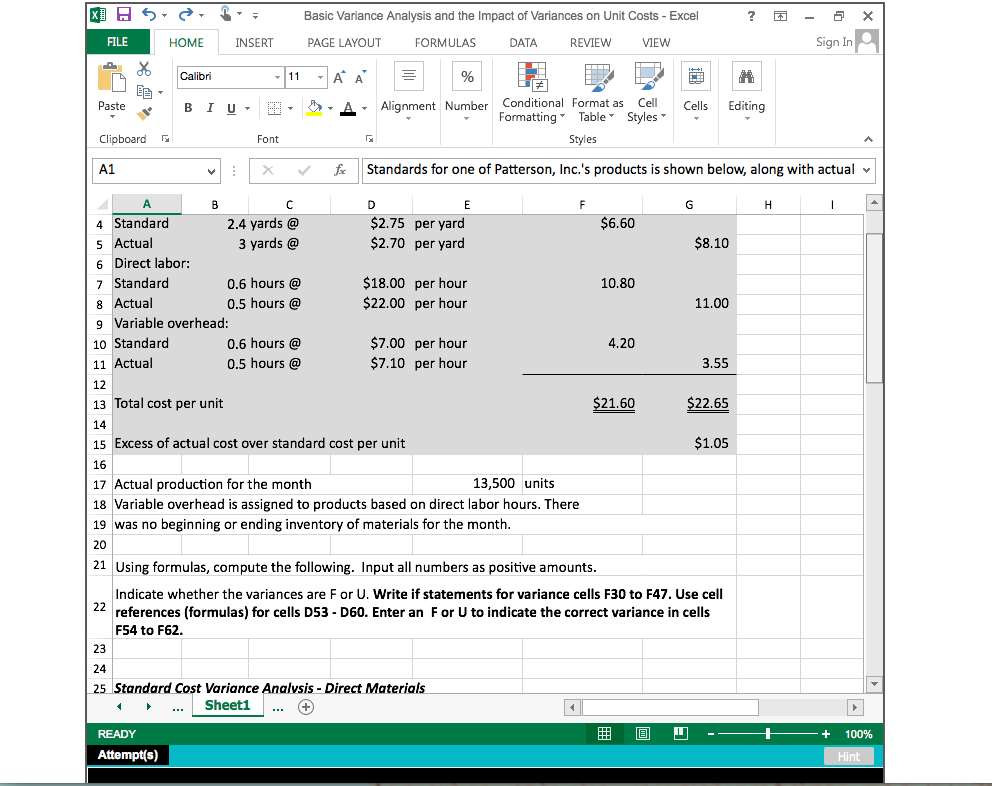

How do you do the excel work for this analysis?

