Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how do I solve? Gobo-Dharma Ca. has to choose between two mutually exclusive projects. If it chooses project A, Globo-Dharma Co. Will have the opportunity

how do I solve?

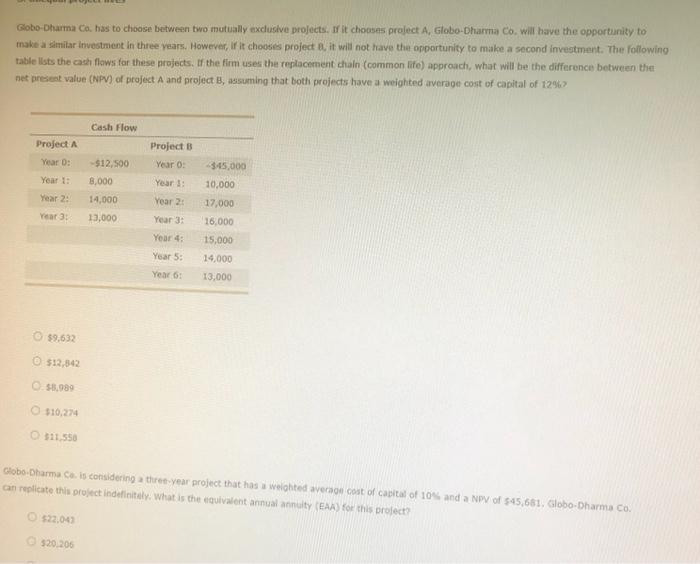

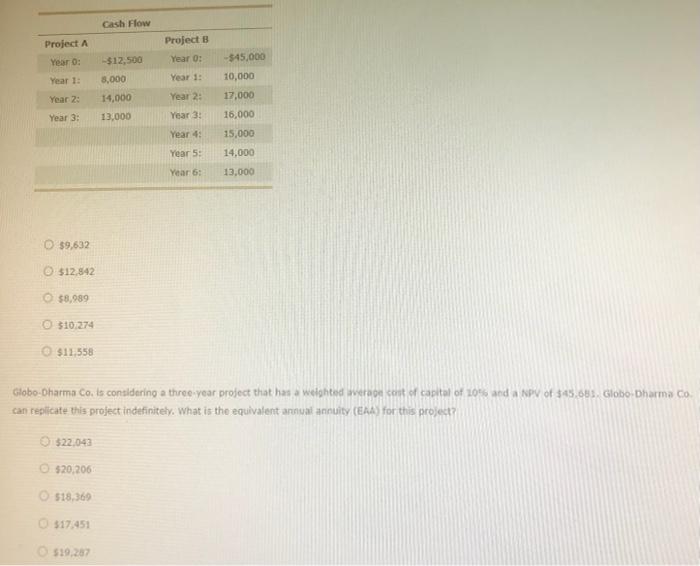

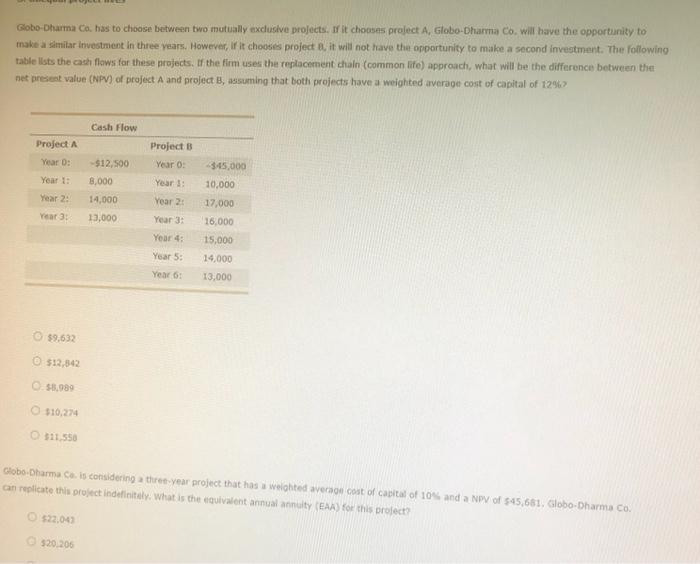

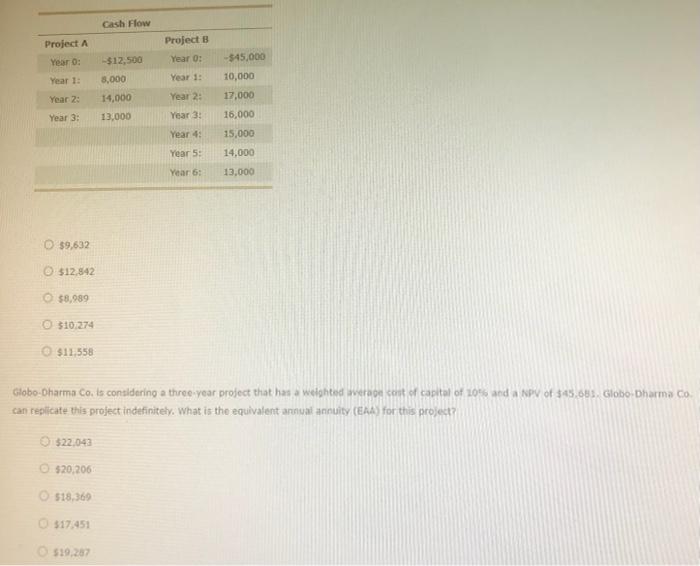

Gobo-Dharma Ca. has to choose between two mutually exclusive projects. If it chooses project A, Globo-Dharma Co. Will have the opportunity to inake a slmilar investment in thiee vears. However, If it chooses project 8 , it will not have tha opportunity to make a second invegtment. The following table llsts the cade flaws tar these nrojects. If the firm uses the replacement chaln (common life) approach, what will he the difference between the net preseat value (VPV) of project A and project B, assuming that both projects have a weighted arverage cosit of capital of 125 . ? an replicate this project indefinitsly. What is the equivalent annual annuity (EAA) for this profect? $22.043 $2..04)$20.206 $9,632 312,542 58,989 $10,274 $11,558 Globo-Dharma Co, is considering a three-year project that has a weighted werape cost of capital of 105 and a kpV of $45,681. Globo-Dharma Co. can replicate this project indefinitehy. What is tho equivalent anaual annuity (EAA) for this project? $22,043 $20,206 518.369 $17.451 519,207

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started