How do I journalize these dates and entries? Please refer to the chart of accounts. Thanks!

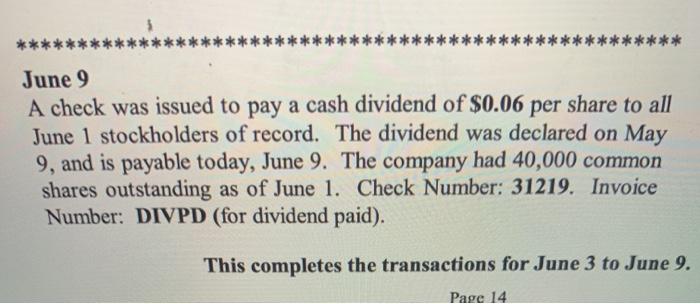

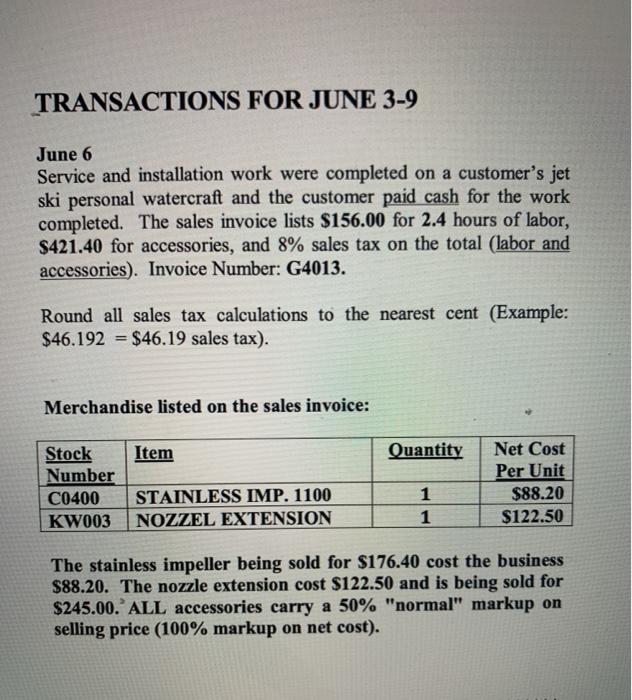

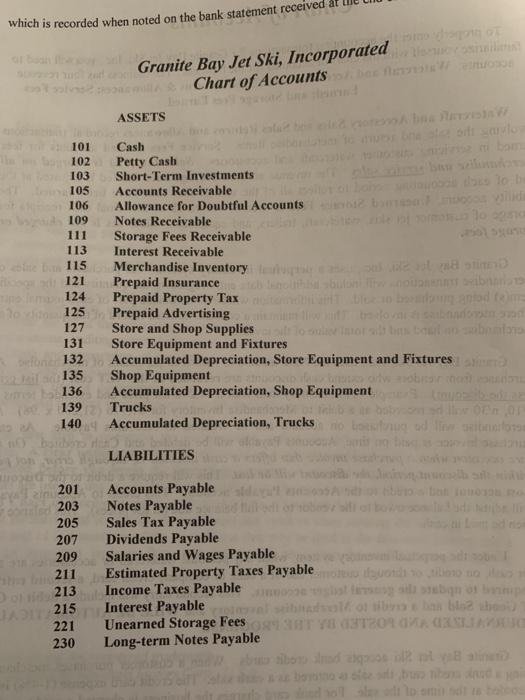

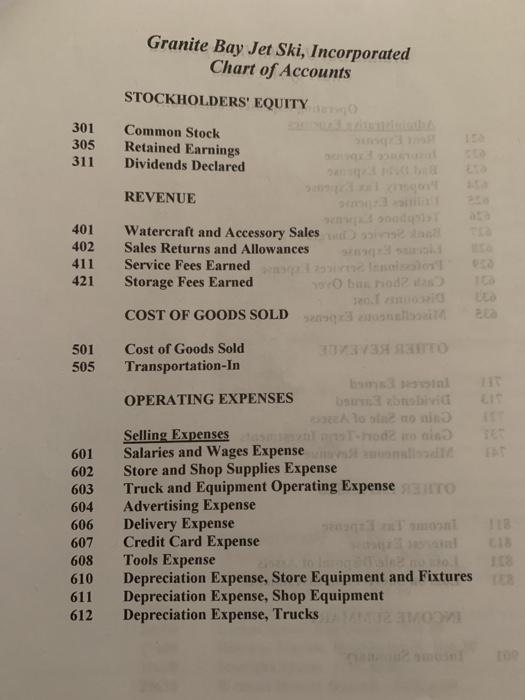

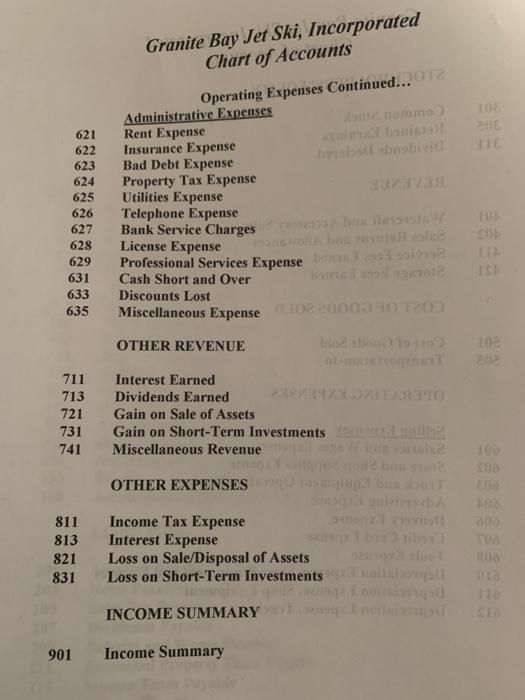

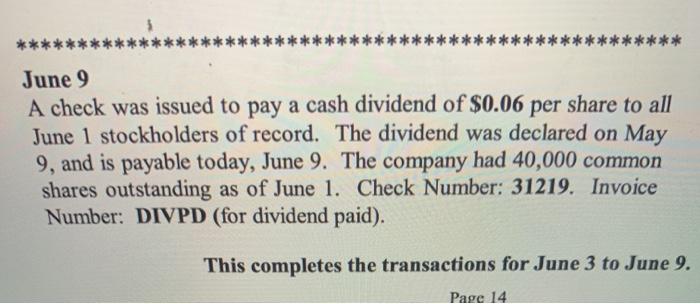

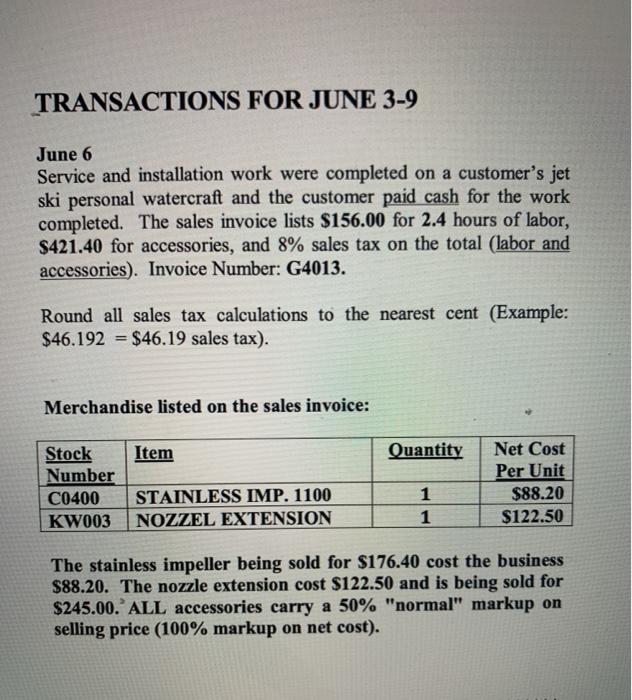

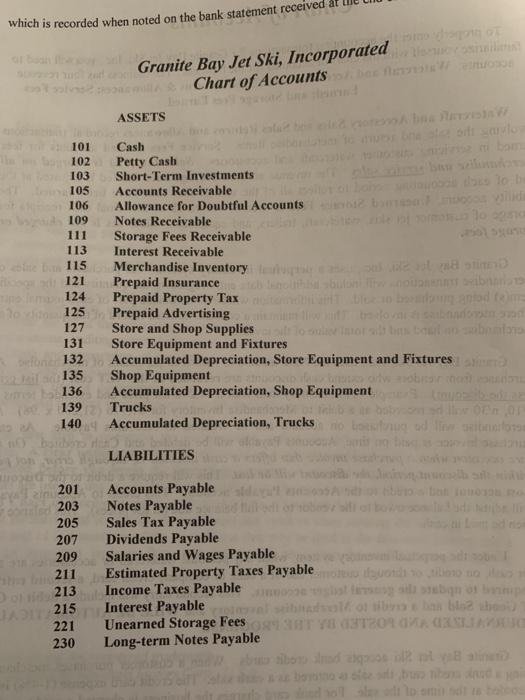

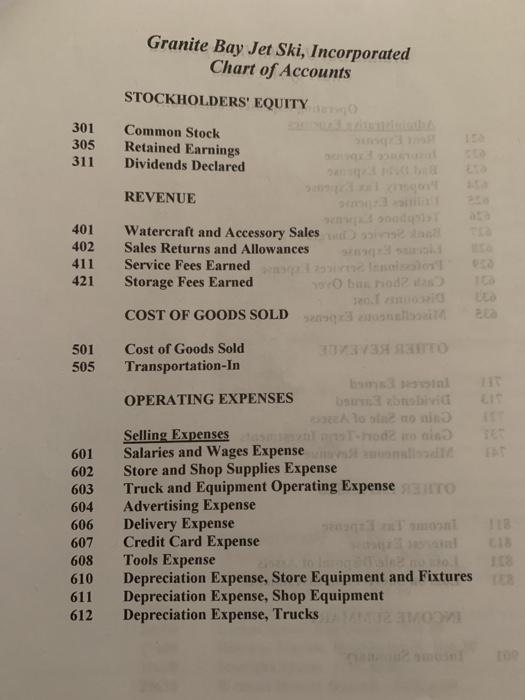

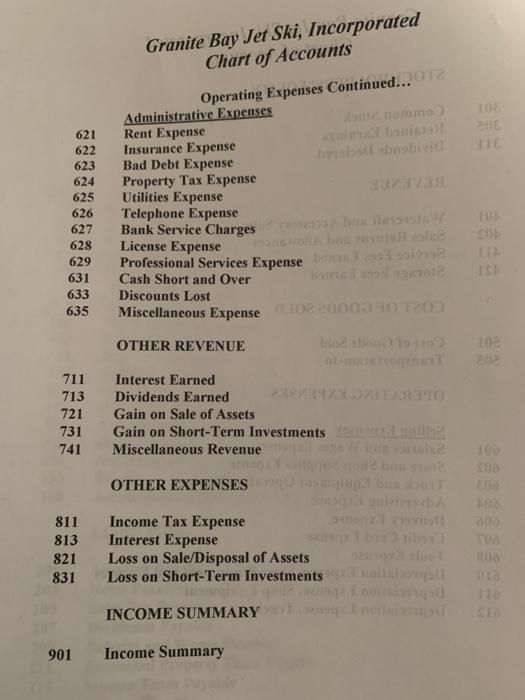

****** June 9 A check was issued to pay a cash dividend of $0.06 per share to all June 1 stockholders of record. The dividend was declared on May 9, and is payable today, June 9. The company had 40,000 common shares outstanding as of June 1. Check Number: 31219. Invoice Number: DIVPD (for dividend paid). This completes the transactions for June 3 to June 9. Page 14 TRANSACTIONS FOR JUNE 3-9 June 6 Service and installation work were completed on a customer's jet ski personal watercraft and the customer