Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how do we do this on excel? 5. Simon Machine Tools Company is a manufacturing company located in London, Ontario. It is considering the purchase

how do we do this on excel?

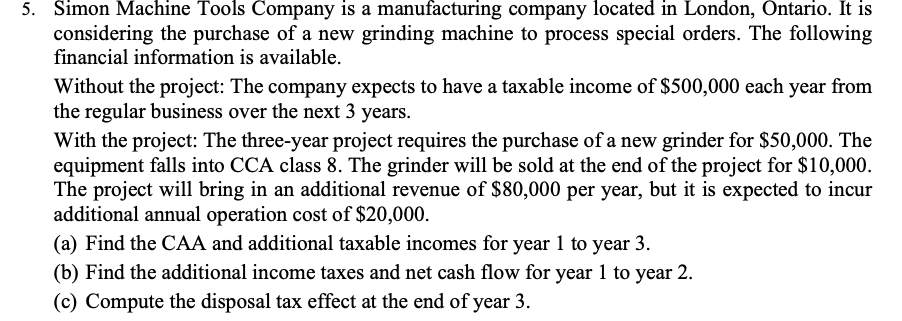

5. Simon Machine Tools Company is a manufacturing company located in London, Ontario. It is considering the purchase of a new grinding machine to process special orders. The following financial information is available. Without the project: The company expects to have a taxable income of $500,000 each year from the regular business over the next 3 years. With the project: The three-year project requires the purchase of a new grinder for $50,000. The equipment falls into CCA class 8. The grinder will be sold at the end of the project for $10,000. The project will bring in an additional revenue of $80,000 per year, but it is expected to incur additional annual operation cost of $20,000. (a) Find the CAA and additional taxable incomes for year 1 to year 3. (b) Find the additional income taxes and net cash flow for year 1 to year 2. (c) Compute the disposal tax effect at the end of year 3. 5. Simon Machine Tools Company is a manufacturing company located in London, Ontario. It is considering the purchase of a new grinding machine to process special orders. The following financial information is available. Without the project: The company expects to have a taxable income of $500,000 each year from the regular business over the next 3 years. With the project: The three-year project requires the purchase of a new grinder for $50,000. The equipment falls into CCA class 8. The grinder will be sold at the end of the project for $10,000. The project will bring in an additional revenue of $80,000 per year, but it is expected to incur additional annual operation cost of $20,000. (a) Find the CAA and additional taxable incomes for year 1 to year 3. (b) Find the additional income taxes and net cash flow for year 1 to year 2. (c) Compute the disposal tax effect at the end of year 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started