How does the net income for this year compare to last?

What caused the change, use the notes to the income statement to support your reason?

What are the accounts (not totals, but accounts i.e. net income is a total, wage expense is an account) that catch your attention compared to the previous year's income statement? List at least 3 and briefly explain why you selected each one. (Total Expenses or Net Income are not accounts, they are totals or labels for totals.) The explanation must say more than the figure increased or decreased, why would that be of interest?

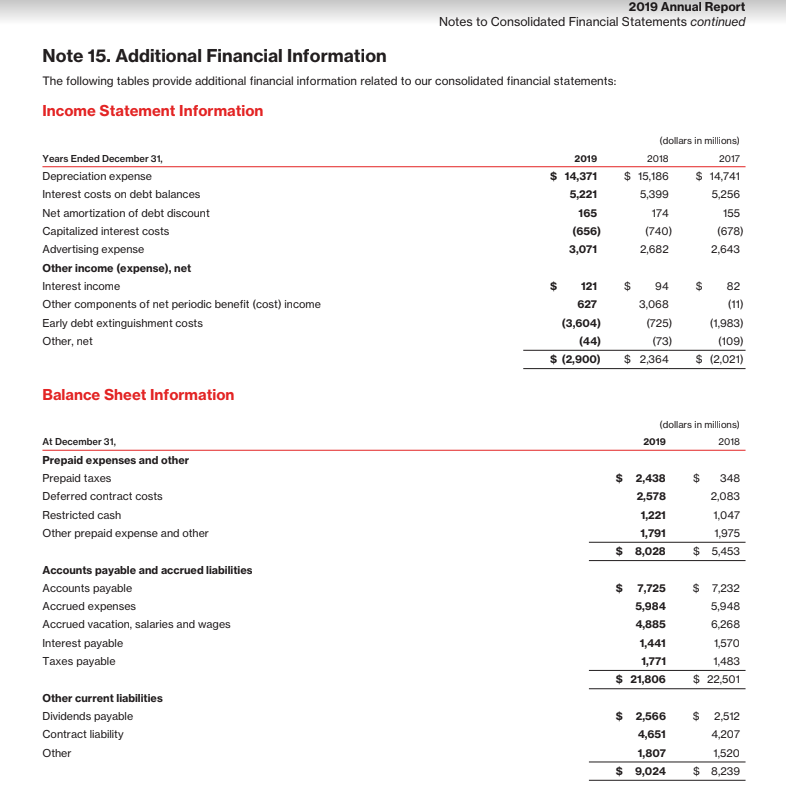

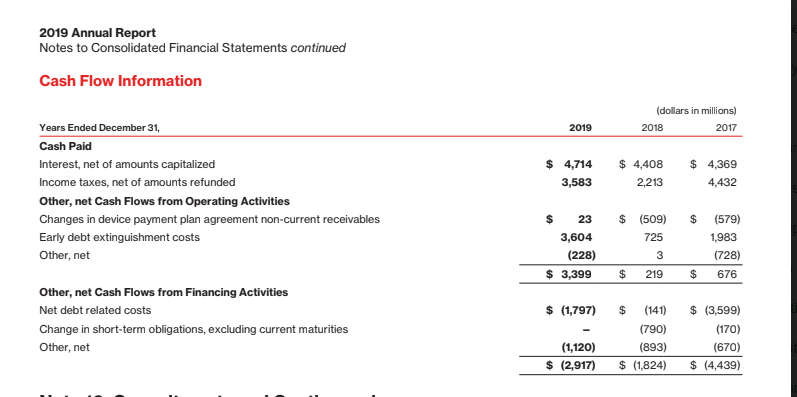

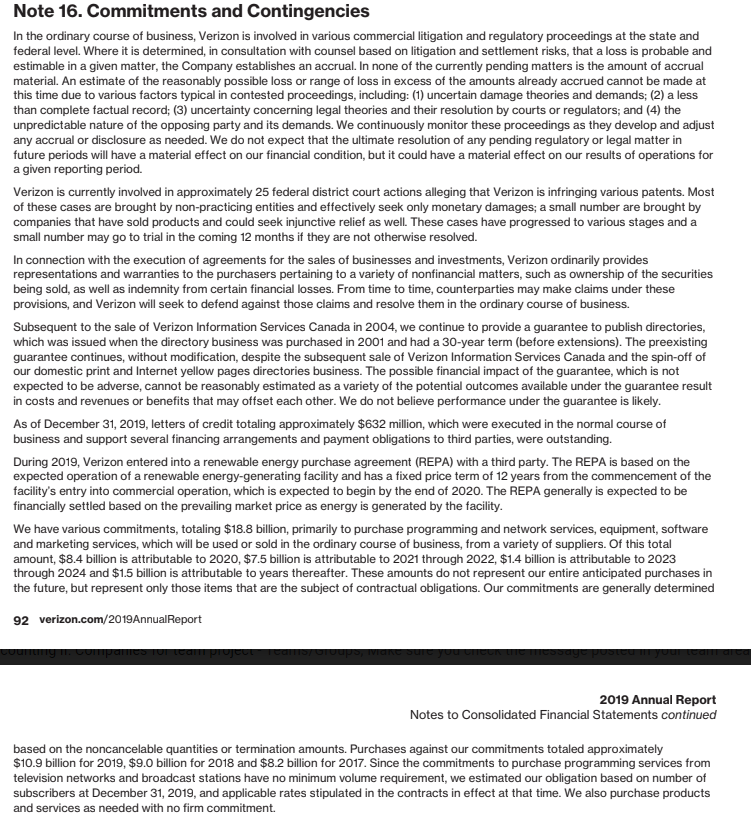

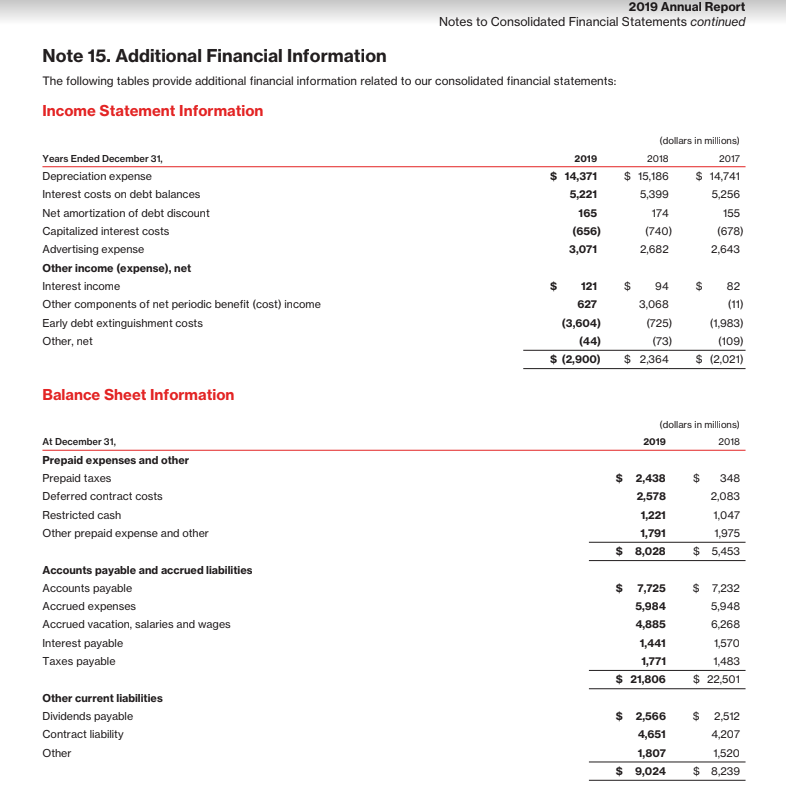

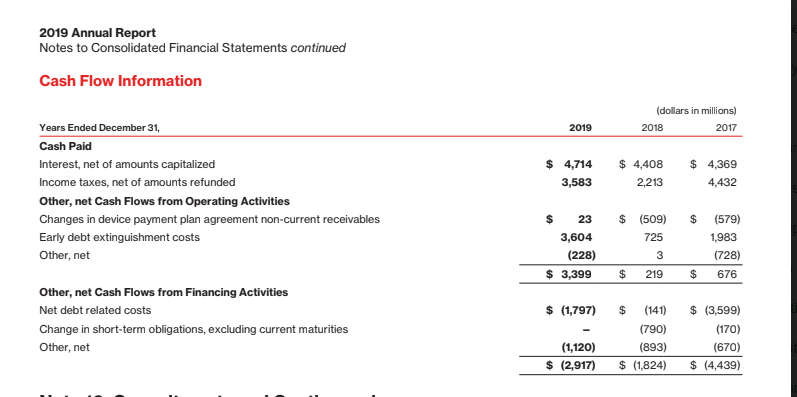

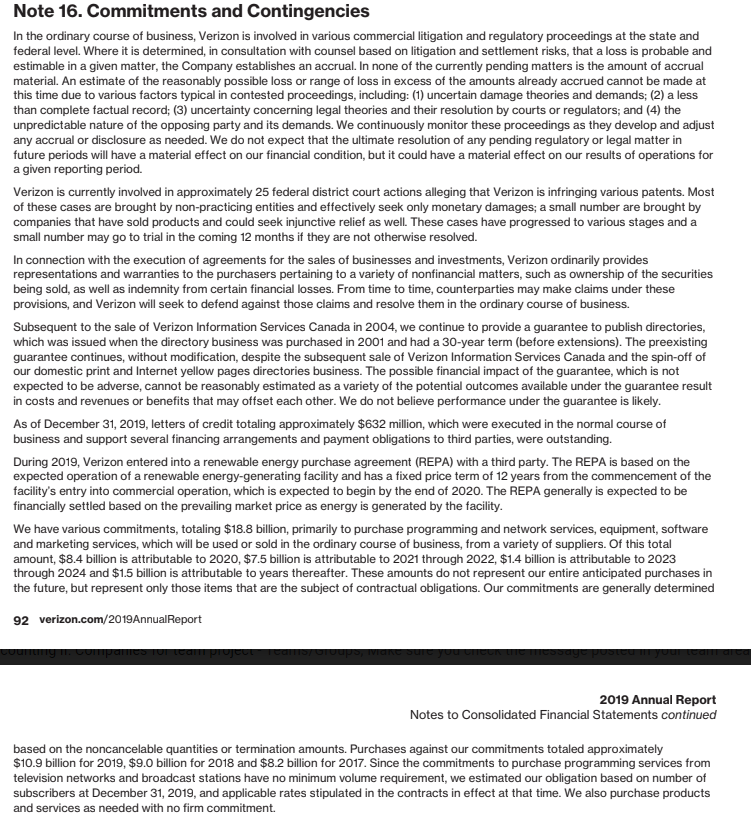

2019 Annual Report Notes to Consolidated Financial Statements continued Note 15. Additional Financial Information The following tables provide additional financial information related to our consolidated financial statements: Income Statement Information (dollars in millions) Years Ended December 31, Depreciation expense Interest costs on debt balances Net amortization of debt discount Capitalized interest costs Advertising expense Other income (expense), net Interest income Other components of net periodic benefit (cost) income Early debt extinguishment costs Other, net 2019 $ 14,371 5,221 165 (656) 3,071 2018 $ 15,186 5,399 174 2017 $ 14,741 5,256 155 (678) 2,643 (740) 2,682 121 627 (3,604) (44) $ 2,900) 94 3,068 (725) (73) $ 2,364 $ 82 (11) (1,983) (109) $ (2,021) Balance Sheet Information (dollars in millions) 2019 2018 At December 31, Prepaid expenses and other Prepaid taxes Deferred contract costs Restricted cash Other prepaid expense and other 348 2,083 $ 2,438 2,578 1,221 1,791 $ 8,028 1,047 1,975 $ 5,453 Accounts payable and accrued liabilities Accounts payable Accrued expenses Accrued vacation, salaries and wages Interest payable Taxes payable $ 7,725 5,984 4,885 1,441 1,771 $ 21,806 $ 7,232 5,948 6,268 1,570 1,483 $ 22,501 Other current liabilities Dividends payable Contract liability Other $ 2,566 4,651 1,807 $ 9,024 $ 2,512 4,207 1,520 $ 8,239 2019 Annual Report Notes to Consolidated Financial Statements continued Cash Flow Information (dollars in millions) 2018 2017 2019 $ 4,714 3,583 $ 4,408 2,213 $ 4,369 4,432 Years Ended December 31, Cash Paid Interest, net of amounts capitalized Income taxes, net of amounts refunded Other, net Cash Flows from Operating Activities Changes in device payment plan agreement non-current receivables Early debt extinguishment costs Other, net $ $ (509) 725 $ 23 3,604 (228) $ 3,399 (579) 1,983 (728) 676 3 $ 219 $ $ (1,797) Other, net Cash Flows from Financing Activities Net debt related costs Change in short-term obligations, excluding current maturities Other, net $ (141) (790) (893) $ (1,824) $ (3,599) (170) (670) $ (4,439) (1,120) $ (2,917) Note 16. Commitments and Contingencies In the ordinary course of business, Verizon