Question: how do i solve the following Based on historical data, assume you have estimated the average dollar amount of loss per claim for the next

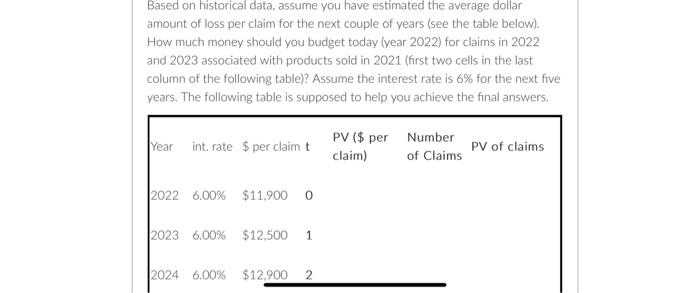

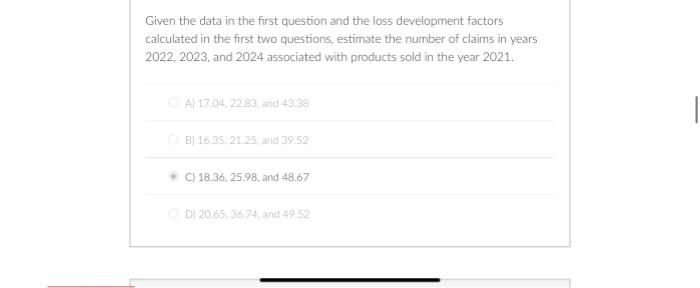

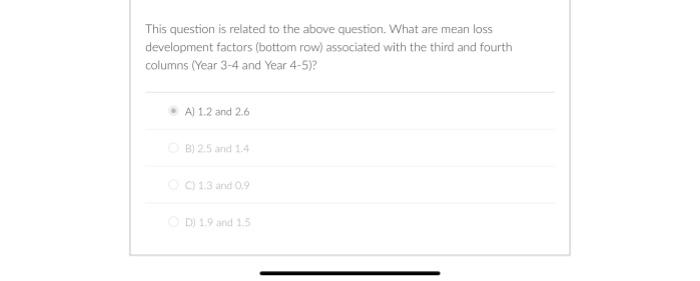

Based on historical data, assume you have estimated the average dollar amount of loss per claim for the next couple of years (see the table below). How much money should you budget today (year 2022) for claims in 2022 and 2023 associated with products sold in 2021 (first two cells in the last column of the following table)? Assume the interest rate is 6% for the next five years. The following table is supposed to help you achieve the final answers. Given the data in the first question and the loss development factors calculated in the first two questions, estimate the number of claims in years 2022,2023 , and 2024 associated with products sold in the year 2021. A) 1704,22.83, and 43.38 B) 16.35,21.25 and 39.52 c) 18.36.25.98, and 48.67 D) 20.65,36.74, and 49.52 This question is related to the above question. What are mean loss development factors (bottom row) associated with the third and fourth columns (Year 3-4 and Year 4-5)? A) 1.2 and 2.6 B) 2.5 and 1.4 Cl1.3 and 0.9 Di) 1.9 and 1.5 Based on historical data, assume you have estimated the average dollar amount of loss per claim for the next couple of years (see the table below). How much money should you budget today (year 2022) for claims in 2022 and 2023 associated with products sold in 2021 (first two cells in the last column of the following table)? Assume the interest rate is 6% for the next five years. The following table is supposed to help you achieve the final answers. Given the data in the first question and the loss development factors calculated in the first two questions, estimate the number of claims in years 2022,2023 , and 2024 associated with products sold in the year 2021. A) 1704,22.83, and 43.38 B) 16.35,21.25 and 39.52 c) 18.36.25.98, and 48.67 D) 20.65,36.74, and 49.52 This question is related to the above question. What are mean loss development factors (bottom row) associated with the third and fourth columns (Year 3-4 and Year 4-5)? A) 1.2 and 2.6 B) 2.5 and 1.4 Cl1.3 and 0.9 Di) 1.9 and 1.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts