HOW DO YOU GET RISK WEIGHTED ASSETS?

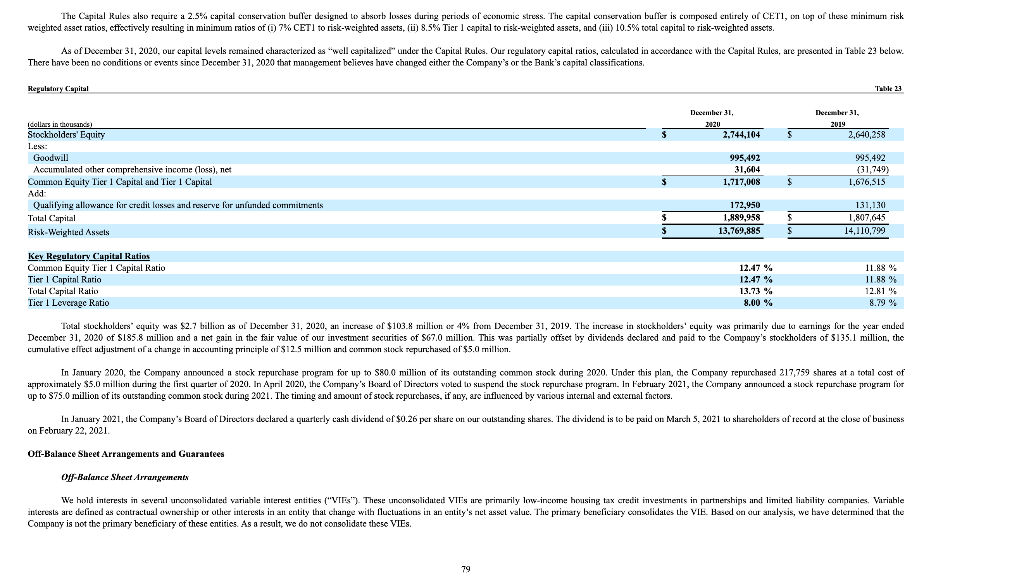

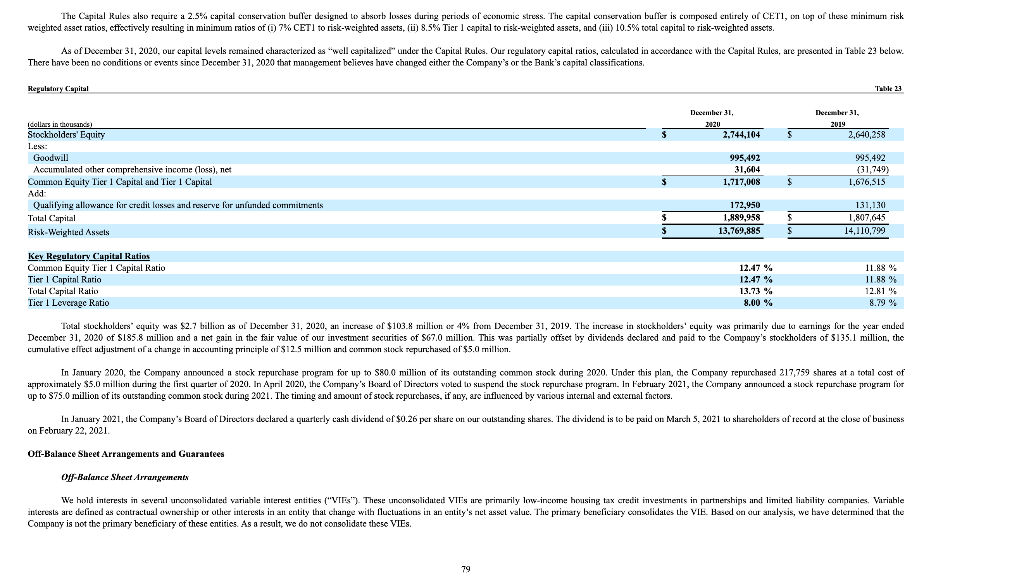

The Capital Rules also require a 2.5% capital conservation buller designed to absorb losses during periods of economic stress. The capital cinservaticin buffer is composed entirely of CETI, in lixp of these minimurn risk weighted asset ratios, cffectively resulting in minimum ratios of 7% CETI to risk-weighted assets, () 8.5% Tier 1 capital to risk-weighted assets, and (ii) 10.5% total capital to risk-weighted assets. As of December 31, 2020, our capital levels remained characterized as well capitalized" under the Capital Rules. Our regulatory capital ratios, calculated in accordance with the Capital Rules, are presented in Table 23 below. There bave been no conditions or events since December 31, 2020 that management believes have changed either the Company's or the Bank's capital classifications. Regulatory Capital Taille 21 December 31, 2020 2,744,104 December M. 2019 2,640,258 S Icollars in thousands Stockholders' Equity Less: Goodwill Accumulated other comprehensive income (loss), net Common Equity Tier 1 Capital and Tier 1 Capital Add Qualifying allowance for credit lasses and reserve for unlunced commitments Total Capital Risk-Weighted Assets 995,492 31,604 1,717,008 995,492 (31,749) 1,676,SIS $ $ $ S 172,950 1,889,958 13,769,885 131,130 1,807,645 14,110,799 S Key Regulatory Capital Ruties Common Equity Tier 1 Capital Ratio Tier 1 Capital Ratio Total Capital Ratio Tier 1 Leverage Ratio 12.47 % 12.47 % 13.73 % 8.00 % 11.88 % 11.88 % 12.81 % 8.79% Total stockholders' equily was $2.7 billion as of December 31, 2020, an increase of $103.8 million or 1% from December 31, 2019. The increase in slickholders' equily was primarily due li camnings for the year ended December 31, 2020 of $185.8 million and a net gain in the fair value of our investment securitics of $67.0 million. This was partially offset by dividends declared and paid to the Company's stockholders of 3135.1 million, the cumulative effect adjustment of a change in accounting principle of $12.5 million and common stock repurchase of $5.0 million. In January 2020, the Company announced a stock repurchase program for up to $800 million of its outstanding common stock during 2020. Under this plan, the Company repurchased 217,759 shares at a total cost of piproximately $5.0 million during the first quarter of 2020. In April 2020, the Company's land of Directors vorled to suspend the stock repurchase prograrn. In February 2021, the Company aninciunced a slock repurchase program for up to $75.0 million of its outstanding common stock during 2021. The timing and amount of stock repurchases, if any, are influenced by various internal and external factors. In January 2021, the Company's Board of Directors declared a quarterly cash dividende $0.26 per share on our sulklanding shares. The dividend is to be paid on March 5, 2021 to sharebulders of record at the close of business on February 22, 2021 Off-Balance Sheet Arrangements and Guarantees Off-Balance Sheet Arrangements We hold interests in several unconsolidated variable interest entities ("VIES"). These unconscicated VICs are primarily low-income housing tax credit investments in partnerships and limited liability companies. Variable interests are defined as contractual ownership or other interests in an entity that change with fluctuations in an entity's net asset value. The primary beneficiary consolidates the VIE. Based on our analysis, we have determined that the Company is not the primary beneficiary of these