Answered step by step

Verified Expert Solution

Question

1 Approved Answer

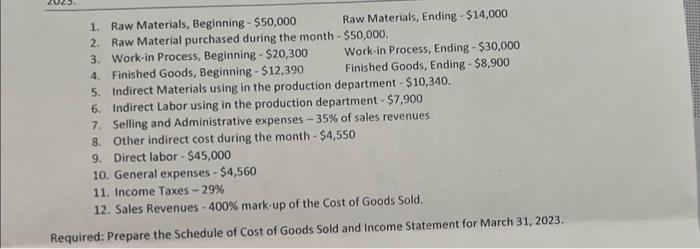

Raw Materials, Ending - $14,000 1. Raw Materials, Beginning - $50,000 2. Raw Material purchased during the month - $50,000. 3. Work-in Process, Beginning

Raw Materials, Ending - $14,000 1. Raw Materials, Beginning - $50,000 2. Raw Material purchased during the month - $50,000. 3. Work-in Process, Beginning - $20,300 Work-in Process, Ending - $30,000 Finished Goods, Ending-$8,900 4. Finished Goods, Beginning - $12,390 5. Indirect Materials using in the production department - $10,340. 6. Indirect Labor using in the production department - $7,900 7. Selling and Administrative expenses-35% of sales revenues. Other indirect cost during the month - $4,550 8. 9. Direct labor- $45,000 10. General expenses - $4,560 11. Income Taxes -29% 12. Sales Revenues-400% mark-up of the Cost of Goods Sold. Required: Prepare the Schedule of Cost of Goods Sold and Income Statement for March 31, 2023..

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Lost of Goods Sold COGS 82690 50000 124790 2 50000 20300 12390 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started