Answered step by step

Verified Expert Solution

Question

1 Approved Answer

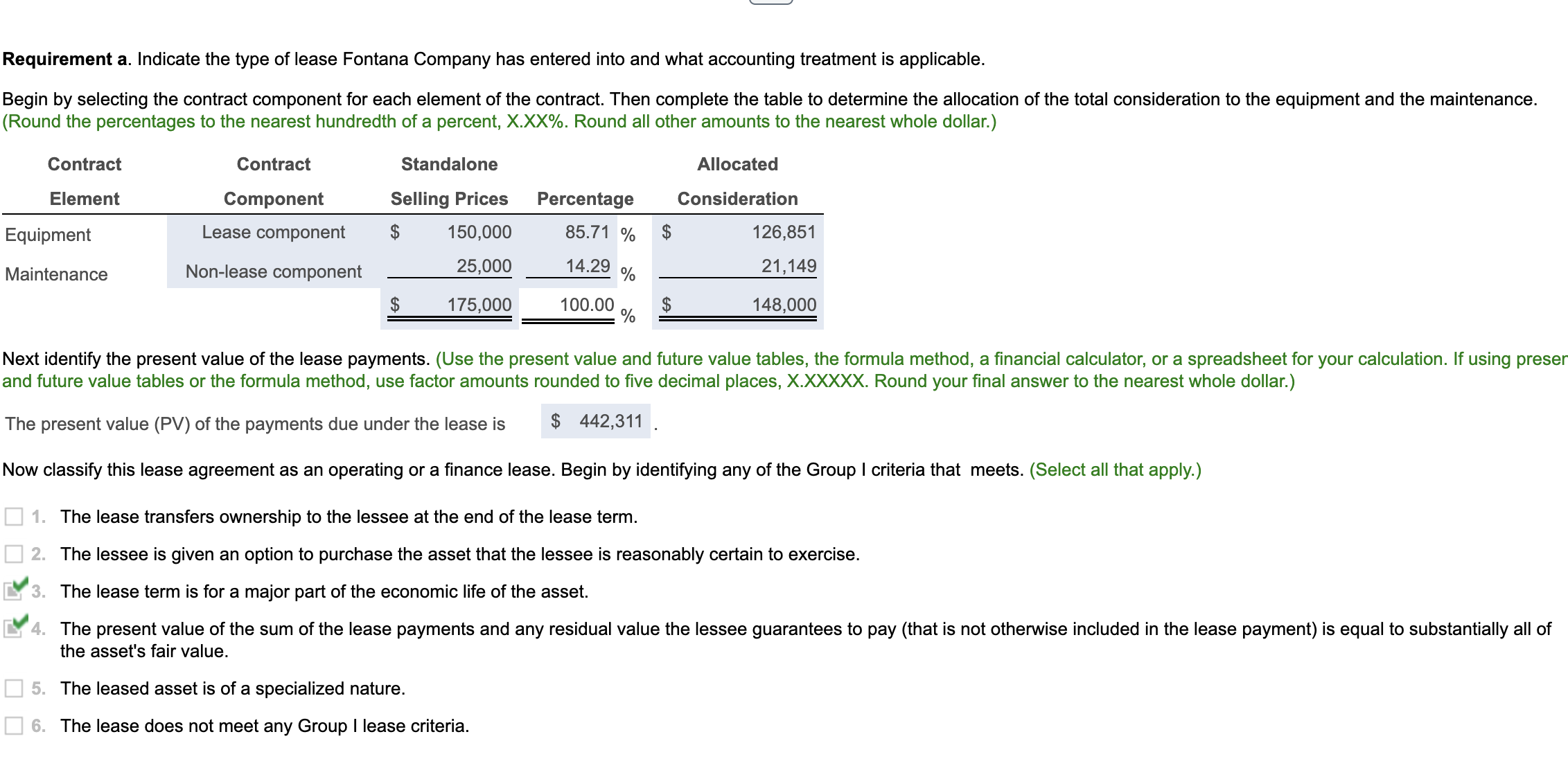

How do you get the present value (PV) of the payments under the the lease? (aka. the $442,311) Show work, please. This is a(n) lease

How do you get the present value (PV) of the payments under the the lease? (aka. the $442,311) Show work, please.

