How do you solve this question?

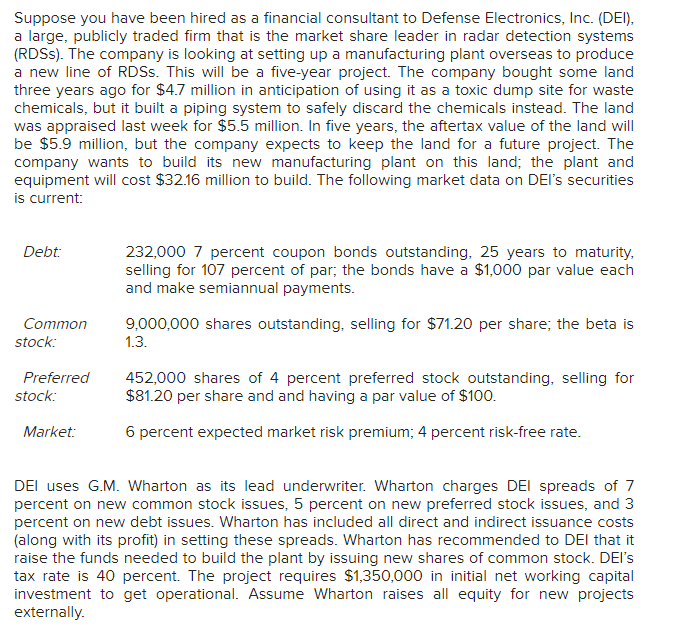

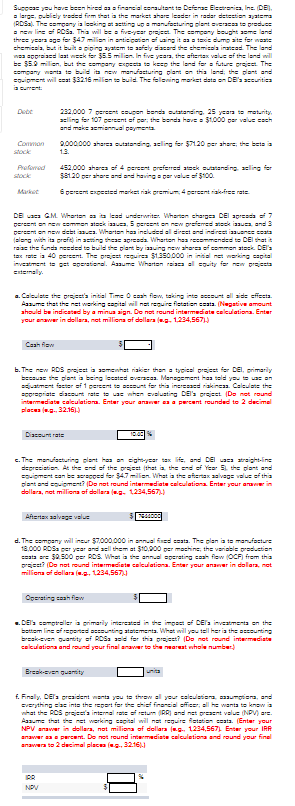

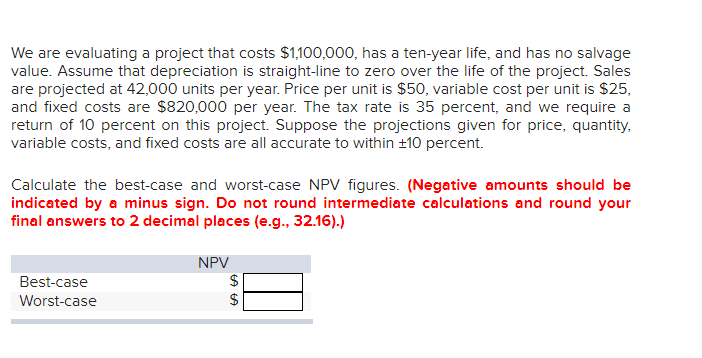

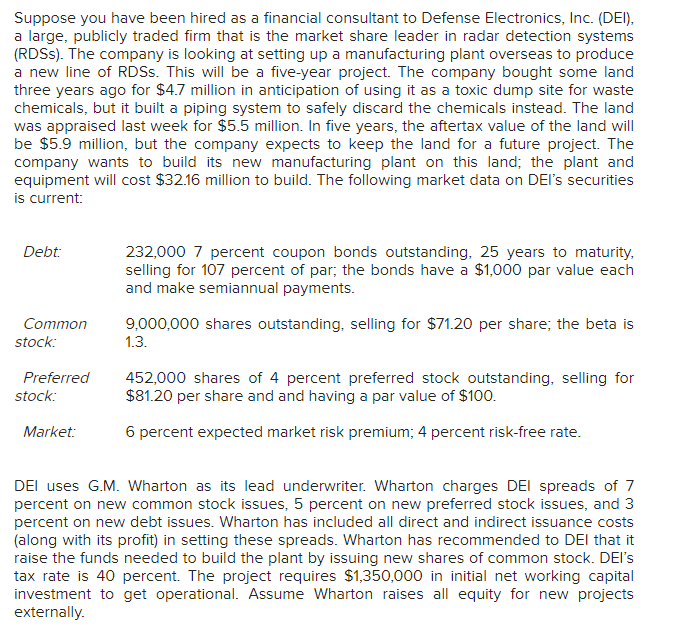

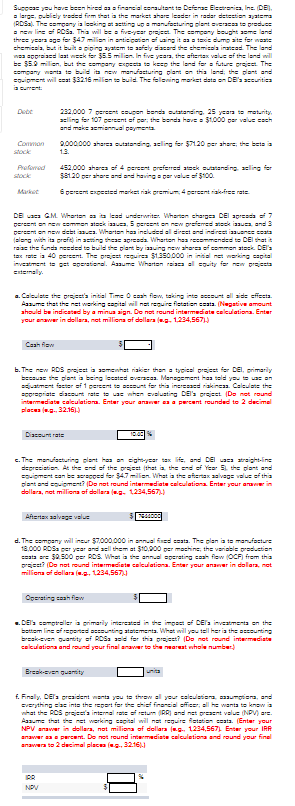

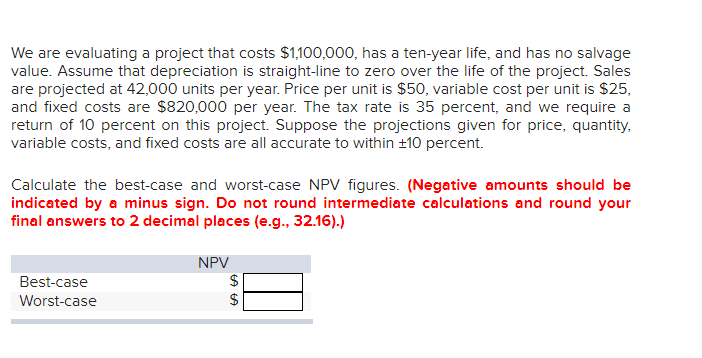

Suppose you have been hired as a financial consultant to Defense Electronics, Inc. (DEI), a large, publicly traded firm that is the market share leader in radar detection systems (RDSS). The company is looking at setting up a manufacturing plant overseas to produce a new line of RDSs. This will be a five-year project. The company bought some land three years ago for $4.7 million in anticipation of using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. The land was appraised last week for $5.5 million. In five years, the aftertax value of the land will be $5.9 million, but the company expects to keep the land for a future project. The company wants to build its new manufacturing plant on this land; the plant and equipment will cost $32.16 million to build. The following market data on DEI's securities is current: Debt: 232,000 7 percent coupon bonds outstanding, 25 years to maturity, selling for 107 percent of par, the bonds have a $1,000 par value each and make semiannual payments. 9,000,000 shares outstanding, selling for $71.20 per share; the beta is 1.3. Common stock: Preferred stock: 452,000 shares of 4 percent preferred stock outstanding, selling for $81.20 per share and and having a par value of $100. 6 percent expected market risk premium; 4 percent risk-free rate. Market: DEI uses G.M. Wharton as its lead underwriter. Wharton charges DEI spreads of 7 percent on new common stock issues, 5 percent on new preferred stock issues, and 3 percent on new debt issues. Wharton has included all direct and indirect issuance costs (along with its profit) in setting these spreads. Wharton has recommended to Del that it raise the funds needed to build the plant by issuing new shares of common stock. DEI's tax rate is 40 percent. The project requires $1,350,000 in initial net working capital investment to get operational. Assume Wharton raises all