Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume Posey were to obtain a international subsidiary with non-US$ functioning currency. Prepare a memo that addresses the following critical elements: A. Outline the unique

Assume Posey were to obtain a international subsidiary with non-US$ functioning currency. Prepare a memo that addresses the following critical elements:

A. Outline the unique calculations required to complete the consolidation worksheet.

B. Outline the unique calculations required on the statement of cash flows.

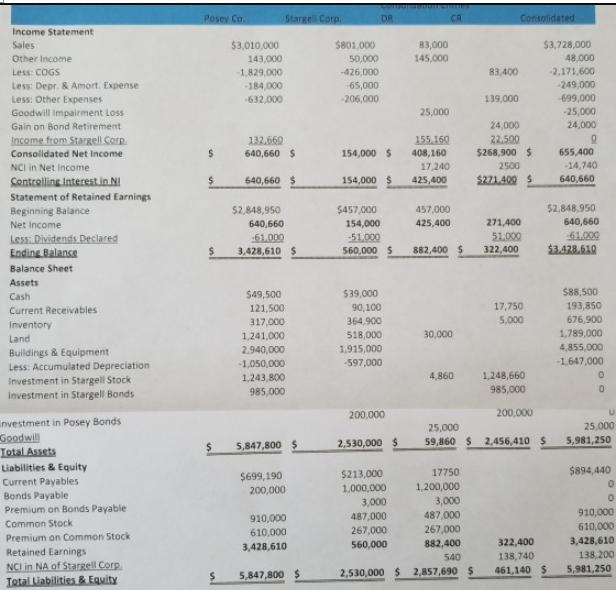

Posev Co. Stargell Corp. DR CR Consolidated Income Statement $801.000 $3,728,000 83,000 145,000 Sales $3,010.000 143,000 1,829,000 Other income 50,000 48,000 Less: COGS 426,000 83,400 2,171,600 Less: Depr. & Amort. Expense -249,000 184,000 632,000 65,000 699,000 -25,000 Less: Other Expenses 206,000 139,000 Goodwill impairment Loss 25,000 Gain on Bond Retirement 24,000 24,000 Income from Starell Corp. 132.660 640,660 $ 22.500 $268,900 $ 155,160 Consolidated Net Income 154,000 S 408,160 655,400 NCI in Net income 17,240 2500 -14,740 Contrelling Interest in NI $271.400 $ 640,660 $ 154,000 $ 425,400 640,660 Statement of Retained Earnings 52.848,950 640,660 Beginning Balance $2,848,950 $457,000 457,000 271,400 154,000 -51.000 560,000 Net Income 640,660 425,400 Less: Dividends Declared Ending Balance 51,000 322,400 61.000 $3.428.610 61.000 3,428,610 $ 882,400 $ Balance Sheet Assets Cash $49,500 $39,000 $88,500 17,750 193,850 676,900 Current Receivables 121,500 90,100 Inventory 317,000 364,900 5,000 1,789,000 1,241,000 2.940,000 518,000 30,000 Land 1.915,000 4,855,000 Buildings & Equipment Less: Accumulated Depreciation Investment in Stargell Stock investment in Stargell Bonds -1,050,000 597,000 -1,647,000 1,243,800 4,860 1,248,660 985,000 985,000 200,000 200,000 nvestment in Posey Bonds Goodwill Total Assets 25,000 25,000 59,860 S 2,456,410 S %2$ 5,847,800 $ 2,530,000 $ 5,981,250 Liabilities & Equity Current Payables $213,000 17750 $894,440 $699,190 200,000 1,200,000 3,000 1,000,000 Bonds Payable Premium on Bonds Payable 3,000 487,000 487,000 910,000 910,000 Common Stock 610,000 610,000 267,000 267,000 Premium on Common Stock Retained Earnings NCI in NA of Stargell Corp Total Liabilities & Equity 3,428,610 138,200 5,981,250 3,428,610 560,000 882,400 322,400 540 138,740 5,847,800 $ 2,530,000 $ 2,857,690 $ 461,140 $

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

A Memorandum When preparing consolidated financial statements of a company that has a foreign subsid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started