How do I solve this??

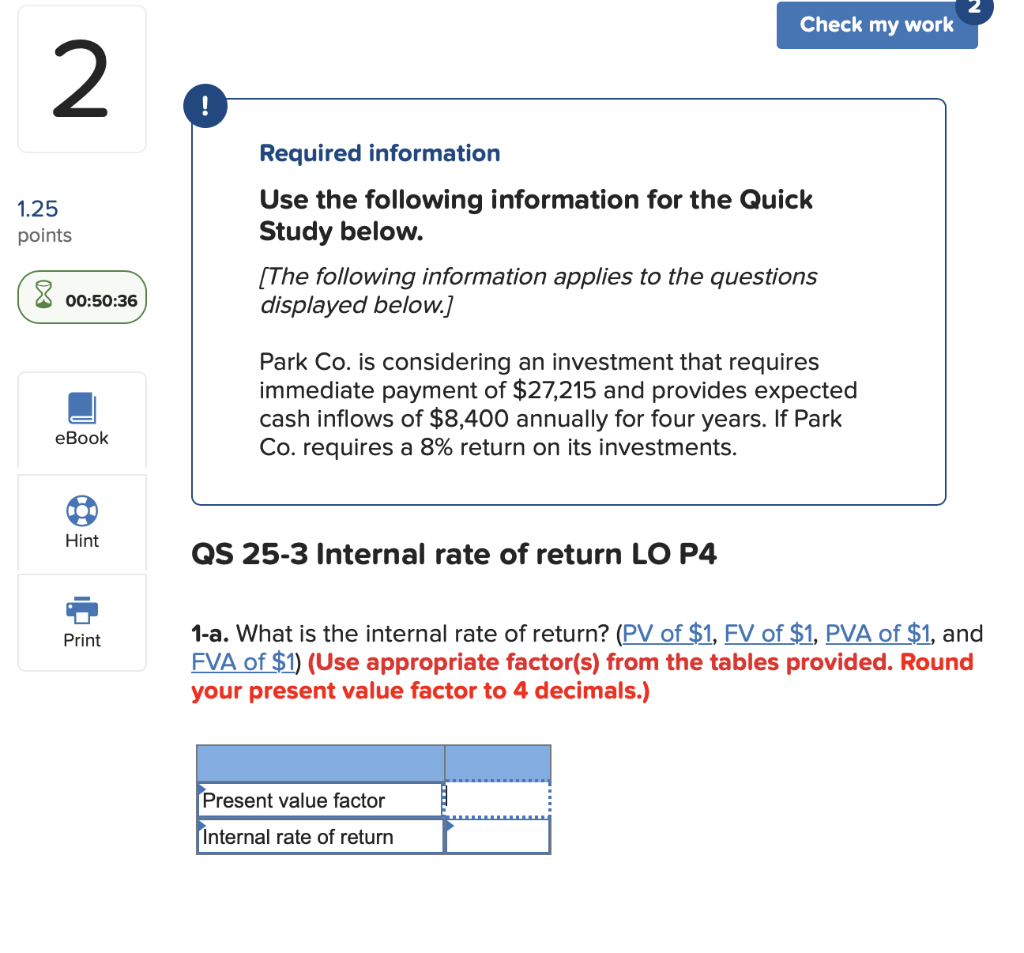

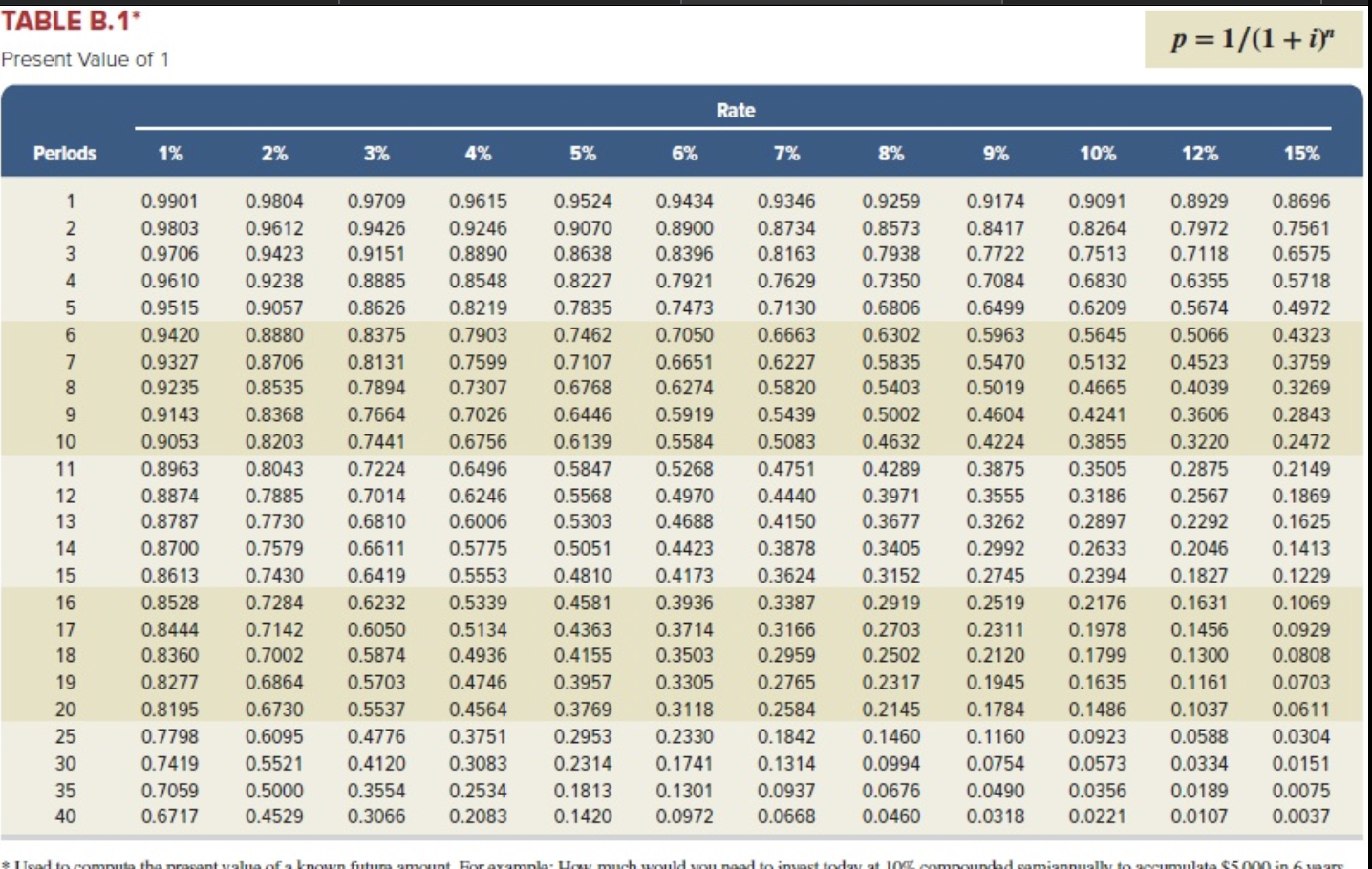

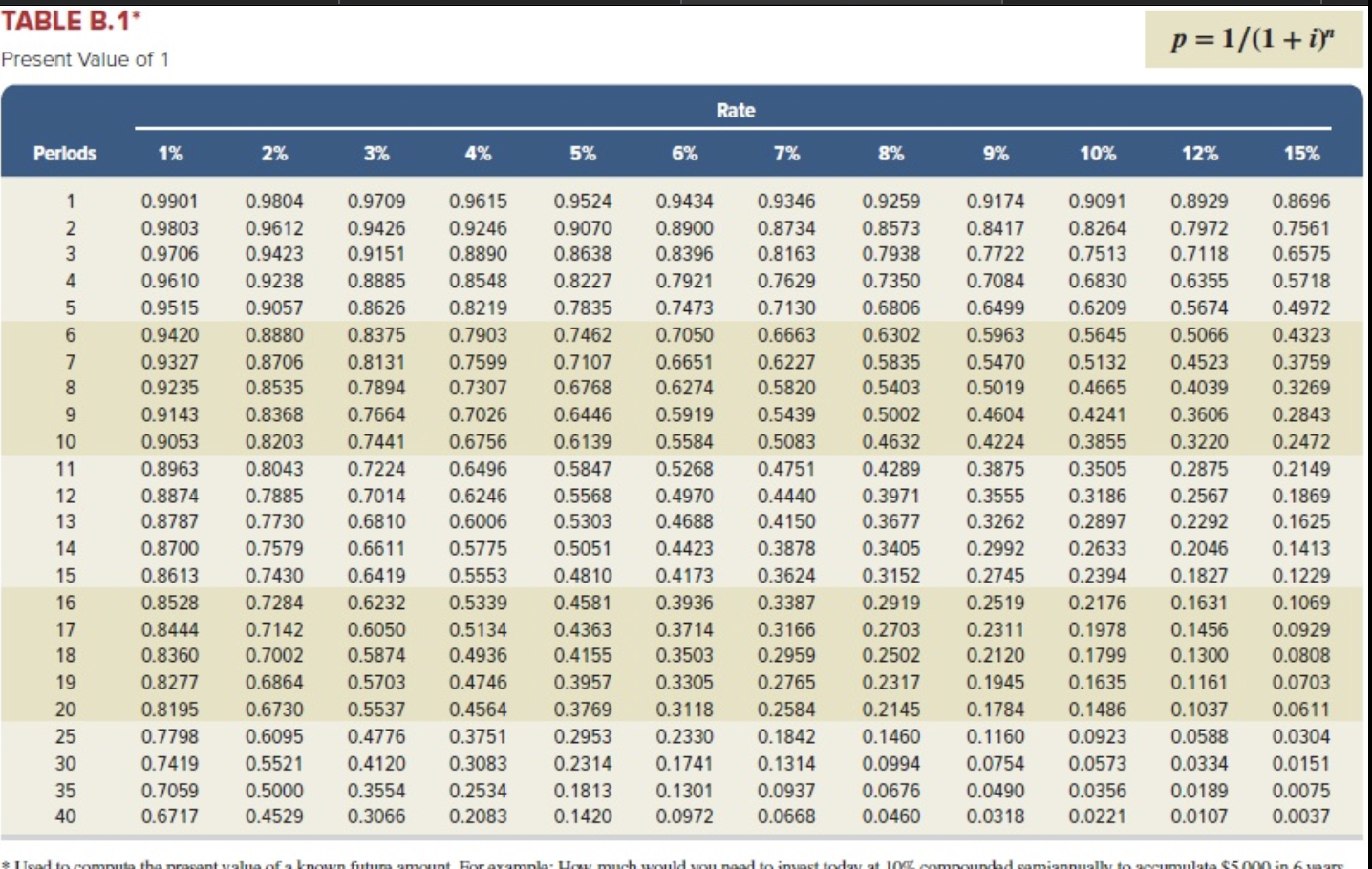

Check my work 2 ! 1.25 points Required information Use the following information for the Quick Study below. [The following information applies to the questions displayed below.) 00:50:36 Park Co. is considering an investment that requires immediate payment of $27,215 and provides expected cash inflows of $8,400 annually for four years. If Park Co. requires a 8% return on its investments. eBook 100 Hint QS 25-3 Internal rate of return LO P4 Print 1-a. What is the internal rate of return? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) Present value factor Internal rate of return TABLE B.1* p=1/(1 + i)" Present Value of 1 Rate Perlods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 15% 1 2 3 4 5 6 7 8 9 10 11 12 13 14 0.9901 0.9803 0.9706 0.9610 0.9515 0.9420 0.9327 0.9235 0.9143 0.9053 0.8963 0.8874 0.8787 0.8700 0.8613 0.8528 0.8444 0.8360 0.8277 