Answered step by step

Verified Expert Solution

Question

1 Approved Answer

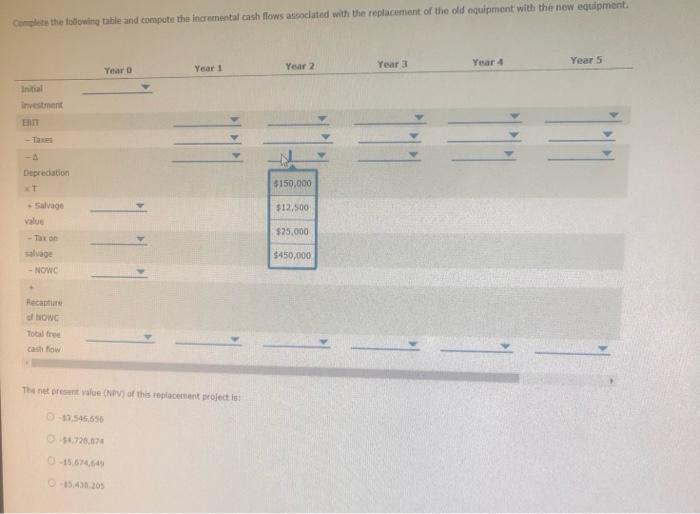

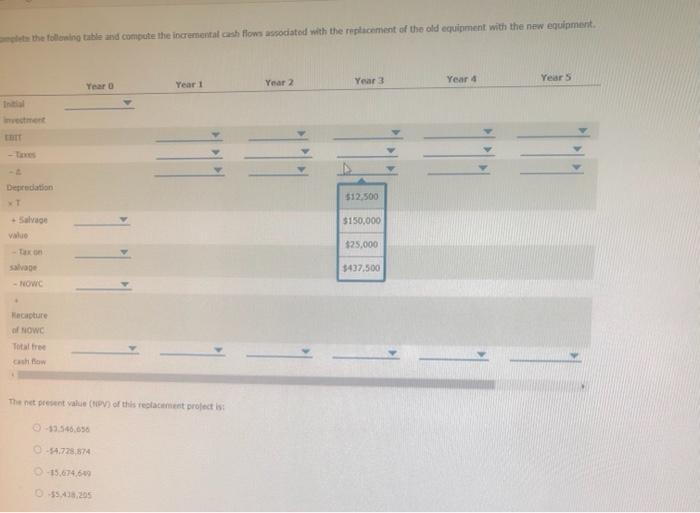

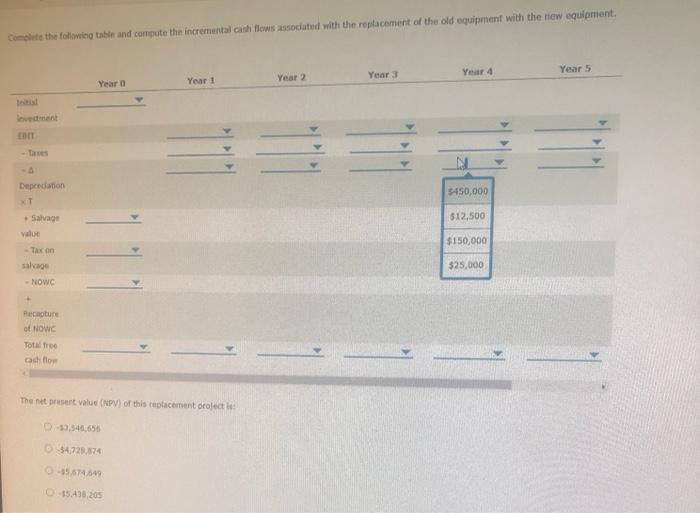

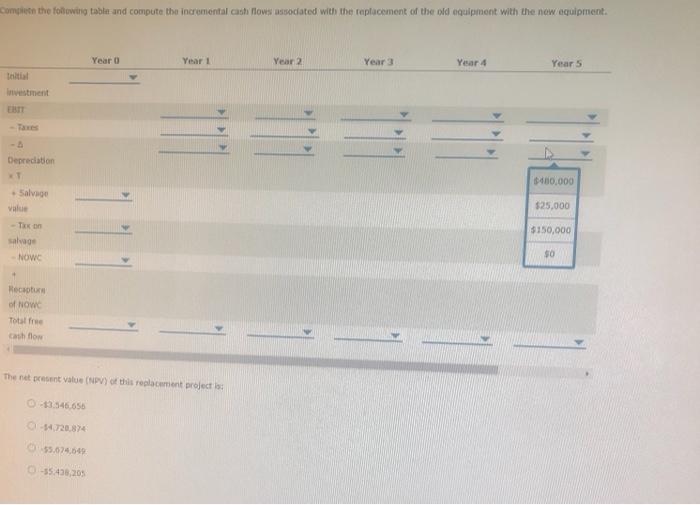

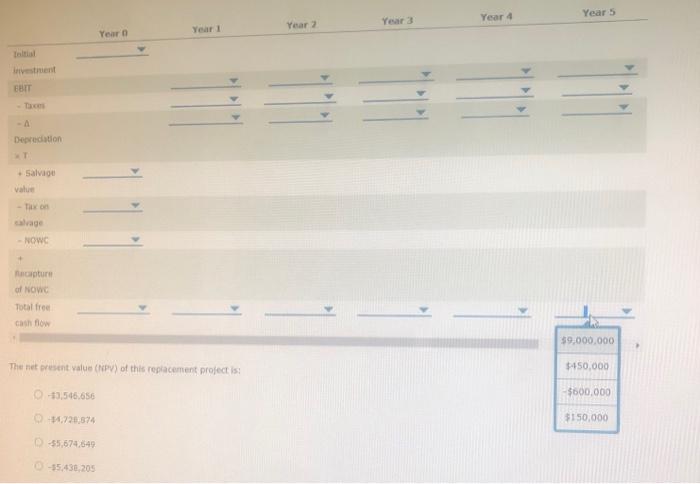

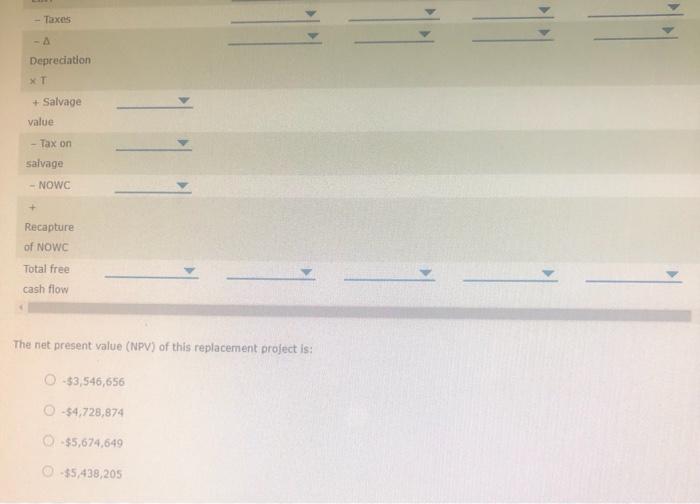

how do I properly solve this question? campacy will need to do moticement anahous to determine whilch egtion is the beat financial decision for the

how do I properly solve this question?