is involved in various commercial litigation and regulatory proceedings at the state and federal level. Where it is determined, in consultation with counsel based on litigation and settlement risks, that a loss is probable and estimable in a given matter, the Company establishes an accrual. In none of the currently pending matters is the amount of accrual material. An estimate of the reasonably possible loss or range of loss in excess of the amounts already accrued cannot be made at this time due to various factors typical in contested proceedings, including: (1) uncertain damage theories and demands; (2) a less than complete factual record; (3) uncertainty concerning legal theories and their resolution by courts or regulators; and (4) the unpredictable nature of the opposing party and its demands. We continuously monitor these proceedings as they develop and adjust any accrual or disclosure as needed. We do not expect that the ultimate resolution of any pending regulatory or legal matter in future periods will have a material effect on our financial condition, but it could have a material effect on our results of operations for a given reporting period. Verizon is currently involved in approximately 25 federal district court actions alleging that Verizon is infringing various patents. Most of these cases are brought by non-practicing entities and effectively seek only monetary damages; a small number are brought by companies that have sold products and could seek injunctive relief as well. These cases have progressed to various stages and a small number may go to trial in the coming 12 months if they are not otherwise resolved. In connection with the execution of agreements for the sales of businesses and investments, Verizon ordinarily provides representations and warranties to the purchasers pertaining to a variety of nonfinancial matters, such as ownership of the securities being sold, as well as indemnity from certain financial losses. From time to time, counterparties may make claims under these provisions, and Verizon will seek to defend against those claims and resolve them in the ordinary course of business. Subsequent to the sale of Verizon Information Services Canada in 2004, we continue to provide a guarantee to publish directories, which was issued when the directory business was purchased in 2001 and had a 30-year term (before extensions). The preexisting guarantee continues, without modification, despite the subsequent sale of Verizon Information Services Canada and the spin-off of our domestic print and Internet yellow pages directories business. The possible financial impact of the guarantee, which is not expected to be adverse, cannot be reasonably estimated as a variety of the potential outcomes available under the guarantee result in costs and revenues or benefits that may offset each other. We do not believe performance under the guarantee is likely. As of December 31, 2019, letters of credit totaling approximately $632 million, which were executed in the