0.8195 0.7798 0.7419 0.7059 0.6717 0.9804 0.9612 0.9423 0.9238 0.9057 0.8880 0.8706 0.8535 0.8368 0.8203 0.8043 0.7885 0.7730 0.7579 0.7430 0.7284 0.7142 0.7002 0.6864 0.6730 0.6095 0.5521 0.5000 0.4529 0.9709 0.9426 0.9151 0.8885 0.8626 0.8375 0.8131 0.7894 0.7664 0.7441 0.7224 0.7014 0.6810 0.6611 0.6419 0.6232 0.6050 0.5874 0.5703 0.5537 0.4776 0.4120 0.3554 0.3066 0.9615 0.9246 0.8890 0.8548 0.8219 0.7903 0.7599 0.7307 0.7026 .6756 0.6496 0.6246 0.6006 0.5775 0.5553 0.5339 0.5134 0.4936 0.4746 0.4564 0.3751 0.3083 0.2534 0.2083 0.9524 0.9070 0.8638 0.8227 0.7835 0.7462 0.7107 0.6768 0.6446 0.6139 0.5847 0.5568 0.5303 0.5051 0.4810 0.4581 0.4363 0.4155 0.3957 0.3769 0.2953 0.2314 0.1813 0.1420 0.9434 0.8900 0.8396 0.7921 0.7473 0.7050 0.6651 0.6274 0.5919 0.5584 0.5268 0.4970 0.4688 0.4423 0.4173 0.3936 0.3714 0.3503 0.3305 0.3118 0.2330 0.1741 0.1301 0.0972 0.9346 0.8734 0.8163 0.7629 0.7130 0.6663 0.6227 0.5820 0.5439 0.5083 0.4751 0.4440 0.4150 0.3878 0.3624 0.3387 0.3166 0.2959 0.2765 0.2584 0.1842 