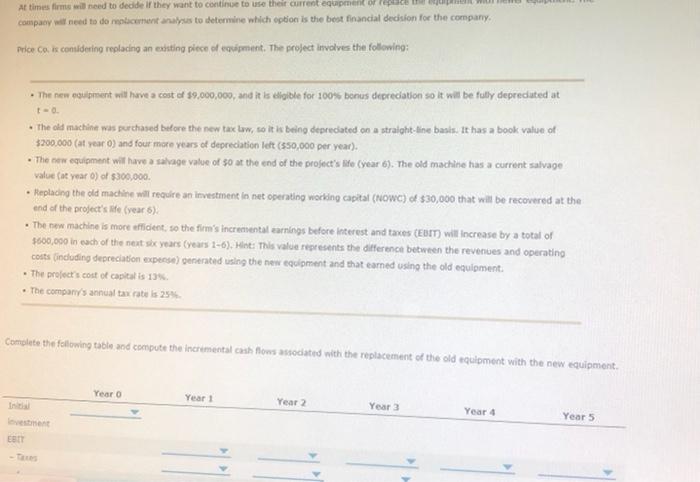

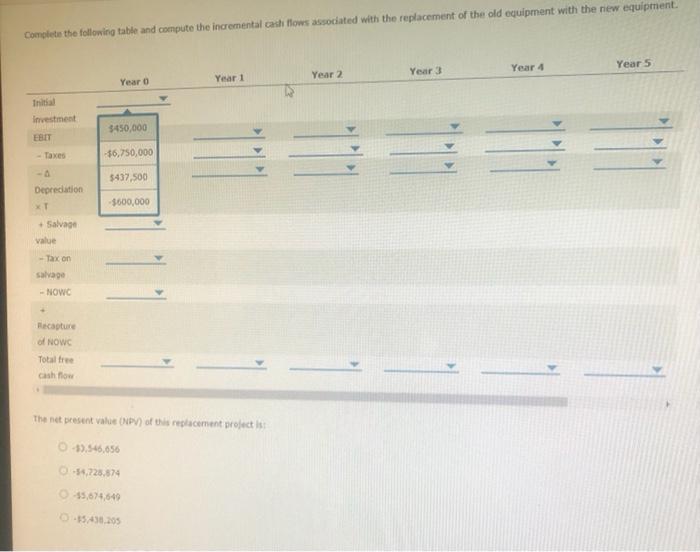

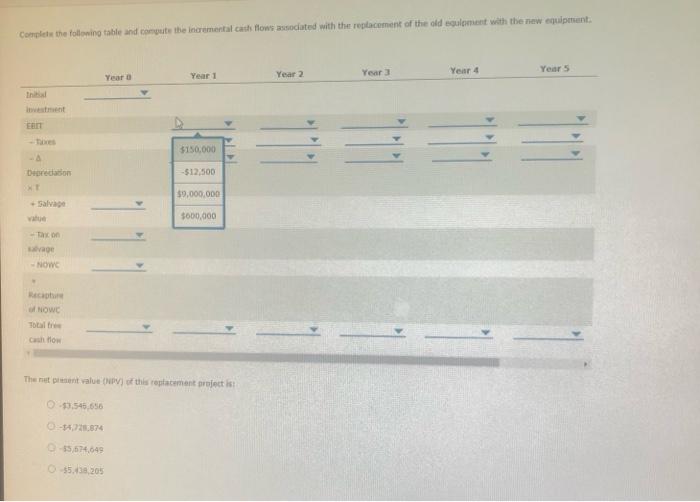

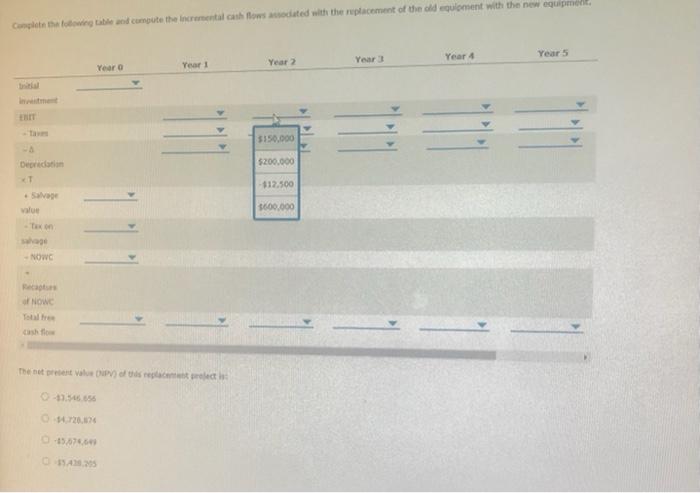

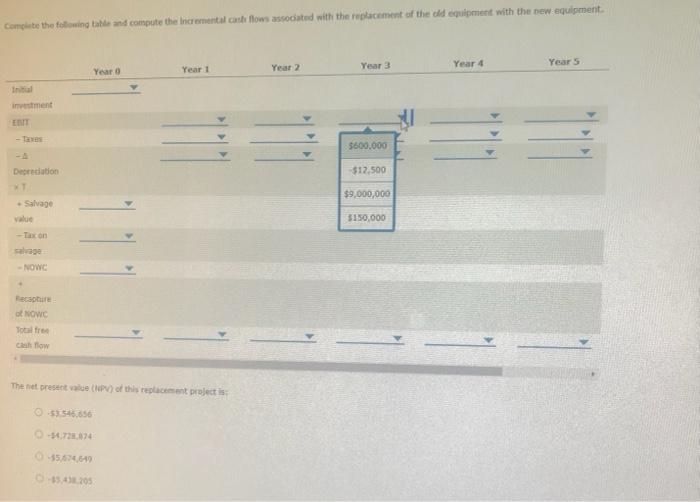

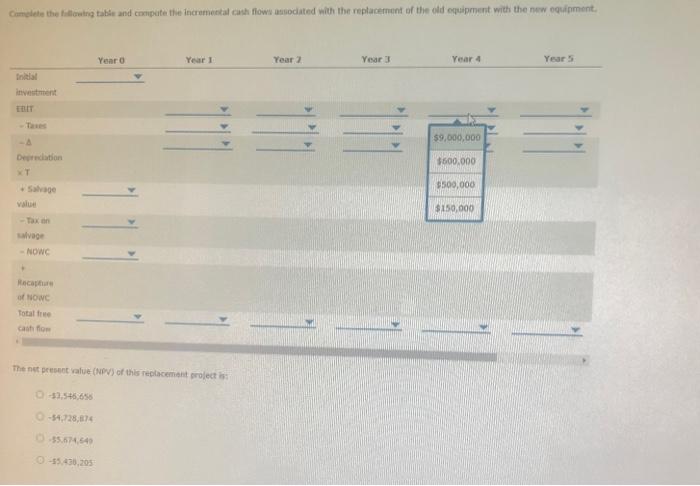

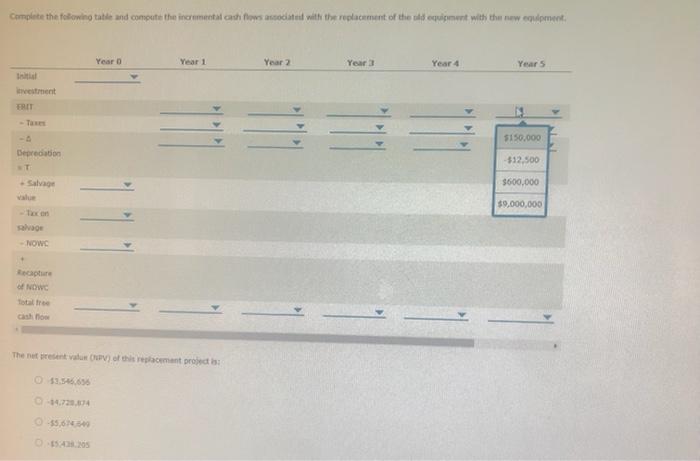

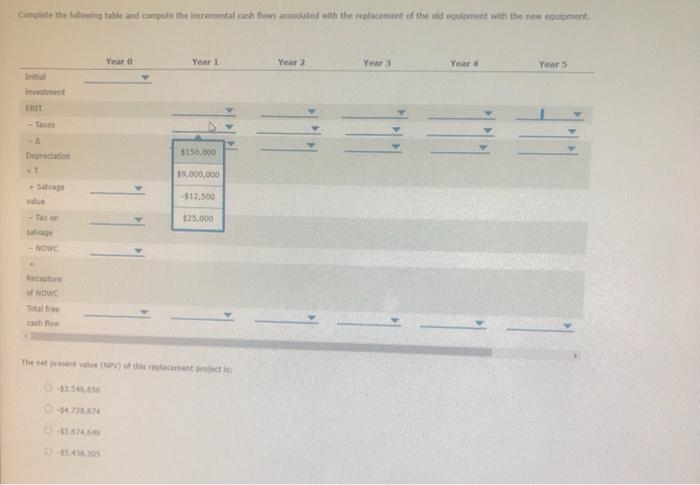

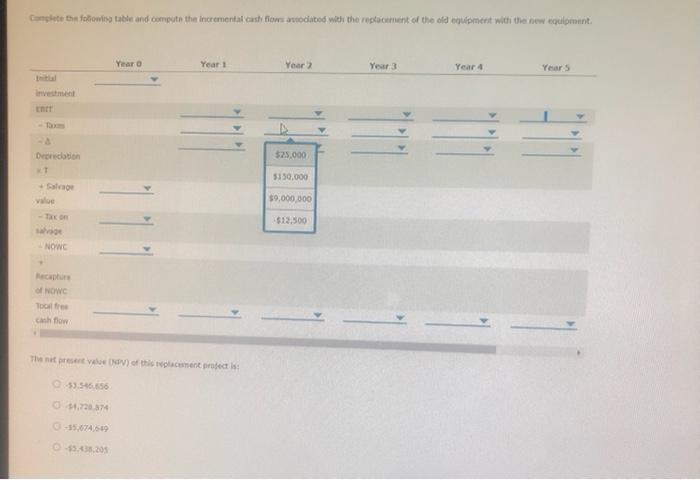

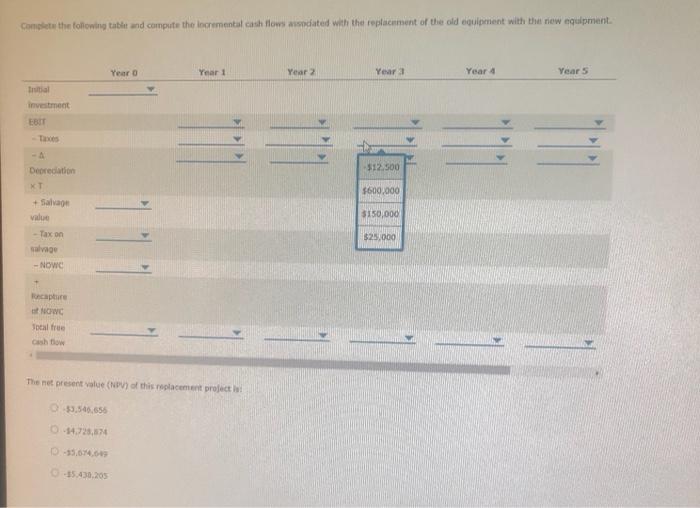

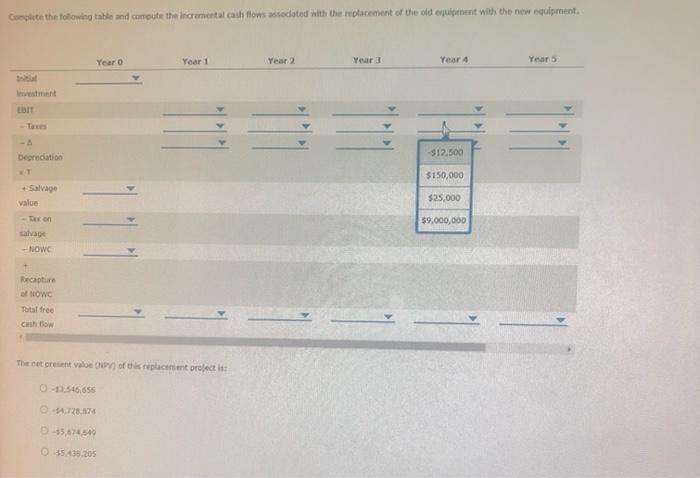

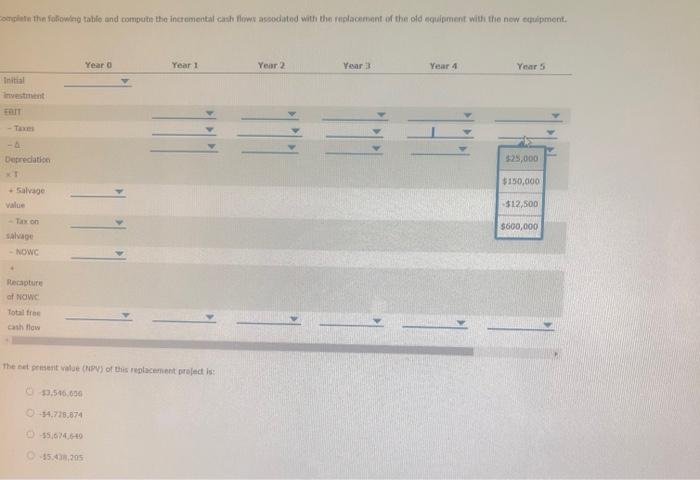

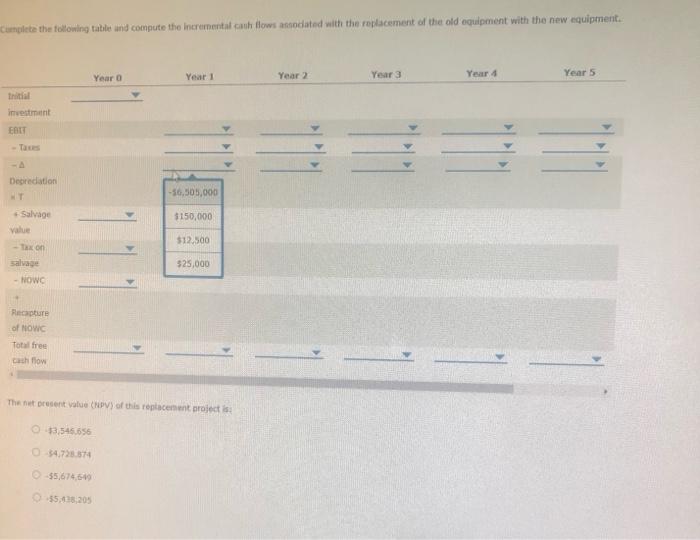

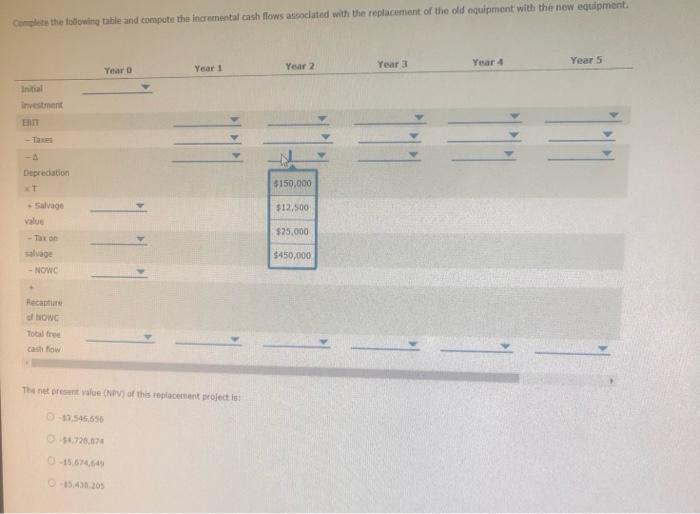

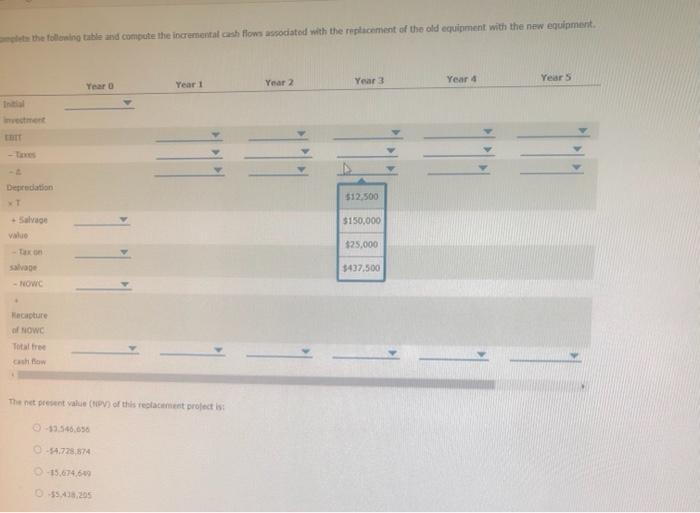

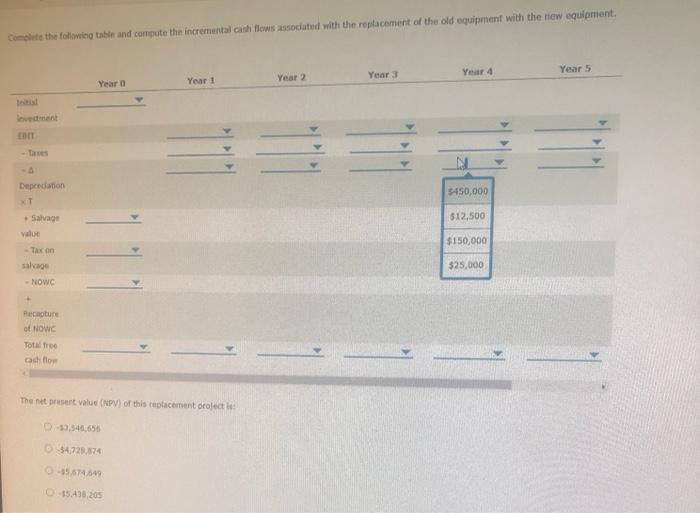

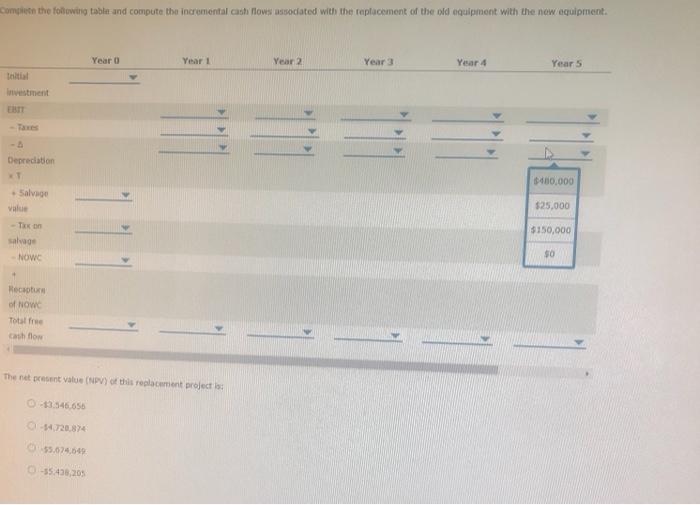

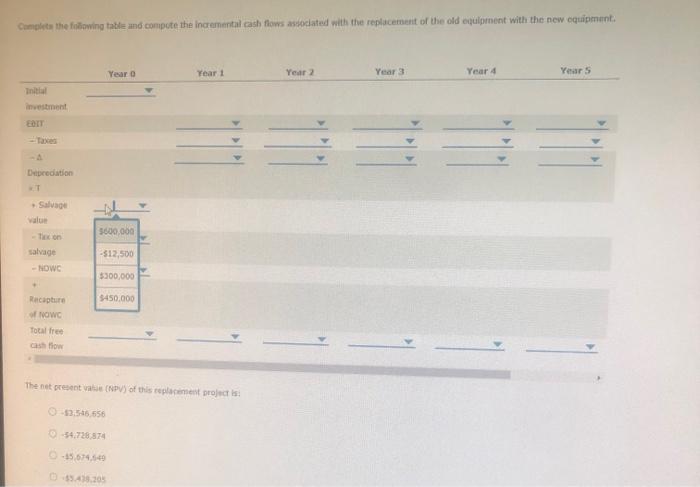

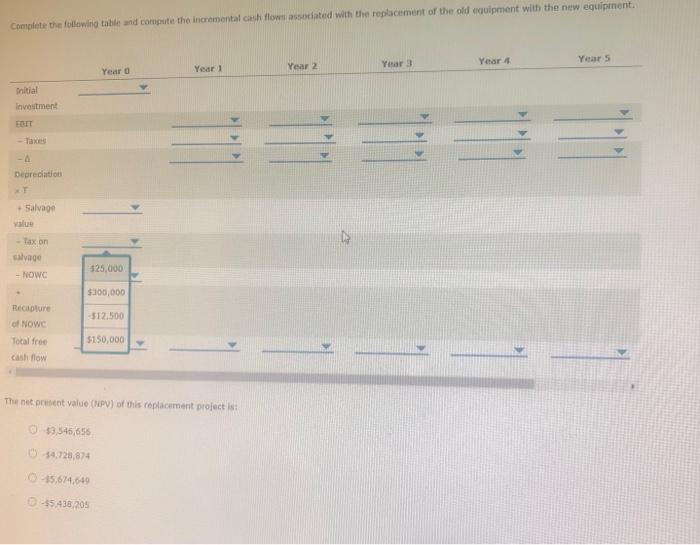

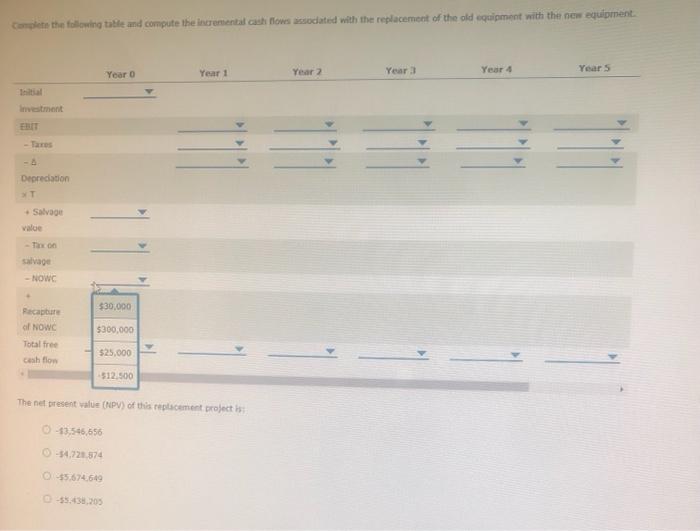

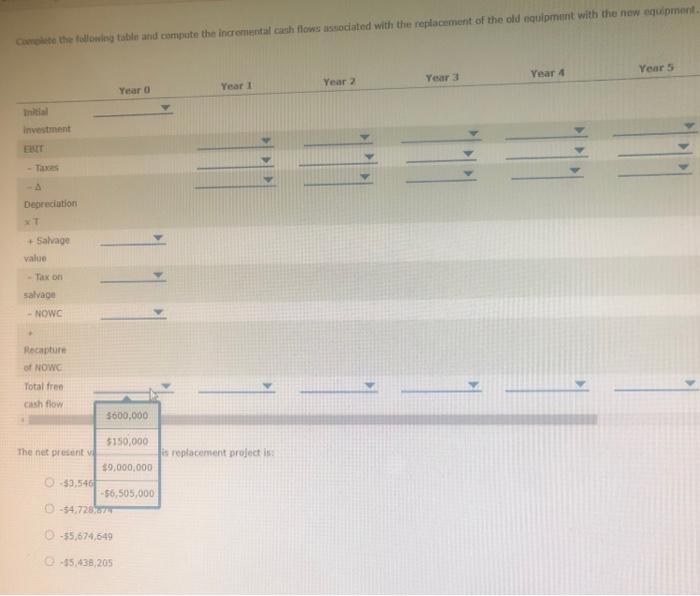

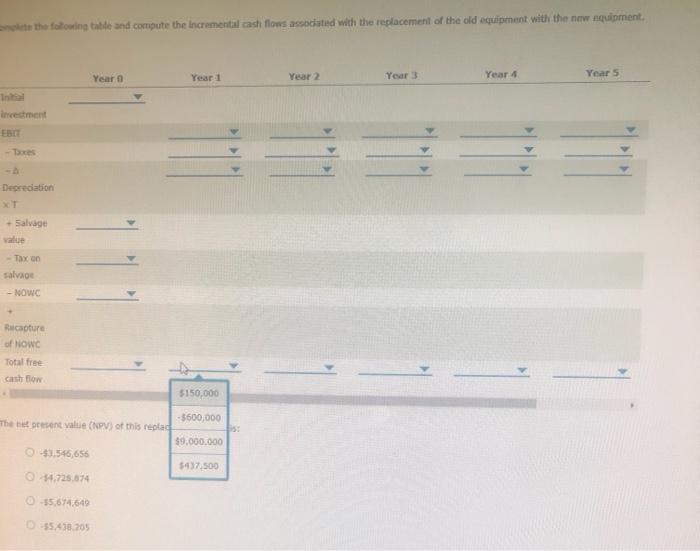

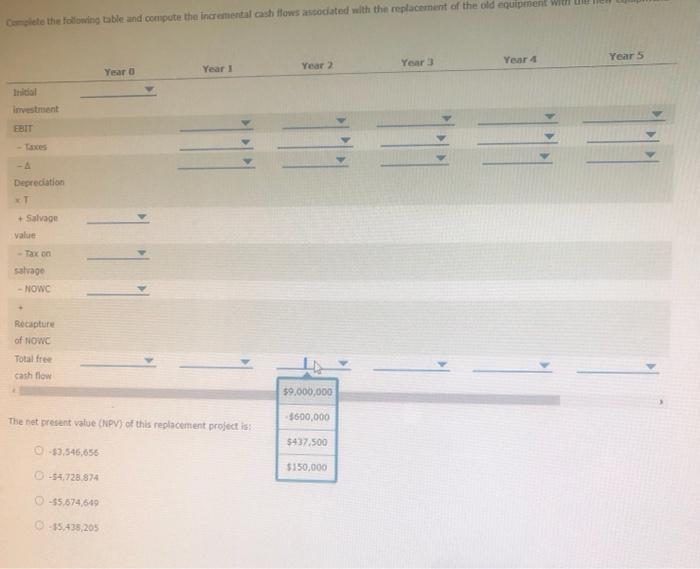

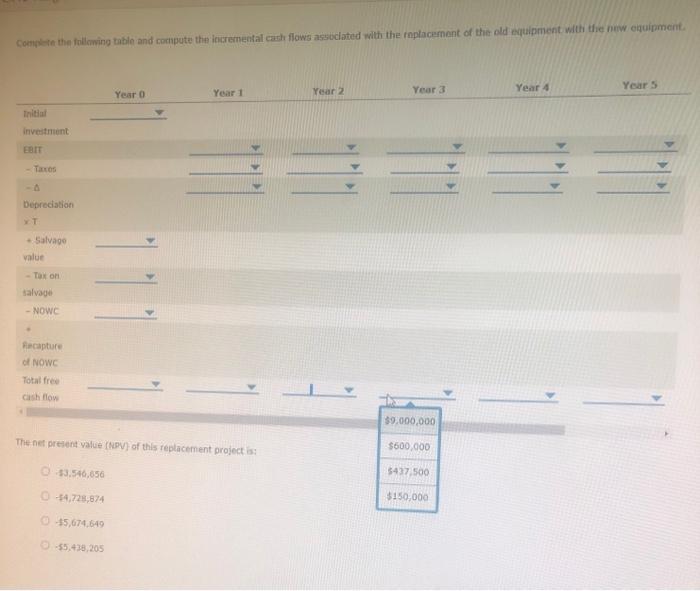

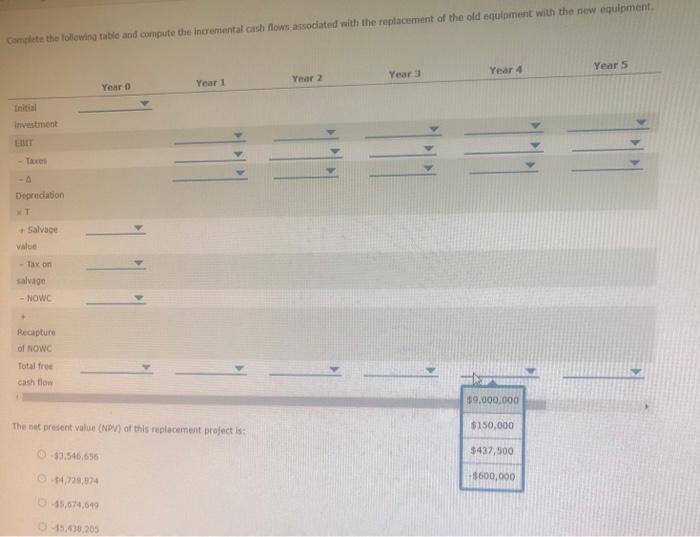

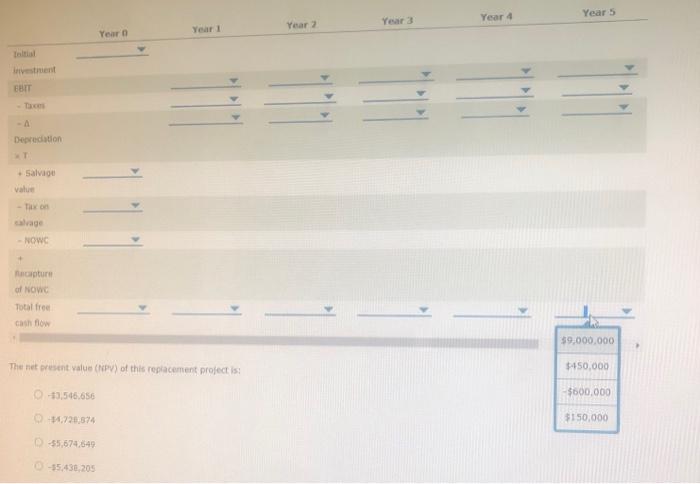

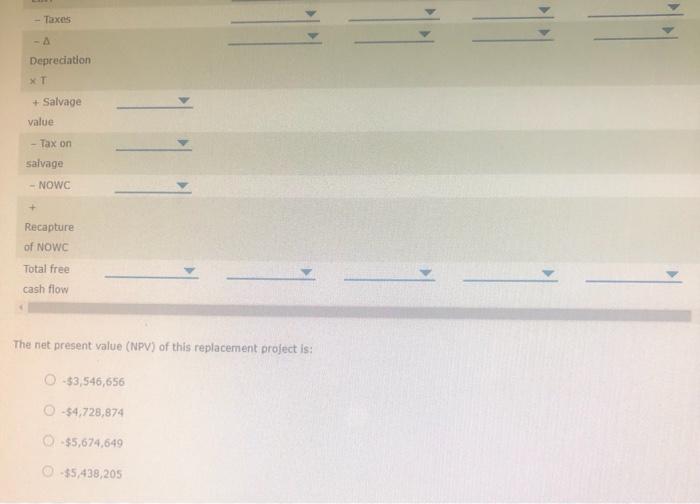