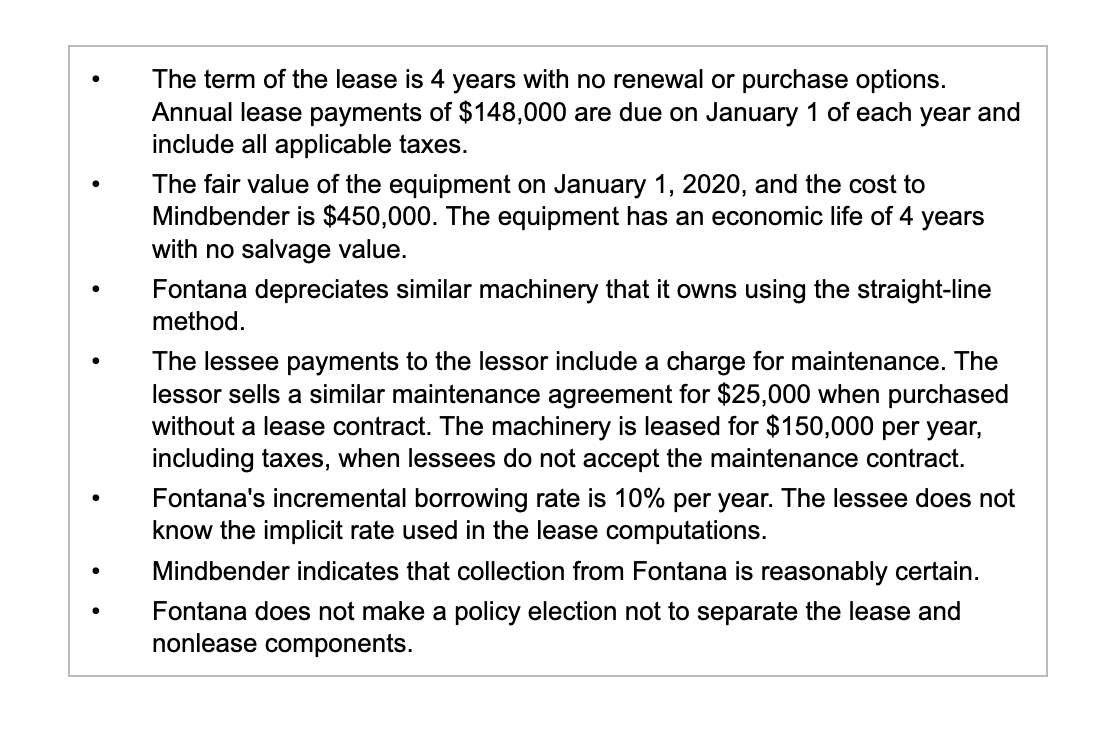

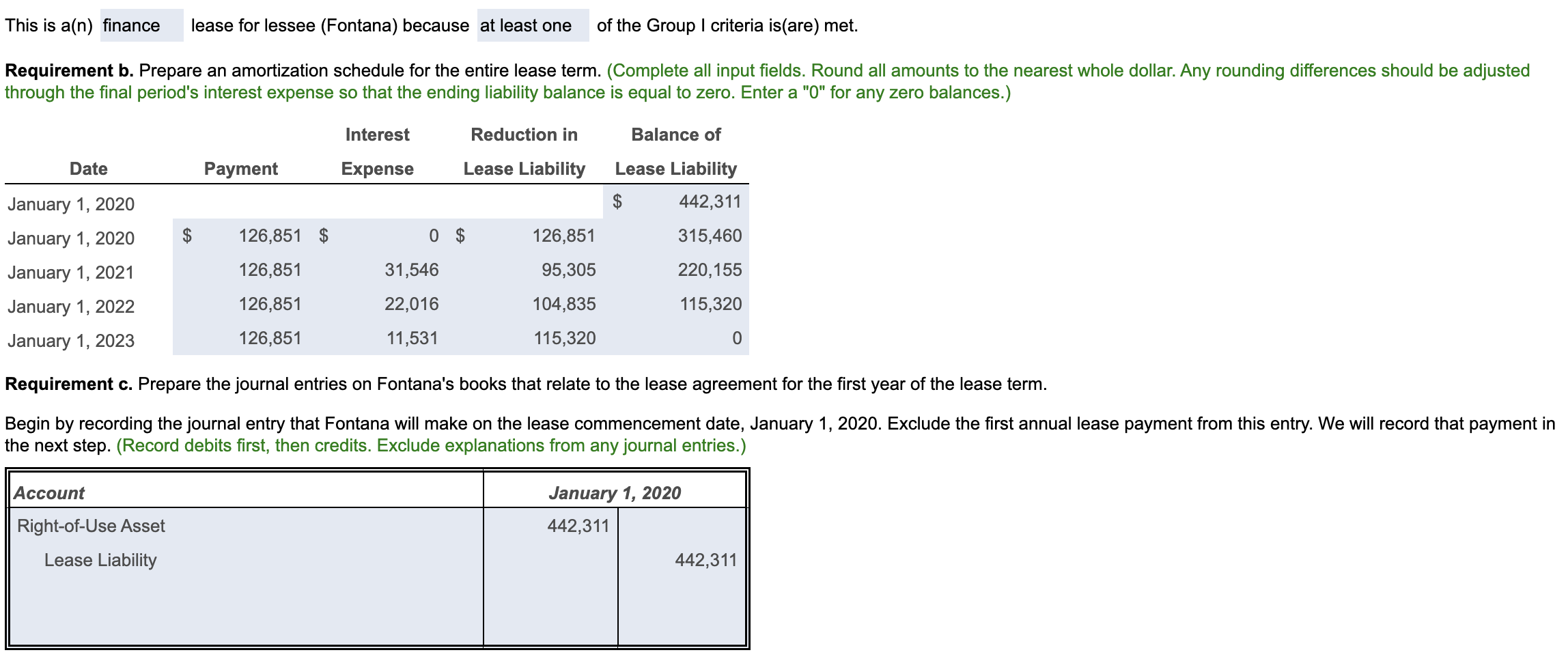

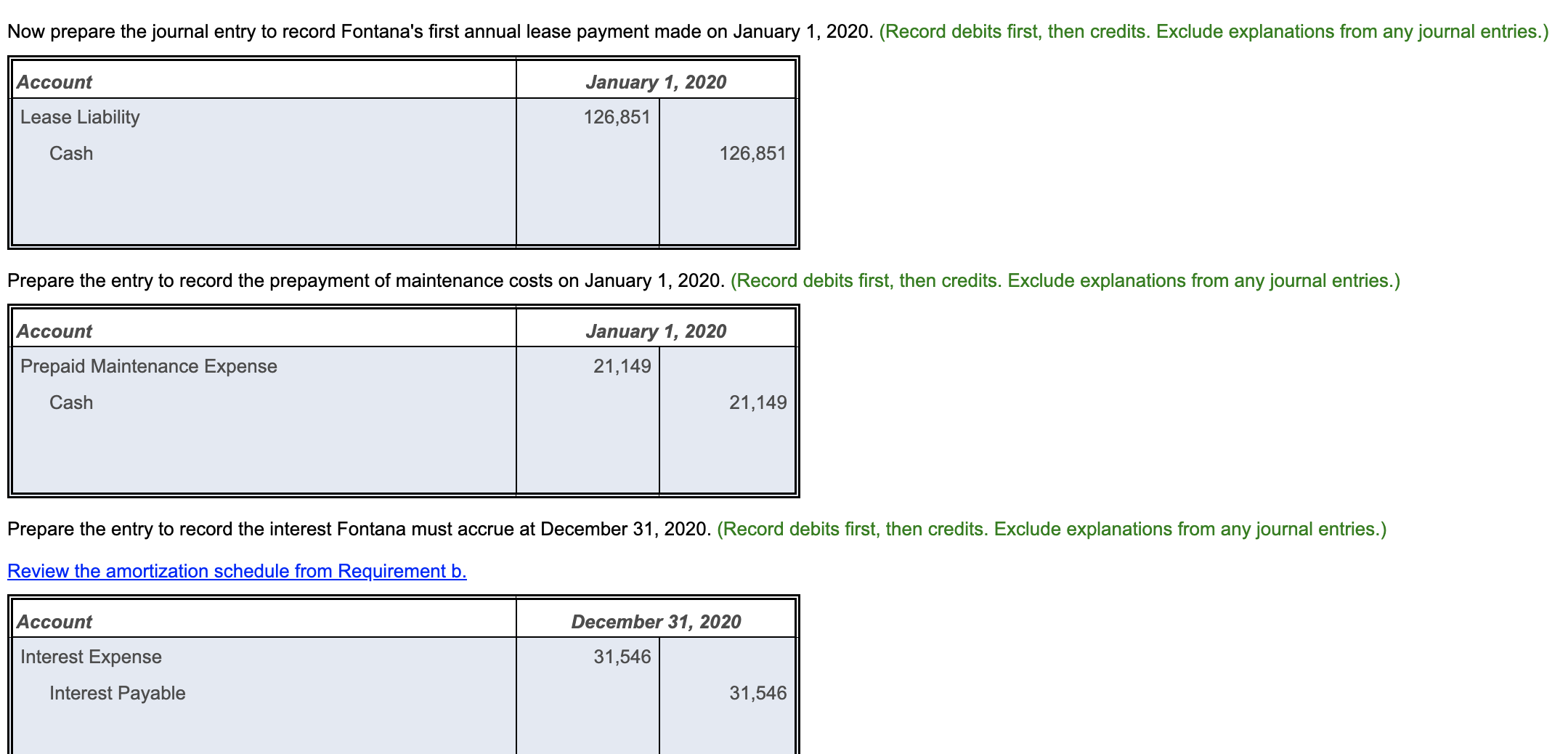

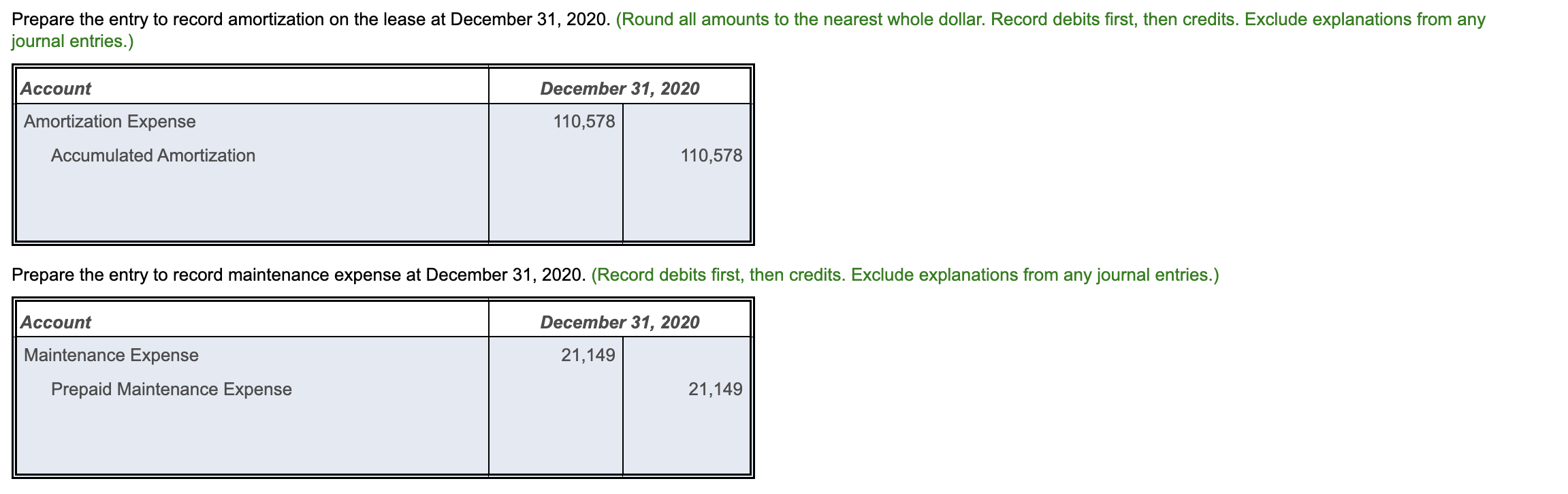

This is a(n) lease for lessee (Fontana) because of the Group I criteria is(are) met. through the final period's interest expense so that the ending liability balance is equal to zero. Enter a "0" for any zero balances.) Requirement c. Prepare the journal entries on Fontana's books that relate to the lease agreement for the first year of the lease term. the next step. (Record debits first, then credits. Exclude explanations from any journal entries.) Eontana Company enters into a lease agreement on January 1, 2020, for nonspecialized equipment leased by Mindbender Insurance Company. The following data are relevant to the ease agreement: (Click the icon to view the details of the lease.) Euture Value of $1 table Future Value of an Ordinary Annuity table Future Value of an Annuity Due table Present Value of $1 table Present Value of an Ordinary Annuity table Present Value of an Annuity Due table Read the requirements. Prepare the entry to record amortization on the lease at December 31, 2020. (Round all