0.1314 0.0937 0.0668 0.9259 0.8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 0.5002 0.4632 0.4289 0.3971 0.3677 0.3405 0.3152 0.2919 0.2703 0.2502 0.2317 0.2145 0.1460 0.0994 0.0676 0.0460 0.9174 0.8417 0.7722 0.7084 0.6499 0.5963 0.5470 0.5019 0.4604 0.4224 0.3875 0.3555 0.3262 0.2992 0.2745 0.2519 0.2311 0.2120 0.1945 0.1784 0.1160 0.0754 0.0490 0.0318 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4665 0.4241 55 0.3505 0.3186 0.2897 0.2633 0.2394 0.2176 0.1978 0.1799 0.1635 0.1486 0.0923 0.0573 0.0356 0.0221 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 0.3220 0.2875 0.2567 0.2292 0.2046 0.1827 0.1631 0.1456 0.1300 0.1161 0.1037 0.0588 0.0334 0.0189 0.0107 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.3759 0.3269 0.2843 0.2472 0.2149 0.1869 0.1625 0.1413 0.1229 0.1069 0.0929 0.0808 0.0703 0.0611 0.0304 0.0151 0.0075 0.0037 15 16 17 18 19 20 25 30 35 40 Ilse tomuto the procent value of nown futuromut Ferayamala. Uw much would not invast tavat luntad amiannualk to wymulata Sinar