Answered step by step

Verified Expert Solution

Question

1 Approved Answer

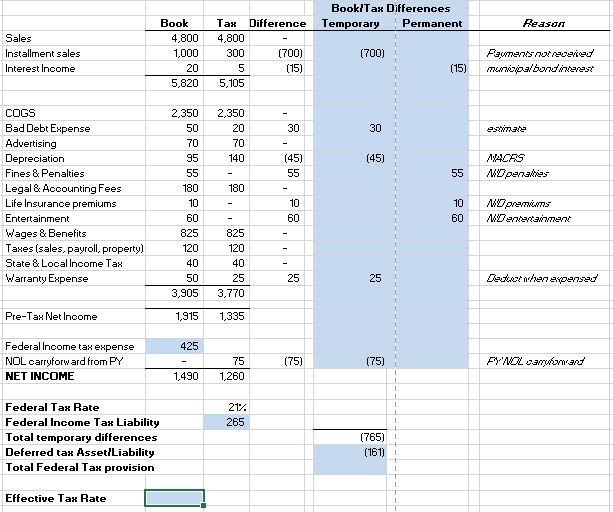

How is the effective tax rate and total federal tax provision calculated from this information? What would the journal entry for the income tax be?

How is the effective tax rate and total federal tax provision calculated from this information? What would the journal entry for the income tax be?

Book/Tax Differences Temporary Permanent Reason Sales Installment sales Interest Income Book 4,800 1,000 Tax Difference 4,800 300 (700) 5 (15) 5,105 (700) Pewnesna Sveries munal bondineres (15) 5.820 2,350 50 70 esimees 2,350 20 70 140 95 55 M440AS penates 180 COGS Bad Debt Expense Advertising Depreciation Fines & Penalties Legal & Accounting Fees Life Insurance premiums Entertainment Wages & Benefits Taxes (sales, payroll, property) State & Local Income Tax Warranty Expense 180 M ore inns w 825 40 825 120 40 25 3,770 25 Dadex/97 sxpenses 50 3,905 1,915 Pre-Tax Net Income 1,335 425 Federal Income tax expense NOL carryforward from PY NET INCOME (75) (75) FYM carmant 1,490 2015 1,260 217 265 Federal Tax Rate Federal Income Tax Liability Total temporary differences Deferred tax Asset/Liability Total Federal Tax provision (765) (161) Effective Tax RateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started