Question

how do I solve this WesternGear.com is expected to have operating losses of $350,000 in its first year of business and $270,000 in its second

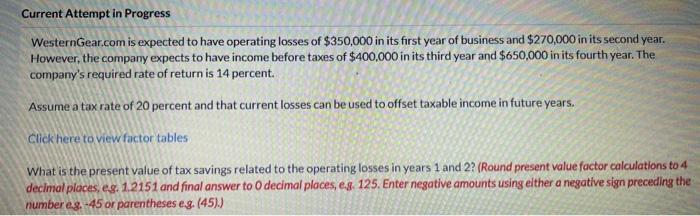

WesternGear.com is expected to have operating losses of $350,000 in its first year of business and $270,000 in its second year.

However, the company expects to have income before taxes of $400,000 in its third year and $650,000 in its fourth year. The company's required rate of return is 14 percent.

Assume a tax rate of 20 percent and that current losses can be used to offset taxable income in future years.

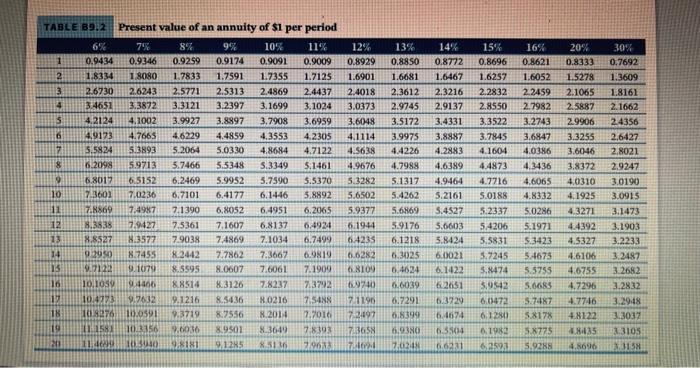

What is the present value of tax savings related to the operating losses in years 1 and 2? (Round present value factor calculations to 4 decimal places, e.g. 1.2151 and final answer to 0 decimal places, e.g. 125. Enter negative amounts using either a negative sign preceding the number e g. -45 or parentheses e.g. (45).)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started