Answered step by step

Verified Expert Solution

Question

1 Approved Answer

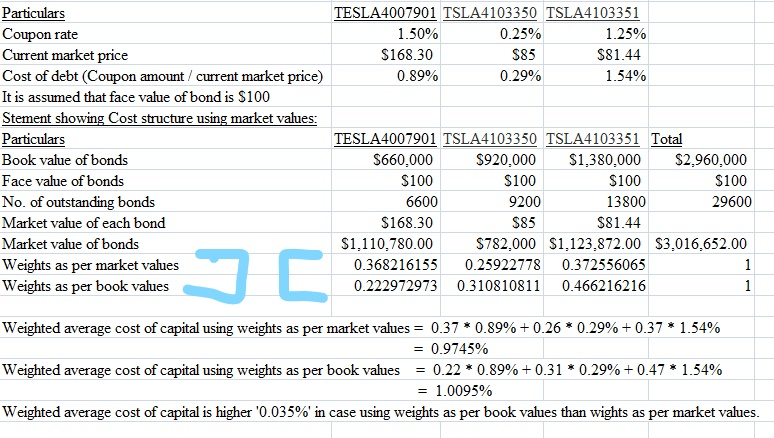

How do you calculate the WEIGHTS AS PER MARKET VALUES and WEIGHTS AS PER BOOK VALUES found in the picture attached. ? Particulars Coupon rate

How do you calculate the WEIGHTS AS PER MARKET VALUES and WEIGHTS AS PER BOOK VALUES found in the picture attached. ?

Particulars Coupon rate Current market price Cost of debt (Coupon amount / current market price) It is assumed that face value of bond is $100 Stement showing Cost structure using market values: Particulars Book value of bonds Face value of bonds No. of outstanding bonds Market value of each bond Market value of bonds Weights as per market values Weights as per book values TESLA4007901 TSLA4103350 TSLA4103351 0.25% $85 0.29% 1.25% $81.44 1.54% 1.50% $168.30 0.89% TESLA4007901 TSLA4103350 TSLA410335 Total S660,000 $100 6600 $168.30 $1,110,780.00 $920,000 S1,380,000S2,960,000 $100 29600 $100 9200 $85 $100 13800 $81.44 $782,000S1,123.872.00 S3,016,652.00 0.368216155 0.259227780.372556065 0.222972973 0.310810811 0.466216216 Weighted average cost of capital using weights as per market values = 0.37 * 0.89% +0.26 * 0.29% 0.37 * 1.54% Weighted average cost of capital using weights as per book values = 0.22 * 0.89% + 0.31 * 0.29% + 0.47 * 1.54% Weighted average cost of capital is higher 0.035% in case using weights as per book values than wights as per market values -0.9745% -1.0095% Particulars Coupon rate Current market price Cost of debt (Coupon amount / current market price) It is assumed that face value of bond is $100 Stement showing Cost structure using market values: Particulars Book value of bonds Face value of bonds No. of outstanding bonds Market value of each bond Market value of bonds Weights as per market values Weights as per book values TESLA4007901 TSLA4103350 TSLA4103351 0.25% $85 0.29% 1.25% $81.44 1.54% 1.50% $168.30 0.89% TESLA4007901 TSLA4103350 TSLA410335 Total S660,000 $100 6600 $168.30 $1,110,780.00 $920,000 S1,380,000S2,960,000 $100 29600 $100 9200 $85 $100 13800 $81.44 $782,000S1,123.872.00 S3,016,652.00 0.368216155 0.259227780.372556065 0.222972973 0.310810811 0.466216216 Weighted average cost of capital using weights as per market values = 0.37 * 0.89% +0.26 * 0.29% 0.37 * 1.54% Weighted average cost of capital using weights as per book values = 0.22 * 0.89% + 0.31 * 0.29% + 0.47 * 1.54% Weighted average cost of capital is higher 0.035% in case using weights as per book values than wights as per market values -0.9745% -1.0095%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started