Question

Saola has traditionally purchased all of its manufacturing equipment. However, in 2022 they were unable to find a vendor willing to sell them a new

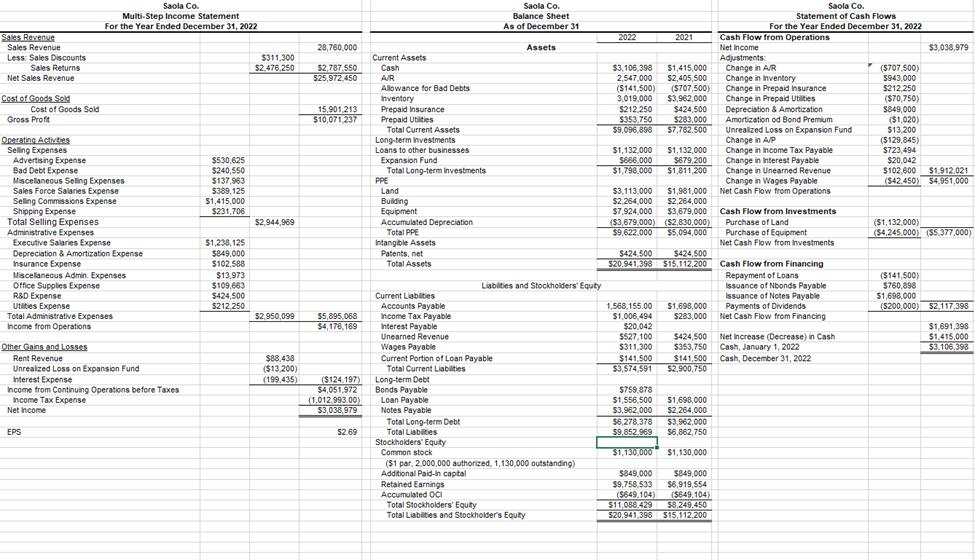

Saola has traditionally purchased all of its manufacturing equipment. However, in 2022 they were unable to find a vendor willing to sell them a new $12,426,000 machine. After some careful negotiations, however, they were able to lease the needed equipment for 5 years. At the end of the lease Saola will have the option to purchase the equipment for $994,000, the estimated fair value at the end of the lease. They currently plan to exercise the option and keep the equipment at the end of the lease, but that could change if they find a better option.

The machine has an estimated economic life of 7 years with no salvage value. The payments on the lease will be $2,412,148. Saola does not know the implicit interest rate used by the vendor, but their incremental interest rate is 6.0%. The lease period began on May 1, 2022 and the first payment was made that day. Subsequent payments will be made each year and should be paid one day before the start date to ensure that no late penalties are accrued. In addition to the first payment, Saola paid $18,000 in legal and other lease origination fees on May 1, 2022.

Saola has decided to keep all of its accumulated depreciation in one account rather than createA separate account for leased assets.

Saola's management would like to know the effect of your adjustment on the following ratios:

• Profit Margin

• Debt-to-Equity

• ROA

Calculations

1. Make the appropriate journal entries, if any, to account for the lease (including any necessary changes to income tax expense)

2. Make any necessary changes to the financial statements. Please see the hints about the special adjustment to the Statement of Cash Flows.

Critical Thinking

3. Calculate each of the required ratios using the original values (before any changes) and the updated values (after your changes).

4. How does this new lease affect Saola's risk? Defend your answer using your ratios and key numbers in the updated financial statements. Give your answer, do think the lease was a good idea or should the company have found a way to purchase the equipment outright? Defend your answer.

5. Management has asked the accounting department to ensure that the new lease be structured as an operating lease, even changing the contract if necessary to keep the cost of the lease in rent expense instead of adding to interest expense and depreciation. Saola's controller feels that the company should get the most appropriate contract for their needs, then worry about the accounting classification. Provide two (2) arguments that the controller could use to convince the management team that her plan is the most appropriate

Hints:

1.Don't forget to check to see how this lease should be classified by Saola.

2.While you will need to add a new 'ROU asset' account to Saola's Balance Sheet, Saola's management wants ALL of the accumulated depreciation and amortization on PPE (including leased assets) to be combined in one account on the balance sheet.

3. Technically, a Lease Liability should be broken into current and long-term portions on Saola's Balance Sheet based on when the payment will be made. However, for the sake of simplicity, classify the entire amount as long-term for this Saola. Remember that the lease liability balance will also include any accrued, but unpaid interest as of December 31st

4.You will need to make three adjustments to your Statement of Cash Flows. The first will be for the actual cash paid ON THE LEASE, and it will be a new line item in the Financing Activities section. The second will be for the actual cash paid FOR THE INITIAL COSTS, and it will be an increase to the Cash Paid for Equipment. The third is a special adjustment to the Operating Activities section for the interest expense accrued. Normally when you record interest expense, the other account is interest payable, which automatically updates with the equations in Operating Activities section. However, for this entry, you put the interest directly into the lease payable account. So, net income has dropped, but no payments were made. To remove the non-cash interest (i.e. the interest NOT paid this year), you will need to change the equation in the Change in Interest Payable line to include the interest on the lease. Then, since that line item isn't just the Change in Interest Payable anymore, you'll need to change the title to be Change in Interest Accrued.

