How do I prepare a General Journal with these transactions and charts of accounts.

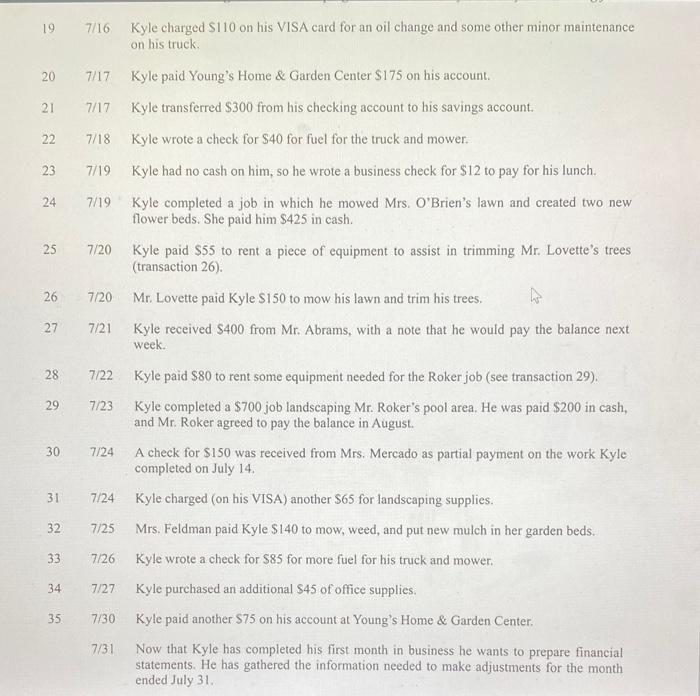

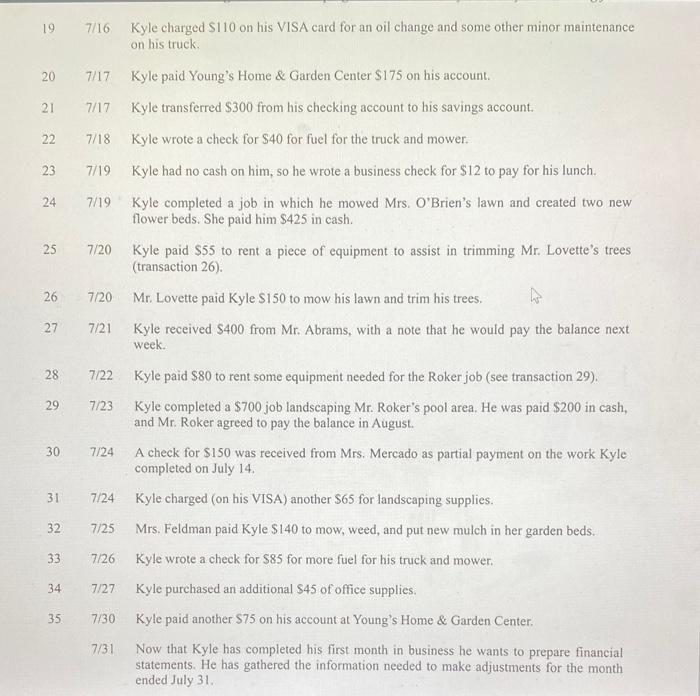

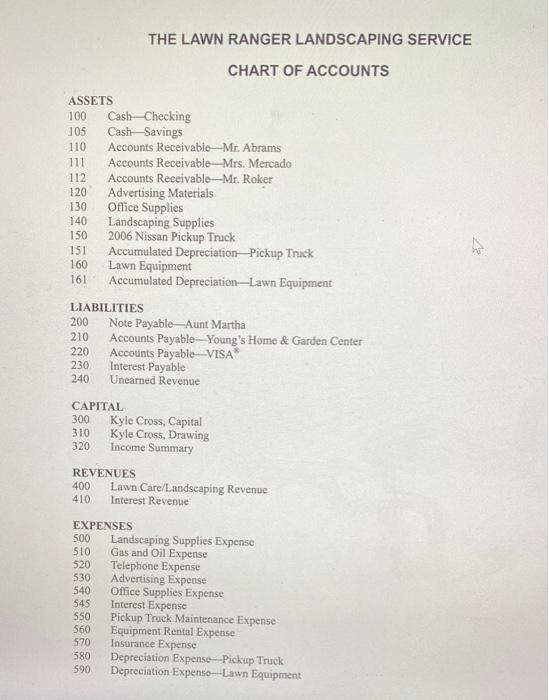

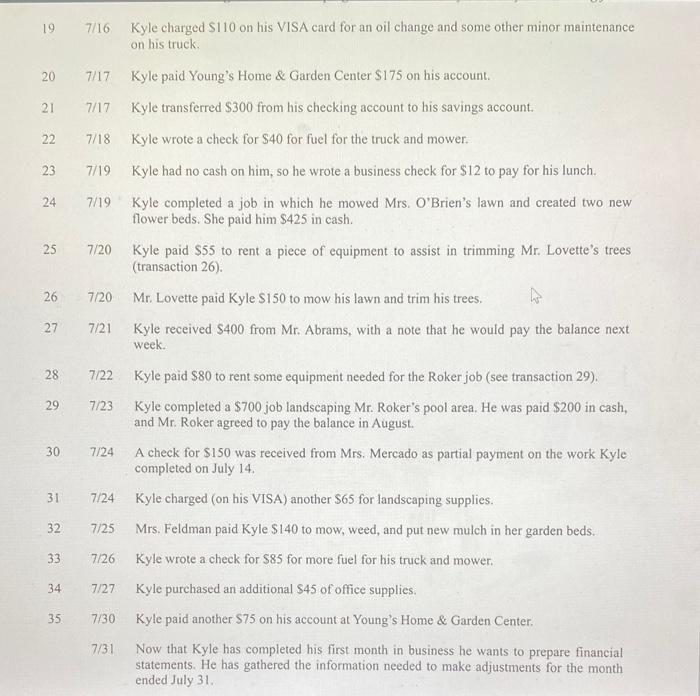

197/16 Kyle charged S110 on his VISA card for an oil change and some other minor maintenance on his truck. 207/17 Kyle paid Young's Home \& Garden Center $175 on his account. 217/17 Kyle transferred $300 from his checking account to his savings account. 227/18 Kyle wrote a check for $40 for fuel for the truck and mower. 237/19 Kyle had no cash on him, so he wrote a business check for $12 to pay for his lunch. 247/19 Kyle completed a job in which he mowed Mrs. O'Brien's lawn and created two new flower beds. She paid him $425 in cash. 257/20 Kyle paid $55 to rent a piece of equipment to assist in trimming Mr. Lovette's trees (transaction 26). 267/20 Mr. Lovette paid Kyle $150 to mow his lawn and trim his trees. 277/21 Kyle received $400 from Mr. Abrams, with a note that he would pay the balance next week. 287/22 Kyle paid $80 to rent some equipment needed for the Roker job (see transaction 29). 297/23 Kyle completed a $700 job landscaping Mr. Roker's pool area. He was paid $200 in cash, and Mr. Roker agreed to pay the balance in August. 