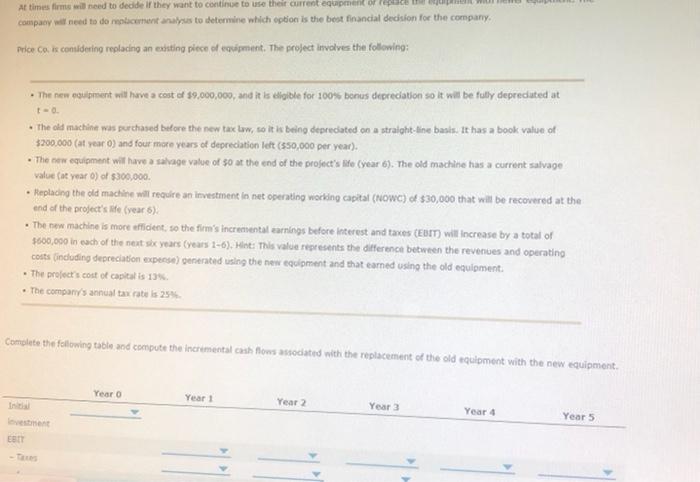

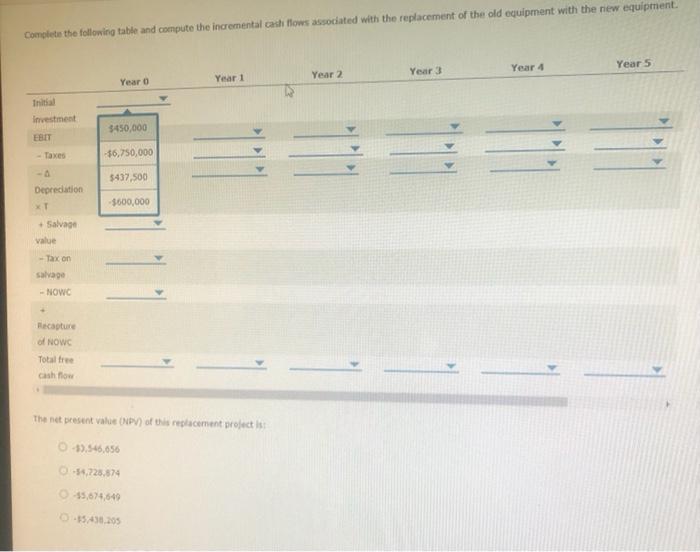

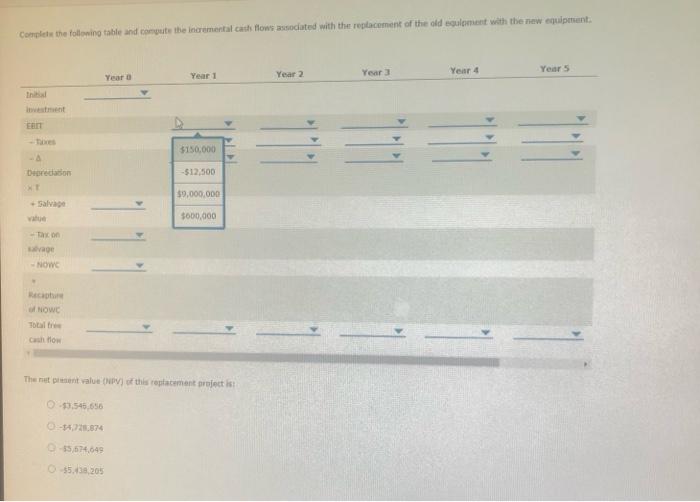

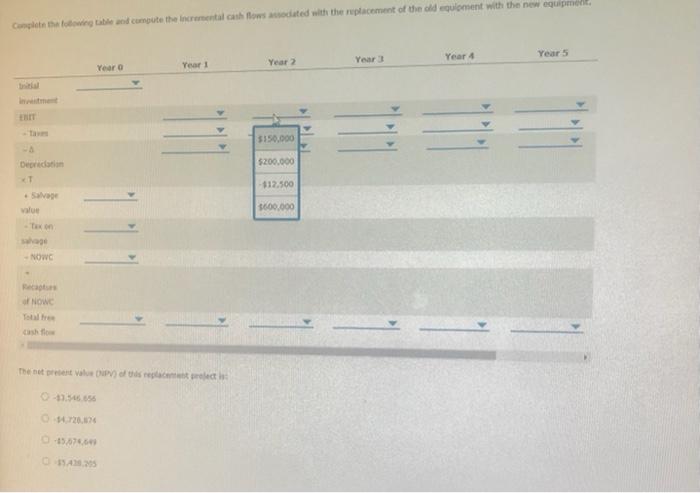

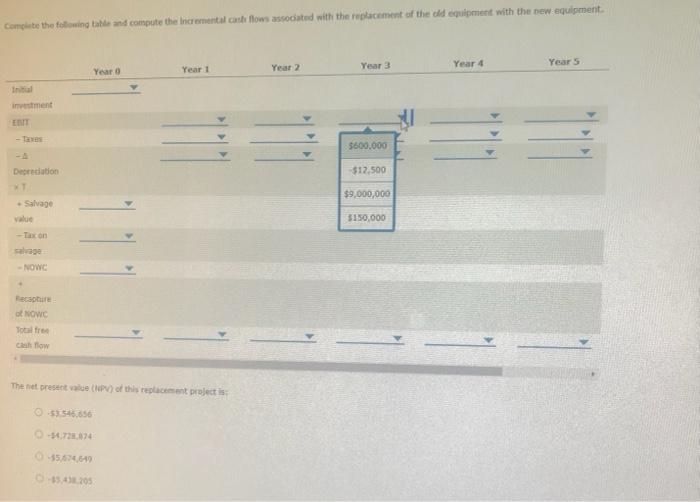

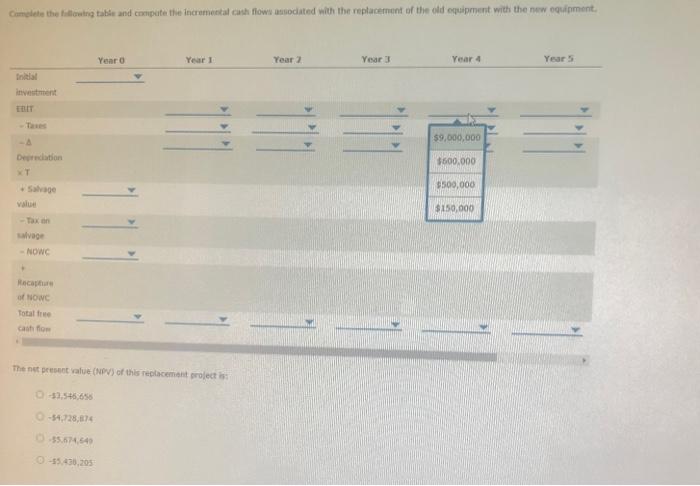

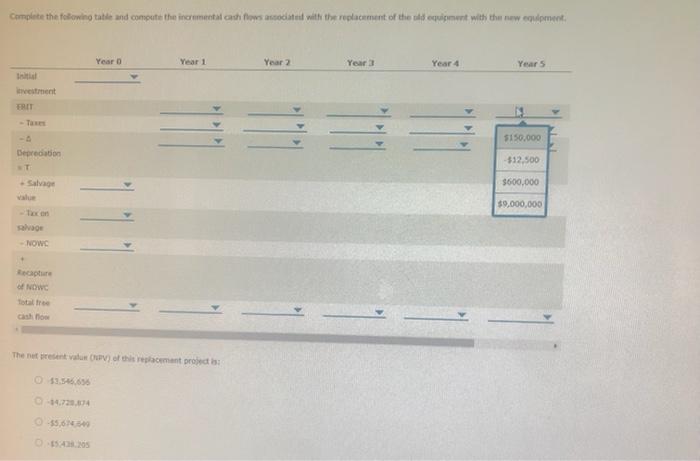

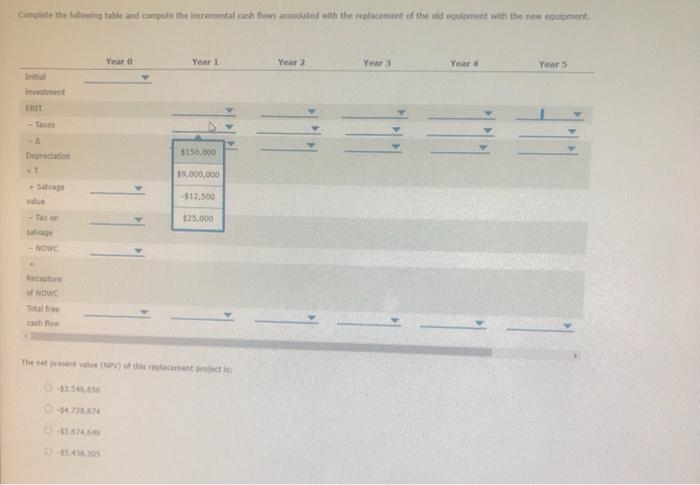

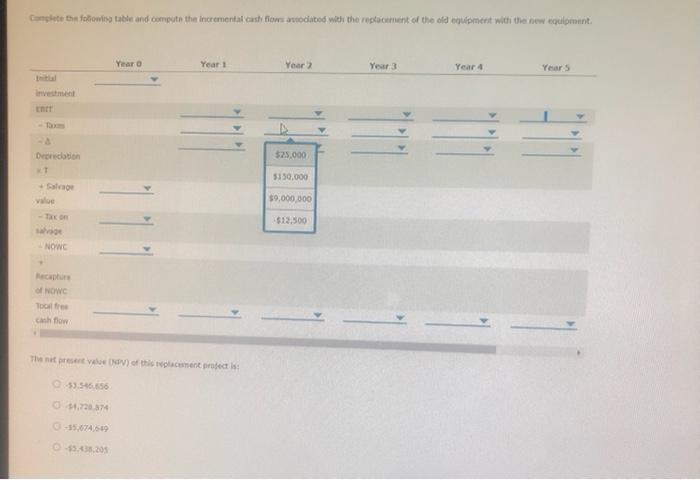

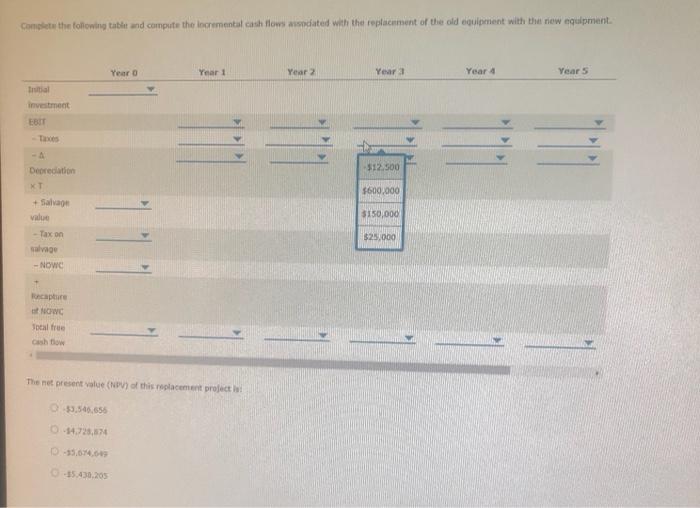

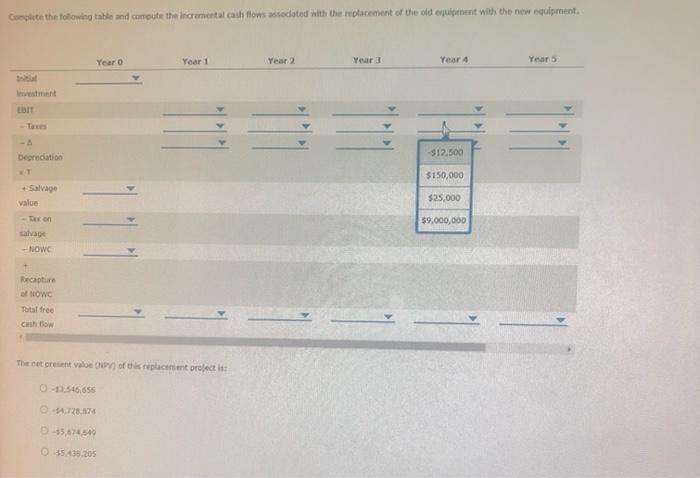

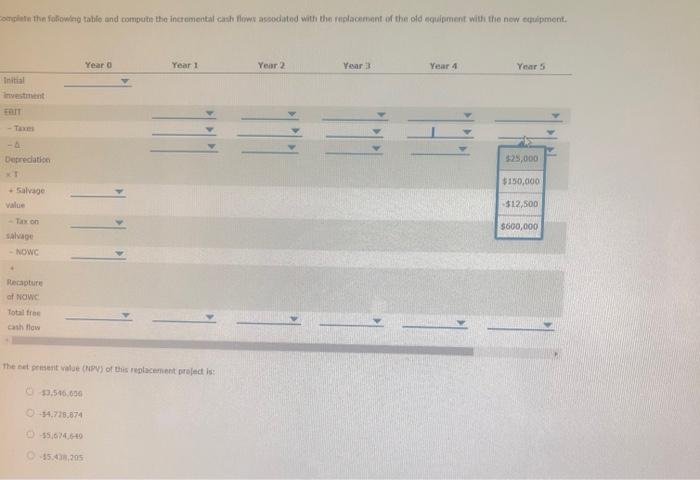

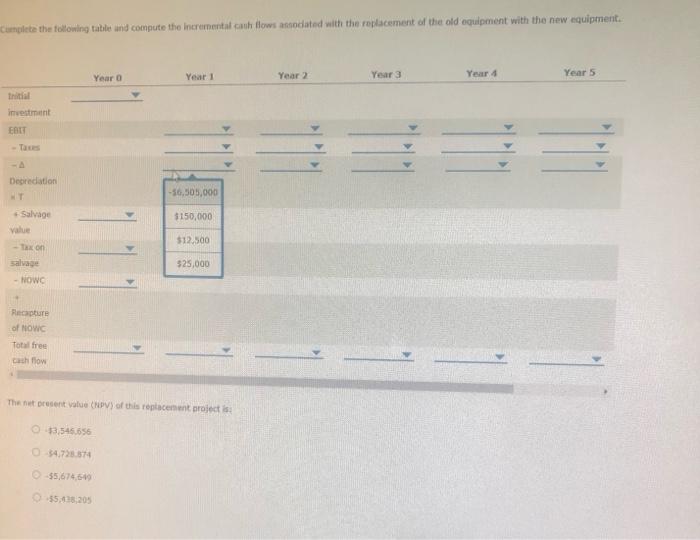

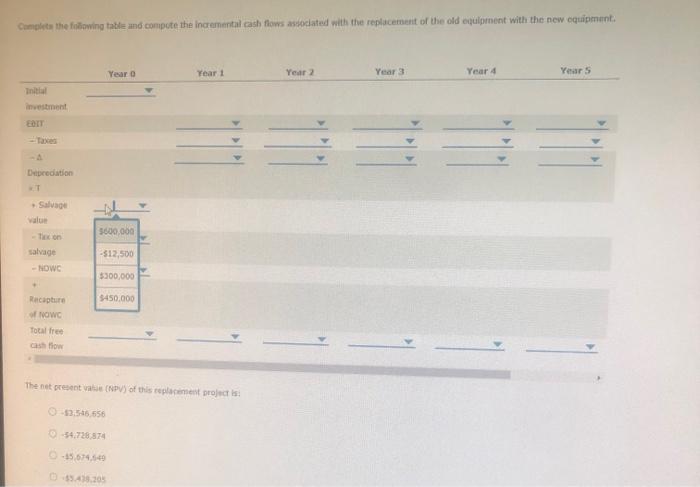

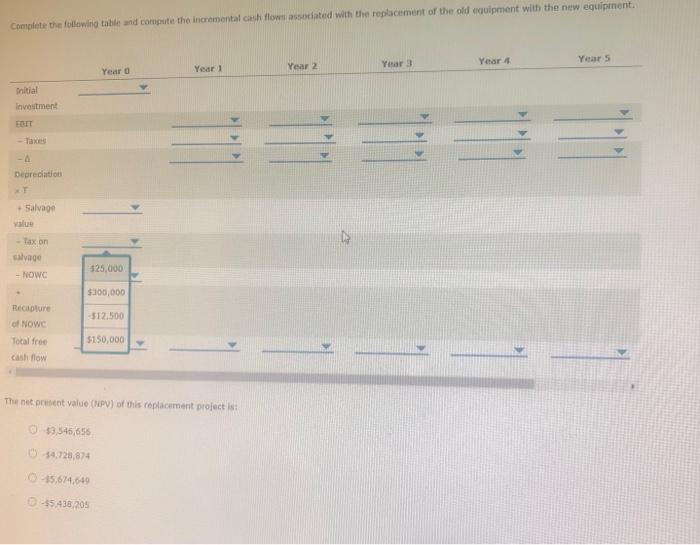

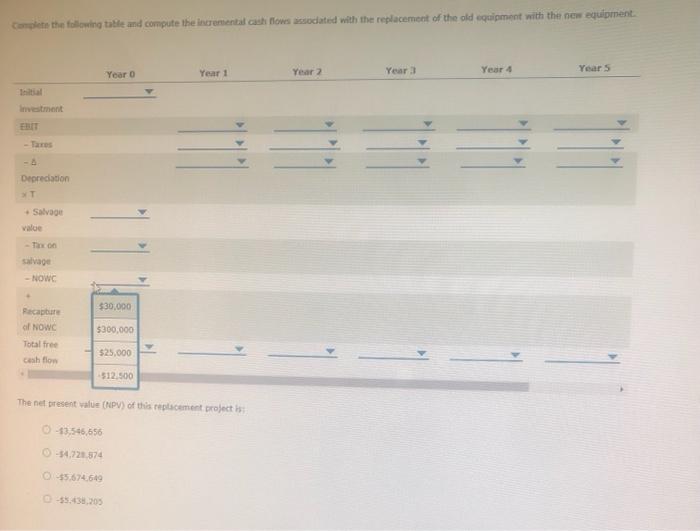

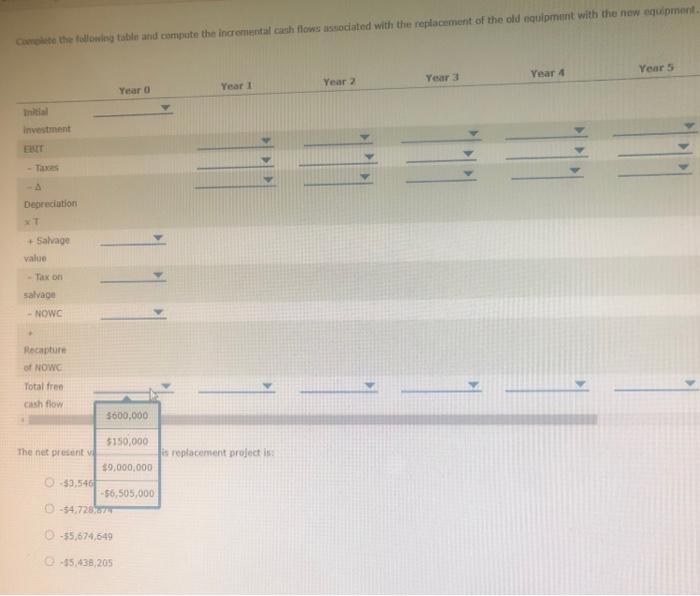

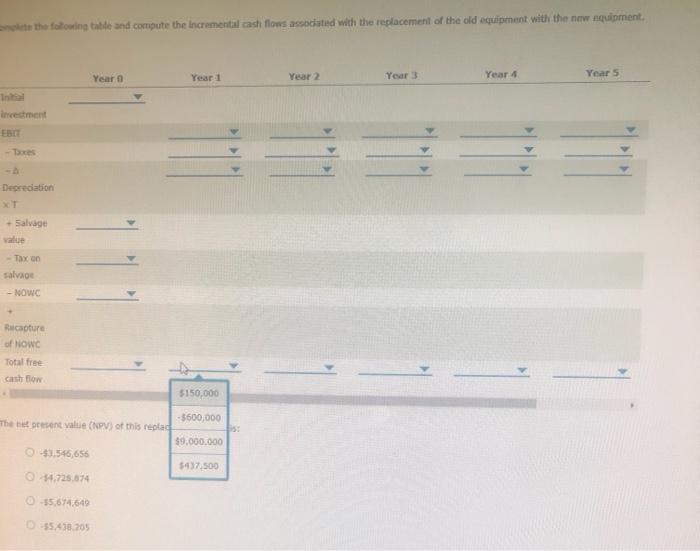

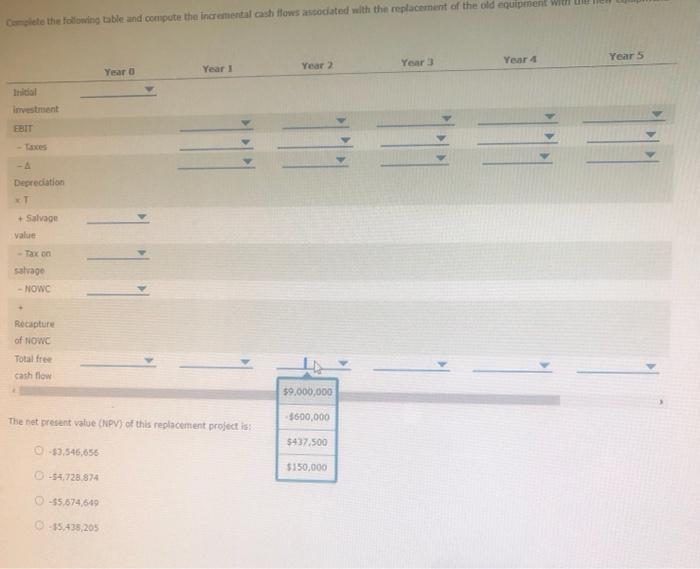

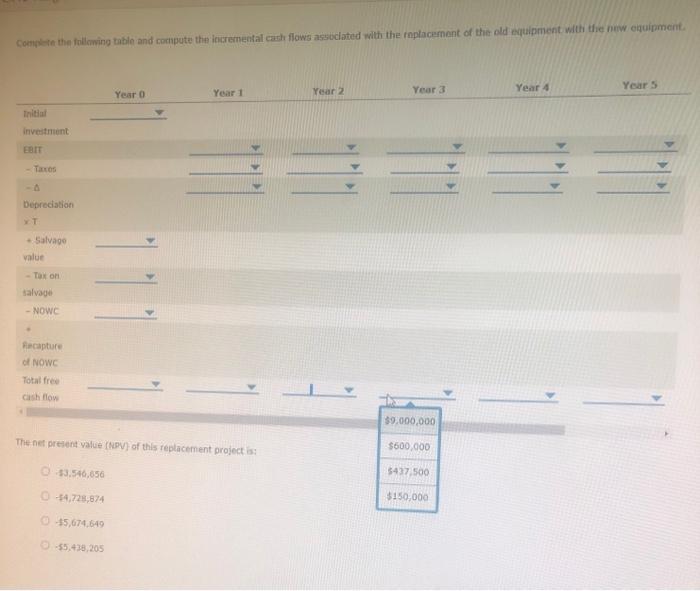

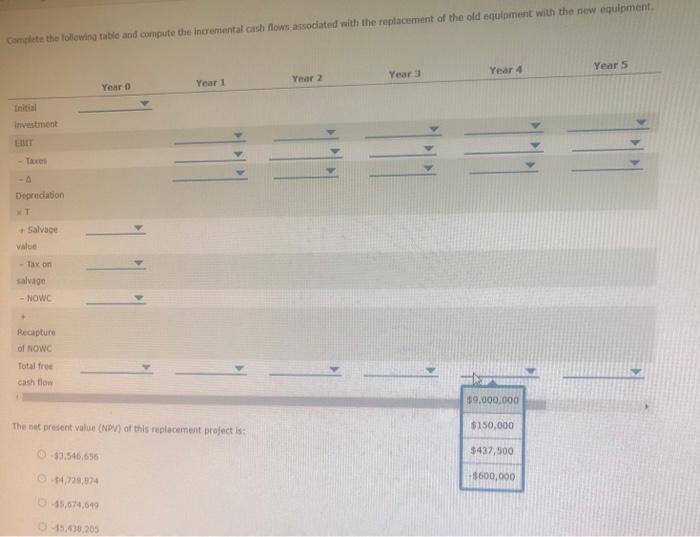

campacy will need to do moticement anahous to determine whilch egtion is the beat financial decision for the cornpary. Price Ca is contidering replacing an exsting piece of equipment, The project irvolves the following: - The new