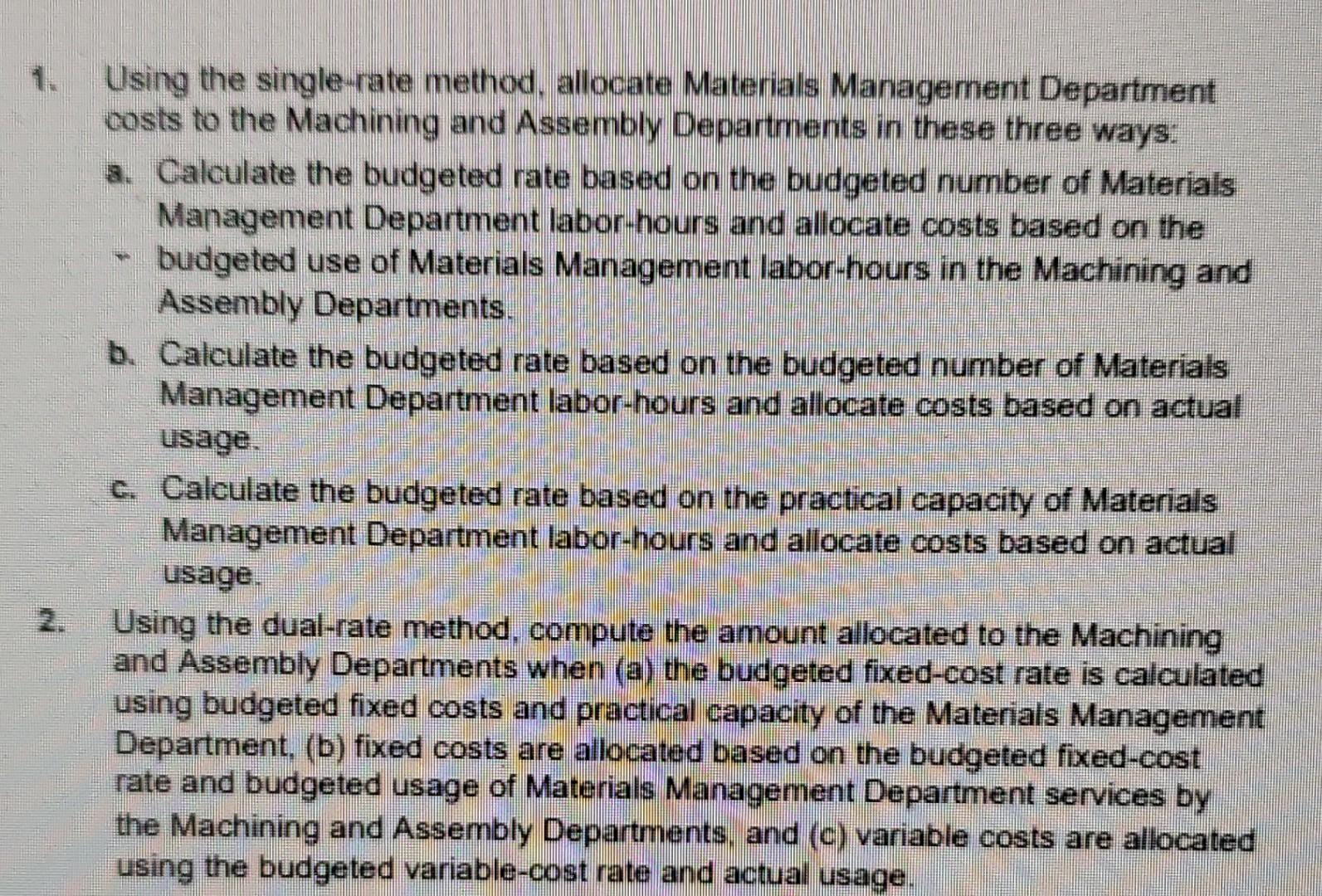

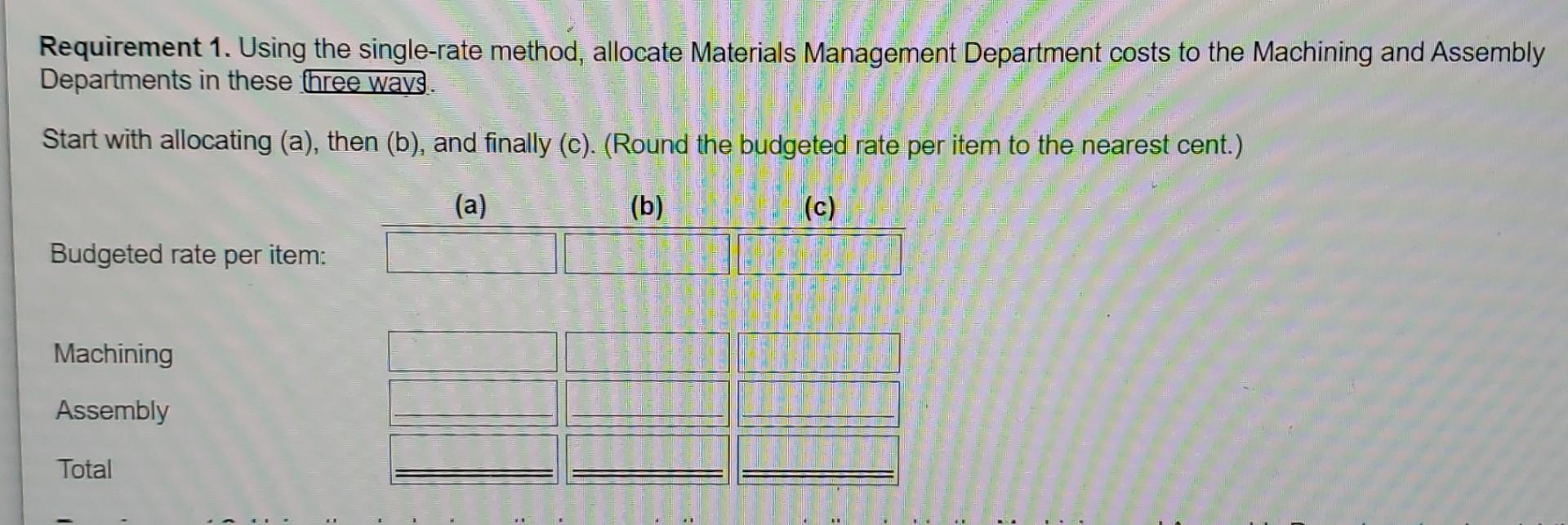

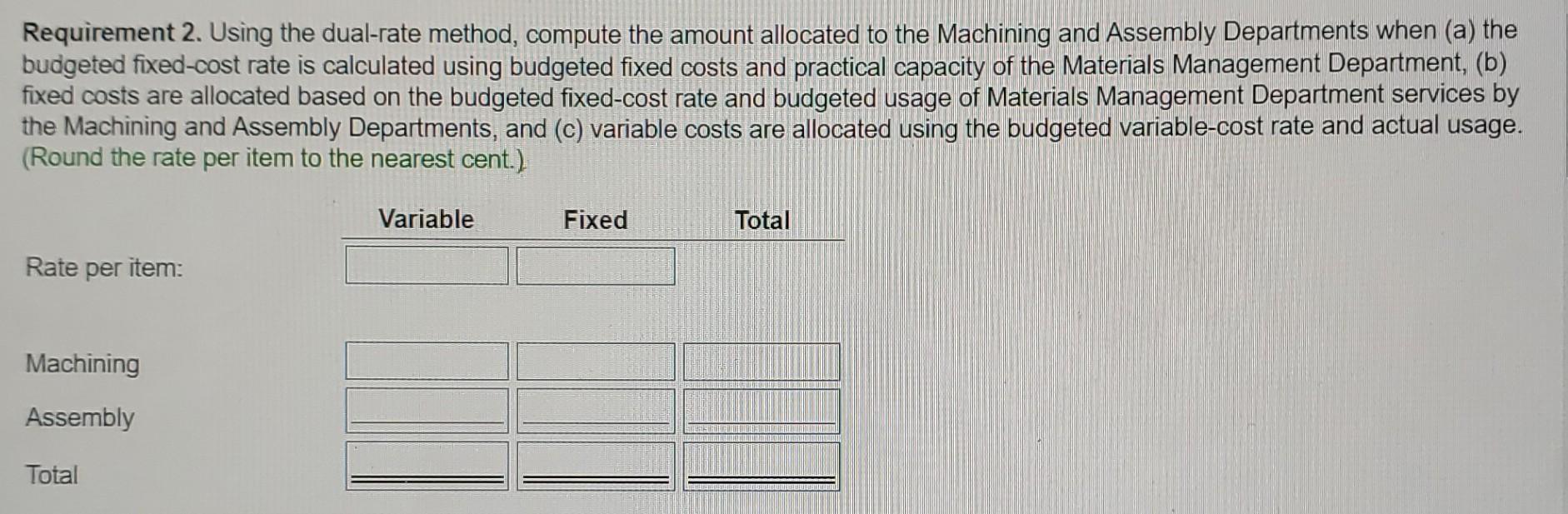

Luke Johnson, the new controller of Collective Manufacturing Company (CMC) believes that the company should use the dual rate method of allocating overhead costs of its Materials Management Department to its Machining and Assembly Departments instead of the single rate method, which the company has used since its inception 20 years ago. Johnson's Materials Management Department has an annual capacity of 7,440 labor-hours and a budgeted fixed cost of $297,600. The budgeted variable cost per labor-hour of the Materials Management Department is $28. Johnson gathers the following information: (Click the icon to view the information.) Read the requirements. Data table Requirement 1. Using the sin three ways. y Departments in these Start with allocating (a), then Machining Department 1,200 Assembly Department 5,000 Total 6,200 Budgeted usage of Materials Management labor-hours Budgeted rate per item: 1,150 3,850 5,000 Actual usage of Materials Management labor-hours