Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jegadeesh and Titman (JT 1993) perform a return decomposition on a momentum portfolio, based on a one-factor return specification in Eq (1) and a

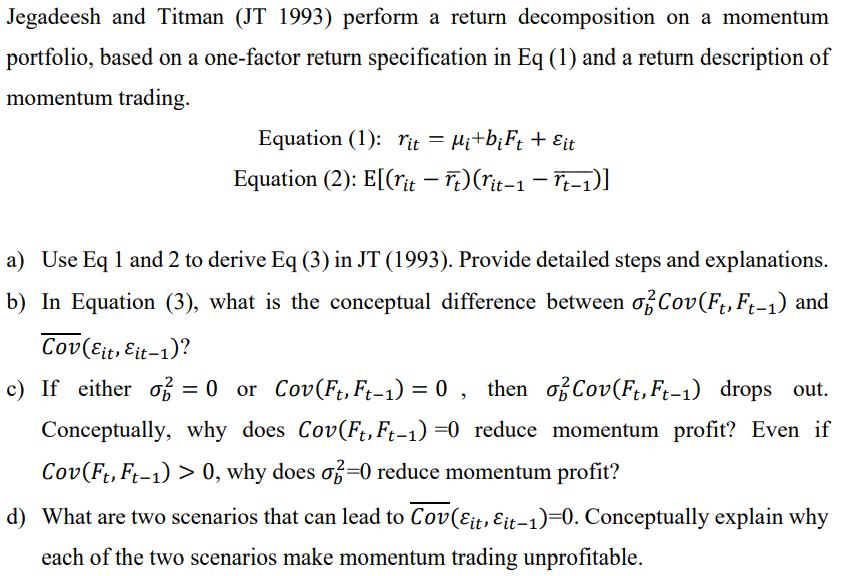

Jegadeesh and Titman (JT 1993) perform a return decomposition on a momentum portfolio, based on a one-factor return specification in Eq (1) and a return description of momentum trading. Equation (1): rit = Mi+biFt + Eit Equation (2): E[(rit Ft) (rit-1 rt-1)] - - a) Use Eq 1 and 2 to derive Eq (3) in JT (1993). Provide detailed steps and explanations. b) In Equation (3), what is the conceptual difference between of Cov(Ft, Ft-1) and Cov(Eit, Eit-1)? c) If either of = 0 or Cov(Ft, Ft-1) = 0, then of Cov(Ft, Ft-1) drops out. Conceptually, why does Cov(Ft, Ft-1)=0 reduce momentum profit? Even if Cov(Ft, Ft-1) > 0, why does o2=0 reduce momentum profit? d) What are two scenarios that can lead to Cov(Eit, Eit-1)=0. Conceptually explain why each of the two scenarios make momentum trading unprofitable.

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Eq 3 Eritrit 1 EMitbiFt EitMit1biFt1 Eit1 Eq 3 Eritrit 1 EMitbiFt EitMit1biFt1 Eit1 EMitMit1biFtFt...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started