normal course of business and support several financing arrangements and payment obligations to third parties, were outstanding. During 2019, Verizon entered into a renewable energy purchase agreement (REPA) with a third party. The REPA is based on the expected operation of a renewable energy-generating facility and has a fixed price term of 12 years from the commencement of the facility's entry into commercial operation, which is expected to begin by the end of 2020. The REPA generally is expected to be financially settled based on the prevailing market price as energy is generated by the facility. We have various commitments, totaling $18.8 billion, primarily to purchase programming and network services, equipment, software and marketing services, which will be used or sold in the ordinary course of business, from a variety of suppliers. Of this total amount, $8.4 billion is attributable to 2020, $7.5 billion is attributable to 2021 through 2022, $1.4 billion is attributable to 2023 through 2024 and $1.5 billion is attributable to years thereafter. These amounts do not represent our entire anticipated purchases in the future, but represent only those items that are the subject of contractual obligations. Our commitments are generally determined 92 verizon.com/2019Annual Report 2019 Annual Report Notes to Consolidated Financial Statements continued based on the noncancelable quantities or termination amounts. Purchases against our commitments totaled approximately $10.9 billion for 2019, $9.0 billion for 2018 and $8.2 billion for 2017. Since the commitments to purchase programming services from television networks and broadcast stations have no minimum volume requirement, we estimated our obligation based on number of subscribers at December 31, 2019, and applicable rates stipulated in the contracts in effect at that time. We also purchase products and services as needed with no firm commitment 2019 Annual Report Notes to Consolidated Financial Statements continued Note 15. Additional Financial Information The following tables provide additional financial information related to our consolidated financial statements: Income Statement Information (dollars in millions) Years Ended December 31, Depreciation expense Interest costs on debt balances Net amortization of debt discount Capitalized interest costs Advertising expense Other income (expense), net Interest income Other components of net periodic benefit (cost) income Early debt extinguishment costs Other, net 2019 $ 14,371 5,221 165 (656) 3,071 2018 $ 15,186 5,399 174 2017 $ 14,741 5,256 155 (678) 2,643 (740) 2,682 121 627 (3,604) (44) $ 2,900) 94 3,068 (725) (73) $ 2,364 $ 82 (11) (1,983) (109) $ (2,021) Balance Sheet Information (dollars in millions) 2019 2018 At December 31, Prepaid expenses and other Prepaid taxes Deferred contract costs Restricted cash Other prepaid expense and other 348 2,083 $ 2,438 2,578 1,221 1,791 $ 8,028 1,047 1,975 $ 5,453 Accounts payable and accrued liabilities Accounts payable Accrued expenses