Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How do you do these problems and can you worked them out on excel? - o x Sam Youngblood 8 Case Studies (2) - Saved

How do you do these problems and can you worked them out on excel?

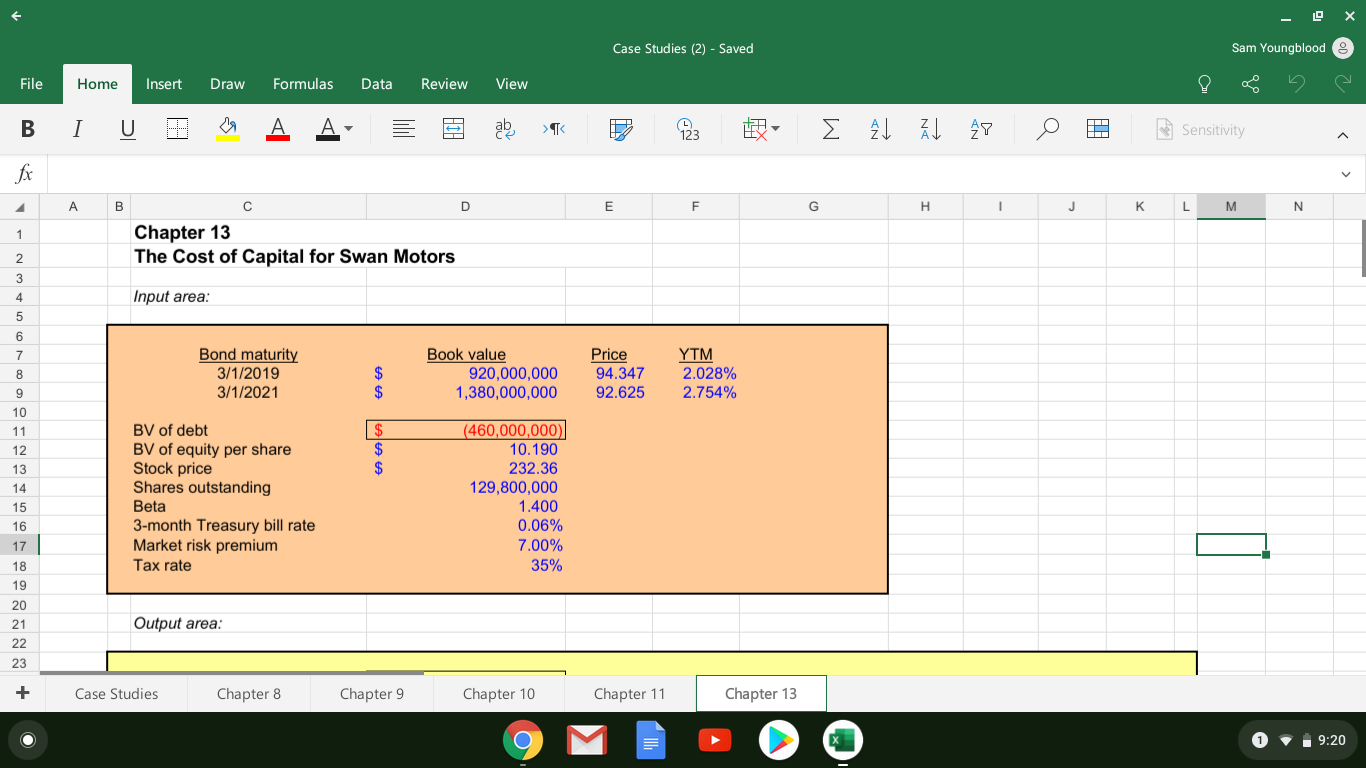

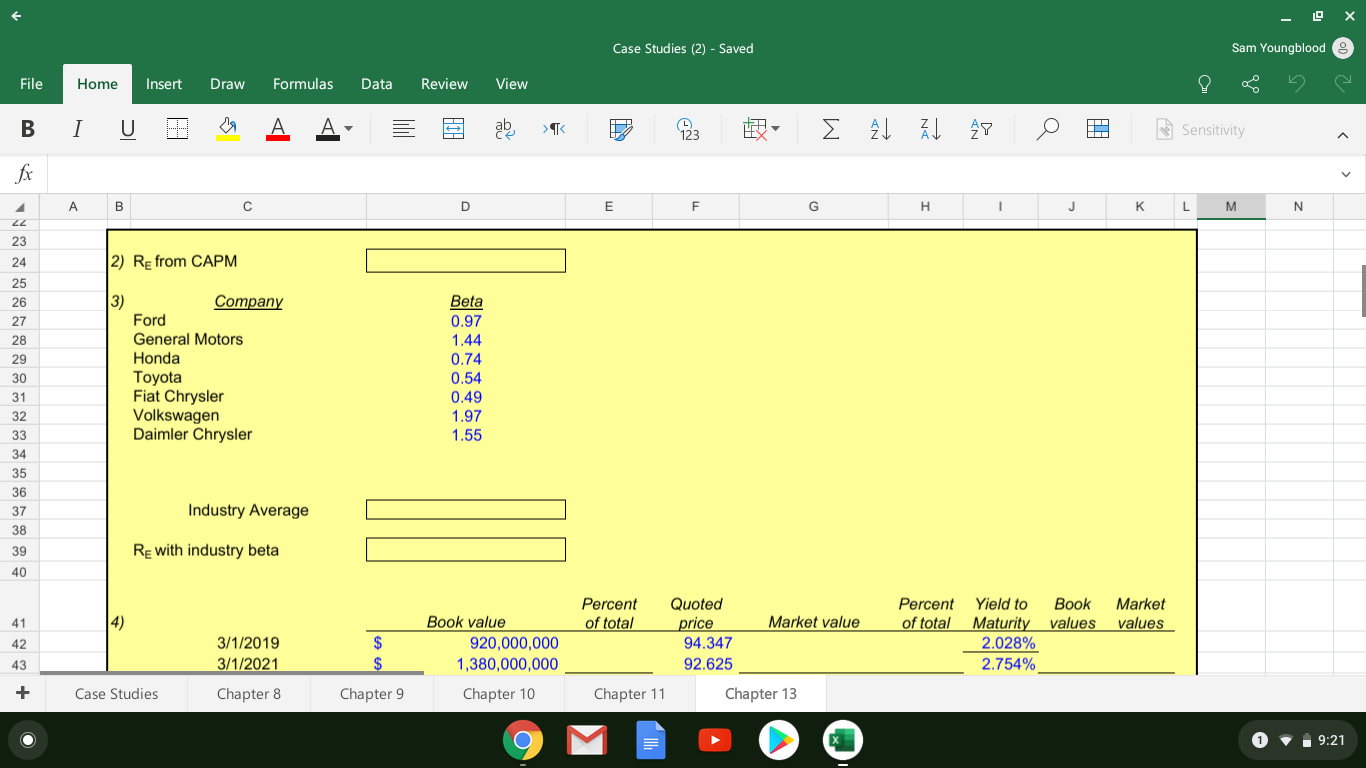

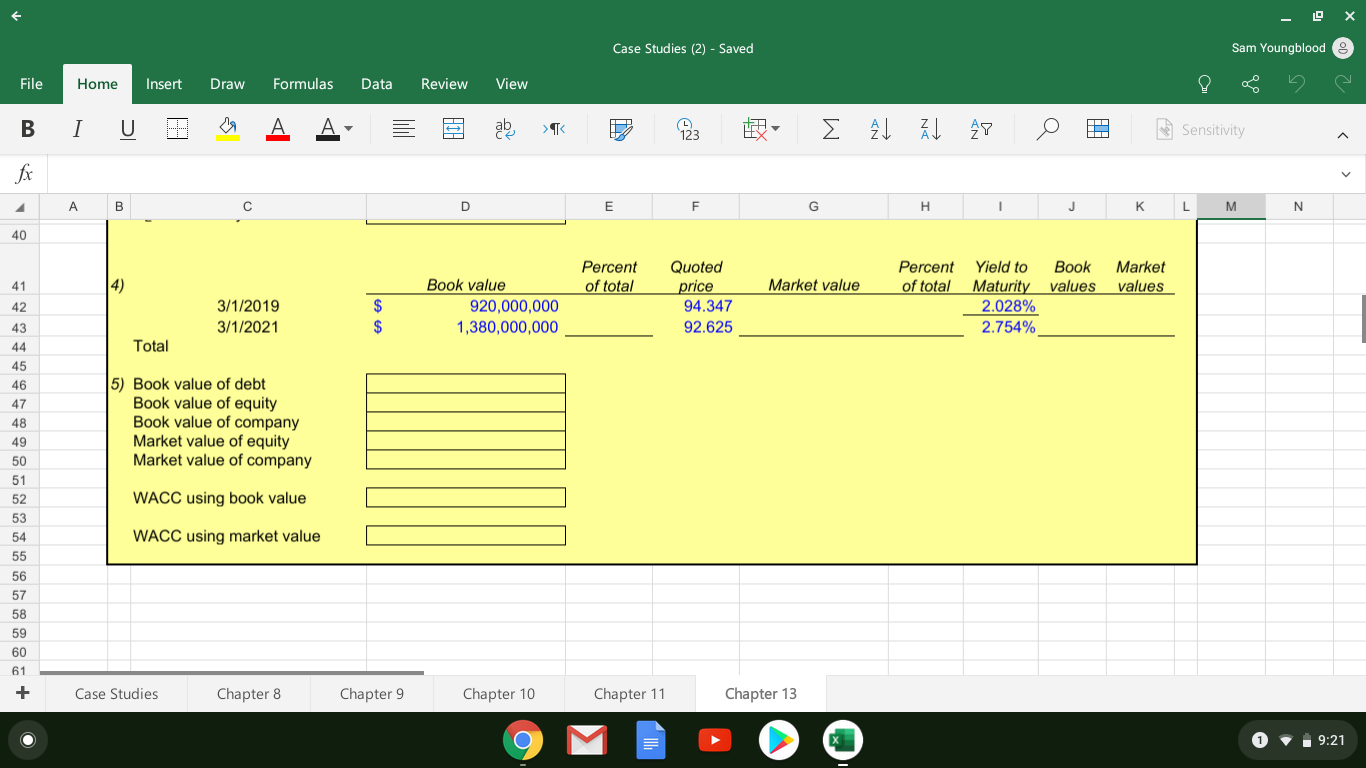

- o x Sam Youngblood 8 Case Studies (2) - Saved File Home Insert Draw Formulas Data Review View B I U A A 3 ele q B 23 AL AL 47 0 Sensitivity J K L M N AB D Chapter 13 The Cost of Capital for Swan Motors Input area: Bond maturity 3/1/2019 3/1/2021 A A Book value 920,000,000 1,380,000,000 Price 94.347 92.625 YTM 2.028% 2.754% SA A A BV of debt BV of equity per share Stock