How do I solve for D through H with the given information?

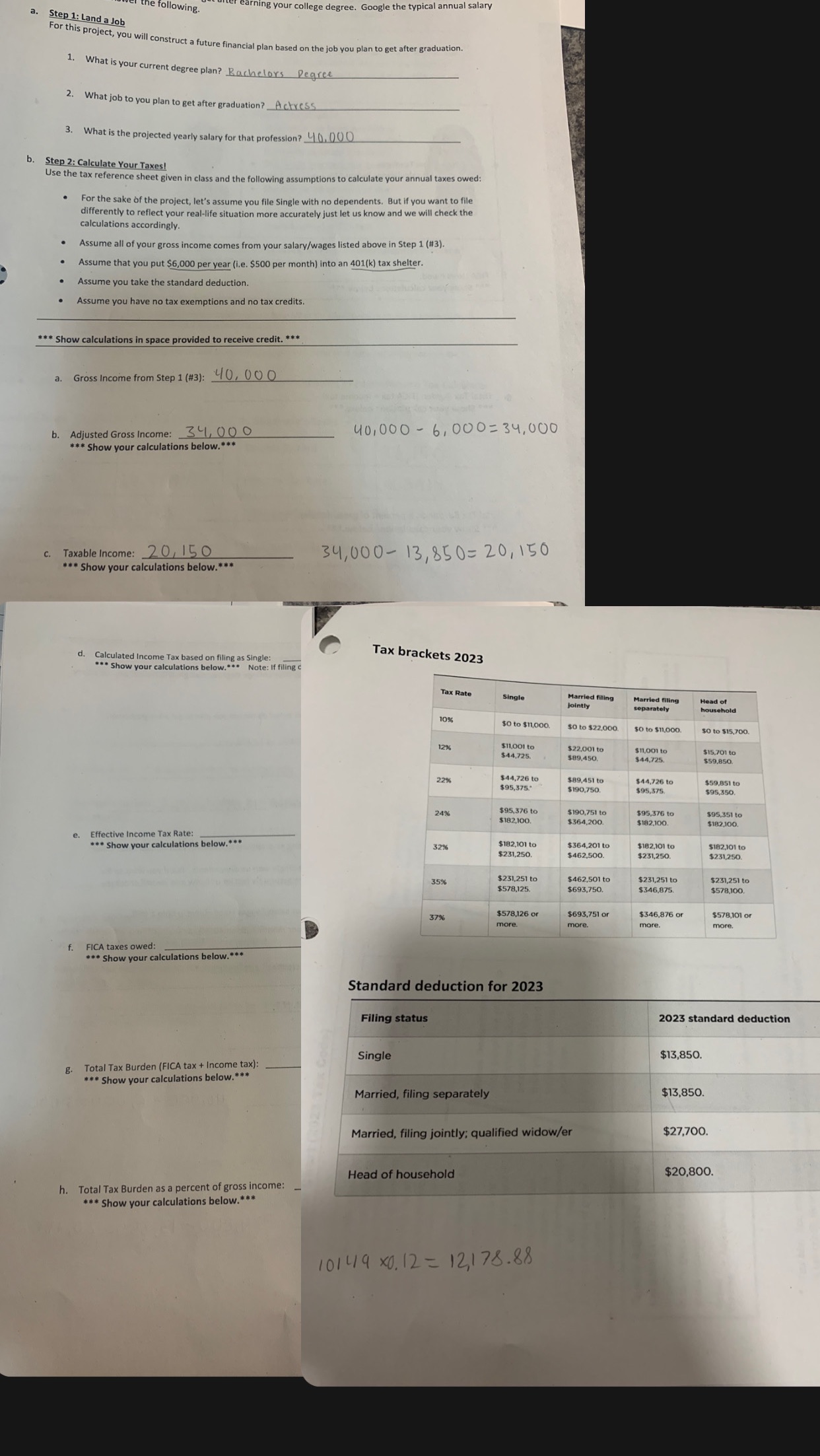

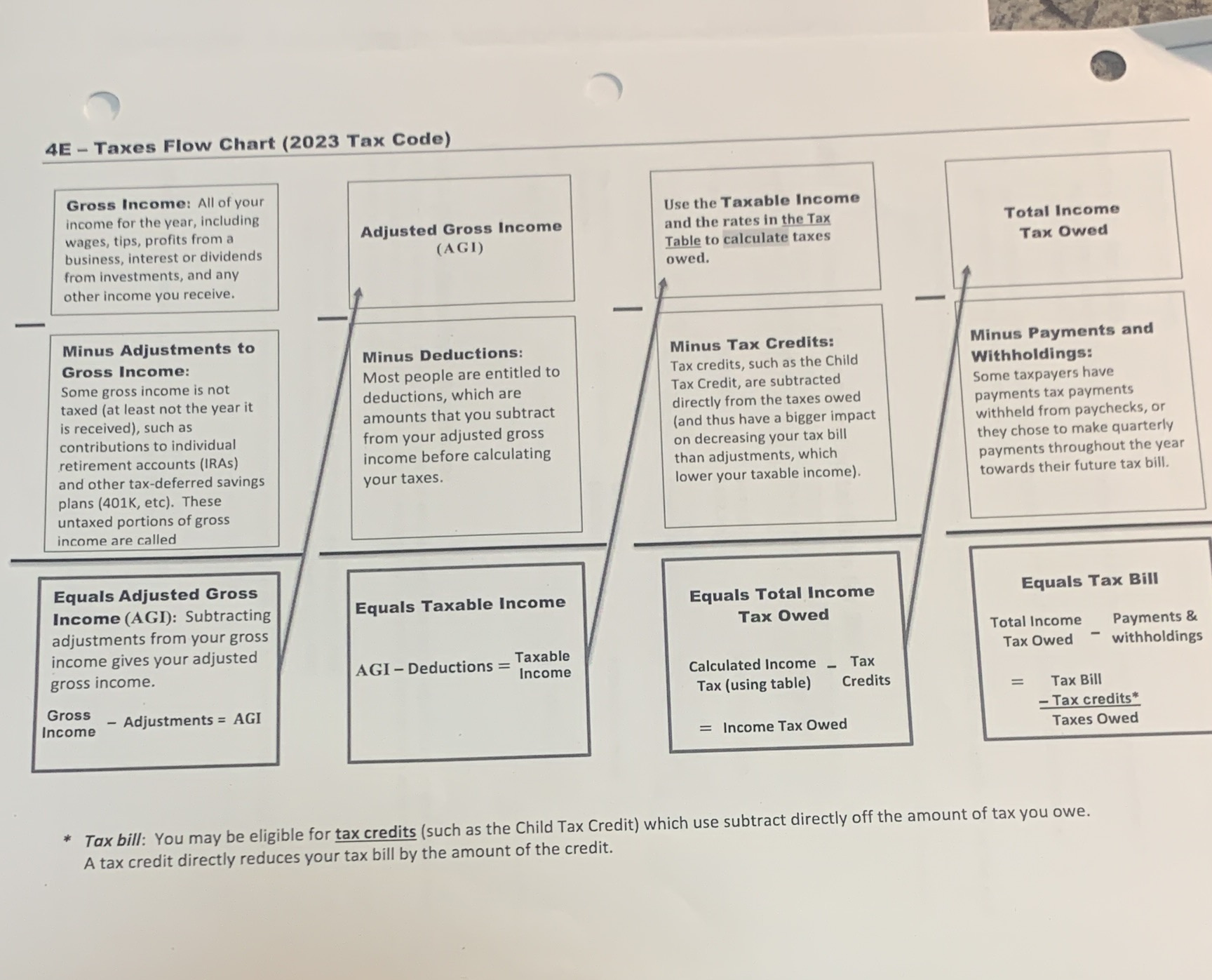

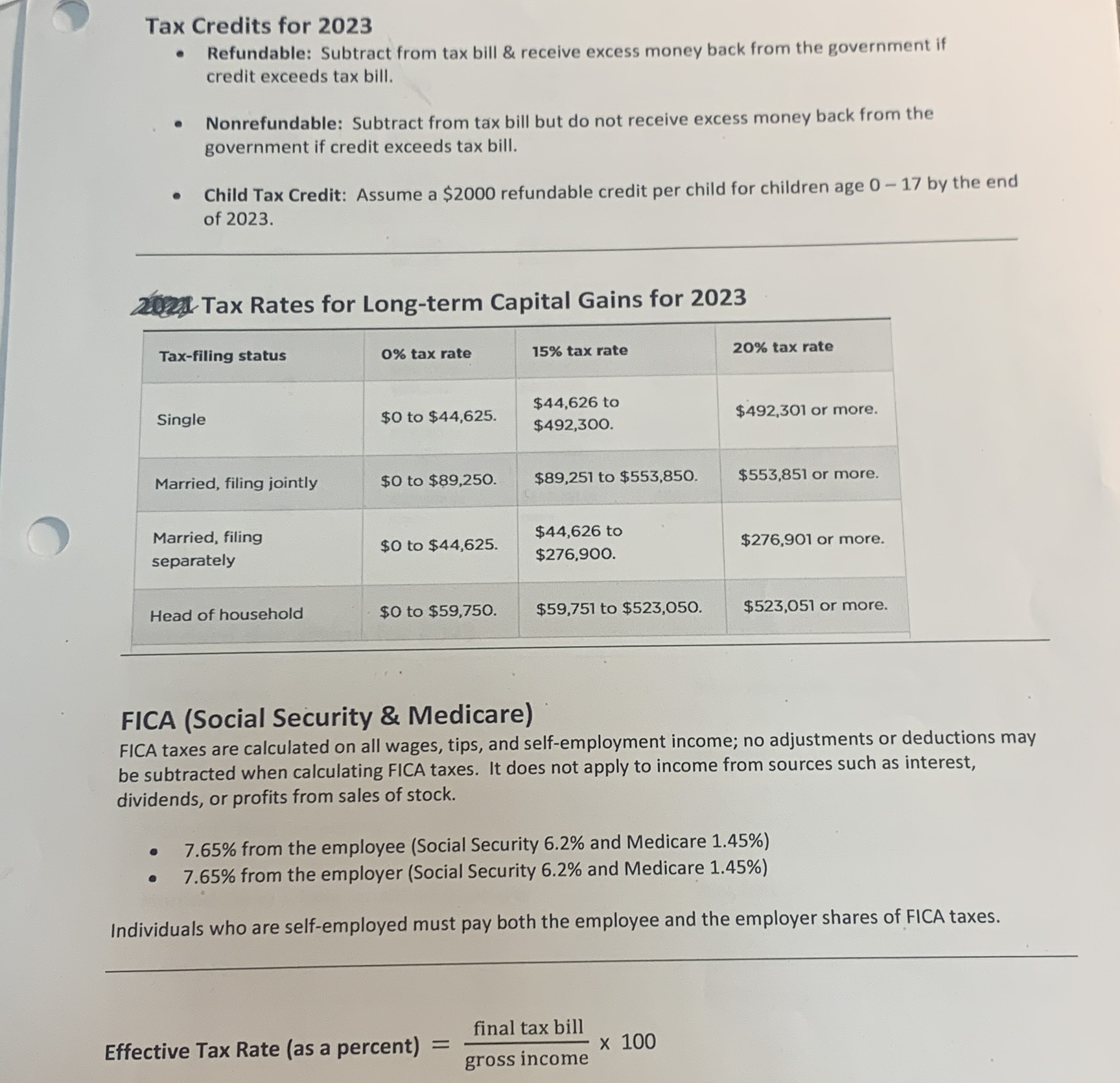

e following. rning your college degree. Google the typical annual salary a. Step 1: Land a Job For this project, you will construct a future financial plan based on the job you plan to get after graduation. 1. What is your current degree plan? Bachelors Degree 2. What job to you plan to get after graduation? Actress What is the projected yearly salary for that profession? _40 000 b. Step 2: Calculate Your Taxes! Use the tax reference sheet given in class and the following assumptions to calculate your annual taxes owed: For the sake of the project, let's assume you file Single with no dependents. But if you want to file differently to reflect your real-life situation more accurately just let us know and we will check the calculations accordingly. Assume all of your gross income comes from your salary/wages listed above in Step 1 (#3). Assume that you put $6,000 per year (i.e. $500 per month) into an 401(k) tax shelter. Assume you take the standard deduction. Assume you have no tax exemptions and no tax credits. ***Show calculations in space provided to receive credit. *** a. Gross Income from Step 1 (#3): 40, 00 0 b. Adjusted Gross Income: 3'LOO O 401 000 - 6, 000= 34, 000 *** Show your calculations below.*** Taxable Income: 20, 150 34, 000- 13, 85 0= 20, 150 *** Show your calculations below.