Answered step by step

Verified Expert Solution

Question

1 Approved Answer

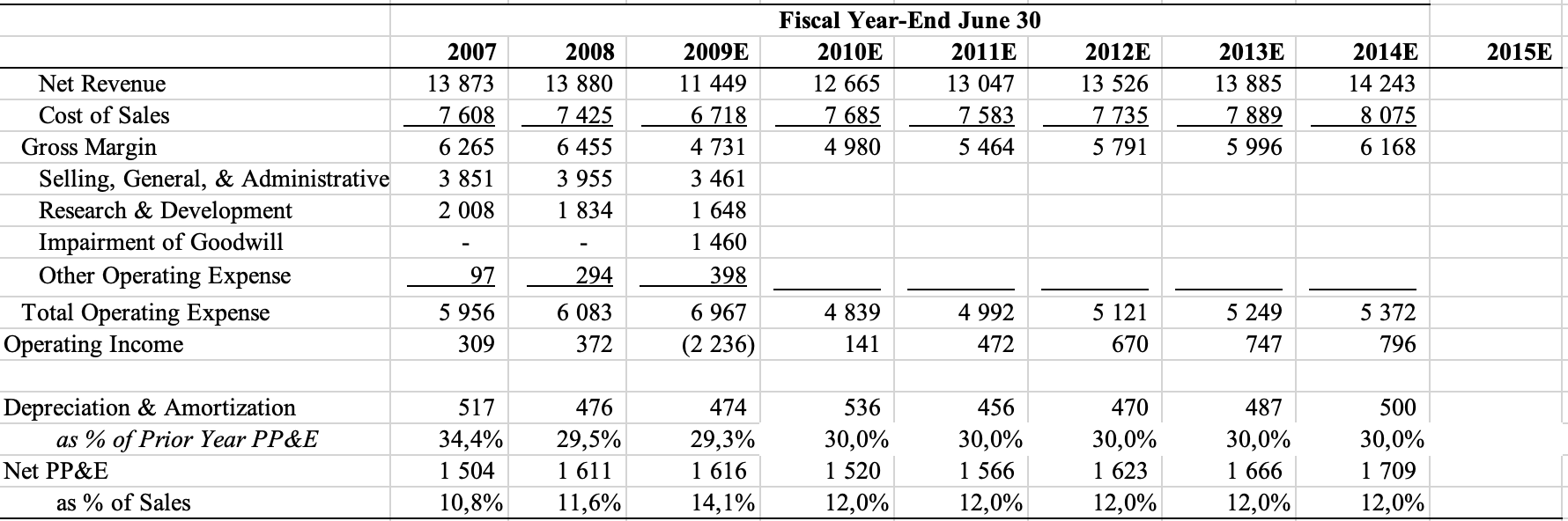

How do I go about making a forecast in this scenario? Where am I supposed to look, I can include other documents as well if

How do I go about making a forecast in this scenario? Where am I supposed to look, I can include other documents as well if that helps.

I have calculated a WACC of 9.77% and a multiple of 6.65.

2015E 2007 13 873 7 608 6 265 3 851 2008 Fiscal Year-End June 30 2010E 2011E 12 665 13 047 7 685 7 583 4 980 5 464 2008 13 880 |_7 425 6 455 3 955 1 834 2012E 13 526 7 735 5 791 2013E 13 885 7 889 5 996 Net Revenue Cost of Sales Gross Margin Selling, General, & Administrative Research & Development Impairment of Goodwill Other Operating Expense Total Operating Expense Operating Income 2014E 14 243 8 075 6 168 2009E 11 449 6 718 4 731 3461 1 648 1 460 398 294 97 5956 309 6 083 372 6967 (2 236) 4 839 141 4 992 472 5 121 670 5 249 747 5 372 796 Depreciation Amortization as % of Prior Year PP&E Net PP&E as % of Sales 517 34,4% 1 504 10,8% 476 29,5% 1 611 11,6% 74 29,3% 1 616 14,1% 53 30,0% 1 520 12,0% 30,0% 1 566 12,0% 470 30,0% 1 623 12,0% 30,0% 1 666 12,0% 30,0% 1 709 12,0% 2015E 2007 13 873 7 608 6 265 3 851 2008 Fiscal Year-End June 30 2010E 2011E 12 665 13 047 7 685 7 583 4 980 5 464 2008 13 880 |_7 425 6 455 3 955 1 834 2012E 13 526 7 735 5 791 2013E 13 885 7 889 5 996 Net Revenue Cost of Sales Gross Margin Selling, General, & Administrative Research & Development Impairment of Goodwill Other Operating Expense Total Operating Expense Operating Income 2014E 14 243 8 075 6 168 2009E 11 449 6 718 4 731 3461 1 648 1 460 398 294 97 5956 309 6 083 372 6967 (2 236) 4 839 141 4 992 472 5 121 670 5 249 747 5 372 796 Depreciation Amortization as % of Prior Year PP&E Net PP&E as % of Sales 517 34,4% 1 504 10,8% 476 29,5% 1 611 11,6% 74 29,3% 1 616 14,1% 53 30,0% 1 520 12,0% 30,0% 1 566 12,0% 470 30,0% 1 623 12,0% 30,0% 1 666 12,0% 30,0% 1 709 12,0%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started