Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how do we deal with revaluation reserve? does it affect property plant and equipment note? how is it treatted in the statement of financial position?

how do we deal with revaluation reserve?

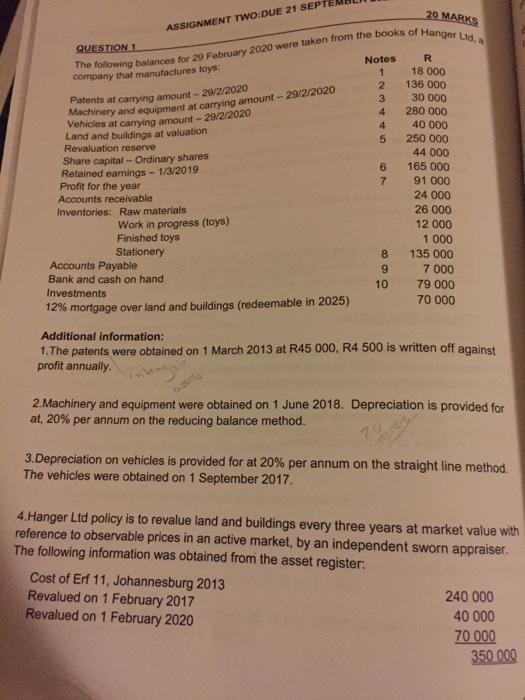

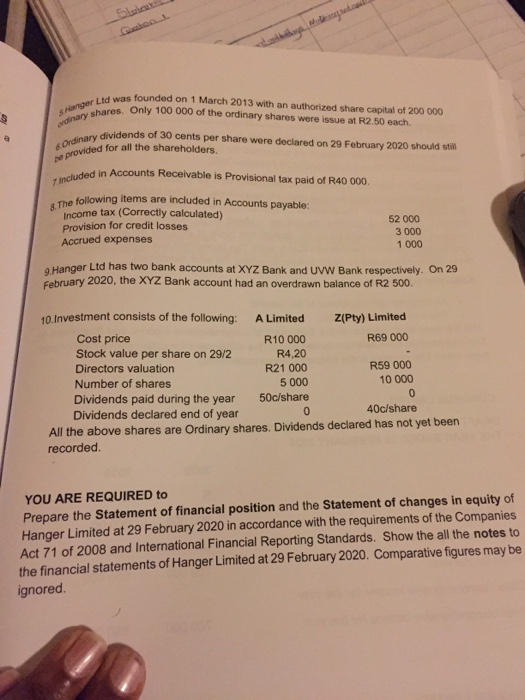

20 MARKS ASSIGNMENT TWO DUE 21 SEPTE company that manufactures toys: Notes 1 2 3 4 4 5 The following balances for 29 February 2020 were taken from the books of Hanger da Machinery and equipment at carrying amount - 29/2/2020 QUESTION 1 Patents at carrying amount - 29/2/2020 Vehicles at carrying amount - 29/2/2020 Land and buildings at valuation Revaluation reserve Share capital - Ordinary shares Retained earnings - 1/3/2019 Profit for the year Accounts receivable Inventories: Raw materials Work in progress (toys) Finished toys Stationery Accounts Payable Bank and cash on hand Investments 12% mortgage over land and buildings (redeemable in 2025) 6 7 R 18 000 136 000 30 000 280 000 40 000 250 000 44 000 165 000 91 000 24 000 26 000 12 000 1 000 135 000 7 000 79 000 70 000 8 9 10 Additional information: 1. The patents were obtained on 1 March 2013 at R45 000, R4 500 is written off against profit annually. 2. Machinery and equipment were obtained on 1 June 2018. Depreciation is provided for at, 20% per annum on the reducing balance method. 3.Depreciation on vehicles is provided for at 20% per annum on the straight line method. The vehicles were obtained on 1 September 2017 4.Hanger Ltd policy is to revalue land and buildings every three years at market value with reference to observable prices in an active market, by an independent sworn appraiser. The following information was obtained from the asset register: Cost of Erf 11, Johannesburg 2013 240 000 Revalued on 1 February 2017 Revalued on 1 February 2020 40 000 70 000 350 000 Slacus duthaya Miten sadece Hunger Lid was founded on 1 March 2013 with an authorized share capital of 200 000 ordinary shares. Only 100 000 of the ordinary shares were issue at R250 each. & Ordinary dividends of 30 cents per share were declared on 29 February 2020 should still De provided for all the shareholders. 7. Included in Accounts Receivable is Provisional tax paid of R40 000. 8. The following items are included in Accounts payable: Provision for credit losses Accrued expenses Income tax (Correctly calculated) 52 000 3 000 1 000 9.Hanger Ltd has two bank accounts at XYZ Bank and UVW Bank respectively. On 29 February 2020, the XYZ Bank account had an overdrawn balance of R2 500 10.Investment consists of the following: A Limited Z(Pty) Limited Cost price R10 000 R69 000 Stock value per share on 29/2 R4,20 Directors valuation R21 000 R59 000 Number of shares 5 000 10 000 Dividends paid during the year 50c/share 0 Dividends declared end of year 0 40c/share All the above shares are Ordinary shares. Dividends declared has not yet been recorded. YOU ARE REQUIRED to Prepare the Statement of financial position and the Statement of changes in equity of Hanger Limited at 29 February 2020 in accordance with the requirements of the Companies Act 71 of 2008 and International Financial Reporting Standards. Show the all the notes to the financial statements of Hanger Limited at 29 February 2020. Comparative figures may be ignored. 