Machining LL Assembly Using the single-rate method, allocate Materials Management Department costs to the Machining and Assembly Departments in these three ways: a. Calculate the budgeted rate based on the budgeted number of Materials Management Department labor hours and allocate costs based on the budgeted use of Materials Management labor-hours in the Machining and Assembly Departments. b. Calculate the budgeted rate based on the budgeted number of Materials Management Department labor-hours and allocate costs based on actual usage. c. Calculate the budgeted rate based on the practical capacity of Materials Management Department labor-hours and allocate costs based on actual usage. Using the dual-rate method, compute the amount allocated to the Machining and Assembly Departments when (a) the budgeted fixed-cost rate is calculated using budgeted fixed costs and practical capacity of the Materials Management Department, (b) fixed costs are allocated based on the budgeted fixed-cost rate and budgeted usage of Materials Management Department services by the Machining and Assembly Departments, and (c) variable costs are allocated using the budgeted variable-cost rate and actual usage. 2. Requirement 1. Using the single-rate method, allocate Materials Management Department costs to the Machining and Assembly Departments in these three ways. Start with allocating (a), then (b), and finally (c). (Round the budgeted rate per item to the nearest cent.) (a) (b) (c) Budgeted rate per item: Machining Assembly Total Requirement 2. Using the dual-rate method, compute the amount allocated to the Machining and Assembly Departments when (a) the budgeted fixed-cost rate is calculated using budgeted fixed costs and practical capacity of the Materials Management Department, (b) fixed costs are allocated based on the budgeted fixed-cost rate and budgeted usage of Materials Management Department services by the Machining and Assembly Departments, and (c) variable costs are allocated using the budgeted variable-cost rate and actual usage. (Round the rate per item to the nearest cent.) Variable Fixed Total Rate per item: Machining Assembly Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started