307/24 A check for $150 was received from Mrs. Mercado as partial payment on the work Kyle completed on July 14. 31 7/24 Kyle charged (on his VISA) another $65 for landscaping supplies. 327/25 Mrs. Feldman paid Kyle $140 to mow, weed, and put new mulch in her garden beds. 337/26 Kyle wrote a check for $85 for more fuel for his truck and mower. 347/27 Kyle purchased an additional $45 of office supplies. 35. 7/30 Kyle paid another $75 on his account at Young's Home \& Garden Center. 7/31 Now that Kyle has completed his first month in business he wants to prepare financial statements. He has gathered the information needed to make adjustments for the month ended July 31 . THE LAWN RANGER LANDSCAPING SERVICE CHART OF ACCOUNTS LIABILITIES 200 Note Payable-Aunt Martha 210 Accounts Payable-Young's Home \& Garden Center 220 Accounts Payable-VISA 230 Interest Payable 240 Unearned Revenue CAPITAL 300 Kyle Cross, Capital 310 Kyle Cross, Drawing 320 Income Summary REVENUES 400 Lawn Care/Landscaping Revenue 410 Interest Revenue EXPENSES 500 Landscaping Supplies Expense 510 Gas and Oil Expense 520 Telephone Expense 530 Advertising Expense 540 Office Supplies Expense 545 Interest Expense 550 Pickup Truck Maintenance Expense. 560 Equipment Rental Expense 570 Insurance Expense 580 Depreciation Expense-Pickup Truck 590 Depreciation Expense - Lawn Equipment