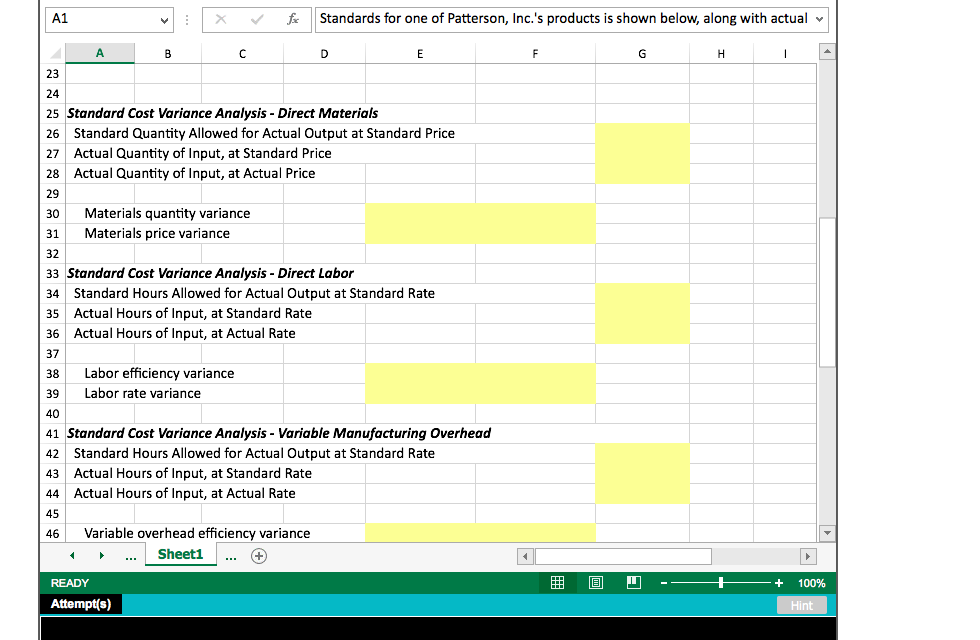

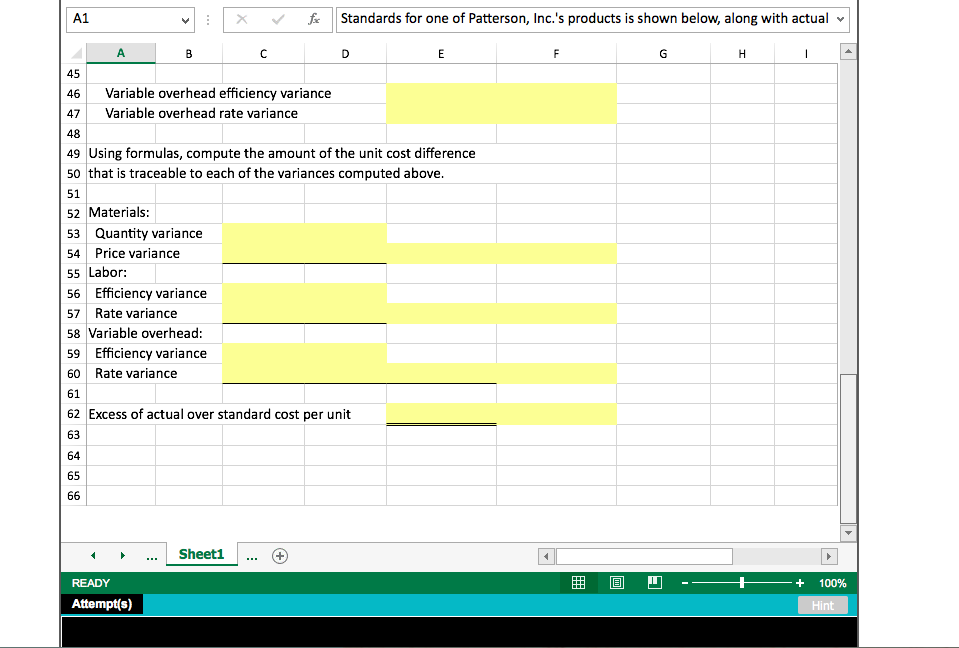

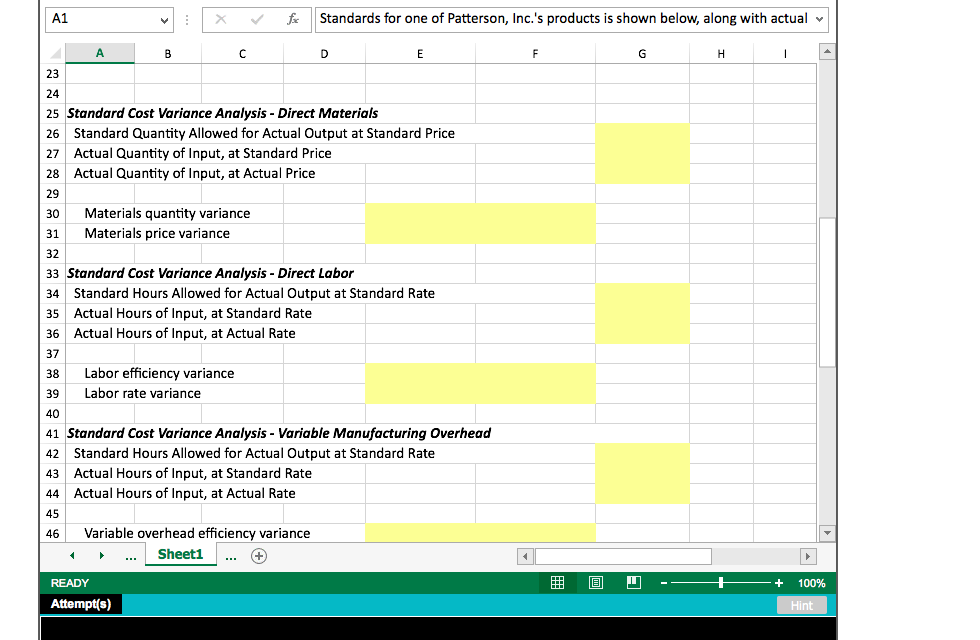

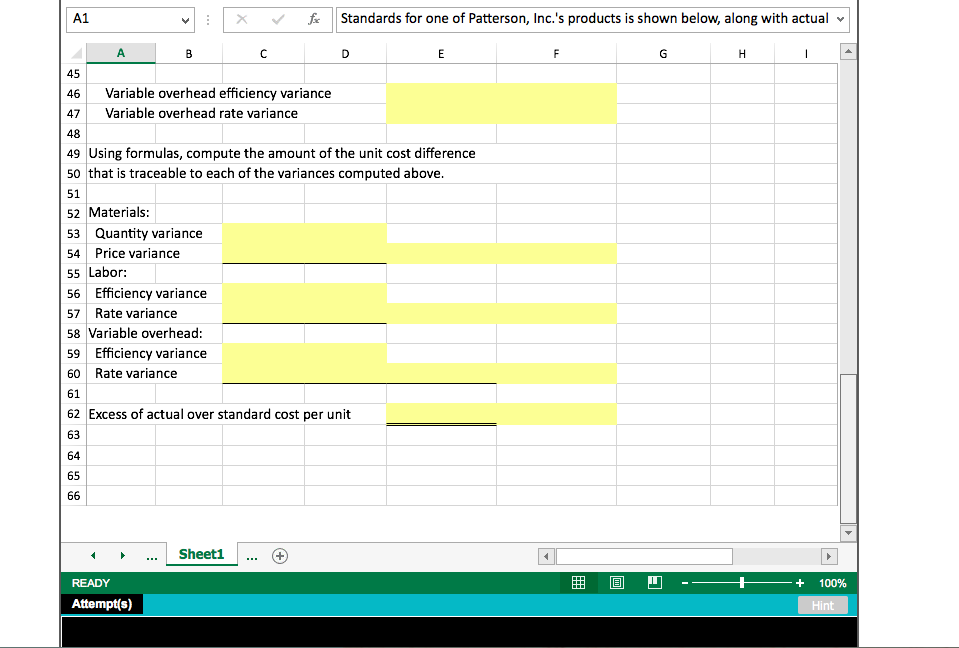

Basic Variance Analysis and the lmpact of Variances on Unit Costs Excel FILE Sign In HOME NSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW A Alignment Number Conditional Format as Cel Cells Editing Formatting Table Styles Paste B I U Clipboard Font Styles Standards for one of Patterson, Inc.'s products is shown below along with actual A1 2.4 yards $6.60 4 Standard $2.75 per yard $8.10 s Actual 3 yards $2.70 per yard 6 Direct labor 0.6 hours Standard 18.00 per hour 10.80 11.00 0.5 hours $22.00 per hour 8 Actual g Variable overhead: 10 Standard 0.6 hours $7.00 per hour 0.5 hours $7.10 per hour 11 Actual 12 13 Total cost per unit 21.60 22.65 14 $1.05 15 Excess of actual cost over standard cost p 17 Actual production for the month 13,500 units 18 Variable overhead is assigned to products based on direct labor hours. There 19 was no beginning or ending inventory of materials for the month 21 Using formulas, compute the following. Input all numbers as positive amounts. Indicate whether the variances are For U Write if statements for variance cells F30 to F47. Use cel 22 references (formulas) for cells D53 D60. Enter an F or U to indicate the correct variance in cells F54 to F62. 