How do we find the income tax expense? The answer is supposed to be 426

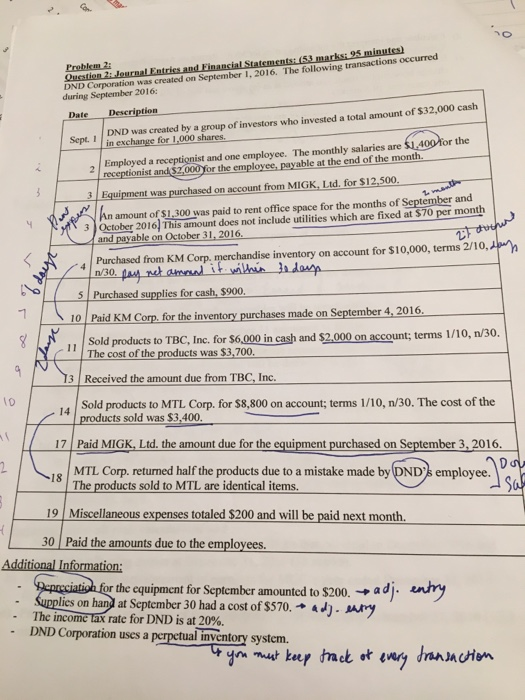

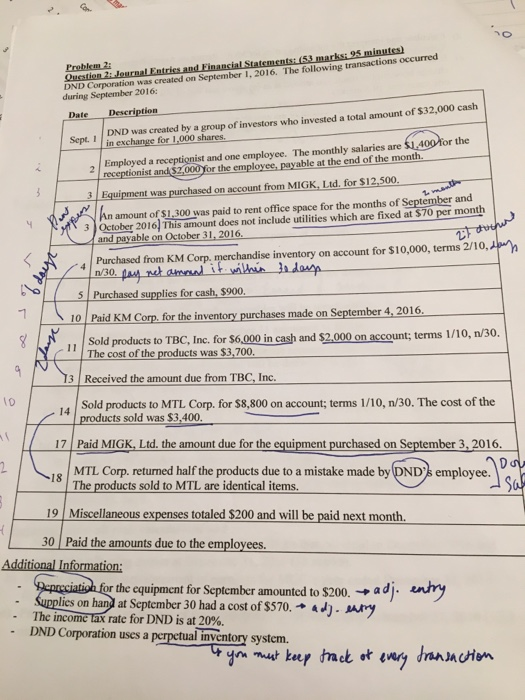

DND Corporation was created on September 1, 2016. The following transactions occurred during September 2016: Date Description DND was created by a group of investors who invested a total amount of $32,000 cash Sept. I he in exchange for 1,000 shares. receptionist and $2,000for the employes,payable at the end of the month 3 Equipment was purchased on account from MIGK, Ltd. for $12,500 Employed a receptignist and one employee. The monthly salaries are $1 400 for t in amount of $1,300 was paid to rent office space for the months of September and 3 October 2016] This amount does not include utilities which are fixed at $70 per month and payable on October 31, 2016. 4 Purchased from KM Corp. merchandise inventory on account for $10,000, terms 2/10, n/30. 5 Purchased supplies for cash, $900 made on r 4, 2016 10 Paid KM Corp, for the 11 Sold products to TBC, Inc. for $6,000 in cash and $2,000 on account; terms 1/10, n/30. The cost of the products was $3,700 Received the amount due from TBC, Inc Sold products to MTL Corp. for $8,800 on account; terms 1/10, n/30. The cost of the products sold was $3,400 Paid MIGK, Ltd. the amount due for the equipment purchased on September 3,2016 MTL Corp. returned half the products due to a mistake made by DND's employee. 3 I0 14 17 18 The products sold to MTL are identical items. 19 Miscellaneous expenses totaled $200 and will be paid next month. 30 Paid the amounts due to the employees. or the equipment for September amounted to $200. a ry . lies on hand at September 30 had a cost of $570. The income Tax rate for DND is at 20% DND Corporation uses a inventory system. Heng noen DND Corporation was created on September 1, 2016. The following transactions occurred during September 2016: Date Description DND was created by a group of investors who invested a total amount of $32,000 cash Sept. I he in exchange for 1,000 shares. receptionist and $2,000for the employes,payable at the end of the month 3 Equipment was purchased on account from MIGK, Ltd. for $12,500 Employed a receptignist and one employee. The monthly salaries are $1 400 for t in amount of $1,300 was paid to rent office space for the months of September and 3 October 2016] This amount does not include utilities which are fixed at $70 per month and payable on October 31, 2016. 4 Purchased from KM Corp. merchandise inventory on account for $10,000, terms 2/10, n/30. 5 Purchased supplies for cash, $900 made on r 4, 2016 10 Paid KM Corp, for the 11 Sold products to TBC, Inc. for $6,000 in cash and $2,000 on account; terms 1/10, n/30. The cost of the products was $3,700 Received the amount due from TBC, Inc Sold products to MTL Corp. for $8,800 on account; terms 1/10, n/30. The cost of the products sold was $3,400 Paid MIGK, Ltd. the amount due for the equipment purchased on September 3,2016 MTL Corp. returned half the products due to a mistake made by DND's employee. 3 I0 14 17 18 The products sold to MTL are identical items. 19 Miscellaneous expenses totaled $200 and will be paid next month. 30 Paid the amounts due to the employees. or the equipment for September amounted to $200. a ry . lies on hand at September 30 had a cost of $570. The income Tax rate for DND is at 20% DND Corporation uses a inventory system. Heng noen

How do we find the income tax expense? The answer is supposed to be 426

How do we find the income tax expense? The answer is supposed to be 426