Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HOW do you calculate the value for ER1!?!? i keep getting different asnwers.. the answer should be rounded to the nearest hundreds. THE PW VALUE

HOW do you calculate the value for ER1!?!? i keep getting different asnwers.. the answer should be rounded to the nearest hundreds.

THE PW VALUE OF ER1 IS 16,200. how??? i got 22283.

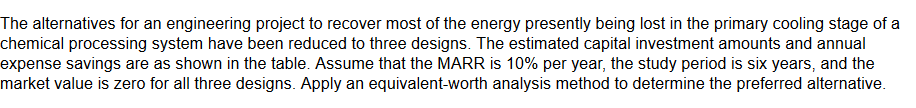

The alternatives for an engineering project to recover most of the energy presently being lost in the primary cooling stage of a chemical processing system have been reduced to three designs. The estimated capital investment amounts and annual expense savings are as shown in the table. Assume that the MARR is 10% per year, the study period is six years, and the market value is zero for all three designs. Apply an equivalent-worth analysis method to determine the preferred alternative. ER1 - $100,000 24,000 Design ER2 - $115,000 31,000 ER3 - $81,000 20,000 1=7%a G=$1506 33,661 31,750 20,000 The alternatives for an engineering project to recover most of the energy presently being lost in the primary cooling stage of a chemical processing system have been reduced to three designs. The estimated capital investment amounts and annual expense savings are as shown in the table. Assume that the MARR is 10% per year, the study period is six years, and the market value is zero for all three designs. Apply an equivalent-worth analysis method to determine the preferred alternative. ER1 - $100,000 24,000 Design ER2 - $115,000 31,000 ER3 - $81,000 20,000 1=7%a G=$1506 33,661 31,750 20,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started