Accrued vacation, salaries and wages Interest payable Taxes payable $ 7,725 5,984 4,885 1,441 1,771 $ 21,806 $ 7,232 5,948 6,268 1,570 1,483 $ 22,501 Other current liabilities Dividends payable Contract liability Other $ 2,566 4,651 1,807 $ 9,024 $ 2,512 4,207 1,520 $ 8,239 2019 Annual Report Notes to Consolidated Financial Statements continued Cash Flow Information (dollars in millions) 2018 2017 2019 $ 4,714 3,583 $ 4,408 2,213 $ 4,369 4,432 Years Ended December 31, Cash Paid Interest, net of amounts capitalized Income taxes, net of amounts refunded Other, net Cash Flows from Operating Activities Changes in device payment plan agreement non-current receivables Early debt extinguishment costs Other, net $ $ (509) 725 $ 23 3,604 (228) $ 3,399 (579) 1,983 (728) 676 3 $ 219 $ $ (1,797) Other, net Cash Flows from Financing Activities Net debt related costs Change in short-term obligations, excluding current maturities Other, net $ (141) (790) (893) $ (1,824) $ (3,599) (170) (670) $ (4,439) (1,120) $ (2,917) Note 16. Commitments and Contingencies In the ordinary course of business, Verizon is involved in various commercial litigation and regulatory proceedings at the state and federal level. Where it is determined, in consultation with counsel based on litigation and settlement risks, that a loss is probable and estimable in a given matter, the Company establishes an accrual. In none of the currently pending matters is the amount of accrual material. An estimate of the reasonably possible loss or range of loss in excess of the amounts already accrued cannot be made at this time due to various factors typical in contested proceedings, including: (1) uncertain damage theories and demands; (2) a less than complete factual record; (3) uncertainty concerning legal theories and their resolution by courts or regulators; and (4) the unpredictable nature of the opposing party and its demands. We continuously monitor these proceedings as they develop and adjust any accrual or disclosure as needed. We do not expect that the ultimate resolution of any pending regulatory or legal matter in future periods will have a material effect on our financial condition, but it could have a material effect on our results of operations for a given reporting period. Verizon is currently involved in approximately 25 federal district court actions alleging that Verizon is infringing various patents. Most of these cases are brought by non-practicing entities and effectively seek only monetary damages; a small number are brought by companies that have sold products and could seek injunctive relief as well. These cases have progressed to various stages and a small number may go to trial in the coming 12 months if they are not otherwise resolved. In connection with the execution of agreements for the sales of businesses and investments, Verizon ordinarily provides representations and warranties to the purchasers pertaining to a variety of nonfinancial matters, such as ownership of the securities being sold, as