Answered step by step

Verified Expert Solution

Question

1 Approved Answer

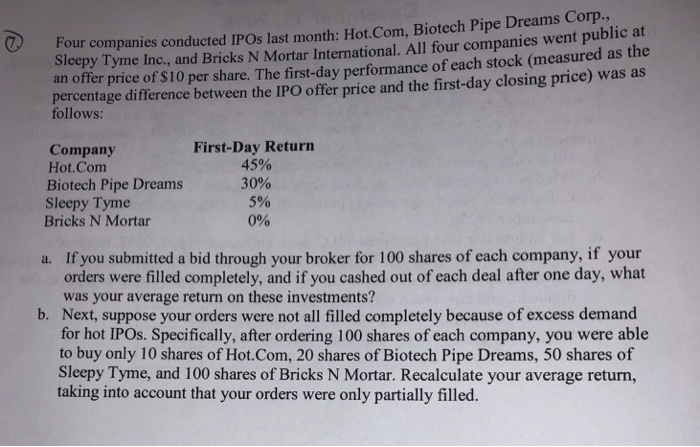

How do I solve? Four companies conducted IPOs last month: Hot.Com, Biotech Pipe Dreams Corp, Sleepy Tyme Inc., and Bricks N Mortar International. All four

How do I solve?

Four companies conducted IPOs last month: Hot.Com, Biotech Pipe Dreams Corp, Sleepy Tyme Inc., and Bricks N Mortar International. All four companies went public at an offer price of $10 per share. The first-day performance of each stock (measured as the percentage difference between the IPO offer price and the first-day closing price) was as follows: Company Hot.Com Biotech Pipe Dreams Sleepy Tyme Bricks N Mortar First-Day Return 45% 30% 5% 090 a. If you submitted a bid through your broker for 100 shares of each company, if your orders were filled completely, and if you cashed out of each deal after one day, what was your average return on these investments? Next, suppose your orders were not all filled completely because of excess demand for hot IPOs. Specifically, after ordering 100 shares of each company, you were able to buy only 10 shares of Hot.Com, 20 shares of Biotech Pipe Dreams, 50 shares of Sleepy Tyme, and 100 shares of Bricks N Mortar. Recalculate your average return, taking into account that your orders were only partially filled. b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started