*** d. Calculated Income Tax based on filing as Single: Tax brackets 2023 **Show your calculations below.".* Note: If filing c Tax Rate ingle Married filing Married filing ointly separately Head of 109 $0 to $11,000. $0 to $22,000. $0 to $11,000. SO to $15,700. 12%% $11,001 to $22,001 to 1,001 to $44,725. $89.450. $15,701 to $44,725. $59,850. 22% $44,726 to $89,451 to $95,375' $44,726 to $59,851 to $190,750. $95,375. $95,350. 24% $95,376 to $190,751 to $95,376 to $95,351 to $182,100. $364,200. $182,100. $182,100. e. Effective Income Tax Rate: .** Show your calculations below.*** 32% $182,101 to $364,201 to $182,101 to $182,101 to $231,250 $462,500. $231,250. $231,250. 35% $231,251 to $462,501 to $231,251 to $231,251 to $578.125. $693,750. $346,875. $578,100. 37% $578,126 or $693,751 or $346,876 or $578,101 or more. more. more. more. f . FICA taxes owed: *** Show your calculations below.*** Standard deduction for 2023 Filing status 2023 standard deduction Single $13,850. g. Total Tax Burden (FICA tax + Income tax): ***Show your calculations below.*** Married, filing separately $13,850 Married, filing jointly; qualified widow/er $27,700. Head of household $20,800 . Total Tax Burden as a percent of gross income: ***Show your calculations below.* ** 10149 x0. 12 = 12,178. 