Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How do I properly use the DB function in excel? My homework question says, In cell E4, enter a formula that subtracts the result of

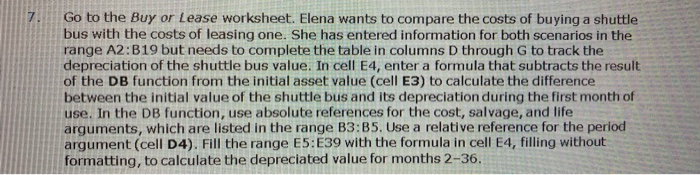

How do I properly use the DB function in excel? My homework question says, "In cell E4, enter a formula that subtracts the result of the DB function from the initial asset value (cell E3) to calculate the difference between the initial value of the shuttle bus and its depreciation during the first month of use. In the DB function, use absolute references for the cost, salvage, and life arguments, which are listed in the range B3:B5. use a relative reference for the period argument (cell D4)

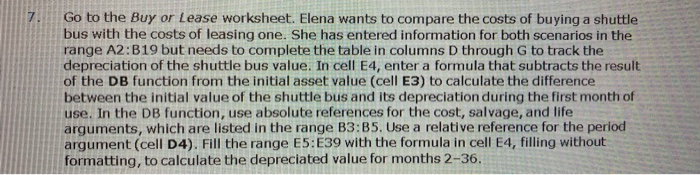

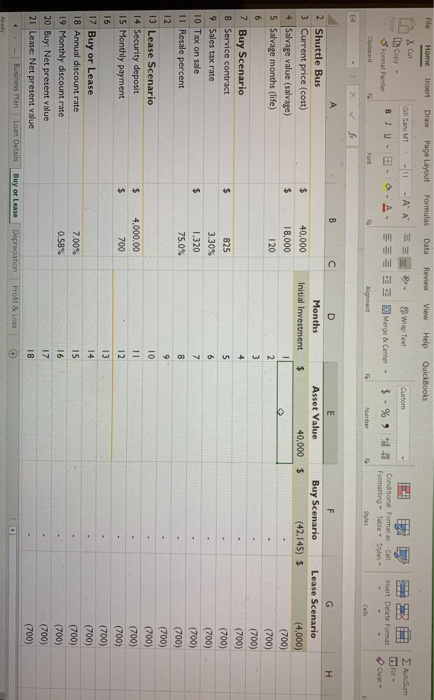

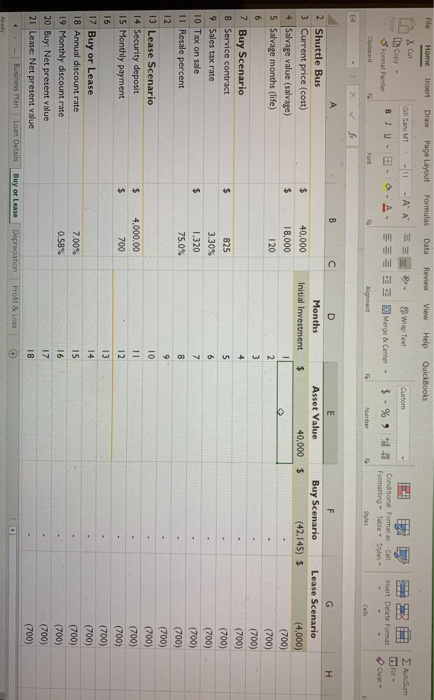

7 Go to the Buy or Lease worksheet. Elena wants to compare the costs of buying a shuttle bus with the costs of leasing one. She has entered information for both scenarios in the range A2:B19 but needs to complete the table in columns D through G to track the depreciation of the shuttle bus value. In cell E4, enter a formula that subtracts the result of the DB function from the initial asset value (cell E3) to calculate the difference between the initial value of the shuttle bus and its depreciation during the first month of use. In the DB function, use absolute references for the cost, salvage, and life arguments, which are listed in the range B3:35. Use a relative reference for the period argument (cell D4). Fill the range E5:E39 with the formula in cell E4, filling without formatting, to calculate the depreciated value for months 2-36. File Home Insert Draw Page Layout Formulas Data Review View Help QuickBooks Gill San MT - AA Custom Autosum X cut In Copy - Format Painter Clipboard Wrap Text Merge & Center BIU-EB $ -% -8 Insert Delete Format Conditional Formatas Cell Formatting Table Styles Styles & Clear Fort Alignment Number f B D H E Asset Value 40,000 $ Months Initial Investment 40,000 $ $ $ 18,000 120 2 3 4 5 $ 6 825 3.30% 1,320 75.0 $ 7 00 2 Shuttle Bus 3 Current price (cost) 4 Salvage value (salvage) 5 Salvage months (life) 6 7 Buy Scenario 8 Service contract 9 Sales tax rate 10 Tax on sale Il Resale percent 12 13 Lease Scenario 14 Security deposit 15 Monthly payment 16 17 Buy or Lease 18 Annual discount rate 19 Monthly discount rate 20 Buy: Net present value 21 Lease: Net present value Business Plan Loan Details F Buy Scenario Lease Scenario (42,145) $ (4,000) (700) (700) (700) (700) (700) (700) (700) (700) (700) (700) (700) (700) (700) (700) (700) (700) (700) (700) 9 $ $ 4,000.00 700 10 11 12 13 14 7.00% 0.58% 15 16 17 18 + Buy or Lease Deprecation Profit & Loss Rout

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started