20 MARKS ASSIGNMENT TWO DUE 21 SEPTE company that manufactures toys: Notes 1 2 3 4 4 5 The following balances for 29 February 2020 were taken from the books of Hanger da Machinery and equipment at carrying amount - 29/2/2020 QUESTION 1 Patents at carrying amount - 29/2/2020 Vehicles at carrying amount - 29/2/2020 Land and buildings at valuation Revaluation reserve Share capital - Ordinary shares Retained earnings - 1/3/2019 Profit for the year Accounts receivable Inventories: Raw materials Work in progress (toys) Finished toys Stationery Accounts Payable Bank and cash on hand Investments 12% mortgage over land and buildings (redeemable in 2025) 6 7 R 18 000 136 000 30 000 280 000 40 000 250 000 44 000 165 000 91 000 24 000 26 000 12 000 1 000 135 000 7 000 79 000 70 000 8 9 10 Additional information: 1. The patents were obtained on 1 March 2013 at R45 000, R4 500 is written off against profit annually. 2. Machinery and equipment were obtained on 1 June 2018. Depreciation is provided for at, 20% per annum on the reducing balance method. 3.Depreciation on vehicles is provided for at 20% per annum on the straight line method. The vehicles were obtained on 1 September 2017 4.Hanger Ltd policy is to revalue land and buildings every three years at market value with reference to observable prices in an active market, by an independent sworn appraiser. The following information was obtained from the asset register: Cost of Erf 11, Johannesburg 2013 240 000 Revalued on 1 February 2017 Revalued on 1 February 2020 40 000 70 000 350 000 Slacus duthaya Miten sadece Hunger Lid was founded on 1 March 2013 with an authorized share capital of 200 000 ordinary shares. Only 100 000 of the ordinary shares were issue at R250 each. & Ordinary dividends of 30 cents per share were declared on 29 February 2020 should still De provided for all the shareholders. 7. Included in Accounts Receivable is Provisional tax paid of R40 000. 8. The following items are included in Accounts payable: Provision for credit losses Accrued expenses Income tax (Correctly calculated) 52 000 3 000 1 000 9.Hanger Ltd has two bank accounts at XYZ Bank and UVW Bank respectively. On 29 February 2020, the XYZ Bank account had an overdrawn balance of R2 500 10.Investment consists of the following: A Limited Z(Pty) Limited Cost price R10 000 R69 000 Stock value per share on 29/2 R4,20 Directors valuation R21 000 R59 000 Number of shares 5 000 10 000 Dividends paid during the year 50c/share 0 Dividends declared end of year 0 40c/share All the above shares are Ordinary shares. Dividends declared has not yet been recorded. YOU ARE REQUIRED to Prepare the Statement of financial position and the Statement of changes in equity of Hanger Limited at 29 February 2020 in accordance with the requirements of the Companies Act 71 of 2008 and International Financial Reporting Standards. Show the all the notes to the financial statements of Hanger Limited at 29 February 2020. Comparative figures may be ignored does it affect property plant and equipment note?

how is it treatted in the statement of financial position?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started