How do you use Average % of sales for the past 5 years?

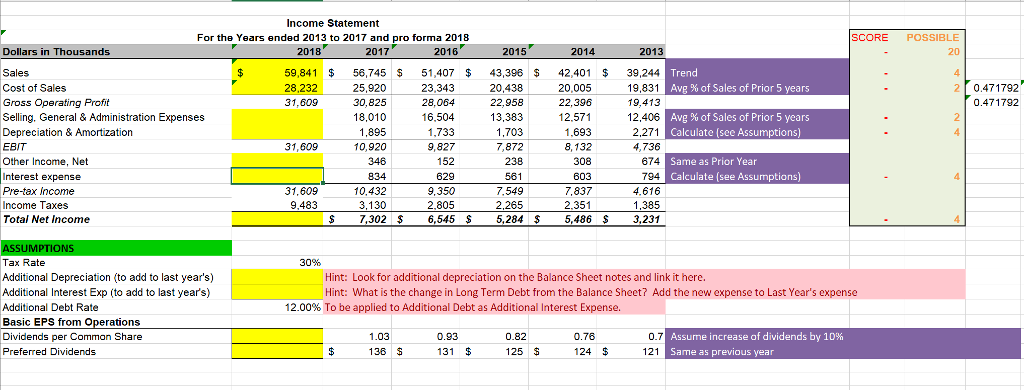

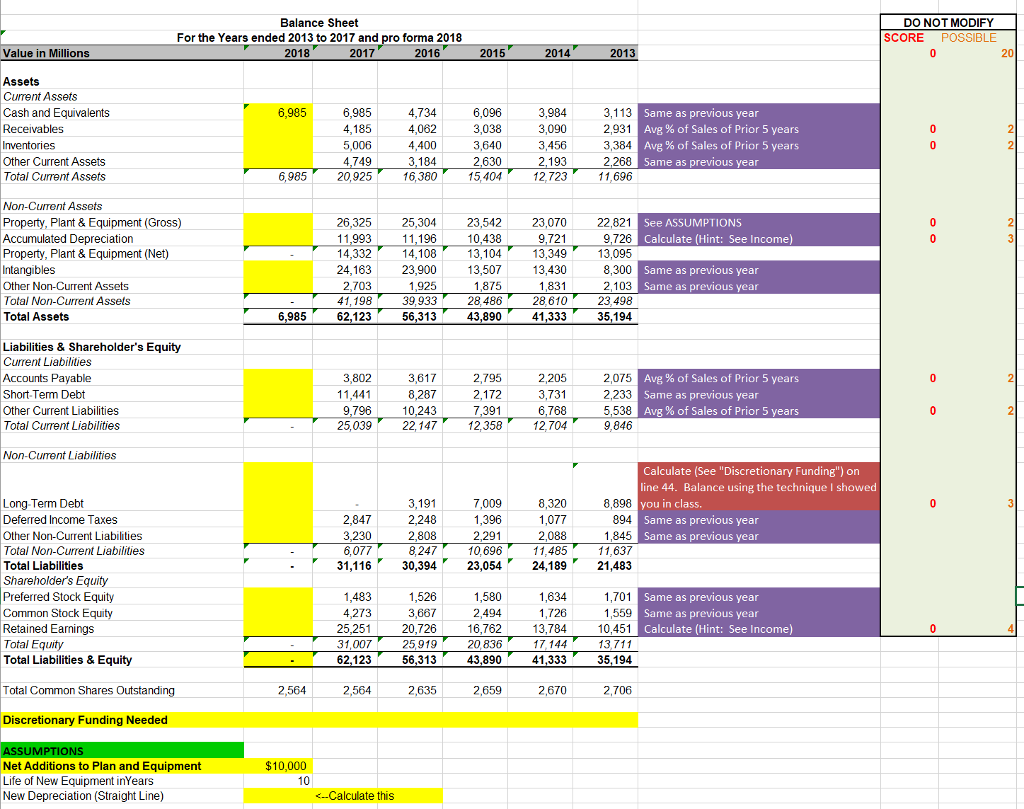

Income Statement For the Years ended 2013 to 2017 and pro forma 2018 SCORE POSSIBLE 20 Dollars in Thousands 2018 2017 2016 2015 2014 2013 Trend Avg % of Sales of Prior 5 years Sales Cost of Sales Gross Operating Selling. General & Administration Expenses Depreciation & Amortization EBIT Other Income, Net Interest expense Pre-tax income Income Taxes Total Net Income 59,841 $56,745 $ 51,407 $43,396$42,401 $39,244 22,39619.831 12,406 2,271 4,736 674 794 4.616 1,385 $7,302$ 6,545 $5,284$ 5,486 $3,231 28.232 31,609 25,920 30,825 18,010 1,895 10,920 346 834 10,432 3,130 23,343 28,064 16,504 1,733 9,827 152 629 9.350 2.805 20,438 22,958 13,383 1,703 7,872 238 561 7.549 2,265 20,005 0.471792 0.471792 Profit 19,413 12.571 1.693 8,132 308 603 7,837 2.351 Avg % of Sales of Prior 5 years Calculate (see Assumptions) 31,609 Same as Prior Year Calculate (see Assumptions) 31,609 9.483 30% Tax Rate Additional Depreciation to add to last year's) Additional Interest Exp (to add to last year's) Additional Debt Rate Basic EPS from Operations Dividends per Common Share Preferred Dividends Hint: Look for additional depreciation on the Balance Sheet notes and link it here Hint: What is the change in Long Term Debt from the Balance Sheet? Add the new expense to Last Year's expense 12.00% To be applied to Additional Debt as Additional Interest Expense. 0.93 131 Assume increase of dividends by 10% 1.03 136 0.82 125 0.76 124 121 ame as previous year Balance Sheet For the Years ended 2013 to 2017 and pro forma 2018 DO NOTMODIFY SCORE POSSIBLE Value in Millions 2018 2014 2013 Assets Current Assets Cash and Equivalents 50064062 6096 4.749 6,985 1843640 3090 3113 2,931 