Answered step by step

Verified Expert Solution

Question

1 Approved Answer

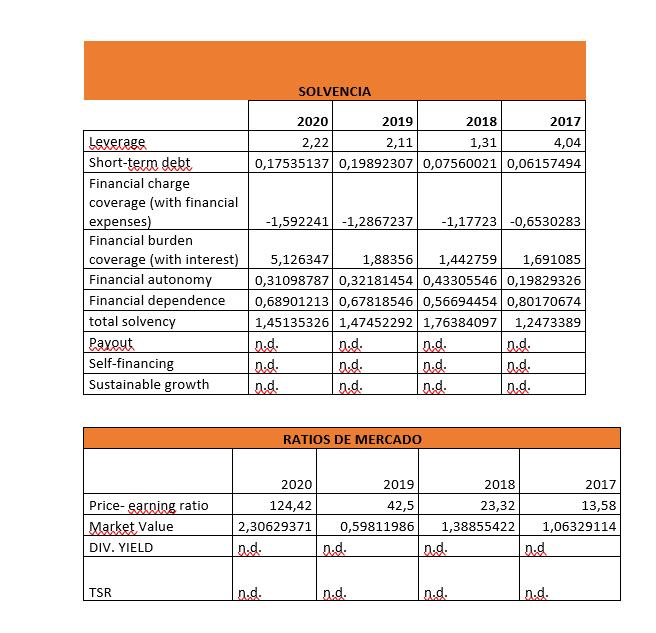

How has the market's perception of the company evolved? -What are the market's expectations for the company's future in 2020? -How has the solvency evolved?

How has the market's perception of the company evolved?

-What are the market's expectations for the company's future in 2020?

-How has the solvency evolved?

-Is the financial structure risky? What is the balance between short and long term debt? Does the company comfortably cover the interest on its debt?

-Is the company's dividend policy prudent?

Leverage Short-term debt Financial charge coverage (with financial expenses) Financial burden coverage (with interest) Financial autonomy Financial dependence total solvency Payout Self-financing Sustainable growth Price-earning ratio Market Value DIV. YIELD TSR 2019 2018 2017 2,11 1,31 4,04 0,17535137 0,19892307 0,07560021 0,06157494 SOLVENCIA n.d. n.d. n.d. 2020 2,22 -1,592241 -1,2867237 -1,17723 -0,6530283 5,126347 1,88356 1,442759 1,691085 0,31098787 0,32181454 0,43305546 0,19829326 0,68901213 0,67818546 0,56694454 0,80170674 1,45135326 1,47452292 1,76384097 1,2473389 n.d. 2020 124,42 2,30629371 n.d. n.d. n.d. n.d. RATIOS DE MERCADO 0,59811986 D.d. 2019 42,5 n.d. n.d. n.d. n.d. 2018 23,32 1,38855422 n.d. n.d. n.d. n.d. n.d. 2017 13,58 1,06329114 n.d.

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided financial ratios for solvency market ratios and dividend policy here are the answers to your questions 1 How has the markets per...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started