eculpront will have a cost of 19,000,000, and it is ellible for 100% benus depreciation so it will be futly depredated at t=0 - the old machine was purchased before the new tas Lw, so it is being depreciated on a straight-line basis. It has a bools value of $200.000 (at year 0) and four mice years of depreciation left ( $50,000 per year). - The new equigment wif have a salvage value of 30 at the end of the project's Mife (year 6 ). The old machline has a current salvage value (at year o) of 5300,000. - Replacing the old machine will require an investment in net operating working capital (fiowc) of 530,000 that will be recovered at the end of the project's ilf (year 6 ). - The new machine is more efficient, so the flim's increasental earnings before interest and taxes (EbIT) will increase by a total of $600,090 in euch of the next six years (years 16 ), Hint: This value fegresents the differencet between the revenues and operating costs (including depreciation experse) generated using the new eqciprnent and that earned using the old equigment. - The prelect's cout of capital is 13%. - The comparir's annual tax rate is 2504 . Complete the fellowing table and compute the incrimental cash flows assodated with the replacemient of the old tquipment with the new equipment. Complete the following table and compute the incremental caili flows assodated with the replacement of the old equipment with the riew equipment. The net present value (MDV) of this replacement project in: 13.546.056 54,725,874 45,674,640 15,436.205 The net pasient walue (kipy) cif this repiatement pripint is: 57,544,656 35.,674,048 55,138,205 75.074,641 |s 4 1) x=5 Cengle te the felowing table and compute the Incremental casfi flows associated with the rechacrimert of the cld equipmient with the new.equigment The fiat presart valie (tapV) of this replaceenent prolect is? -M.72,074.-15.6,69?bs.4)208 The net peesent value (NPV) of thes replacenasht grolect hi: 53,545,68554,728,67455,574,54955,430,205 14,724,134 655,6/4=12 The not probent value (NEN) of Uls replactment proked hi 11.548.556 5472min4 th 4.11. . Ves (4) 4 w 4 usio - 15.674isig Complete the folioning tablit and cornpute the incremental casht floms assopated with the replacingent of the