3,384 6,985 20,925 16,38015,40412,72311,696 Same as previous year Avg % of Sales of Prior 5 years Avg % of Sales of Prior 5 years Same as previous year 4,400 Other Current Assets Total Current Assets 2193 Non-Crrent Assets Property, Plant & Equipment (Gross) Accumulated Depreciation Property, Plant & Equipment (Net) 26,325 11,993 14,332 24,16323,900 25,304 23,542 23,070 9,721 13,349 22,821 9,726 13,095 8,300 2103 23498 35,194 See ASSUMPTIONS Calculate (Hint: See Income Other Non-Current Assets Total Non-Current Assets Total Assets 13,507 1,875 28 486 43,890 Same as previous year Same as previous year 1831 198 62,123 39,933 56,313 28,610 41,333 6,985 Liabilities & Shareholder's Equity Current Liabilities Accounts Payable Short-Term Debt Other Current Liabilities Total Current Liabilities 3,802 172 205 3,731 3,617 2,075 Avg % of Sales of Prior 5 years 11,441 9,796 3Same as previous year 7,391 Avg % of Sales of Prior 5 years 25039 22,14712,358 12,704 9,846 Calculate (See "Discretionary Funding") on line 44. Balance using the technique I showed Long-Term Debt Deferred Income Taxes Other Non-Current Liabilities Total Non-Current Liabilities Total Liabilities Shareholder's Equity Preferred Stock Equity Common Stock E Retained Earnings Total Equity Total Liabilities & Equity 191 8,320 8,898 894 1077 2,088 Same as previous year Same as previous year 2,808 2,291 6,077 8,24710,69611,485 11,637 31,11630,39423,054 24,189 21,483 1,483 4,273 1,701 Same as previous year Same as previous year Calculate (Hint: See Income) 3,667 494 31,007 62,123 25.251 20,72616,762 13,78410.451 20 836 43,890 25,919 56,313 41,333 35,194 Total Common Shares Outstanding 2,635 2,670 Discretionary Funding Needed SU Net Additions to Plan and Equipment Life of New Equipment inYears New Depreciation (Straight Line) $10,000