884E - Taxes Flow Chart (2023 Tax Code) Gross Income: All of your income for the year, including Use the Taxable Income wages, tips, profits from a Adjusted Gross Income and the rates in the Tax Total Income business, interest or dividends (AGI) Table to calculate taxes Tax Owed from investments, and any owed. other income you receive. Minus Adjustments to Gross Income: Minus Deductions: Minus Tax Credits: Minus Payments and Most people are entitled to Tax credits, such as the Child Withholdings: Some gross income is not taxed (at least not the year it deductions, which are Tax Credit, are subtracted Some taxpayers have is received), such as amounts that you subtract directly from the taxes owed payments tax payments contributions to individual from your adjusted gross and thus have a bigger impact withheld from paychecks, or retirement accounts (IRAs) income before calculating on decreasing your tax bill they chose to make quarterly than adjustments, which payments throughout the year and other tax-deferred savings your taxes . lower your taxable income). towards their future tax bill. plans (401K, etc). These untaxed portions of gross income are called Equals Adjusted Gross Income (AGI): Subtracting Equals Taxable Income Equals Total Income Equals Tax Bill adjustments from your gross Tax Owed Total Income Payments & income gives your adjusted AGI - Deductions = Taxable Tax Owed withholdings gross income. Income Calculated Income _ T Tax Tax (using table) Credits Gross = Tax Bill Income - Adjustments = AGI - Tax credits* = Income Tax Owed Taxes Owed * Tax bill: You may be eligible for tax credits (such as the Child Tax Credit) which