Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how do you solve for this term it is not given in the problem. We now have the components to calculate the weighted average cost

how do you solve for this term it is not given in the problem.

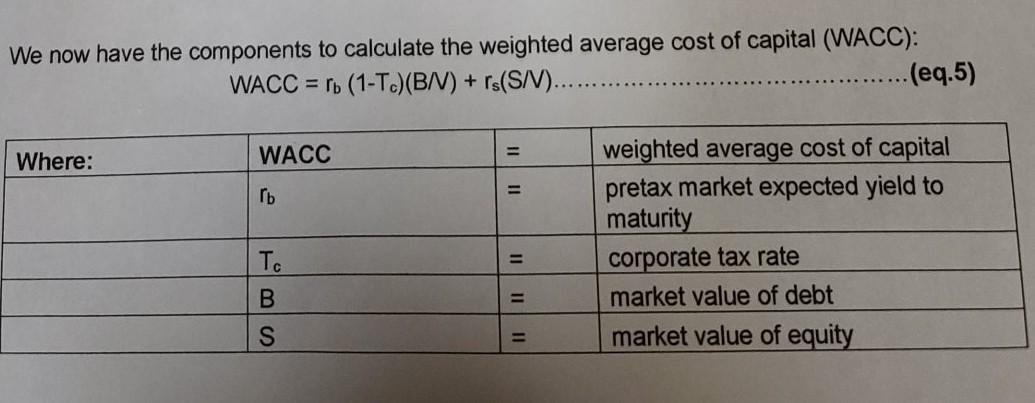

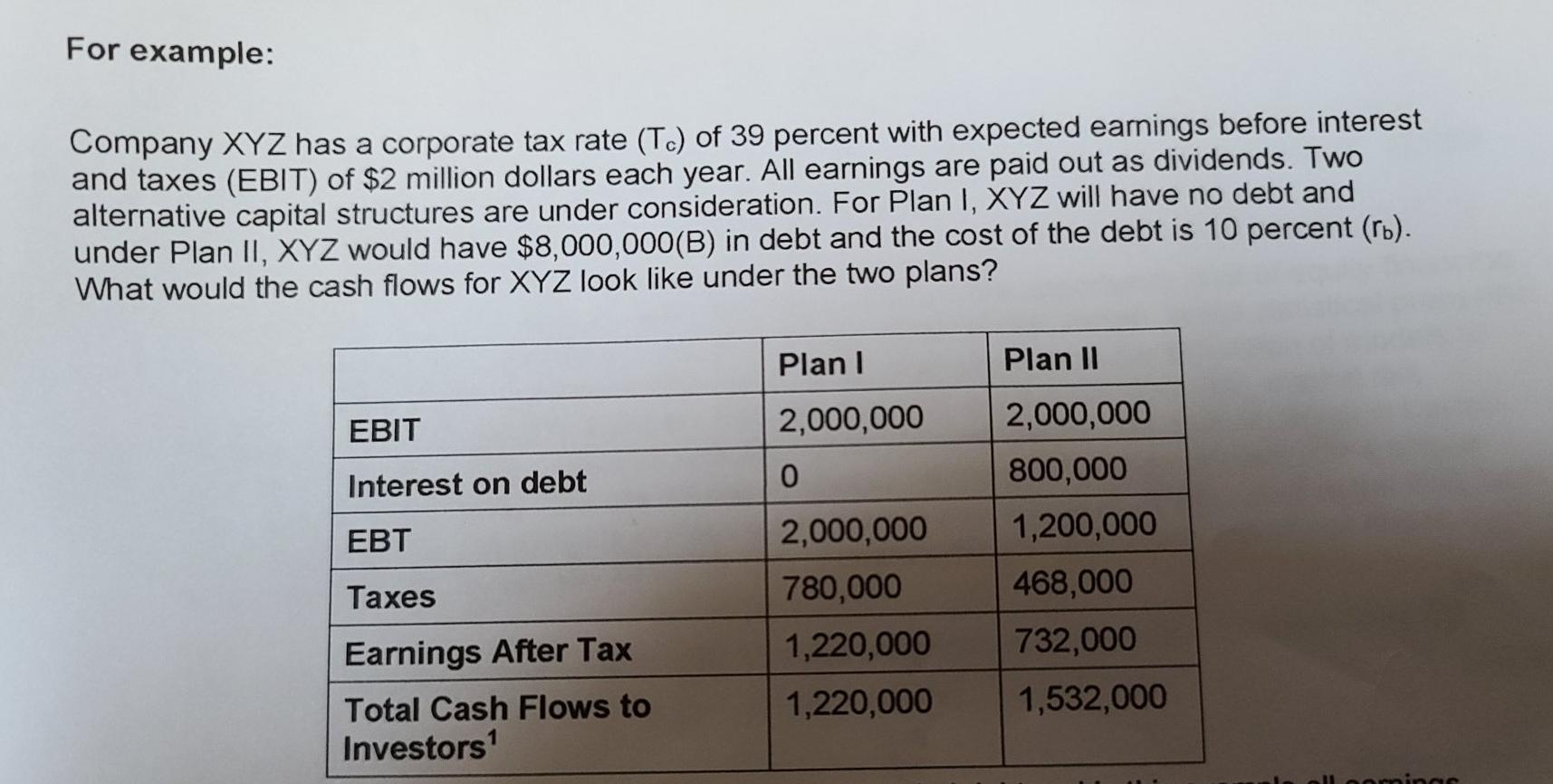

We now have the components to calculate the weighted average cost of capital (WACC): WACC = r. (1-T.)(B/V) + rs(S/V)... (eq.5) Where: WACC ro weighted average cost of capital pretax market expected yield to maturity corporate tax rate market value of debt market value of equity . II II B For example: Company XYZ has a corporate tax rate (Tc) of 39 percent with expected earnings before interest and taxes (EBIT) of $2 million dollars each year. All earnings are paid out as dividends. Two alternative capital structures are under consideration. For Plan I, XYZ will have no debt and under Plan II, XYZ would have $8,000,000(B) in debt and the cost of the debt is 10 percent (ro). What would the cash flows for XYZ look like under the two plans? Plan 1 Plan II EBIT 2,000,000 2,000,000 Interest on debt 0 800,000 EBT 2,000,000 1,200,000 Taxes Earnings After Tax 780,000 1,220,000 1,220,000 468,000 732,000 1,532,000 Total Cash Flows to Investors 1 ominac We now have the components to calculate the weighted average cost of capital (WACC): WACC = r. (1-T.)(B/V) + rs(S/V)... (eq.5) Where: WACC ro weighted average cost of capital pretax market expected yield to maturity corporate tax rate market value of debt market value of equity . II II B For example: Company XYZ has a corporate tax rate (Tc) of 39 percent with expected earnings before interest and taxes (EBIT) of $2 million dollars each year. All earnings are paid out as dividends. Two alternative capital structures are under consideration. For Plan I, XYZ will have no debt and under Plan II, XYZ would have $8,000,000(B) in debt and the cost of the debt is 10 percent (ro). What would the cash flows for XYZ look like under the two plans? Plan 1 Plan II EBIT 2,000,000 2,000,000 Interest on debt 0 800,000 EBT 2,000,000 1,200,000 Taxes Earnings After Tax 780,000 1,220,000 1,220,000 468,000 732,000 1,532,000 Total Cash Flows to Investors 1 ominac

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started