well as indemnity from certain financial losses. From time to time, counterparties may make claims under these provisions, and Verizon will seek to defend against those claims and resolve them in the ordinary course of business. Subsequent to the sale of Verizon Information Services Canada in 2004, we continue to provide a guarantee to publish directories, which was issued when the directory business was purchased in 2001 and had a 30-year term (before extensions). The preexisting guarantee continues, without modification, despite the subsequent sale of Verizon Information Services Canada and the spin-off of our domestic print and Internet yellow pages directories business. The possible financial impact of the guarantee, which is not expected to be adverse, cannot be reasonably estimated as a variety of the potential outcomes available under the guarantee result in costs and revenues or benefits that may offset each other. We do not believe performance under the guarantee is likely. As of December 31, 2019, letters of credit totaling approximately $632 million, which were executed in the normal course of business and support several financing arrangements and payment obligations to third parties, were outstanding. During 2019, Verizon entered into a renewable energy purchase agreement (REPA) with a third party. The REPA is based on the expected operation of a renewable energy-generating facility and has a fixed price term of 12 years from the commencement of the facility's entry into commercial operation, which is expected to begin by the end of 2020. The REPA generally is expected to be financially settled based on the prevailing market price as energy is generated by the facility. We have various commitments, totaling $18.8 billion, primarily to purchase programming and network services, equipment, software and marketing services, which will be used or sold in the ordinary course of business, from a variety of suppliers. Of this total amount, $8.4 billion is attributable to 2020, $7.5 billion is attributable to 2021 through 2022, $1.4 billion is attributable to 2023 through 2024 and $1.5 billion is attributable to years thereafter. These amounts do not represent our entire anticipated purchases in the future, but represent only those items that are the subject of contractual obligations. Our commitments are generally determined 92 verizon.com/2019Annual Report 2019 Annual Report Notes to Consolidated Financial Statements continued based on the noncancelable quantities or termination amounts. Purchases against our commitments totaled approximately $10.9 billion for 2019, $9.0 billion for 2018 and $8.2 billion for 2017. Since the commitments to purchase programming services from television networks and broadcast stations have no minimum volume requirement, we estimated our obligation based on number of subscribers at December 31, 2019, and applicable rates stipulated in the contracts in effect at that time. We also purchase products and services as needed with no firm commitment