equity for new projects externally. Success you have been hired as a financial seratast is Delers Electrica, Inc. De - large, blicly reed firmat is the market share leader in radar detection agaima ROSA. The servery ia lesing ting manfactoring planteraca te red.es oli RS.. This will es far gree. The asmenybugt meland - age is: 547 millisin antician angit it saat date for at chemicals, but it butong ayam te fel de semaines. The land weared last week f355 million in five years, the attentax value of the land will = $50 milion, but the many expect to keep the land for future gree. The SSSR warta to build it now manufacturing plant on this led the plant and =9-igrant will ess: 32.16 - len to build the fisningsredste DE's securitica Date | 222.000 7 percet suen tanda tatancing 25 years to returity linge 107 creant fer the band he 34.000 per vacach and make a management 9.000.000 hores setata-cing alinger $7120 gr share the beta 13. Com Promed stock 452.000 ahera of 4 gerst preferred steek vatanding lige $3120 per here are and having carval=300 6 percent exceed markeriak gremis, gerenties rais DES GM What at lead underwrite: Wharten charge DEl agrada gerentemente aces, 5 percent en su greements aus and Cerent ens ett ca. Whaises includes al direct and indireciones seats slag with its groft in a sing as agrees Wharten har sendes te DEI reas the fine needed to build the plant by sing where I disck DE tax rate is 40 cereen. The priest requirea $1.350.000 in inal string capital investments get gerstiel. Lau hartan rasa al guity for projects externally a. Caislete the project's initial Time Ocase flow, taking into acust allaide effects. A32. that the networking capital wil net reguire flatstien csata. (Negative amount ahould be indicated by a minua sign. De not reund intermediate calculations. Enter your wer in dollars, not millions of dollars. 1,234,5671) Cash flow . The SSN RDS taas iht niake the typical greet DEI, primarily Sessuas the data ingleses averassa. Management al yatasan 25-tister of 1 green test is this increased riskineza. Caleate the scoregrisis diassunt rate to was when Salusting Des rejest De mot round intermediate calculation. Enter your answer a percent rounded to 2 decimal places... 