Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How do you convert the conventional retail method to the LIFO retail method? I have the answers but they seem wrong, can someone please explain

How do you convert the conventional retail method to the LIFO retail method? I have the answers but they seem wrong, can someone please explain the solutions to me?

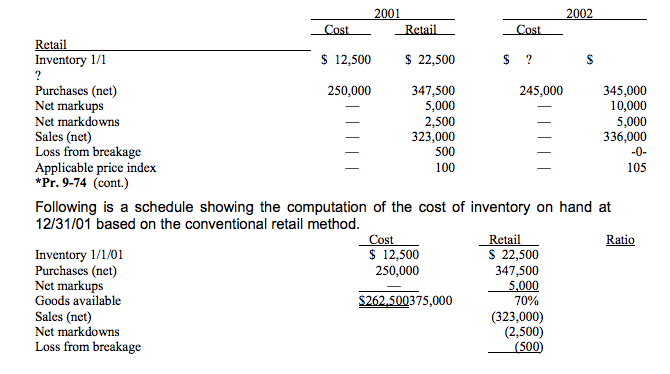

the question is:

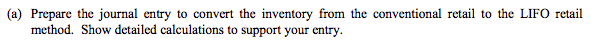

this is the solution:

My question is: why would you multiply the cost to retail ratio to the ending inventory? Isn't the requirement for LIFO retail to multiply the cost to retail ratio only to the layer added? Why does adjustment mean multiplying the cost to retail ratio to the ending inventory?

2002 Inventory 1/1 S 12,500 22,500 250,000 Purchases (net) Net markups Net markdowns Sales (net) Loss from breakage Applicable price index *Pr. 9-74 (cont.) 347,500 5,000 2,500 323,000 500 100 345,000 10,000 5,000 336,000 245,000 105 Following is a schedule showing the computation of the cost of inventory on hand at 12/31/01 based on the conventional retail method Ratio Inventory 1/1/01 Purchases (net) Net markups Goods available Sales (net) S 22,500 347,500 5.000 70% (323,000) (2,500) 500 $ 12,500 250,000 S262,500375,000 Loss from breakageStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started