25 Standard Cost Variance Analysis Direct Materials Sheet1 BEE Attempt(s) Basic Variance Analysis and the lmpact of Variances on Unit Costs Excel FILE Sign In HOME NSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW A Alignment Number Conditional Format as Cel Cells Editing Formatting Table Styles Paste B I U Clipboard Font Styles Standards for one of Patterson, Inc.'s products is shown below along with actual A1 2.4 yards $6.60 4 Standard $2.75 per yard $8.10 s Actual 3 yards $2.70 per yard 6 Direct labor 0.6 hours Standard 18.00 per hour 10.80 11.00 0.5 hours $22.00 per hour 8 Actual g Variable overhead: 10 Standard 0.6 hours $7.00 per hour 0.5 hours $7.10 per hour 11 Actual 12 13 Total cost per unit 21.60 22.65 14 $1.05 15 Excess of actual cost over standard cost p 17 Actual production for the month 13,500 units 18 Variable overhead is assigned to products based on direct labor hours. There 19 was no beginning or ending inventory of materials for the month 21 Using formulas, compute the following. Input all numbers as positive amounts. Indicate whether the variances are For U Write if statements for variance cells F30 to F47. Use cel 22 references (formulas) for cells D53 D60. Enter an F or U to indicate the correct variance in cells F54 to F62. 25 Standard Cost Variance Analysis Direct Materials Sheet1 BEE Attempt(s)