Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how do you solve? The thrt evaluation method ariumen that cash flows from the project are reirvested at the sarne rate equal to the IRe.

how do you solve?

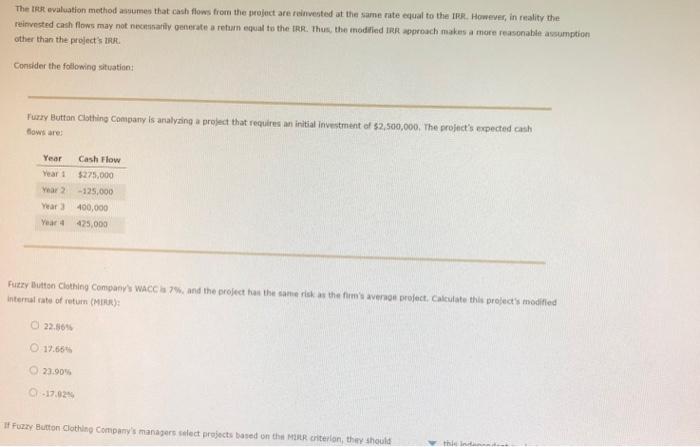

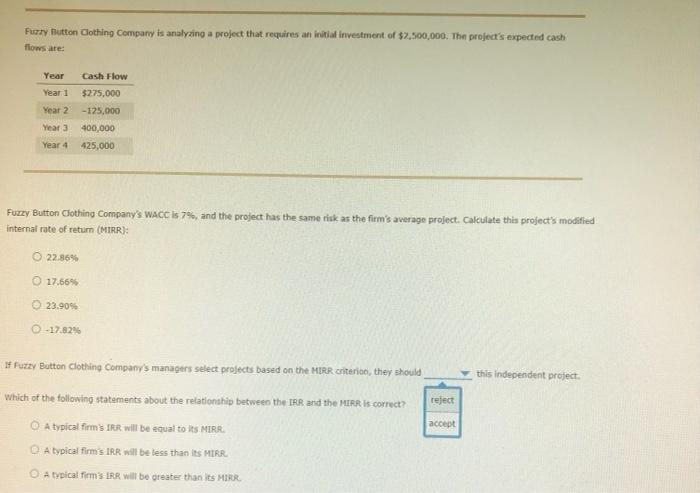

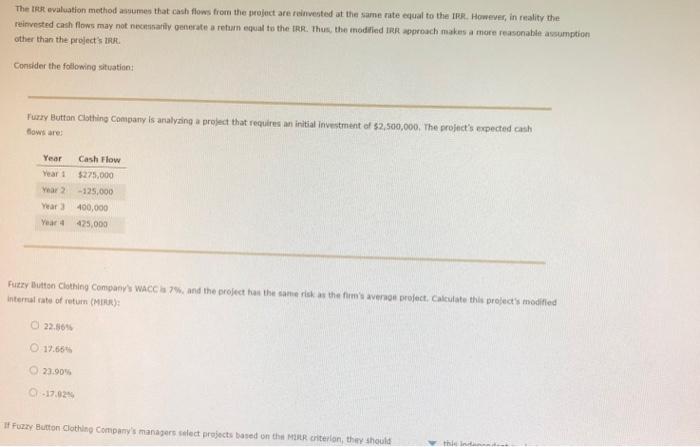

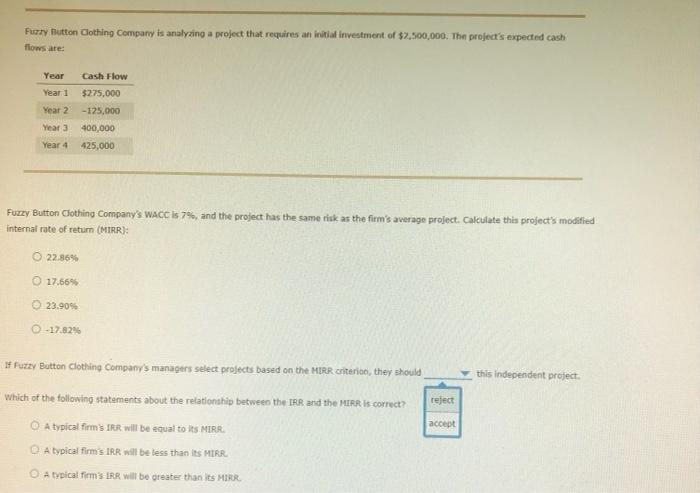

The thrt evaluation method ariumen that cash flows from the project are reirvested at the sarne rate equal to the IRe. Howeyer, in reality the reirverted cash flows may not nectinatily oenerate a refaun equal to the IRR. Thus, the inodifid tiph abprosch makes a more reasonable assumption other than the project's 18 . Consider the following situation: Furey Buttan Clathing Company is analysing a prolect that requites an initial investment of 32,500,000, The prolict's expected cash Bowis are: internal rate of retion (M)tis) 22.5646 17.652 27.904 17.024 If Fowey Budton Glothise Company's managers ielect projects based on thin MantR criterlon, thet should. Fursy fiutton Cothing Company is analyzing a project that requires an initial investment of $2,500,000. The project's expected cash floms are: Fuzzy eutton Cothing Company's WACC is 7%, and the project has the same risk ar the firm's average project. Calculate this project's modified internal rate of retum (MIRR): If Fuzzy Butten clothing Company's managers select prolects based on the Mirk citerian, ther should this independent profect. Which of the following statements about the relationship between the IRR and the MIFR is correct? A typical firm's IRRR will be equal to its MIRR. A typical firm's 1RR nill be less than its MiRR. A typical firms IRR will be greater than its Mire

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started