32.16) Date c. The menuisering plants anghyar text and De-asa straight-in degresisties. At the end of the great that is the sea of Year the last and sigment can be acceder 34.7ilen. What is the aftertax savage value of this last and simet? Da net reund intermediate calculation Enter your amane in dollara, nct millions of dollara - 1234,567) Arex alvage value d. The company will insur 37.000.000 in analised seats. The plan in tamen fastur 18.000 ROSA ger year are all them a $10.000 per rachin the variable gracion seats are $2.500 DE ROS. What is the annual sperating cash flow (OCF) from this Orgeet? (De not round intermediate celelations. Enter your answer in celiara, net millions of dollars. 1234,567 Operating cash flow De celerrimarily more than of Era inveatment on the bottom line fregarded as ting attenta. What will you telleria the accounting break-even gantity sf Sa asid for this proje? De net round intermediate calculation and round your final saver to the area whole number) Bresk-EVER Guarity UR f. Finally, DET a greaident want you to throw all your calculator saugesna, and srsrything lasinis the report for the final offices all he wants to know nette Ros grejesa interest rate fret RR and net gresent valus (NPV)ars. ATS that there werking capital wil net reguire fist sata. (Enter your NPV anawer in dollara, not millions of dollara las 1234,567L Enter your IRR anawer a percent. Do not round intermediate calculations and round your final anaverato 2 decimal place leg.32-164 IRR NOV We are evaluating a project that costs $1,100,000, has a ten-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 42,000 units per year. Price per unit is $50, variable cost per unit is $25, and fixed costs are $820,000 per year. The tax rate is 35 percent, and we require a return of 10 percent on this project . Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within 10 percent. Calculate the best-case and worst-case NPV figures. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations and round your final answers to 2 decimal places (e.g., 32.16).) Best-case Worst-case NPV $ $