entities. As a result, we do not consolidate these VIES. 79 The Capital Rules also require a 2.5% capital conservation buller designed to absorb losses during periods of economic stress. The capital cinservaticin buffer is composed entirely of CETI, in lixp of these minimurn risk weighted asset ratios, cffectively resulting in minimum ratios of 7% CETI to risk-weighted assets, () 8.5% Tier 1 capital to risk-weighted assets, and (ii) 10.5% total capital to risk-weighted assets. As of December 31, 2020, our capital levels remained characterized as well capitalized" under the Capital Rules. Our regulatory capital ratios, calculated in accordance with the Capital Rules, are presented in Table 23 below. There bave been no conditions or events since December 31, 2020 that management believes have changed either the Company's or the Bank's capital classifications. Regulatory Capital Taille 21 December 31, 2020 2,744,104 December M. 2019 2,640,258 S Icollars in thousands Stockholders' Equity Less: Goodwill Accumulated other comprehensive income (loss), net Common Equity Tier 1 Capital and Tier 1 Capital Add Qualifying allowance for credit lasses and reserve for unlunced commitments Total Capital Risk-Weighted Assets 995,492 31,604 1,717,008 995,492 (31,749) 1,676,SIS $ $ $ S 172,950 1,889,958 13,769,885 131,130 1,807,645 14,110,799 S Key Regulatory Capital Ruties Common Equity Tier 1 Capital Ratio Tier 1 Capital Ratio Total Capital Ratio Tier 1 Leverage Ratio 12.47 % 12.47 % 13.73 % 8.00 % 11.88 % 11.88 % 12.81 % 8.79% Total stockholders' equily was $2.7 billion as of December 31, 2020, an increase of $103.8 million or 1% from December 31, 2019. The increase in slickholders' equily was primarily due li camnings for the year ended December 31, 2020 of $185.8 million and a net gain in the fair value of our investment securitics of $67.0 million. This was partially offset by dividends declared and paid to the Company's stockholders of 3135.1 million, the cumulative effect adjustment of a change in accounting principle of $12.5 million and common stock repurchase of $5.0 million. In January 2020, the Company announced a stock repurchase program for up to $800 million of its outstanding common stock during 2020. Under this plan, the Company repurchased 217,759 shares at a total cost of piproximately $5.0 million during the first quarter of 2020. In April 2020, the Company's land of Directors vorled to suspend the stock repurchase prograrn. In February 2021, the Company aninciunced a slock repurchase program for up to $75.0 million of its outstanding common stock during 2021. The timing and amount of stock repurchases, if any, are influenced by various internal and external factors. In January 2021, the Company's Board of Directors declared a quarterly cash dividende $0.26 per share on our sulklanding shares. The dividend is to be paid on March 5, 2021 to sharebulders of record at the close of business on February 22, 2021 Off-Balance Sheet Arrangements and Guarantees Off-Balance Sheet Arrangements We hold interests in several unconsolidated variable interest entities ("VIES"). These unconscicated VICs are primarily low-income housing tax credit investments in partnerships and limited liability companies. Variable interests are defined as contractual ownership or other interests in an entity that change with fluctuations in an entity's net asset value. The primary beneficiary consolidates the VIE. Based on our analysis, we have determined that the Company is not the primary beneficiary of these entities. As a result, we do not consolidate these VIES. 79