Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How do i get YTM on at BA 2 Plus calculator. I know the answer is 7.55 but how do i do this on a

How do i get YTM on at BA 2 Plus calculator.

I know the answer is 7.55 but how do i do this on a BA 2 Plus calculator. i tried using the equation above but still confused.

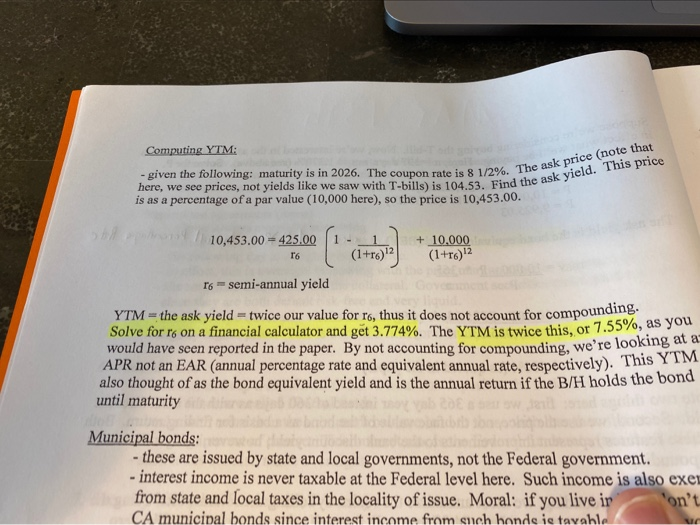

here, we see prices, not yields like we saw with T-bills) is 104.53. Find the ask yield. This price - given the following: maturity is in 2026. The coupon rate is 8 1/2%. The ask price note that Computing YTM: is as a percentage of a par value (10,000 here), so the price is 10,453.00. 1 - 10,453.00 - 425.00 + 10,000 16 (1+r6) (1+r)2 16 semi-annual yield YTM = the ask yield = twice our value for r, thus it does not account for compounding. Solve for ro on a financial calculator and get 3.774%. The YTM is twice this, or 7.55%, as you would have seen reported in the paper. By not accounting for compounding, we're looking at a APR not an EAR (annual percentage rate and equivalent annual rate, respectively). This YTM also thought of as the bond equivalent yield and is the annual return if the B/H holds the bond until maturity Municipal bonds: - these are issued by state and local governments, not the Federal government. - interest income is never taxable at the Federal level here. Such income is also exe from state and local taxes in the locality of issue. Moral: if you live ir 'on't CA municipal bonds since interest income from ench honde is tavahle uc Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started