use subtract directly off the amount of tax you owe. A tax credit directly reduces your tax bill by the amount of the credit.Tax Credits for 2023 . Refundable: Subtract from tax bill & receive excess money back from the government if credit exceeds tax bill. Nonrefundable: Subtract from tax bill but do not receive excess money back from the government if credit exceeds tax bill. Child Tax Credit: Assume a $2000 refundable credit per child for children age 0 - 17 by the end of 2023. 2024 Tax Rates for Long-term Capital Gains for 2023 Tax-filing status 0% tax rate 15% tax rate 20% tax rate Single $0 to $44,625. $44,626 to $492,300 $492,301 or more. Married, filing jointly $0 to $89,250. $89,251 to $553,850. $553,851 or more. Married, filing $44,626 to $0 to $44,625. $276,901 or more. separately $276,900. Head of household $0 to $59,750. $59,751 to $523,050. $523,051 or more. FICA (Social Security & Medicare) FICA taxes are calculated on all wages, tips, and self-employment income; no adjustments or deductions may be subtracted when calculating FICA taxes. It does not apply to income from sources such as interest, dividends, or profits from sales of stock. 7.65% from the employee (Social Security 6.2% and Medicare 1.45%) . 7.65% from the employer (Social Security 6.2% and Medicare 1.45%) Individuals who are self-employed must pay both the employee and the employer shares of FICA taxes. final tax bill Effective Tax Rate (as a percent) = x 100 gross income