old equipment with the riew equipment The net present value (taib) of this reglacement project is: 53,546,65514,238,57415,674,60715,430,205 The eet grestent valoe (TaB) of this riplacentent prefoct is: 13.545,555 4. TB. 7 is 35,614,519 45.436.205 13,545,694 34.716.874 35,6,14,640 15.414,205 Eurnicte the tollowing takle and compute the incremental couh flows ansociated with the rojlacement of the old oquipment with the riew equiprnenti. \begin{tabular}{l} 11,545,556 \\ +54,726,074 \\ 15,674,1149 \\ \hline 5,490,205 \end{tabular} The net present vahie (tiph) of this reclacinurat profect is: 13.540,65084,728,87415,674,61955,414,205 Conclite the follwing take and corroute the incremental cash flows associatod with the replacement of the old equipment with the new equigrnent. The net prusert value (NPV) of this ceplacement peolect hi: 13,541,655 34,720.074 35.574.549 15,436,205 Comgietn the follewing tabla and compute the incremental cash flows assodated with the replacement of the old oquagment with the newi equipment. The net present value (NEV) of thils replacerient project bi 13.946.05654,720.87455.074,04955.436,205 TI 13.546.55634,728,51415,674,649it5.4)20. Connolete the following tabin and comprite the incremental cach flown agsociated with the replacement of the old equipment with the new equipinent. + Salvage vilut Tru net prisent value (hipV) of this roplacement project is: 43,545,655 34,128,874 15,674,649 55.438,205 Complete the following talle and compute the increnterial cashi flows assodated with the replacement of the old equipmont nith the nee equipurent *T Yalue - Fax on salvage - NOWC. Recaptiate of NOWC cash flow The net present- F replacement project iss $3,54 54,72man $5,674,649 $5,438,205 Whilth the folooring takte and cornpute the incremental cast flows assocated with the replacement of the old equipment with the neve fuquipment. Year 0 Year 1 Year 2 Yesar 3 Year 4 Year 5 Initul incestment EBII: - Trares. 4 Drigerdation T + Salvage value - Tax en salvage - NDWC Recosture of liowe Total free cash filuw 55,674,649 is5,438.205 Conglete the following table and conpete the incremental cashi flows assodated with the replacement of the old equipinent witur! + Salvage value: - Tax cn salvage - NowC Rocapture of nowc Total ftee sach flow The net present value (hiPV) of this replacement project is: 53,546,65854,128,87455,674,64945,435,205 \begin{tabular}{ll|l|l|l|l|} \hline Year 0 & Year 1 & Year 2 & Year 3 \\ \hline Initial & & \end{tabular} investment EBrT - Tianes Depreciation T + Salvago yalue tox on salvoge - Nowe fecapture of NOWC Total free cash flow The net pretent value (NDV) of this replacement project is: . 33.540.656 54,728,874 55,674,649 55,478,205 Comilete the following tatic and conpute the incremental cash fows assodated with the replacemant of the old equipmerit with the new equipment. XT + Salvege value tax on salvago - NoWC Recaipture of nowc fotal free cash flew The net aresent value (NDV) of this replacement project is: \begin{tabular}{r} 37,546,656 \\ \hline 14,729,974 \\ \hline45,074,649 \\ 45,439,205 \end{tabular} The nef present value (TipV) of this repacement project is: 73,546,656 14.720.874 45,674,647 55,43e,205 The net present value (NPV) of this replacement project is: 33,546,656 54,728,874 $5,674,649 $5,438,205

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started