5.Make sure that you round all of your numbers to the nearest dollar! That's a general rule for Saola, and it is especially important with all of the PV estimates and other calculations you will need to make in this portion of the project. If necessary, use the "rounddown" for your Income Tax Expense calculation, since we have done a lot of rounding up to this point in the project that can easily throw off this calculation and make your B/S off by $1.

Sales Revenue Sales Revenue Leve: Calon D Less: Sales Discounts Sales Returns Net Sales Revenue Cost of Goods Sold Cost of Goods Sold Gross Profit Operating Activities Selling Expenses Advertising Expense Bad Debt Expense Miscellaneous Selling Expenses Saola Co. Multi-Step Income Statement For the Year Ended December 31, 2022 Sales Force Salaries Expense Selling Commissions Expense Shipping Expense Total Selling Expenses Administrative Expenses Executive Salaries Expense Depreciation & Amortization Expense Insurance Expense Miscellaneous Admin. Expenses Office Supplies Expense R&D Expense Utilities Expense Total Administrative Expenses Income from Operations Other Gains and Losses Rent Revenue EPS Unrealized Loss on Expansion Fund Interest Expense Income from Continuing Operations before Taxes Income Tax Expense Net Income $530,625 $240,550 $137,963 $389,125 $1,415,000 $231,706 $1,238,125 $849,000 $102,588 $13,973 $109,663 $424,500 $212,250 $311,300 $2.476,250 $2,944,969 $2,950,099 $88,438 ($13,200) (199.435) 28,760,000 $2,787,550 $25,972,450 15,901,213 $10,071,237 $5,895,068 $4,176,169 ($124.197) $4,051,972 (1.012.993.00) $3,038,979 $2.69 Current Assets Cash A/R Allowance for Bad Debts Inventory Prepaid Insurance Prepaid Utilities Total Current Assets Long-term investments Loans to other businesses Expansion Fund Total Long-term investments PPE Land Building Equipment Accumulated Depreciation Total PPE Intangible Assets Patents, net Total Assets Current Liabilities Accounts Payable Income Tax Payable Interest Payable Unearned Revenue Wages Payable Current Portion of Loan Payable Total Current Liabilities Long-term Debt Bonds Payable Loan Payable Notes Payable Total Long-term Debt Total Liabilities Stockholders' Equity Common stock Saola Co. Balance Sheet As of December 31 Assets Liabilities and Stockholders' Equity ($1 par, 2,000,000 authorized, 1,130,000 outstanding) Additional Paid-in capital Retained Earnings Accumulated OCI Total Stockholders' Equity Total Liabilities and Stockholder's Equity 2022 $3,106,398 2,547,000 ($141,500) 3,019,000 $212,250 $353,750 $9,096,898 $1,132,000 $666,000 31.700 $424.500 $20.941,398 2021 1,568,155.00 $1,006,494 $20,042 $527,100 $311,300 $1,415,000 $2,405,500 ($707,500) $3,962,000 $424,500 $283,000 $7,782.500 ($3,679,000) ($2,830,000) $9,622.000 $5,094,000 $141,500 $3,574,591 $1,132,000 $679,200 $1,811,200 $3,113,000 $1,961,000 $2,264,000 $2,264,000 $7,924,000 $3,679,000 Cash Flow from Investments Purchase of Land Purchase of Equipment Net Cash Flow from Investments $424,500 $15,112,200 $1,698,000 $283,000 $424,500 $353,750 $141,500 $2,900,750 $759,878 $1,556,500 $1,698,000 $3,962,000 $2,264,000 $6,278,378 $3.962.000 $9,852.969 $6,862,750 $1,130,000 $1,130,000 Saolo Cai Statement of Cash Flows For the Year Ended December 31, 2022 Cash Flow from Operations $849,000 $849,000 $9,758,533 $6,919,554 ($649,104) ($649,104) $11,088.429 $8,249,450 $20,941,398 $15,112,200 Net Income Adjustments: Change in A/R Change in Inventory Change in Prepaid Insurance Change in Prepaid Utilities Depreciation & Amortization Amortization od Bond Premium Unrealized Loss on Expansion Fund Change in A/P Change in Income Tax Payable Change in Interest Payable Change in Unearned Revenue Change in Wages Payable Net Cash Flow from Operations Cash Flow from Financing Repayment of Loans Issuance of Nbonds Payable Issuance of Notes Payable Payments of Dividends Net Cash Flow from Financing Net Increase (Decrease) in Cash Cash, January 1, 2022 Cash, December 31, 2022 ($707.500) $943,000 $212,250 ($70,750) $849,000 ($1,020) $13,200 ($129,845) $723,494 $3,038,979 $20,042 $102,600 $1,912,021 ($42.450) $4,951,000 ($1,132,000) ($4,245.000) ($5.377.000) ($141,500) $760,898 $1,698,000 ($200,000) $2,117,398 $1,691,398 $1,415,000 $3,106,398

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries Initial Lease Payment Debit Equipment ROU Asset 12444000 the present value of lease payments plus initial direct costs Credit Lease Li...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started