paid cash for the work completed. The sales invoice lists $156.00 for 2.4 hours of labor, $421.40 for accessories, and 8% sales tax on the total (labor and accessories). Invoice Number: G4013. Round all sales tax calculations to the nearest cent (Example: $46.192 = $46.19 sales tax). Merchandise listed on the sales invoice: Item Quantity Stock Number C0400 KW003 Net Cost Per Unit $88.20 $122.50 STAINLESS IMP. 1100 NOZZEL EXTENSION 1 1 The stainless impeller being sold for $176.40 cost the business $88.20. The nozzle extension cost $122.50 and is being sold for $245.00. ALL accessories carry a 50% "normal" markup on selling price (100% markup on net cost). which is recorded when noted on the bank statement received al Granite Bay Jet Ski, Incorporated Chart of Accounts on ASSETS 101 Cash 102 Petty Cash 103 Short-Term Investments 105 Accounts Receivable 106 Allowance for Doubtful Accounts 109 Notes Receivable 111 Storage Fees Receivable 113 Interest Receivable 115 Merchandise Inventory 121 Prepaid Insurance boob 124 Prepaid Property Tax ble to brown 125 Prepaid Advertising 127 Store and Shop Supplies To 131 Store Equipment and Fixtures 132 Accumulated Depreciation, Store Equipment and Fixtures 135 Shop Equipment 136 Accumulated Depreciation, Shop Equipment 139 Trucks 140 Accumulated Depreciation, Trucks LIABILITIES 201 203 205 207 209 211 213 Accounts Payable Notes Payable Sales Tax Payable Dividends Payable Salaries and Wages Payable Estimated Property Taxes Payable Income Taxes Payable Interest Payable Unearned Storage Fees SHT YH 120 Long-term Notes Payable 215 221 230 Granite Bay Jet Ski, Incorporated Chart of Accounts STOCKHOLDERS' EQUITY 301 305 311 Common Stock Retained Earnings Dividends Declared REVENUE 401 402 411 421 Watercraft and Accessory Sales Sales Returns and Allowances Service Fees Earned Storage Fees Earned O brod Teori COST OF GOODS SOLD 31 SITO 501 505 Cost of Goods Sold Transportation-In 601 602 603 604 606 607 608 610 611 612 OPERATING EXPENSES Blono in Selling Expenses Todos Salaries and Wages Expenses Store and Shop Supplies Expense Truck and Equipment Operating Expense TO Advertising Expense Delivery Expense Credit Card Expense Tools Expense Depreciation Expense, Store Equipment and Fixtures Depreciation Expense, Shop Equipment Depreciation Expense, Trucks Granite Bay Jet Ski, Incorporated Chart of Accounts Operating Expenses Continued...12 Administrative Expenses 2012 nomo TOE TIE 621 622 623 624 625 626 627 628 629 631 633 635 Rent Expense Insurance Expense Bad Debt Expense Property Tax Expense Utilities Expense Telephone Expense Bank Service Charges in License Expense Professional Services Expense 2 Cash Short and Over Discounts Lost Miscellaneous Expense 102200030 OD OTHER REVENUE to bolo 102 202 711 Interest Earned 713 Dividends Earned 721 Gain on Sale of Assets 731 Gain on Short-Term Investments 741 Miscellaneous Revenue OTHER EXPENSES doo 811 813 821 831 Income Tax Expense Interest Expense Loss on Sale/Disposal of Assets Loss on Short-Term Investments INCOME SUMMARY 901 Income Summary