how do I solve this

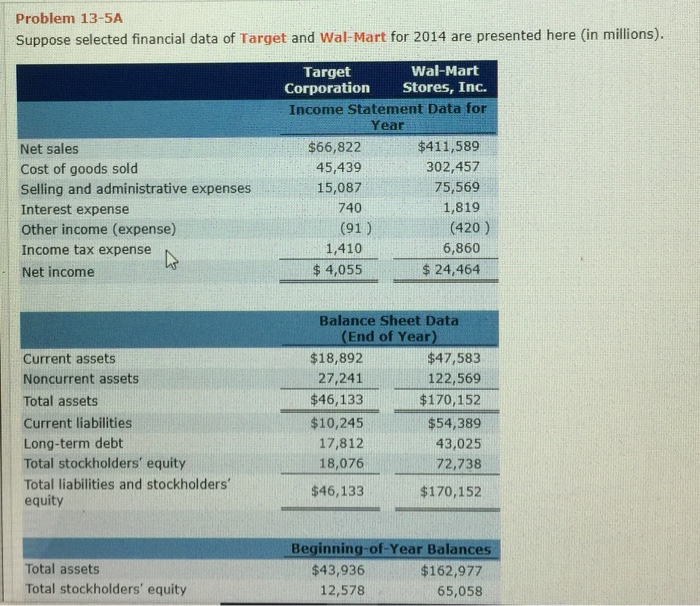

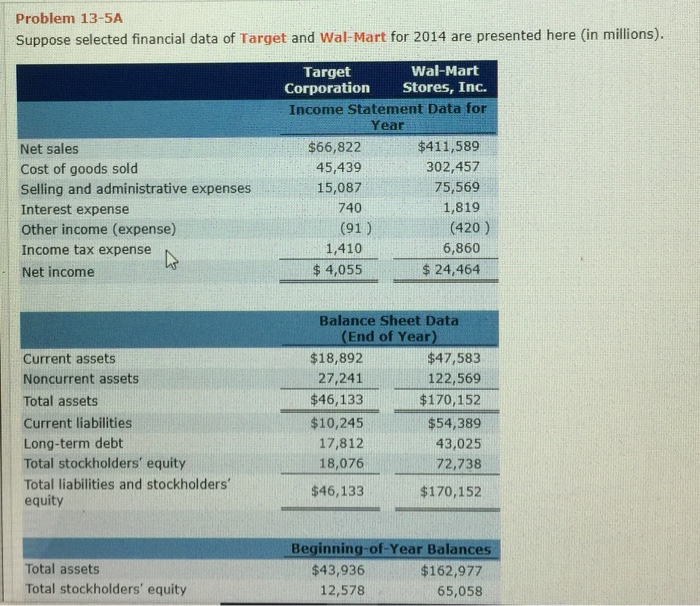

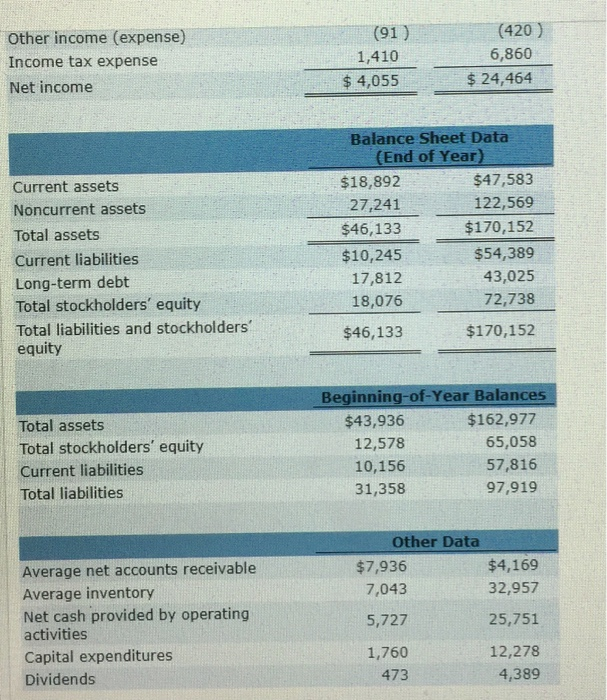

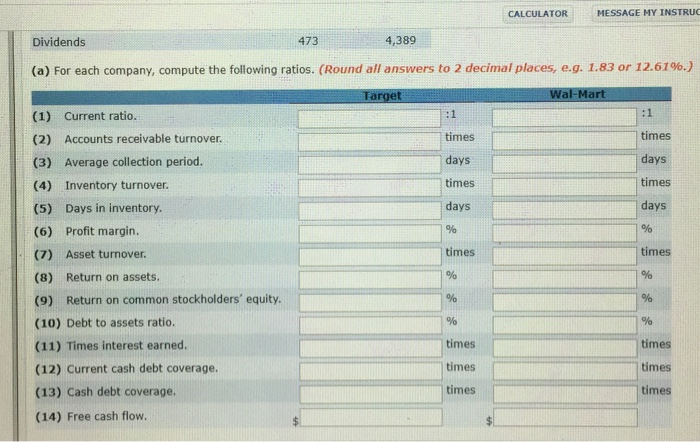

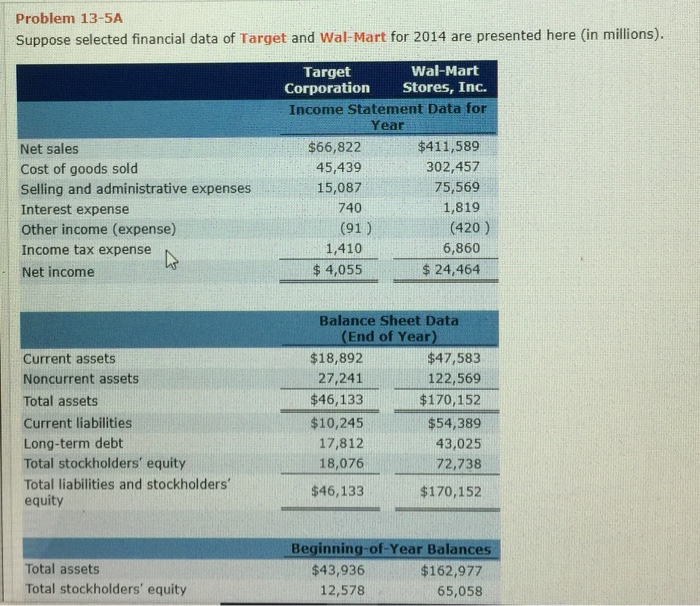

Problem 13-5A Suppose selected financial data of Target and Wal-Mart for 2014 are presented here (in millions). Wal-Mart Target Corporation Stores, Inc. Income Statement Data for Year $411,589 302,457 75,569 1,819 $66,822 45,439 15,087 740 Net sales Cost of goods sold Selling and administrative expenses Interest expense Other income (expense) Income tax expense Net income (91) (420) 6,860 $24,464 1,410 $4,055 Balance Sheet Data (End of Year) $18,892 27,241 $46,133 $10,245 17,812 18,076 $46,133 $47,583 122,569 $170,152 $54,389 43,025 72,738 $170,152 Current assets Noncurrent assets Total assets Current liabilities Long-term debt Total stockholders' equity Total liabilities and stockholders equity Beginning-of Year Balances Total assets Total stockholders' equity $43,936 12,578 $162,977 65,058 (420) (91 1,410 Other income (expense) Income tax expense Net income 6,860 $24,464 $4,055t24 Balance Sheet Data (End of Year) $47,583 122,569 $170,152 $54,389 43,025 72,738 $170,152 $18,892 Current assets Noncurrent assets Total assets Current liabilities Long-term debt Total stockholders' equity Total liabilities and stockholders equity 27,241 $46,133 17,812 18,076 $46,133 Beginning-of Year Balances $162,977 65,058 57,816 97,919 $43,936 12,578 10,156 31,358 Total assets Total stockholders' equity Current liabilities Total liabilities Other Data $7,936 7,043 5,727 1,760 473 $4,169 32,957 25,751 12,278 4,389 Average net accounts receivable Average inventory Net cash provided by operating activities Capital expenditures Dividends CALCULATOR MESSAGE MY INSTRUC 4,389 Dividends 473 (a) For each company, compute the following ratios. (Round all answers to 2 decimal places, e.g. 1.83 or 12.61%.) (1) Current ratio. (2) Accounts receivable turnover (3) Average collection period. (4) Inventory turnover. (5) Days in inventory. (6) Profit margin. (7) Asset turnover (8) Return on assets (9) Return on common stockholders' equity. (10) Debt to assets ratio. (11) Times interest earned. (12) Current cash debt coverage. (13) Cash debt coverage. (14) Free cash flow. times days times days times days times days times times times times times times times times