price Shares outstanding Beta 3-month Treasury bill rate Market risk premium Tax rate (460,000,000 10.190 232.36 129,800,000 1.400 0.06% 7.00% 35% Output area: + Case Studies Chapter 8 Chapter 9 Chapter 10 Chapter 11 Chapter 13 OMIO O 09:20 - o x Sam Youngblood 8 Case Studies (2) - Saved File Home Insert Draw Formulas Data Review View B I U 9 A A. 3 al q $ 23 EK AL 47 0 Sensitivity 2) Re from CAPM Company Ford General Motors Honda Toyota Fiat Chrysler Volkswagen Daimler Chrysler Beta 0.97 1.44 0.74 0.54 0.49 1.97 1.55 Industry Average Re with industry beta Percent of total Book values Market values Market value Quoted price 94.347 92.625 Book value 920,000,000 1,380,000,000 Chapter 10 Percent Yield to of total Maturity 2.028% 2.754% 3/1/2019 3/1/2021 Case Studies Chapter 8 Chapter 9 Chapter 11 Chapter 13 9 M 09:21 - o x Sam Youngblood 8 Case Studies (2) - Saved File Home Insert Draw Formulas Data Review View B I U A A 3 ele q B 23 AL AL 47 0 Sensitivity E F G H I J K L M N Percent of total Book values Market values Market value $ 3/1/2019 3/1/2021 Book value 920,000,000 1,380,000,000 Quoted price 94.347 92.625 Percent Yield to of total Maturity 2.028% 2.754% Total 5) Book value of debt Book value of equity Book value of company Market value of equity Market value of company WACC using book value WACC using market value Case Studies Chapter 8 Chapter 9 Chapter 10 Chapter 11 Chapter 13 9 M 09:21Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started