Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HOW DO YOU GET THIS ANSWER AND WHAT IS THE FORMULA? DO NOT USE AN EXCEL SPREADSHEET IN YOUR ANSWER PLEASE. THANK YOU - Question

HOW DO YOU GET THIS ANSWER AND WHAT IS THE FORMULA? DO NOT USE AN EXCEL SPREADSHEET IN YOUR ANSWER PLEASE. THANK YOU

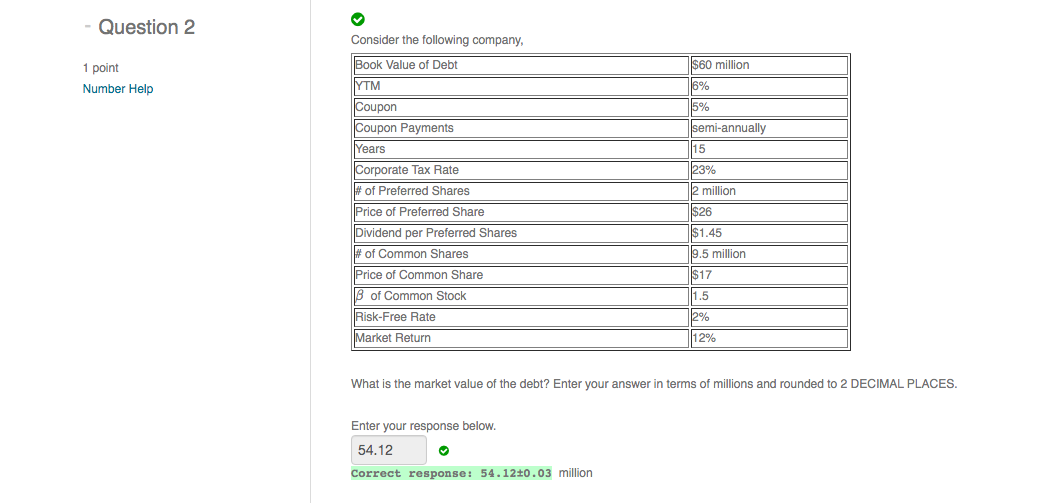

- Question 2 $60 million 1 point Number Help 16 % 5% semi-annually 15 23% Consider the following company, Book Value of Debt YTM Coupon Coupon Payments Years Corporate Tax Rate # of Preferred Shares Price of Preferred Share Dividend per Preferred Shares # of Common Shares Price of Common Share 8 of Common Stock Risk-Free Rate Market Return 2 million $26 |$1.45 9.5 million What is the market value of the debt? Enter your answer in terms of millions and rounded to 2 DECIMAL PLACES. Enter your response below. 54.12 Correct response: 54.12+0.03 millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started