amounts to the nearest whole dollar. Record debits first, then credits. Exclude explanations from any journal entries.) \begin{tabular}{||l|r|r||} \hline \hline Account & \multicolumn{2}{|c|}{ December 31, 2020 } \\ \hline Amortization Expense & 110,578 & \\ Accumulated Amortization & & 110,578 \\ & & \\ \hline \end{tabular} Prepare the entry to record maintenance expense at December 31, 2020. (Record debits first, then credits. Exclude explanations from any journal entries.) \begin{tabular}{||l|r|r||} \hline \hline Account & \multicolumn{2}{|c||}{ December 31, 2020 } \\ \hline Maintenance Expense & 21,149 & \\ Prepaid Maintenance Expense & & 21,149 \\ & & \\ \hline \end{tabular} Requirement a. Indicate the type of lease Fontana Company has entered into and what accounting treatment is applicable. Begin by selecting the contract component for each element of the contract. Then complete the table to determine the allocation of the total consideration to the equipment and the maintenance. (Round the percentages to the nearest hundredth of a percent, X.XX\%. Round all other amounts to the nearest whole dollar.) Next identify the present value of the lease payments. (Use the present value and future value tables, the formula method, a financial calculator, or a spreadsheet for your calculation. If using prese and future value tables or the formula method, use factor amounts rounded to five decimal places, X.XXXXX. Round your final answer to the nearest whole dollar.) The present value (PV) of the payments due under the lease is Now classify this lease agreement as an operating or a finance lease. Begin by identifying any of the Group I criteria that meets. (Select all that apply.) 1. The lease transfers ownership to the lessee at the end of the lease term. 2. The lessee is given an option to purchase the asset that the lessee is reasonably certain to exercise. 3. The lease term is for a major part of the economic life of the asset. The present value of the sum of the lease payments and any residual value the lessee guarantees to pay (that is not otherwise included in the lease payment) is equal to substantially all of the asset's fair value. 5. The leased asset is of a specialized nature. 6. The lease does not meet any Group I lease criteria. Drepare the entry to record the interest Fontana must accrue at December 31, 2020. (Record debits first, then credits. Exclude explanations from any journal entries.) Review the amortization schedule from Requirement b. - The term of the lease is 4 years with no renewal or purchase options. Annual lease payments of $148,000 are due on January 1 of each year and include all applicable taxes. - The fair value of the equipment on January 1,2020 , and the cost to Mindbender is $450,000. The equipment has an economic life of 4 years with no salvage value. - Fontana depreciates similar machinery that it owns using the straight-line method. - The lessee payments to the lessor include a charge for maintenance. The lessor sells a similar maintenance agreement for $25,000 when purchased without a lease contract. The machinery is leased for $150,000 per year, including taxes, when lessees do not accept the maintenance contract. - Fontana's incremental borrowing rate is 10% per year. The lessee does not know the implicit rate used in the lease computations. - Mindbender indicates that collection from Fontana is reasonably certain. - Fontana does not make a policy election not to separate the lease and nonlease componentsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started